Answered step by step

Verified Expert Solution

Question

1 Approved Answer

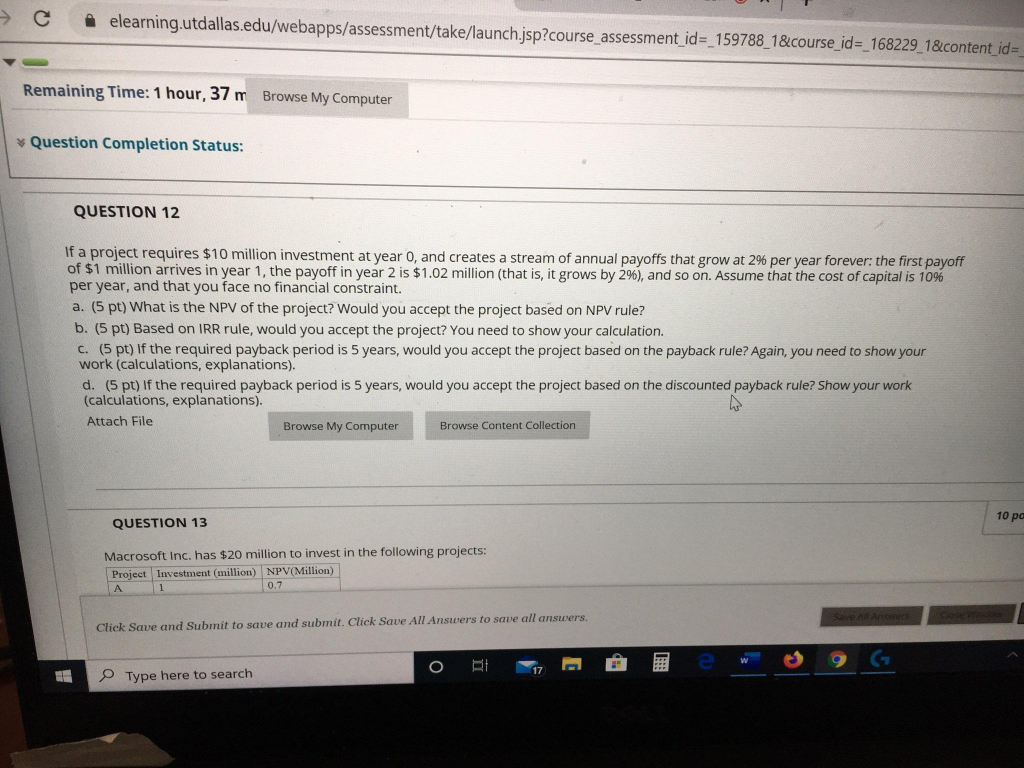

Need ALL parts (a-d) answered for this question right now!! Very urgent!! Please show work!! C elearning.utdallas.edu/webapps/assessment/take/launch.jsp?course_assessment_id=_159788_1& course_id=_168229_1&content_id=_ Remaining Time: 1 hour, 37 m Browse

Need ALL parts (a-d) answered for this question right now!! Very urgent!! Please show work!!

C elearning.utdallas.edu/webapps/assessment/take/launch.jsp?course_assessment_id=_159788_1& course_id=_168229_1&content_id=_ Remaining Time: 1 hour, 37 m Browse My Computer Question Completion Status: QUESTION 12 If a project requires $10 million investment at year 0, and creates a stream of annual payoffs that grow at 2% per year forever: the first payoff of $1 million arrives in year 1, the payoff in year 2 is $1.02 million (that is, it grows by 2%), and so on. Assume that the cost of capital is 1096 per year, and that you face no financial constraint. a. (5 pt) What is the NPV of the project? Would you accept the project based on NPV rule? b. (5 pt) Based on IRR rule, would you accept the project? You need to show your calculation. c. (5 pt) If the required payback period is 5 years, would you accept the project based on the payback rule? Again, you need to show your work (calculations, explanations). d. (5 pt) If the required payback period is 5 years, would you accept the project based on the discounted payback rule? Show your work (calculations, explanations). Attach File Browse My Computer Browse Content Collection QUESTION 13 10 pc Macrosoft Inc. has $20 million to invest in the following projects: Project Investment (million) NPV(Million) Click Save and Submit to save and submit. Click Save All Answers to save all answers. o Pt 2e w Type here to search 9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started