need answer for question b and word count is 300 words

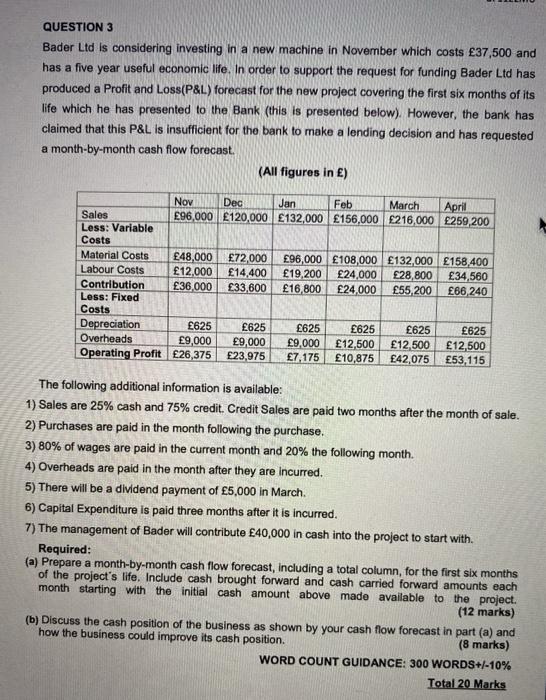

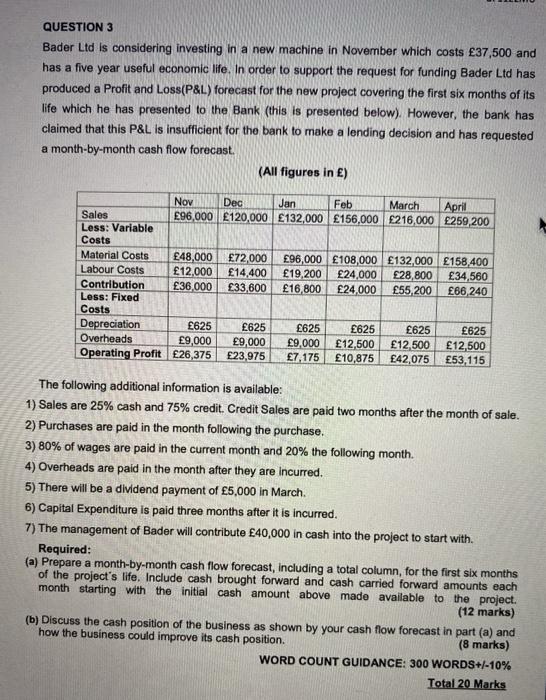

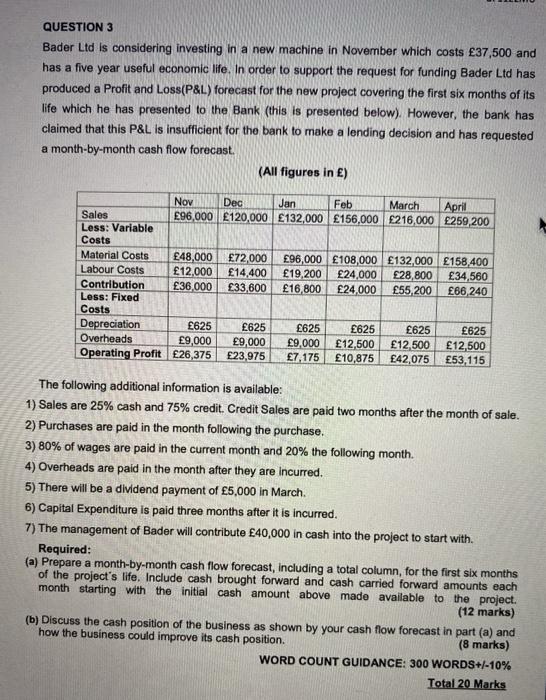

QUESTION 3 Bader Ltd is considering investing in a new machine in November which costs 37,500 and has a five year useful economic life. In order to support the request for funding Bader Ltd has produced a Profit and Loss(P&L) forecast for the new project covering the first six months of its life which he has presented to the Bank (this is presented below). However, the bank has claimed that this P&L is insufficient for the bank to make a lending decision and has requested a month-by-month cash flow forecast. (All figures in ) Nov Dec Jan Feb March April Sales 96,000 120,000 132,000 156,000 216,000 259, 200 Less: Variable Costs Material Costs 48,000 72,000 96,000 108,000 132,000 158,400 Labour Costs 12,000 14,400 19,200 24,000 28,800 34,560 Contribution 36.000 33,600 16,800 24,000 55,200 66.240 Less: Fixed Costs Depreciation 625 625 625 625 625 625 Overheads 9,000 9,000 9,000 12,500 12,500 12,500 Operating Profit 26,375 23,975 7,175 10,875 42,075 53,115 The following additional information is available: 1) Sales are 25% cash and 75% credit. Credit Sales are paid two months after the month of sale. 2) Purchases are paid in the month following the purchase. 3) 80% of wages are paid in the current month and 20% the following month. 4) Overheads are paid in the month after they are incurred. 5) There will be a dividend payment of 5,000 in March. 6) Capital Expenditure is paid three months after it is incurred. 7) The management of Bader will contribute 40,000 in cash into the project to start with. Required: (a) Prepare a month-by-month cash flow forecast, including a total column, for the first six months of the project's life. Include cash brought forward and cash carried forward amounts each month starting with the initial cash amount above made available to the project. (12 marks) (b) Discuss the cash position of the business as shown by your cash flow forecast in part (a) and how the business could improve its cash position. (8 marks) WORD COUNT GUIDANCE: 300 WORDS+/-10% Total 20 Marks Cash Flow Forecast Month Dec Jan Feb March April Total Cash Inflows: Investment 40,000 Cash Sales 24,000 30,000 33,000 39,000 54,000 64,800 2,44,800 Credit Sales 72,000 90,000 99,000 1,17,000 3,78,000 Total Inflows 64,000 30,000 1,05,000 1,29,000 1,53,000 1,81,800 6,22,800 Cash Outflows: Less: Variable Cost Material 48,000 72,000 96,000 1,08,000 1,32,000 4,56,000 Labour 9,600 13,920 18,240 23,040 27,840 50,688 1,33,728 Less: Fixed Cost Overhead 9,000 9,000 9,000 12,500 12,500 12,500 64,500 Capital Expenditure 37,500 37,500 Less : Dividend Paid 5,000 5,000 Total Outflows 18,600 70,920 1,36,740 1,31,540 1,53,340 1,95,188 6,96,728 Net Cash Flows 45,400-40,920-31,740 -2,540 -340 -13,388 -73,928 Opening Balance Closing Balance O 45,400 4,480 -27,260 -29,800 30,140 -43,528 45,400 4,480 -27,260 29,800 30,140 43,528 1,17,456