Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need answer asap Taunton Corp. Suppose you have been hired as a financial consultant to Taunton Corp., a large, publicly traded firm that is the

need answer asap

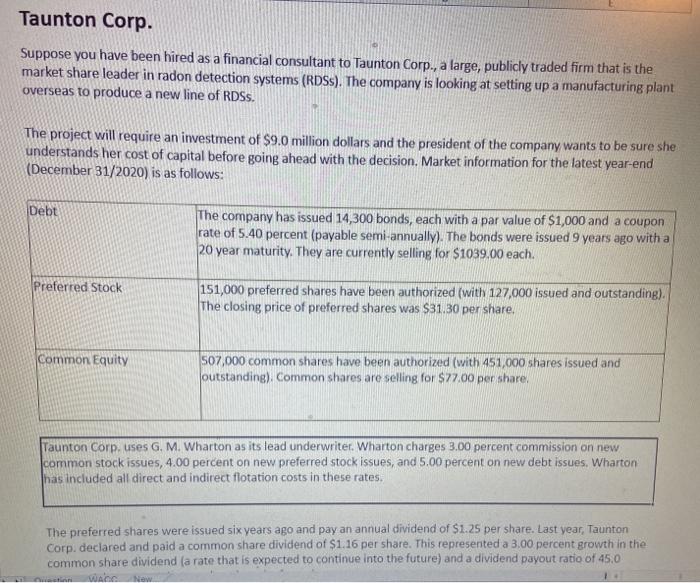

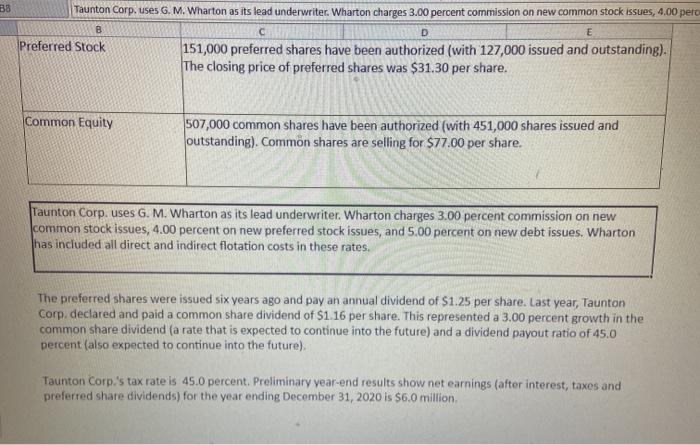

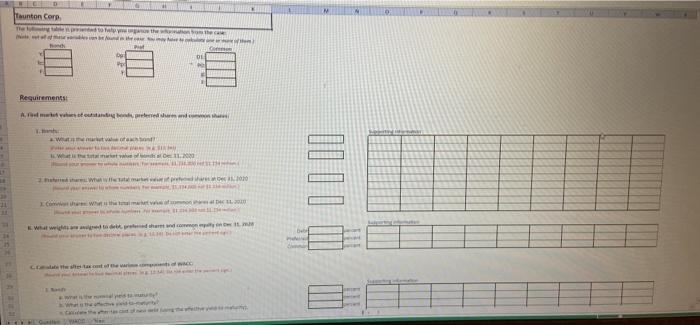

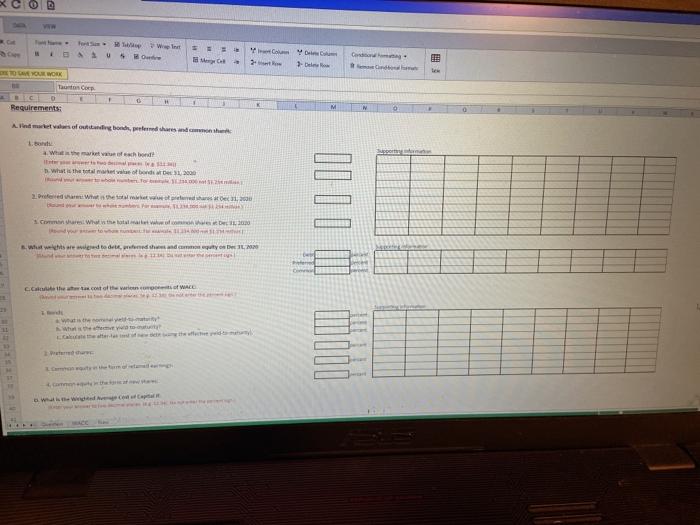

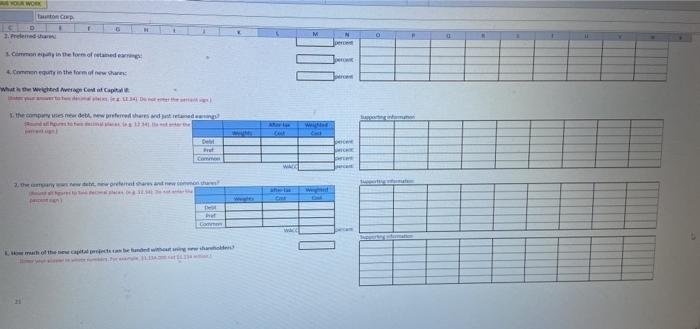

Taunton Corp. Suppose you have been hired as a financial consultant to Taunton Corp., a large, publicly traded firm that is the market share leader in radon detection systems (RDS). The company is looking at setting up a manufacturing plant overseas to produce a new line of RDS. The project will require an investment of $9.0 million dollars and the president of the company wants to be sure she understands her cost of capital before going ahead with the decision. Market information for the latest year-end (December 31/2020) is as follows: Debt The company has issued 14,300 bonds, each with a par value of $1,000 and a coupon rate of 5.40 percent (payable semi-annually). The bonds were issued 9 years ago with a 20 year maturity. They are currently selling for $1039.00 each. Preferred Stock 151,000 preferred shares have been authorized (with 127,000 issued and outstanding). The closing price of preferred shares was $31.30 per share, Common Equity 507,000 common shares have been authorized (with 451,000 shares issued and outstanding). Common shares are selling for $27.00 per share, Taunton Corp. uses G. M. Wharton as its lead underwriter. Wharton charges 3.00 percent commission on new common stock issues, 4.00 percent on new preferred stock issues, and 5.00 percent on new debt issues. Wharton has included all direct and indirect flotation costs in these rates. The preferred shares were issued six years ago and pay an annual dividend of $1.25 per share. Last year, Taunton Corp. declared and paid a common share dividend of $1.16 per share. This represented a 3.00 percent growth in the common share dividend la rate that is expected to continue into the future) and a dividend payout ratio of 45.0 War 88 C D E Taunton Corp. uses G. M. Wharton as its lead underwriter. Wharton charges 3.00 percent commission on new common stock issues, 4.00 pero 8 Preferred Stock 151,000 preferred shares have been authorized (with 127,000 issued and outstanding). The closing price of preferred shares was $31.30 per share. Common Equity 507,000 common shares have been authorized (with 451,000 shares issued and outstanding). Common shares are selling for $77.00 per share. Taunton Corp. uses G. M. Wharton as its lead underwriter. Wharton charges 3.00 percent commission on new common stock issues, 4.00 percent on new preferred stock issues, and 5.00 percent on new debt issues. Wharton has included all direct and indirect flotation costs in these rates. The preferred shares were issued six years ago and pay an annual dividend of $1.25 per share. Last year, Taunton Corp. declared and paid a common share dividend of $1.16 per share. This represented a 3.00 percent growth in the common share dividend (a rate that is expected to continue into the future) and a dividend payout ratio of 45.0 percent (also expected to continue into the future). Taunton Corp.'s tax rate is 45.0 percent. Preliminary year-end results show net earnings (after interest, taxes and preferred share dividends) for the year ending December 31, 2020 is $6.0 million taunton Core Teleph Requirements: A met water wa W trata de 20 Wema 0 oro Como DET What with a Wint DUO CDG DO YOU WORK + D Requirements: And tout bonded and Libo 2. Whecho What is the totalmebord 312000 SE2 2. What the worst 200 1.Can Without com De 20 What we do hmoty Cathew.cout of the area of WAL with Wedd M 0 1. Pred In the form of tandem 4. Con in the form of new three What we were Contact The comprendered heres de Brut w C Taunton Corp. Suppose you have been hired as a financial consultant to Taunton Corp., a large, publicly traded firm that is the market share leader in radon detection systems (RDS). The company is looking at setting up a manufacturing plant overseas to produce a new line of RDS. The project will require an investment of $9.0 million dollars and the president of the company wants to be sure she understands her cost of capital before going ahead with the decision. Market information for the latest year-end (December 31/2020) is as follows: Debt The company has issued 14,300 bonds, each with a par value of $1,000 and a coupon rate of 5.40 percent (payable semi-annually). The bonds were issued 9 years ago with a 20 year maturity. They are currently selling for $1039.00 each. Preferred Stock 151,000 preferred shares have been authorized (with 127,000 issued and outstanding). The closing price of preferred shares was $31.30 per share, Common Equity 507,000 common shares have been authorized (with 451,000 shares issued and outstanding). Common shares are selling for $27.00 per share, Taunton Corp. uses G. M. Wharton as its lead underwriter. Wharton charges 3.00 percent commission on new common stock issues, 4.00 percent on new preferred stock issues, and 5.00 percent on new debt issues. Wharton has included all direct and indirect flotation costs in these rates. The preferred shares were issued six years ago and pay an annual dividend of $1.25 per share. Last year, Taunton Corp. declared and paid a common share dividend of $1.16 per share. This represented a 3.00 percent growth in the common share dividend la rate that is expected to continue into the future) and a dividend payout ratio of 45.0 War 88 C D E Taunton Corp. uses G. M. Wharton as its lead underwriter. Wharton charges 3.00 percent commission on new common stock issues, 4.00 pero 8 Preferred Stock 151,000 preferred shares have been authorized (with 127,000 issued and outstanding). The closing price of preferred shares was $31.30 per share. Common Equity 507,000 common shares have been authorized (with 451,000 shares issued and outstanding). Common shares are selling for $77.00 per share. Taunton Corp. uses G. M. Wharton as its lead underwriter. Wharton charges 3.00 percent commission on new common stock issues, 4.00 percent on new preferred stock issues, and 5.00 percent on new debt issues. Wharton has included all direct and indirect flotation costs in these rates. The preferred shares were issued six years ago and pay an annual dividend of $1.25 per share. Last year, Taunton Corp. declared and paid a common share dividend of $1.16 per share. This represented a 3.00 percent growth in the common share dividend (a rate that is expected to continue into the future) and a dividend payout ratio of 45.0 percent (also expected to continue into the future). Taunton Corp.'s tax rate is 45.0 percent. Preliminary year-end results show net earnings (after interest, taxes and preferred share dividends) for the year ending December 31, 2020 is $6.0 million taunton Core Teleph Requirements: A met water wa W trata de 20 Wema 0 oro Como DET What with a Wint DUO CDG DO YOU WORK + D Requirements: And tout bonded and Libo 2. Whecho What is the totalmebord 312000 SE2 2. What the worst 200 1.Can Without com De 20 What we do hmoty Cathew.cout of the area of WAL with Wedd M 0 1. Pred In the form of tandem 4. Con in the form of new three What we were Contact The comprendered heres de Brut w C Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started