Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need an actual breakdown like 1 a is or 1 6 is . Note: This problem is for the 2 0 2 2 tax year.

Need an actual breakdown like a is or is

Note: This problem is for the tax year. BAA For Disclos

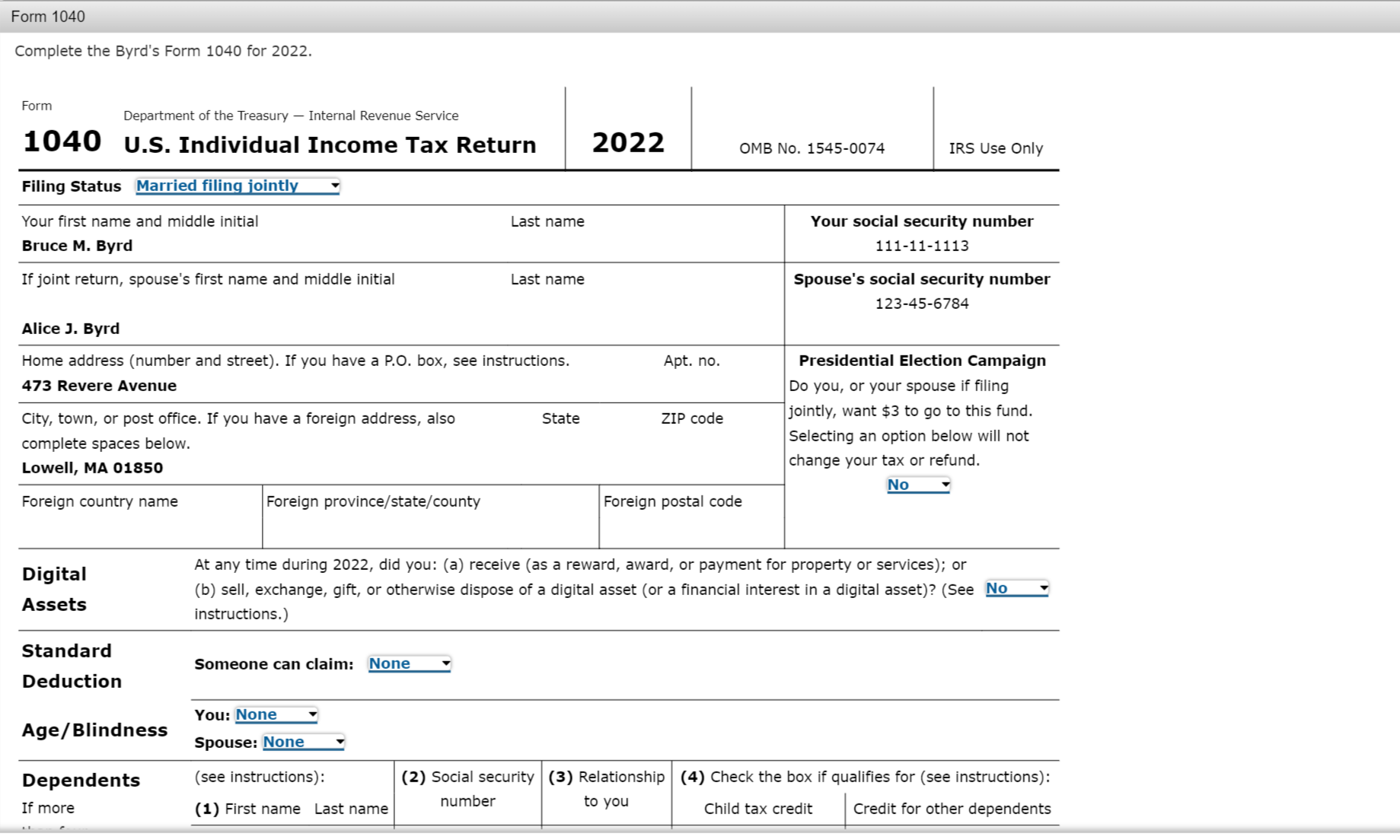

Alice J and Bruce M Byrd are married taxpayers who file a joint return. Their Social Security numbers are and respectively. Alice's birthday is September and Bruce's is June They live at Revere Avenue, Lowell, MA Alice is the office manager for Lowell Dental Clinic, Broad Street, Lowell, MA Employer Identification Number Bruce is the manager of a Super Burgers fastfood outlet owned and operated by Plymouth Corporation, Central Avenue, Hauppauge, NY Employer Identification Number

The following information is shown on their Wage and Tax Statements Form W for :

Line Description Alice Bruce

Wages, tips, other compensation $ $

Federal income tax withheld

Social Security wages

Social Security tax withheld

Medicare wages and tips

Medicare tax withheld

State Massachusetts Massachusetts

State wages, tips, etc.

State income tax withheld

The Byrds provide over half of the support of their two children, Cynthia born January Social Security number and John born February Social Security number Both children are fulltime students and live with the Byrds except when they are away at college. Cynthia earned $ from a summer internship in and John earned $ from a parttime job. Both children received scholarships covering tuition and materials.

During the Byrds provided of the total support of Bruce's widower father, Sam Byrd born March Social Security number Sam lived alone and covered the rest of his support with his Social Security benefits. Sam died in November, and Bruce, the beneficiary of a policy on Sam's life, received life insurance proceeds of $ on December

The Byrds had the following expenses relating to their personal residence during :

Real estate property taxes $

Qualified interest on home mortgage acquisition indebtedness

Repairs to roof

Utilities

Fire and theft insurance

The Byrds had the following medical expenses for :

Medical insurance premiums $

Doctor bill for Sam incurred in and not paid until

Operation for Sam

Prescription medicines for Sam

Hospital expenses for Sam

Reimbursement from insurance company, received in

The medical expenses for Sam represent most of the that Bruce contributed toward his father's support.

Other relevant information follows:

When they filed their state return in the Byrds paid additional state income tax of $

During Alice and Bruce attended a dinner dance sponsored by the Lowell Police Disability Association a qualified charitable organization The Byrds paid $ for the tickets. The cost of comparable entertainment would normally be $

The Byrds contributed $ to Lowell Presbyterian Church and gave used clothing cost of $ and fair market value of $ to the Salvation Army. All donations are supported by receipts, and the clothing is in very good condition.

Via a crowdfunding site gofundmecom Alice and Bruce made a gift to a needy family who lost their home in a fire $ In addition, they made several cash gifts to homeless individuals downtown estimated to be $

In the Byrds received interest income of $ which was reported on a Form INT from Second National Bank, Oak Street, Lowell, MA Employer Identification Number

The home mortgage interest was reported on Form by Lowell Commercial Bank, PO Box Lowell, MA Employer Identification Number The mortgage outstanding balance of $ as of January was taken out by the Byrds on May

Alice's employer requires that all employees wear uniforms to work. During Alice spent $ on new uniforms and $ on laundry charges.

Bruce paid $ for an annual subscription to the Journal of Franchise Management and $ for annual membership dues to his professional association.

Neither Alice's nor Bruce's employer reimburses for employee expenses.

The Byrds do not keep the receipts for the sales taxes they paid and had no major purchases subject to sales tax.

This year the Byrds gave each of their children $ which was then deposited into their Roth IRAs.

Alice and Bruce paid no estimated Federal income tax, and they did not engage in any digital asset transactions during the year. Neither Alice nor Bruce wants to designate $ to the Presidential Election Campaign Fund.

Required:

Complete the Byrds Form for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started