Need answer for question b)

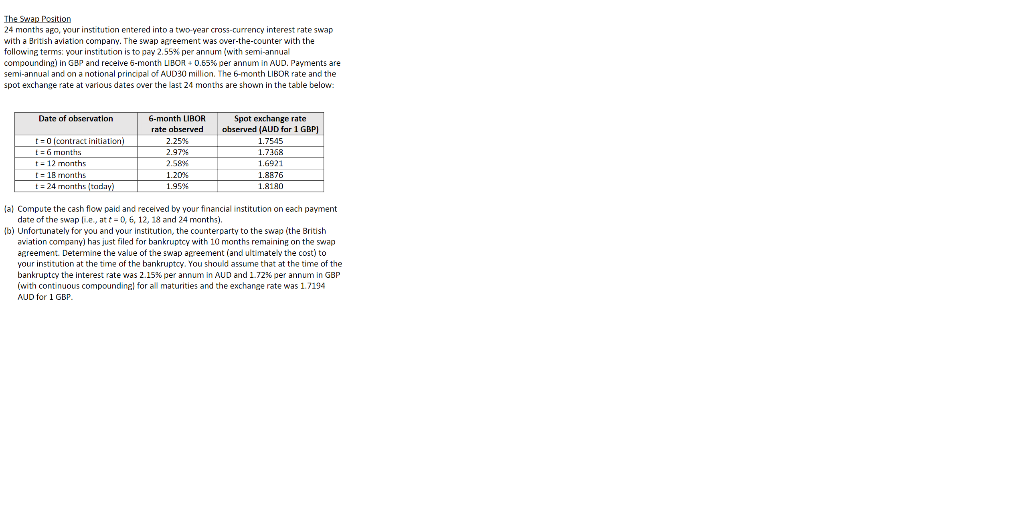

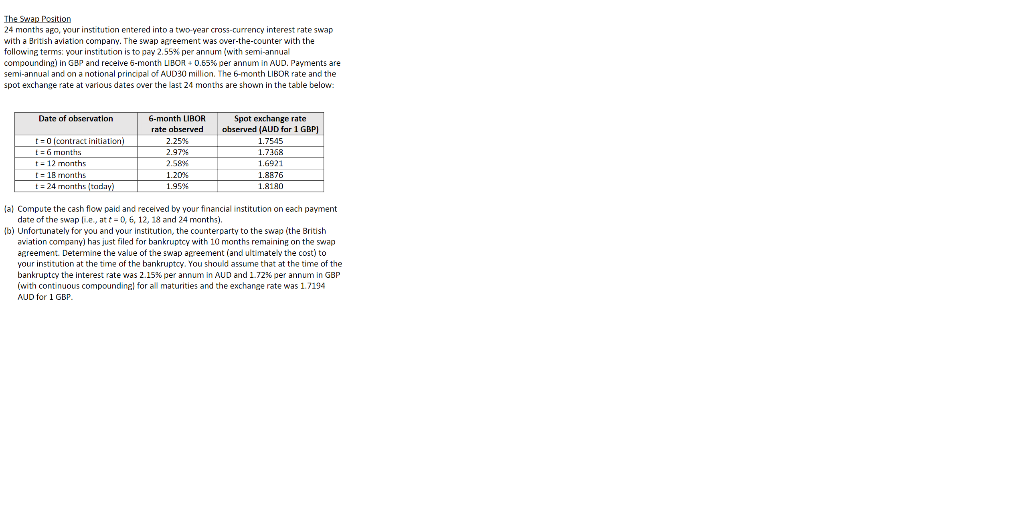

The Swap Position 24 months ago, your institution entered into a two-year cross-currency interest rate swap with a British aviation company. The swap agreement was over-the-counter with the following terms your institution is to pay 2.55% per annum (with semi-annual compoundine) in GBP and receive 6-month LIBOR +0.65% per annum in AUD. Payments are semi-annual and on an on a notional principal of al of AUD30 million. The 6-month LI th LIBOR rate and the spot exchange rate at various dates over the last 24 months are shown in the table below: Date of observation [= contract initiation t = 6 months t - 12 months [ = 18 months t = 24 months taday) 6-month LIBOR rate observed 2.25% 2.97% 2.58% 1.20% 1.95% Spot exchange rate observed (AUD for 1 GBP) 1.7545 1.7368 1.6921 1.8676 1.8180 lal Compute the cash flow paid and received by your financial institution on each payment date of the swap lie, at 0, 6, 12, 18 and 24 months). b) Unfortunately for you and your institution, the counterparty to the swap (the British aviation company has just filed for bankruptcy with 10 months remaining on the swap agreement. Determine the value of the swap apreement and ultimately the cost) to your institution at the time of the bankruptcy. You should assume that at the time of the bankruptcy the interest rate was 2.15% per annum in AUD and 1.72% per annum in GBP (with continuous compoundinal for all maturities and the exchange rate was 1.7194 AUD for 1 GBP. The Swap Position 24 months ago, your institution entered into a two-year cross-currency interest rate swap with a British aviation company. The swap agreement was over-the-counter with the following terms your institution is to pay 2.55% per annum (with semi-annual compoundine) in GBP and receive 6-month LIBOR +0.65% per annum in AUD. Payments are semi-annual and on an on a notional principal of al of AUD30 million. The 6-month LI th LIBOR rate and the spot exchange rate at various dates over the last 24 months are shown in the table below: Date of observation [= contract initiation t = 6 months t - 12 months [ = 18 months t = 24 months taday) 6-month LIBOR rate observed 2.25% 2.97% 2.58% 1.20% 1.95% Spot exchange rate observed (AUD for 1 GBP) 1.7545 1.7368 1.6921 1.8676 1.8180 lal Compute the cash flow paid and received by your financial institution on each payment date of the swap lie, at 0, 6, 12, 18 and 24 months). b) Unfortunately for you and your institution, the counterparty to the swap (the British aviation company has just filed for bankruptcy with 10 months remaining on the swap agreement. Determine the value of the swap apreement and ultimately the cost) to your institution at the time of the bankruptcy. You should assume that at the time of the bankruptcy the interest rate was 2.15% per annum in AUD and 1.72% per annum in GBP (with continuous compoundinal for all maturities and the exchange rate was 1.7194 AUD for 1 GBP