Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need ans ASAP PLTO Ltd. is considering purchasing the net assets of Cheyenne Corporation. Following is the statement of financial position of Cheyenne as at

need ans ASAP

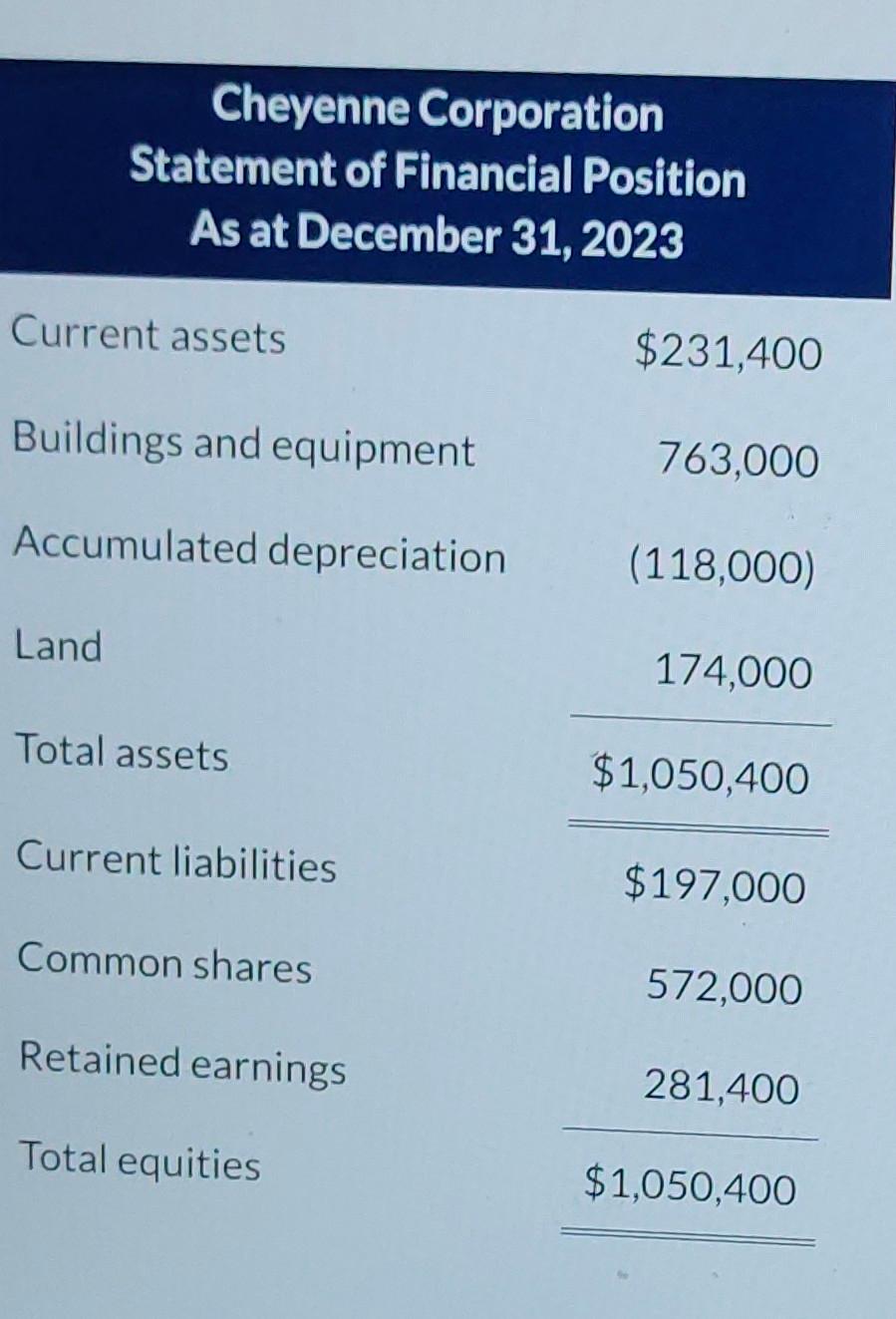

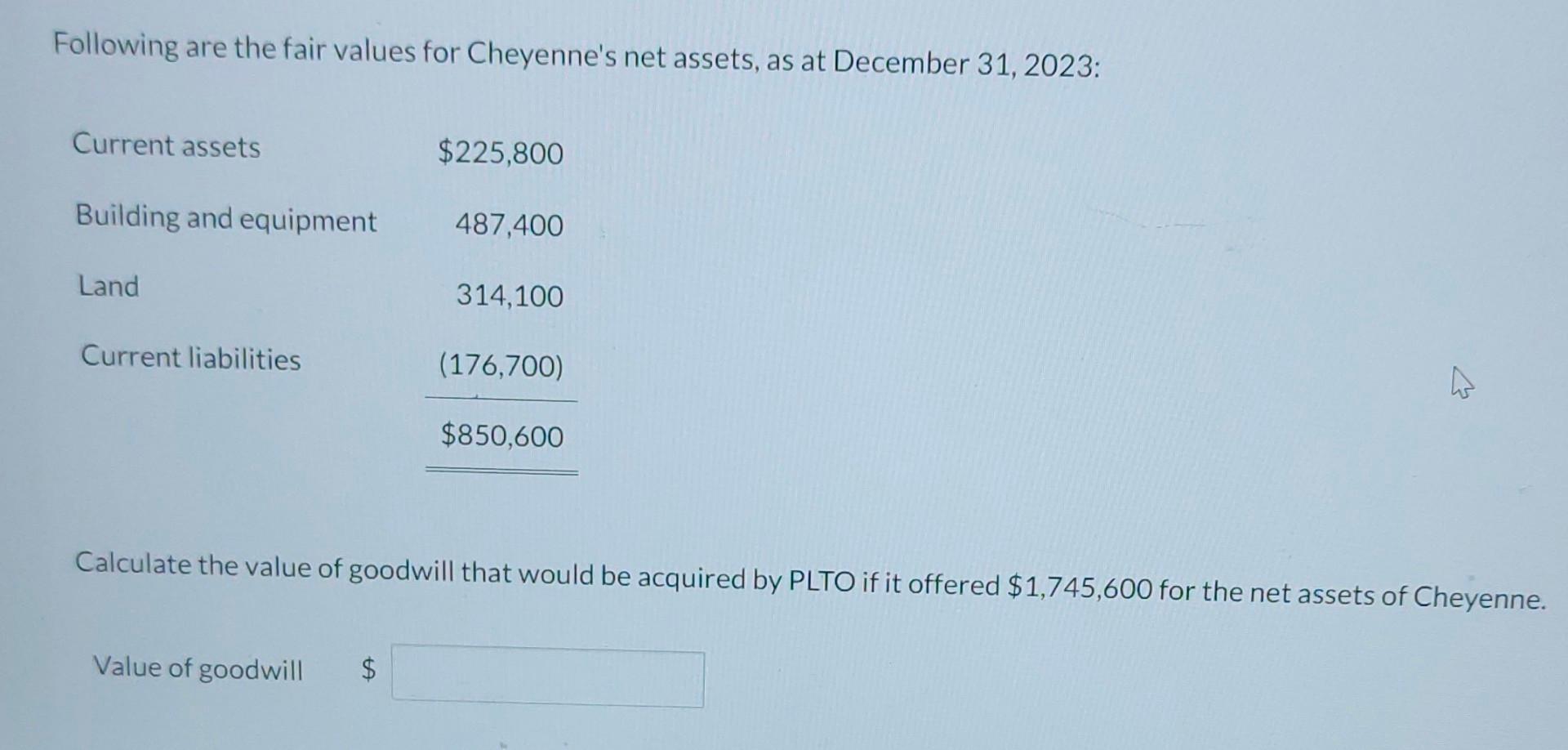

PLTO Ltd. is considering purchasing the net assets of Cheyenne Corporation. Following is the statement of financial position of Cheyenne as at December 31, 2023: Cheyenne Corporation Statement of Financial Position As at December 31, 2023 \\begin{tabular}{lr} Current assets & \\( \\$ 231,400 \\) \\\\ Buildings and equipment & 763,000 \\\\ Accumulated depreciation & \\( (118,000) \\) \\\\ Land & \\( \\$ 174,000 \\) \\\\ \\hline Total assets & \\( \\$ 197,000 \\) \\\\ Current liabilities & 572,000 \\\\ Common shares & 281,400 \\\\ Retained earnings & \\( \\$ 1,050,400 \\) \\\\ \\hline Total equities & \\end{tabular} Following are the fair values for Cheyenne's net assets, as at December 31, 2023: Calculate the value of goodwill that would be acquired by PLTO if it offered \\( \\$ 1,745,600 \\) for the net assets of Cheyenne. Value of goodwill \\( \\$ \\)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started