Answered step by step

Verified Expert Solution

Question

1 Approved Answer

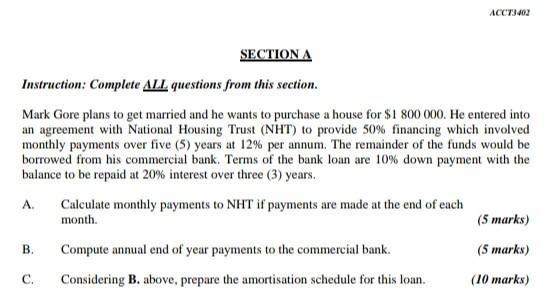

need an answer asap thank you ACC73402 SECTION A Instruction: Complete ALL questions from this section. Mark Gore plans to get married and he wants

need an answer asap thank you

ACC73402 SECTION A Instruction: Complete ALL questions from this section. Mark Gore plans to get married and he wants to purchase a house for $1 800 000. He entered into an agreement with National Housing Trust (NHT) to provide 50% financing which involved monthly payments over five (5) years at 12% per annum. The remainder of the funds would be borrowed from his commercial bank. Terms of the bank loan are 10% down payment with the balance to be repaid at 20% interest over three (3) years. Calculate monthly payments to NHT if payments are made at the end of each (5 marks) A month. B Compute annual end of year payments to the commercial bank. (5 marks) C. Considering B. above, prepare the amortisation schedule for this loan. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started