NEED ALL PLEASE THANK YOU SO MUCH

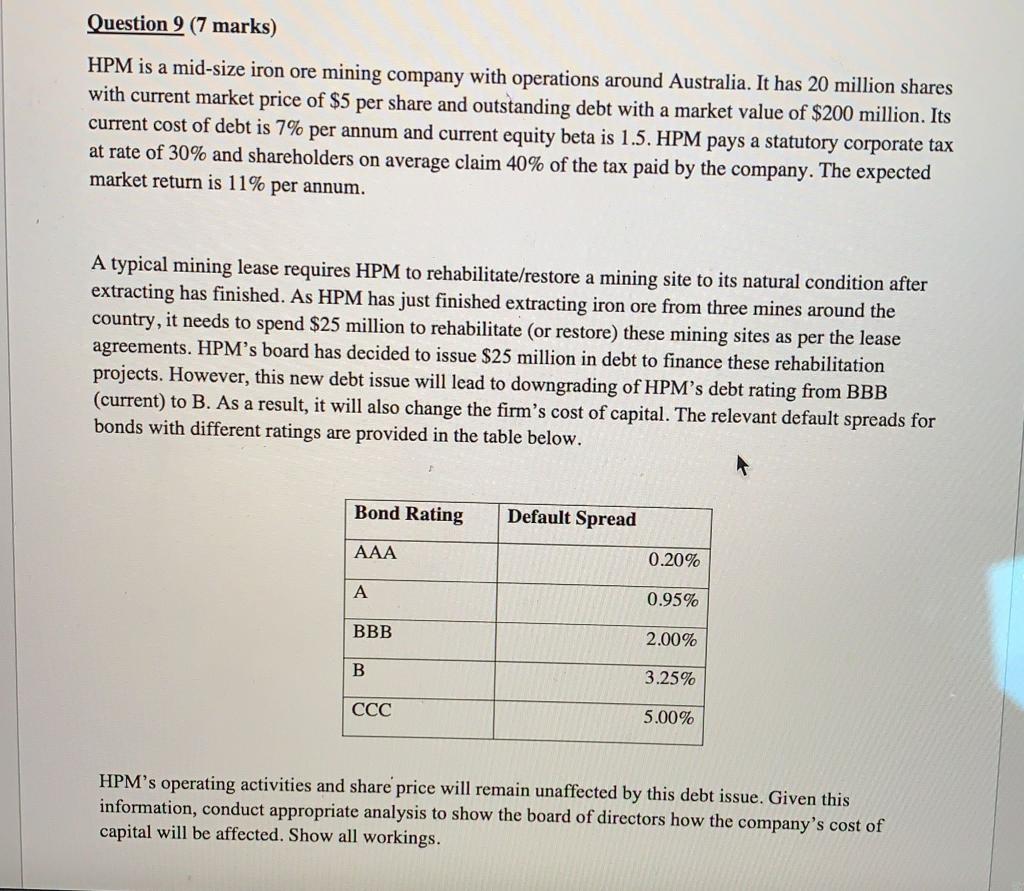

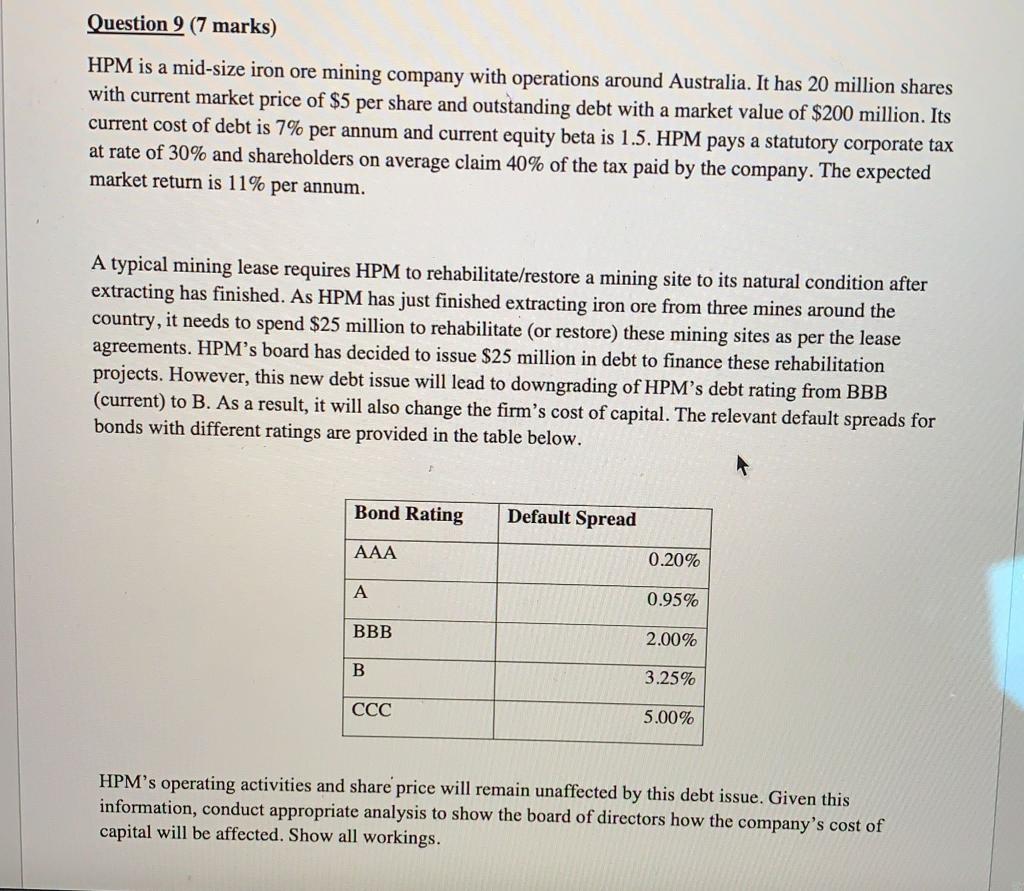

Question 9 (7 marks) HPM is a mid-size iron ore mining company with operations around Australia. It has 20 million shares with current market price of $5 per share and outstanding debt with a market value of $200 million. Its current cost of debt is 7% per annum and current equity beta is 1.5. HPM pays a statutory corporate tax at rate of 30% and shareholders on average claim 40% of the tax paid by the company. The expected market return is 11% per annum. A typical mining lease requires HPM to rehabilitate/restore a mining site to its natural condition after extracting has finished. As HPM has just finished extracting iron ore from three mines around the country, it needs to spend $25 million to rehabilitate (or restore) these mining sites as per the lease agreements. HPM's board has decided to issue $25 million in debt to finance these rehabilitation projects. However, this new debt issue will lead to downgrading of HPM's debt rating from BBB (current) to B. As a result, it will also change the firm's cost of capital. The relevant default spreads for bonds with different ratings are provided in the table below. Bond Rating Default Spread AAA 0.20% A 0.95% BBB 2.00% B 3.25% CCC 5.00% HPM's operating activities and share price will remain unaffected by this debt issue. Given this information, conduct appropriate analysis to show the board of directors how the company's cost of capital will be affected. Show all workings. Question 9 (7 marks) HPM is a mid-size iron ore mining company with operations around Australia. It has 20 million shares with current market price of $5 per share and outstanding debt with a market value of $200 million. Its current cost of debt is 7% per annum and current equity beta is 1.5. HPM pays a statutory corporate tax at rate of 30% and shareholders on average claim 40% of the tax paid by the company. The expected market return is 11% per annum. A typical mining lease requires HPM to rehabilitate/restore a mining site to its natural condition after extracting has finished. As HPM has just finished extracting iron ore from three mines around the country, it needs to spend $25 million to rehabilitate (or restore) these mining sites as per the lease agreements. HPM's board has decided to issue $25 million in debt to finance these rehabilitation projects. However, this new debt issue will lead to downgrading of HPM's debt rating from BBB (current) to B. As a result, it will also change the firm's cost of capital. The relevant default spreads for bonds with different ratings are provided in the table below. Bond Rating Default Spread AAA 0.20% A 0.95% BBB 2.00% B 3.25% CCC 5.00% HPM's operating activities and share price will remain unaffected by this debt issue. Given this information, conduct appropriate analysis to show the board of directors how the company's cost of capital will be affected. Show all workings