Answered step by step

Verified Expert Solution

Question

1 Approved Answer

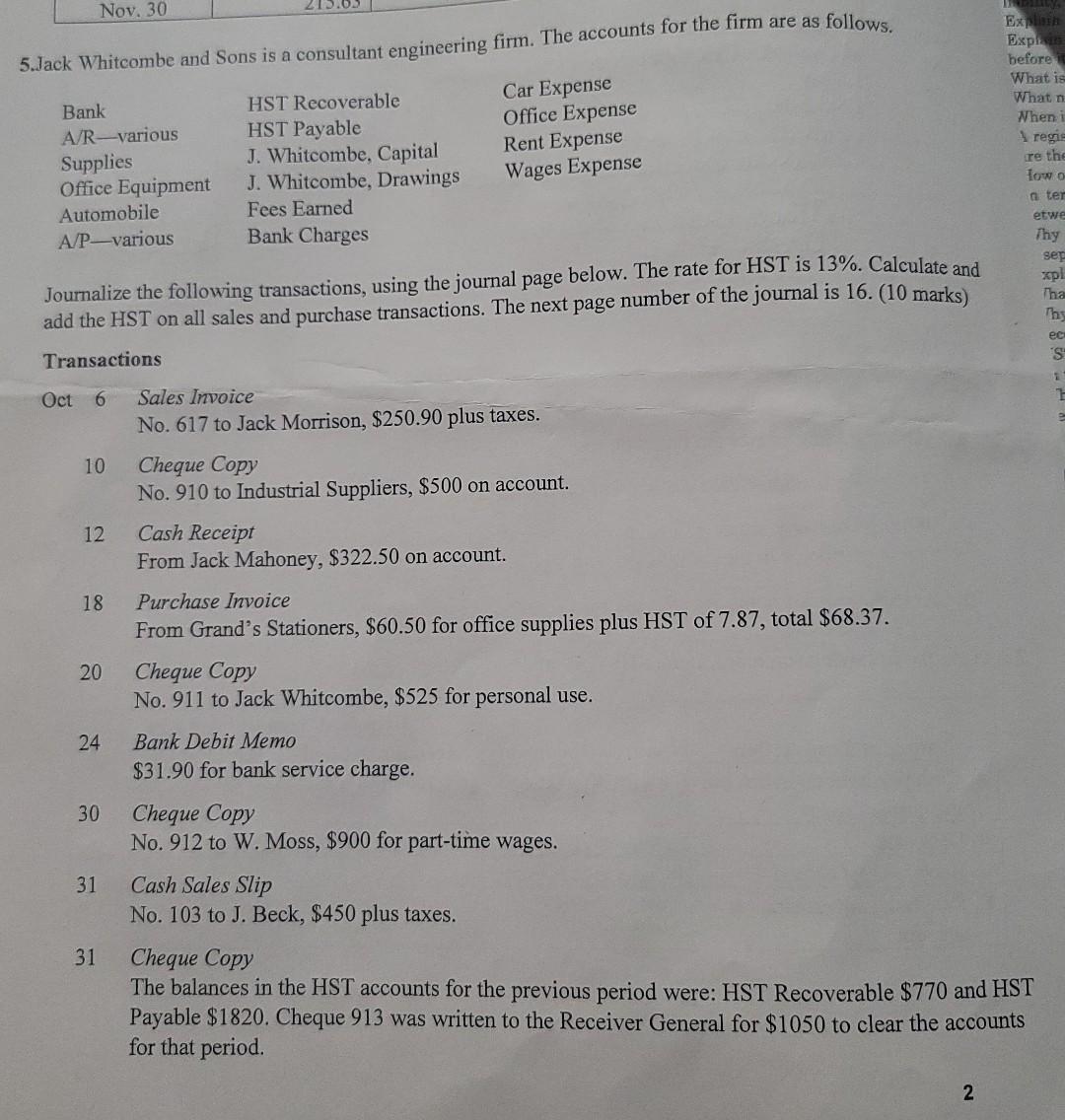

need answer fast please Nov. 30 0.05 5.Jack Whitcombe and Sons is a consultant engineering firm. The accounts for the firm are as follows. Bank

need answer fast please

Nov. 30 0.05 5.Jack Whitcombe and Sons is a consultant engineering firm. The accounts for the firm are as follows. Bank A/R-various Supplies Office Equipment Automobile A/P_various HST Recoverable HST Payable J. Whitcombe, Capital J. Whitcombe, Drawings Fees Earned Bank Charges Car Expense Office Expense Rent Expense Wages Expense Explain Express before What is What When i 4 regis re the lowo a ter etwe Thy sep xpl Tha Journalize the following transactions, using the journal page below. The rate for HST is 13%. Calculate and add the HST on all sales and purchase transactions. The next page number of the journal is 16. (10 marks) Transactions ec 'S 1 Oct 6 10 12 Sales Invoice No. 617 to Jack Morrison, $250.90 plus taxes. Cheque Copy No. 910 to Industrial Suppliers, $500 on account. Cash Receipt From Jack Mahoney, $322.50 on account. Purchase Invoice From Grand's Stationers, $60.50 for office supplies plus HST of 7.87, total $68.37. Cheque Copy No. 911 to Jack Whitcombe, $525 for personal use. 18 20 24 Bank Debit Memo $31.90 for bank service charge. 30 Cheque Copy No. 912 to W. Moss, $900 for part-time wages. Cash Sales Slip No. 103 to J. Beck, $450 plus taxes. 31 31 Cheque Copy The balances in the HST accounts for the previous period were: HST Recoverable $770 and HST Payable $1820. Cheque 913 was written to the Receiver General for $1050 to clear the accounts for that period. 2 GENERAL JOURNAL PAGE P.R. DEBIT CREDIT DATE PARTICULARSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started