Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need answer asap 4. In your opinion, how has Mr. Entrepreneur been doing with his business in terms of profitability, operational efficiency, liquidity, and debt

need answer asap

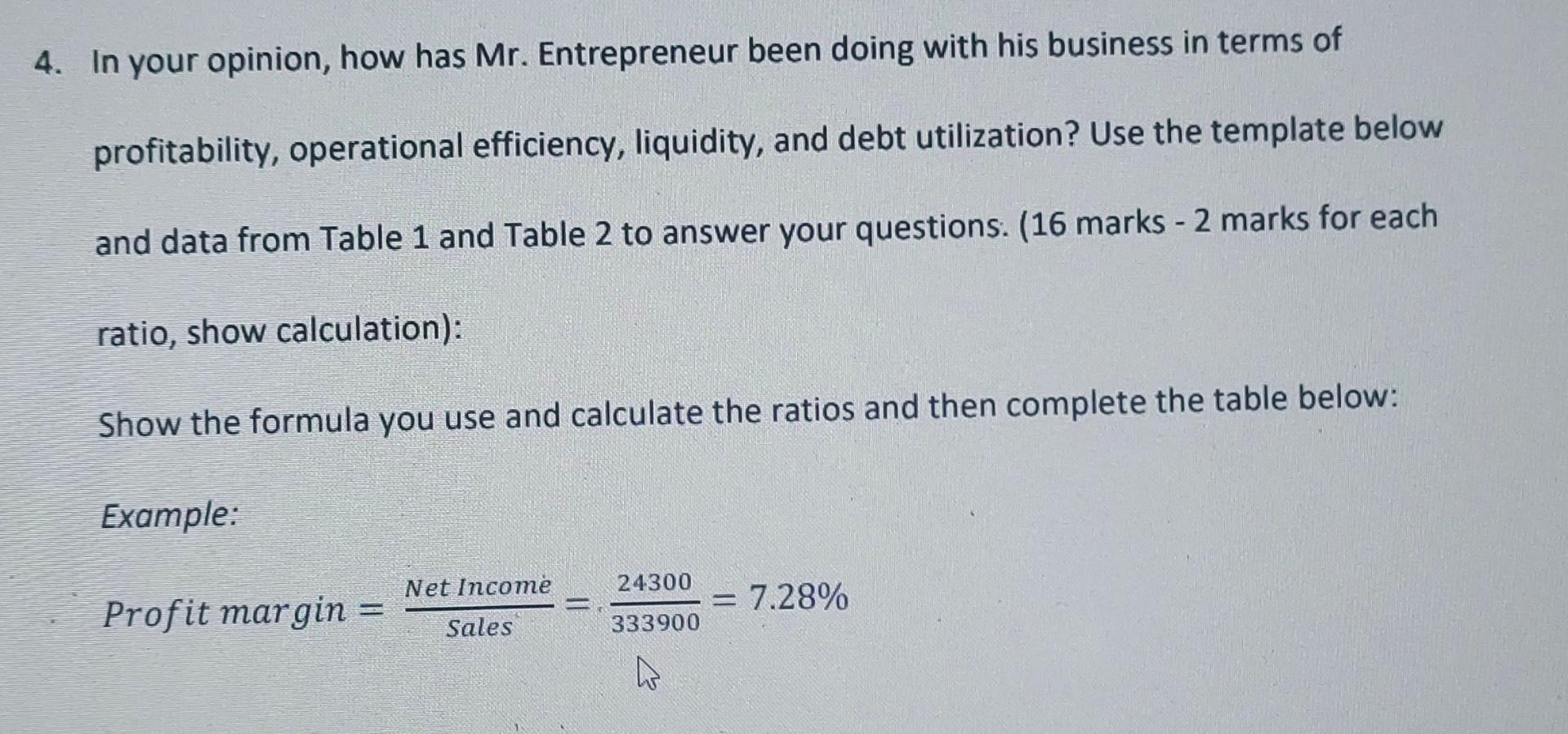

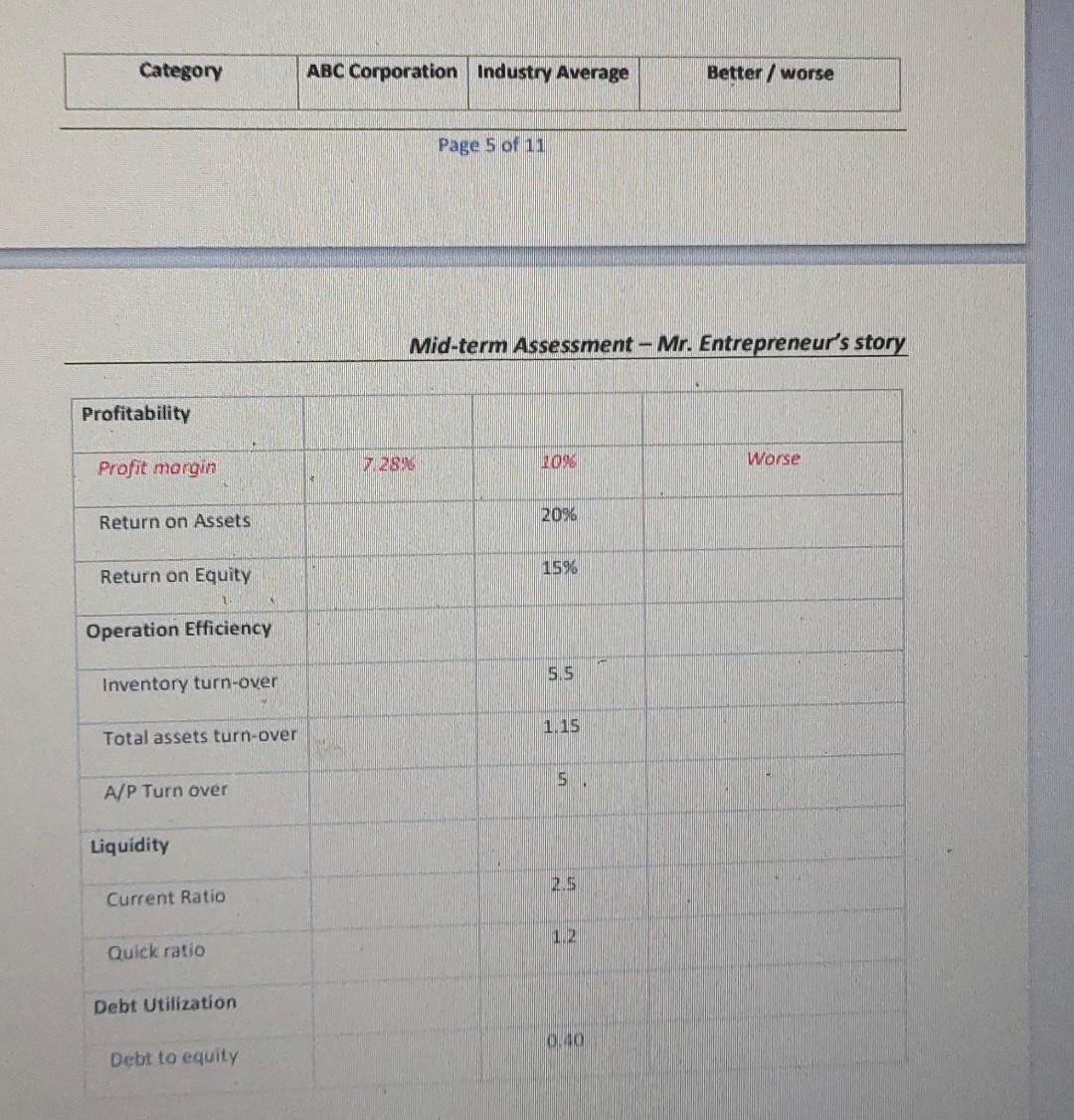

4. In your opinion, how has Mr. Entrepreneur been doing with his business in terms of profitability, operational efficiency, liquidity, and debt utilization? Use the template below and data from Table 1 and Table 2 to answer your questions. (16 marks - 2 marks for each ratio, show calculation): Show the formula you use and calculate the ratios and then complete the table below: Example: Profitmargin=SalesNetIncome=33390024300=7.28% \begin{tabular}{|l|l|l|l|} \hline Category & ABC Corporation & Industry Average & Better/worse \\ \hline \end{tabular} Page 5 of 11 Mid-term Assessment - Mr. Entrepreneur's story \begin{tabular}{|l|} \hline Profitabilit \\ \hline Profit mor \\ \hline Return o \\ \hline Return o \\ \hline Operation \\ \hline Inventor \\ \hline Total asset \\ \hline A/P Turn \\ \hline Liquidity \\ \hline \end{tabular} Current Ratio 2.5 Quick ratio 1.2 Debt Utilization Debt to equity 4. In your opinion, how has Mr. Entrepreneur been doing with his business in terms of profitability, operational efficiency, liquidity, and debt utilization? Use the template below and data from Table 1 and Table 2 to answer your questions. (16 marks - 2 marks for each ratio, show calculation): Show the formula you use and calculate the ratios and then complete the table below: Example: Profitmargin=SalesNetIncome=33390024300=7.28% \begin{tabular}{|l|l|l|l|} \hline Category & ABC Corporation & Industry Average & Better/worse \\ \hline \end{tabular} Page 5 of 11 Mid-term Assessment - Mr. Entrepreneur's story \begin{tabular}{|l|} \hline Profitabilit \\ \hline Profit mor \\ \hline Return o \\ \hline Return o \\ \hline Operation \\ \hline Inventor \\ \hline Total asset \\ \hline A/P Turn \\ \hline Liquidity \\ \hline \end{tabular} Current Ratio 2.5 Quick ratio 1.2 Debt Utilization Debt to equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started