Answered step by step

Verified Expert Solution

Question

1 Approved Answer

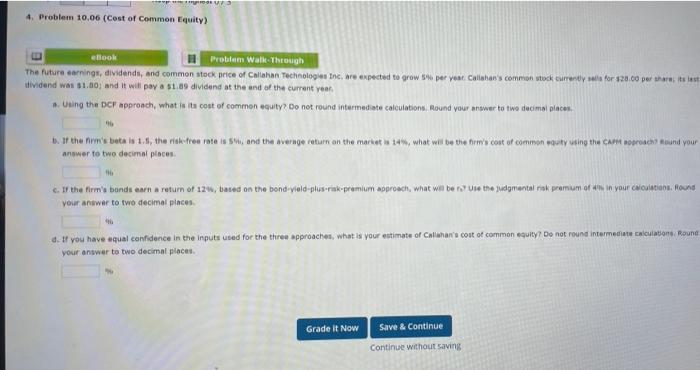

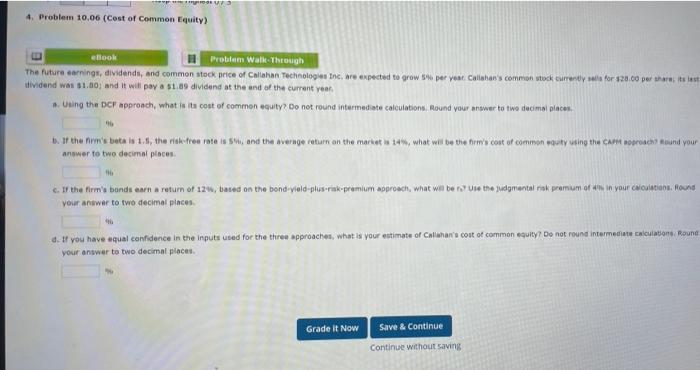

need all 1. 2. 4. Problem 10,06 (Cost of Common Equity) eBook Problem Walk Through The future carings, dividends, and common stock price of Callahan

need all

1.

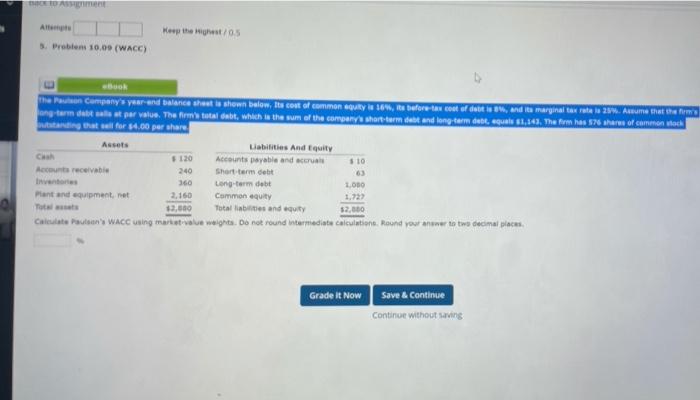

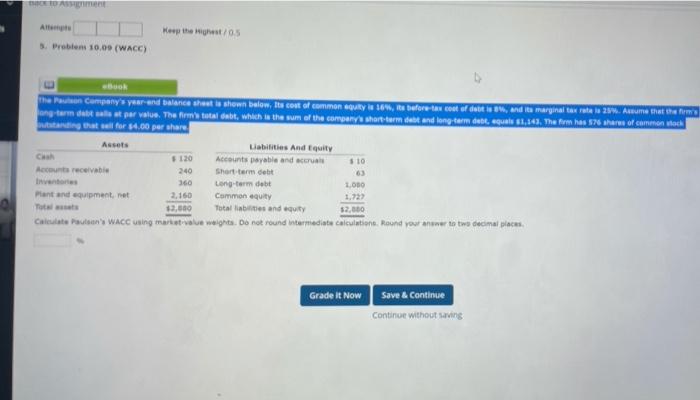

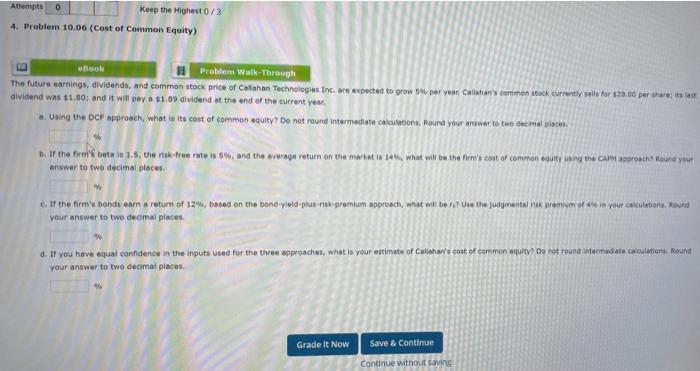

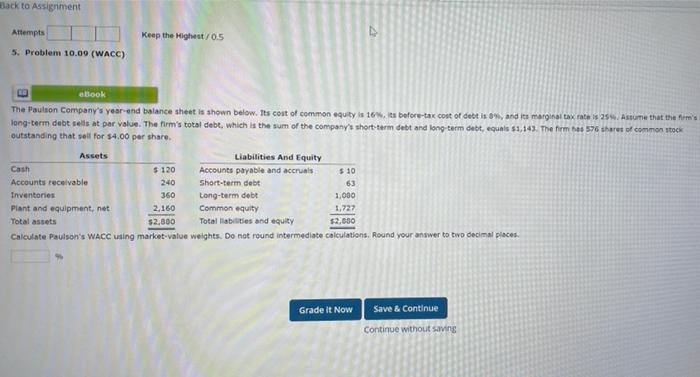

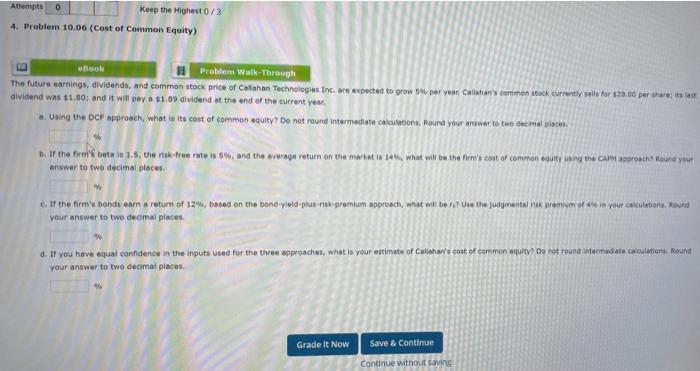

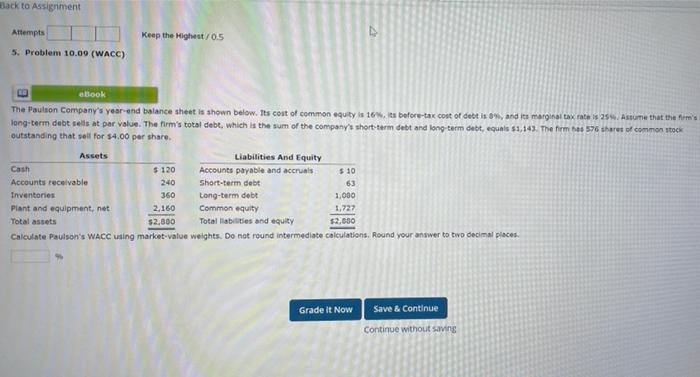

4. Problem 10,06 (Cost of Common Equity) eBook Problem Walk Through The future carings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow $ per year. Callahan's common stock currently sells for $20.00 per haritlast dividend was $1.00; and it will pay a 51.9 dividend at the end of the current year Using the DC approach, what is its cost of common equity? Do not round intermediate calculations, Round your answer to two decimal place 5. If the firm's betais 1., there foarte is, and the average return on the market what will be the w's cost of common equity using the car orth Round your answer to two decimal places c. If the firm's bondi earn a return of 128, bated on the bond-Viold-plus-rink-premium approach, what will be use the judgmental rio premium of an in your own. Hound your answer to two decimal places d. If you have equal confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost of common equity? Do not round intermediate calculation Round your answer to two decimal places Grade it Now Save & Continue Continue without saving A Hep the hest/05 3. Problem 10.09 (WACC) The Pain Company's year and balance she is shown below, its out of common guy la 162, Rts before las cost of dat is, and a marginal tax rate 2 Asume that has eng tarm dat als par value. The firm's total debt, which is the sum of the company's short-terment and long-term destaques 81,341. The firm has 576 share of common och ting that all for 84.00 per share Assets Liabilities And Equity Cha 120 Accounts payable and ca 510 Accounts receivable 240 Short-term debt Inventor 360 Long-term debit 1,000 Plant and equipment net 2,160 Common equity 1.72 12,650 Totalities and equity 52.000 Calculate auto's WACC using market value weight. Do not round witermediate calculation. Round your answer to two decimal places Grade It Now Save & Continue Continue without saving Attempts 0 Keep the Highest 0/3 4. Problem 10.06 (Cost of Common Equity) ebook Problem Walk-Through The future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow per year. Calahon's common stock currently wells for $20.00 per hari dividend was $1.00, and it will pay a $1.09 dividend at the end of the current year, .. Using the DCF approach, what is its cost of common equity? De net round intermediate calculations. Round your answer to two dec mallace b. If there buta la 1.5, therlak-free rate is and the average rotum on the market in 19w what will be the Plum's count of common equity are the Caracoroach one you! answer to two decimal places c. Ir the firm' bands earn a return of 12%, based on the band yield-plus-risk-premium approach, what will be not Use the judgmental rok premium et es in your calculation Found your answer to two decimal places d. If you have equal confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost of common equity? Do not round intermediate calculations, Round your answer to two decimal places Grade It Now Save & Continue Continue without sving Back to Assignment Keep the Highest/0.5 Attempts 5. Problem 10.09 (WACC) eBook The Paulson Company's year and balance sheet is shown below. Its cost of common equity is 16. its before-tax cost of debt is 6, and its marginal tax rate is 25. Assume that the firm's long-term debt sells at per value. The firm's total debt, which is the sum of the company's short-term debt and long term debt, equals 61,14. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Assets Liabilities And Equity Cash $ 120 Accounts payable and accruals $10 Accounts receivable 240 Short-term debt 63 Inventories 360 Long-term debt 1,000 Plant and equipment, net 2,160 Common equity 1.727 Total assets $2.000 Total abilities and equity $2.680 Calculate Paulson's WACC using market value weights. Do not round intermediate calculations. Round your answer to two decimal places Grade It Now Save & Continue Continue without saving

2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started