Need answer for PART B only! I just have 30 minutes to finish. Thank You

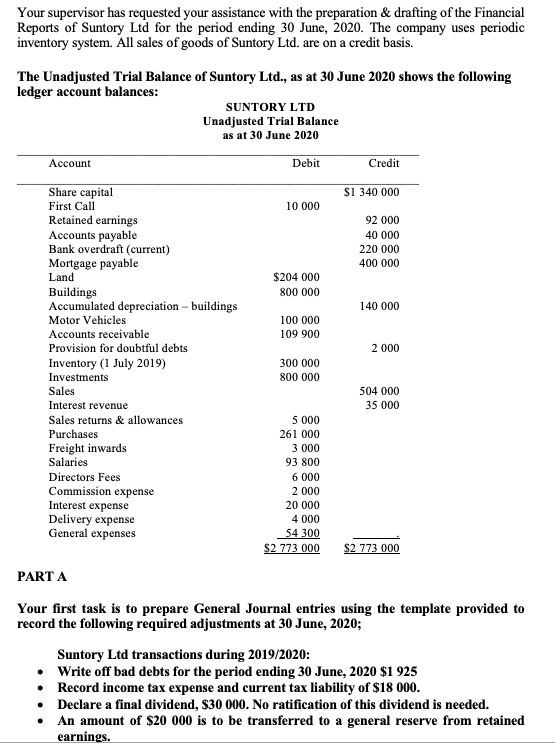

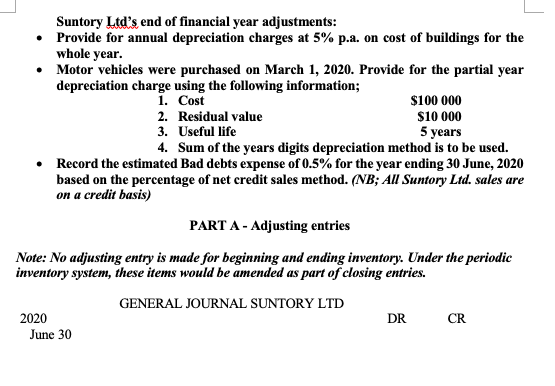

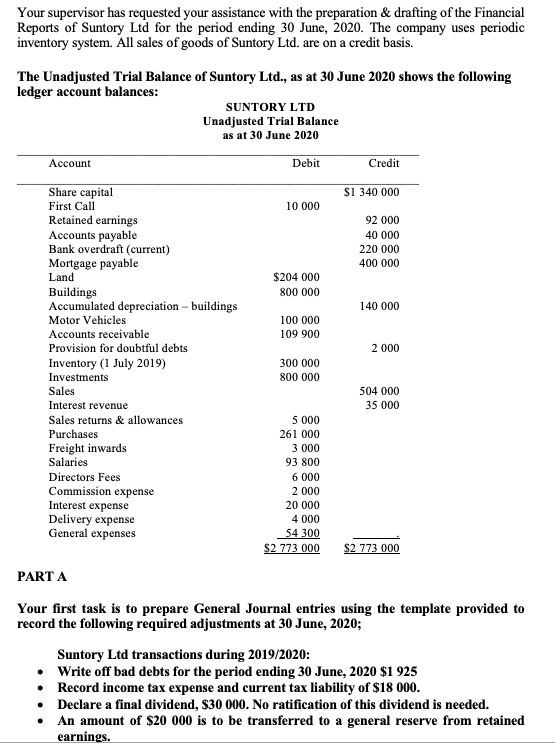

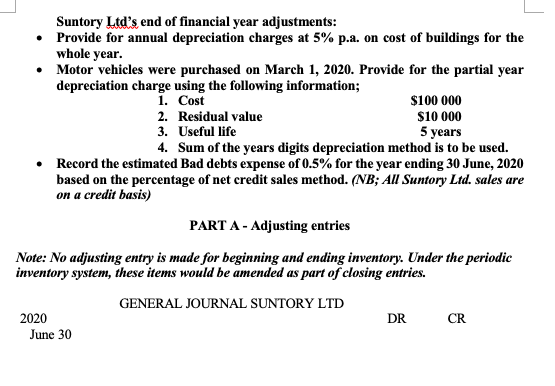

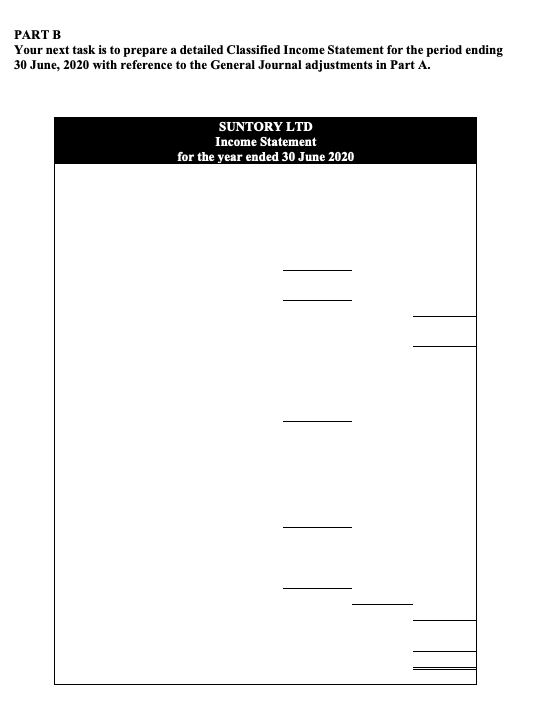

Your supervisor has requested your assistance with the preparation & drafting of the Financial Reports of Suntory Ltd for the period ending 30 June, 2020. The company uses periodic inventory system. All sales of goods of Suntory Ltd. are on a credit basis. The Unadjusted Trial Balance of Suntory Ltd., as at 30 June 2020 shows the following ledger account balances: SUNTORY LTD Unadjusted Trial Balance as at 30 June 2020 Account Debit Credit $1 340 000 10 000 92 000 40 000 220 000 400 000 $204 000 800 000 140 000 100 000 109 900 2 000 Share capital First Call Retained earnings Accounts payable Bank overdraft (current) Mortgage payable Land Buildings Accumulated depreciation - buildings Motor Vehicles Accounts receivable Provision for doubtful debts Inventory (1 July 2019) Investments Sales Interest revenue Sales returns & allowances Purchases Freight inwards Salaries Directors Fees Commission expense Interest expense Delivery expense General expenses 300 000 800 000 504 000 35 000 5 000 261 000 3 000 93 800 6 000 2 000 20 000 4 000 54 300 $2 773 000 $2 773 000 PARTA Your first task is to prepare General Journal entries using the template provided to record the following required adjustments at 30 June, 2020; Suntory Ltd transactions during 2019/2020: Write off bad debts for the period ending 30 June, 2020 $1 925 Record income tax expense and current tax liability of $18 000. Declare a final dividend, $30 000. No ratification of this dividend is needed. An amount of $20 000 is to be transferred to a general reserve from retained earnings. Suntory Ltd's end of financial year adjustments: Provide for annual depreciation charges at 5% p.a. on cost of buildings for the whole year. Motor vehicles were purchased on March 1, 2020. Provide for the partial year depreciation charge using the following information; 1. Cost $100 000 2. Residual value $10 000 3. Useful life 5 years 4. Sum of the years digits depreciation method is to be used. Record the estimated Bad debts expense of 0.5% for the year ending 30 June, 2020 based on the percentage of net credit sales method. (NB; All Suntory Ltd. sales are on a credit basis) PART A - Adjusting entries Note: No adjusting entry is made for beginning and ending inventory. Under the periodic inventory system, these items would be amended as part of closing entries. GENERAL JOURNAL SUNTORY LTD 2020 DR CR June 30 PART B Your next task is to prepare a detailed Classified Income Statement for the period ending 30 June, 2020 with reference to the General Journal adjustments in Part A. SUNTORY LTD Income Statement for the year ended 30 June 2020