Need all 10 questions please

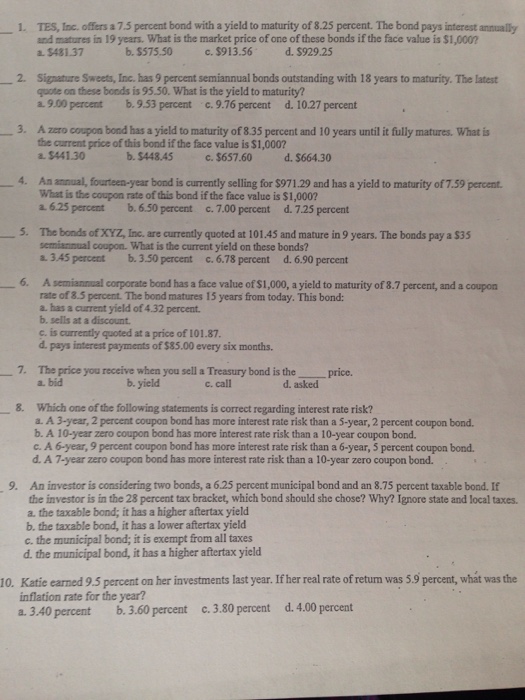

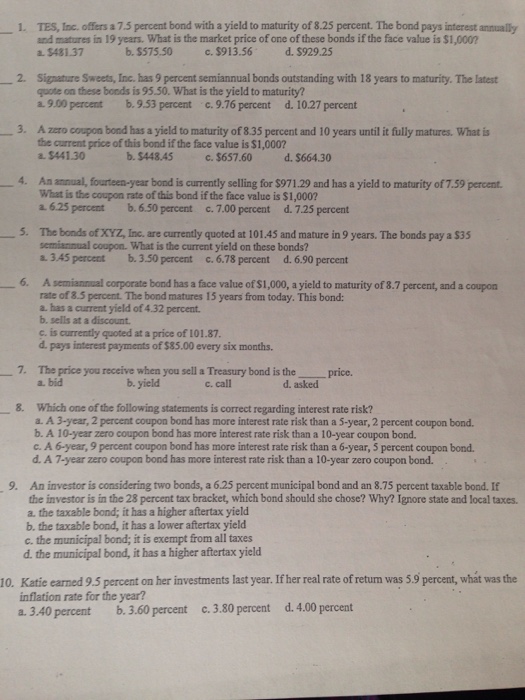

TES, be. offers a 7.5 percent bond with a yield to maturity of 8.25 percent. The bond pays interest annually aod matures in 19years. What is the market price of one of these bonds if the face value is $1,000? a. $48137 b. $575.50 e. $913.56 d. $92925 Signature Sweets. Inc. has 9 percent semiannual bonds outstanding with 18 years to maturity. The latest quote on these bonds is 95 50. What is the yield to maturity? 9.00 percent 9.53 percent 9.76 percent 10.27 percent A zero coupon bond has a yield to maturity of 8.35 percent and 10 years until it fully matures. What a the current price of this bond if the face value is $1,000? a. $441.30 b. $448.45 c. $657.60 d. $664.30 An annual, fourteen-year bond is currently selling for $971.29 and has a yield to maturity of 7.59 percent. What ts the coupon mt of this bond if the face value is $1,000? 6.25 percent 6.50 percent 7.00 percent 725 percent The bonds of XYZ, Inc. are currently quoted at 101.45 and mature in 9 years. The bonds pay a $35 semiannual coupon. What is the current yield on these bonds? 3.45 percent 3 50 percent 6.78 percent 6.90 percent A semiannual corporate bond has a face value of $1,000, a yield to maturity of 8.7 percent, and a coupon me of 8.5 percent The bond matures 15 years from today. This bond: has a current yield of 4.32 percent. sells at a discount b currently quoted at a price of 101.87. pay interest payments of $85.00 every six months. The price you receive when you sell a Treasury bond is the price. bid yield call asked Which one of the following statements is correct regarding interest rate risk? A 3-year, 2 percent coupon bond has more interest rate risk than a 5-year, 2 percent coupon bond. A 19-year zero coupon bond has more interest rate risk than a 10-year coupon bond. A 6-year, 9 percent coupon bond has more interest rate risk than a 6-year, 5 percent coupon bond. A 7-year zero coupon bond has more interest rate risk than a 10-year zero coupon bond. An investor is considering two bonds, a 625 percent municipal bond and an 8.75 percent taxable bond. If the investor is in the 28 percent tax bracket, which bond should she chose? Why? Ignore state and local taxes. the taxable bond; it has a higher aftertax yield the taxable bond, it has a lower aftertax yield the municipal bond; it is exempt from all taxes the municipal bond, it has a higher aftertax yield Kztic earned 9.5 percent on her investments last year. If her real rate of return was 5.9 percent, what was the inflation rate for the year? 3.40 percent 3.60 percent 3.80 percent 4.00 percent

Need all 10 questions please

Need all 10 questions please