Need answer of problem 40 using the format below. To answer problem 40 you need to first complete problem 39 which attached below.

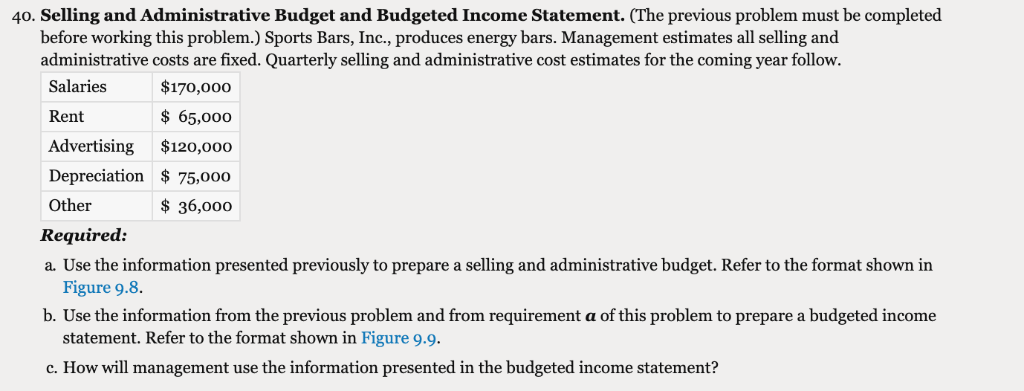

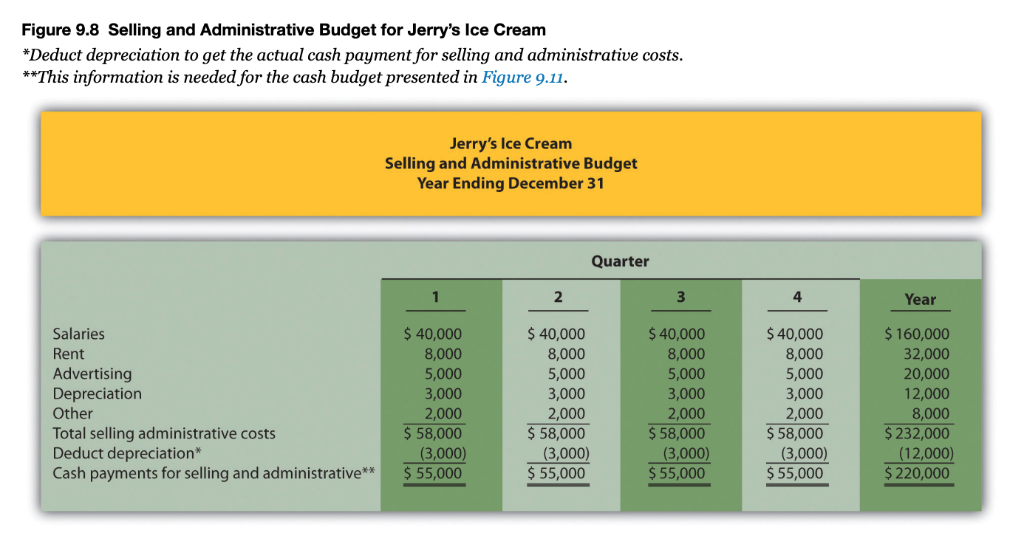

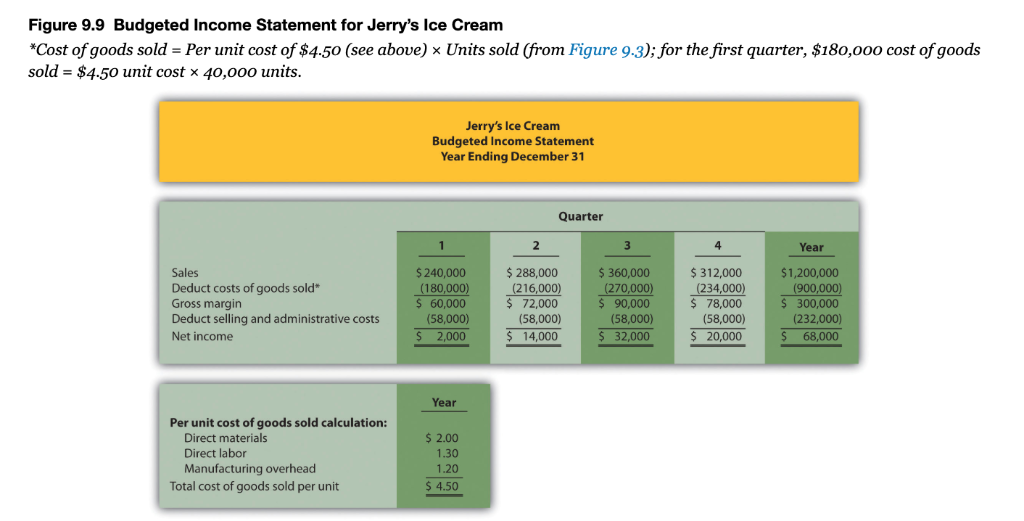

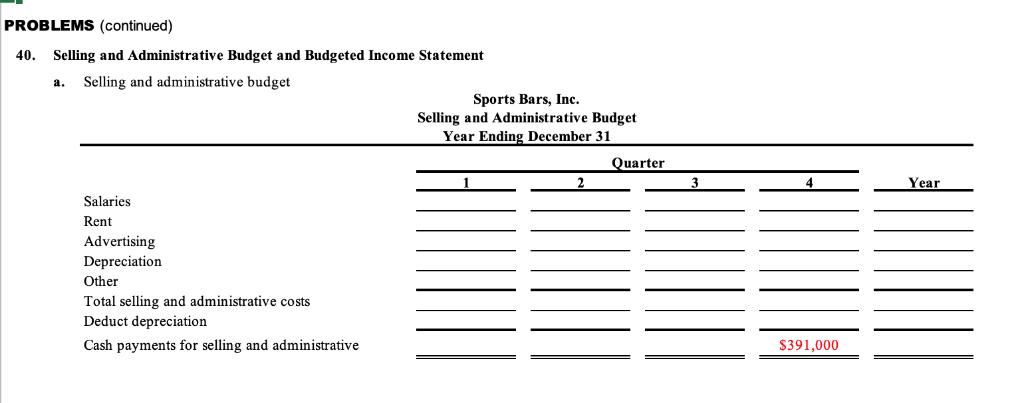

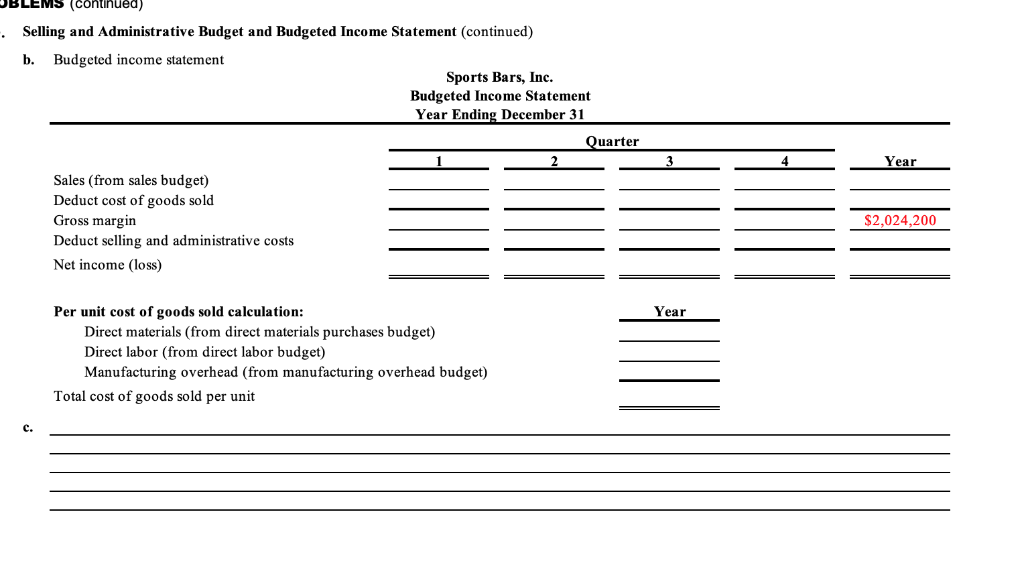

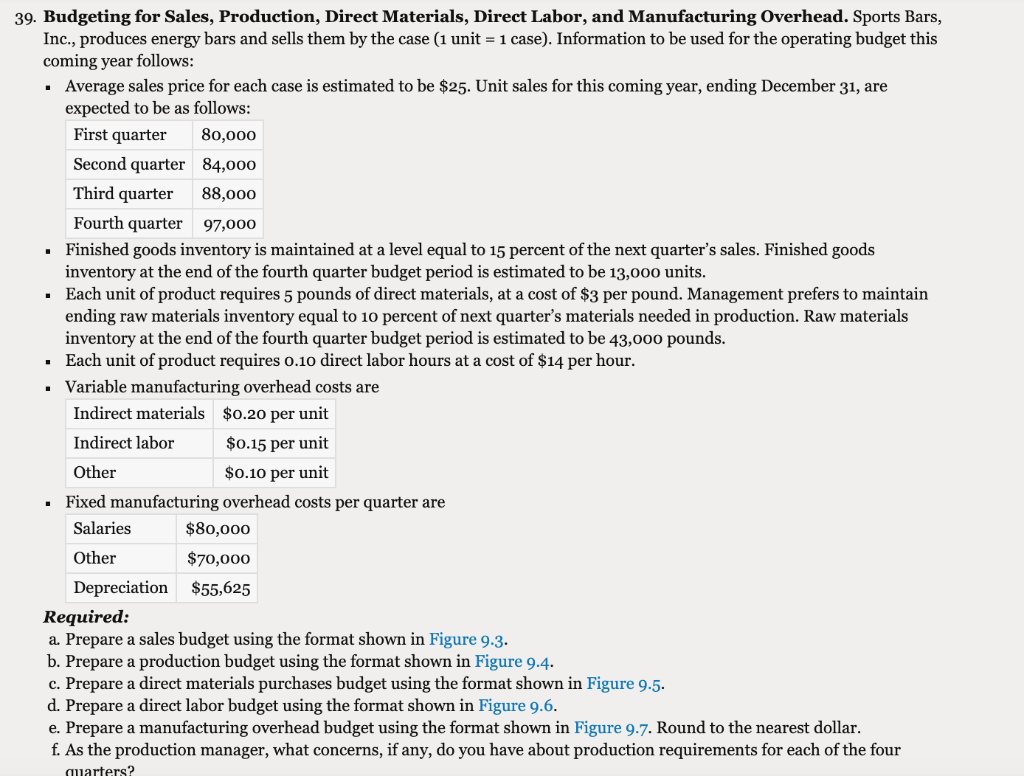

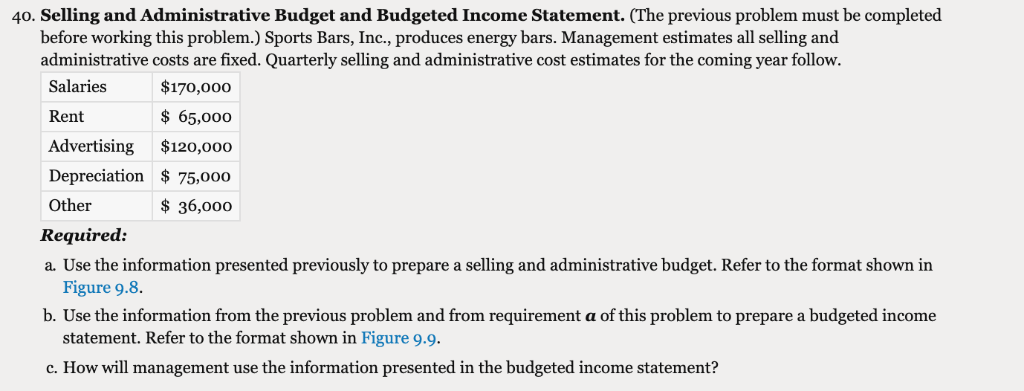

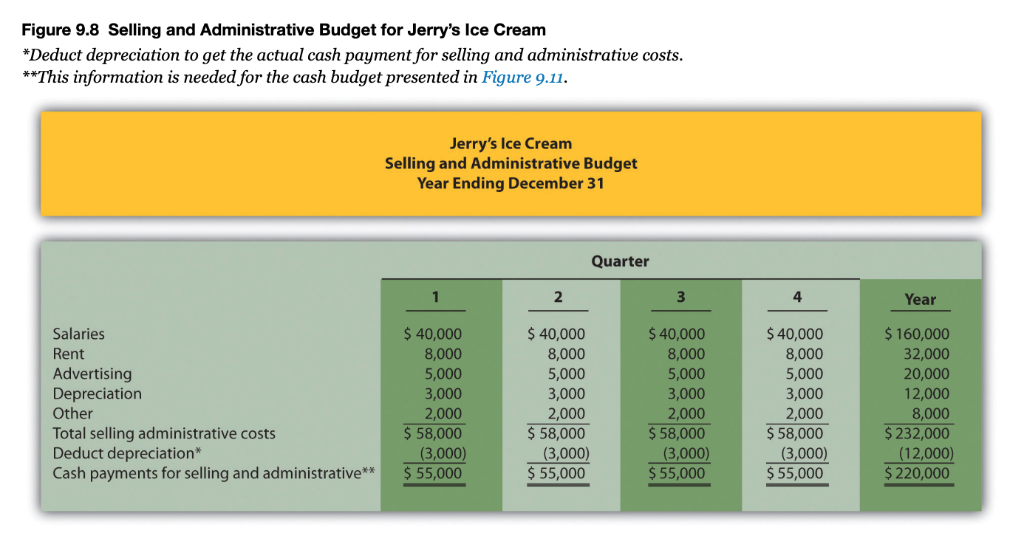

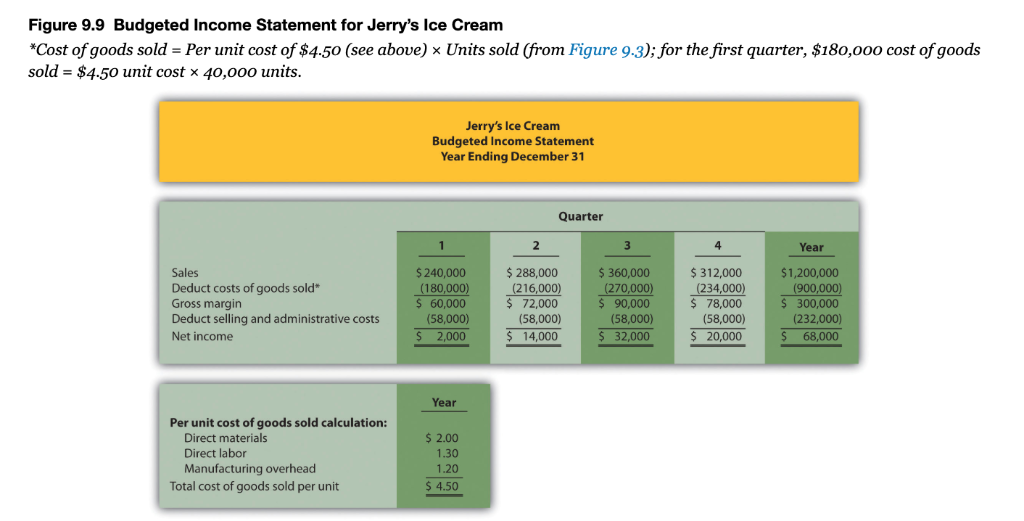

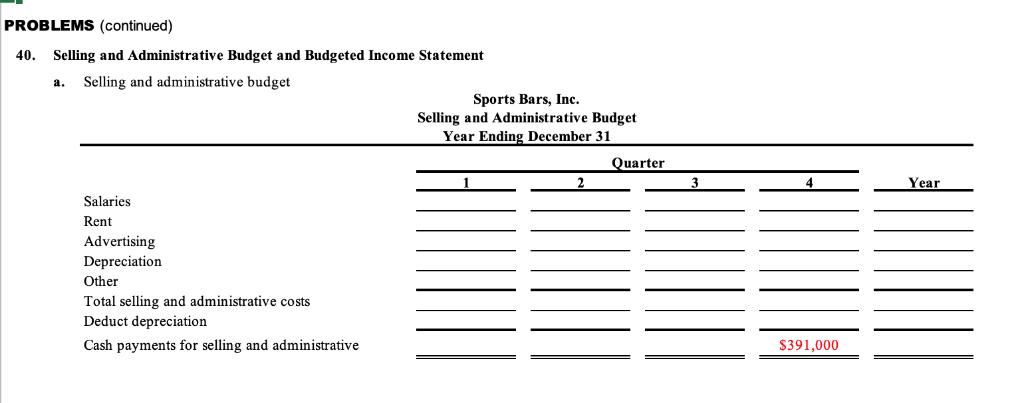

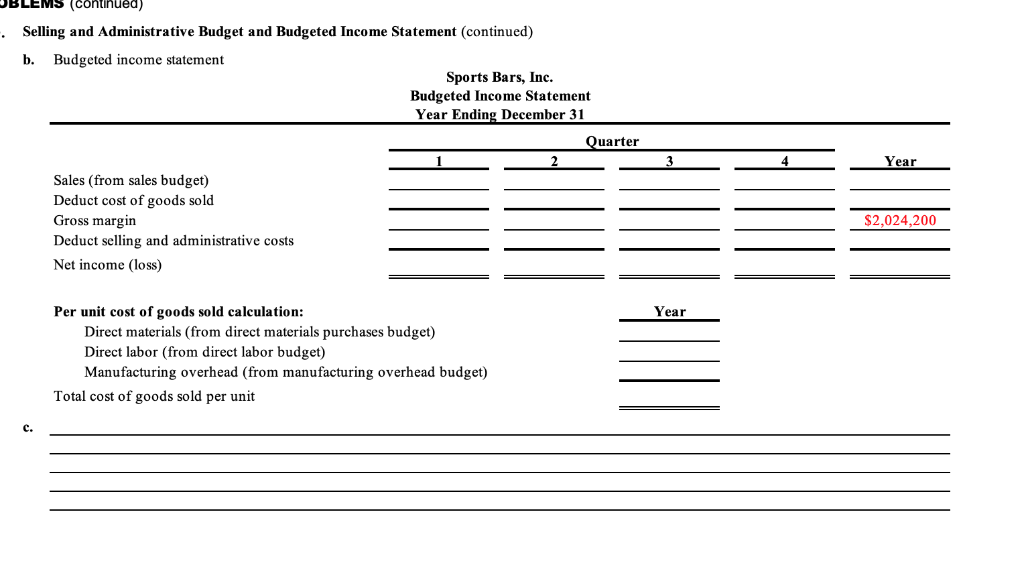

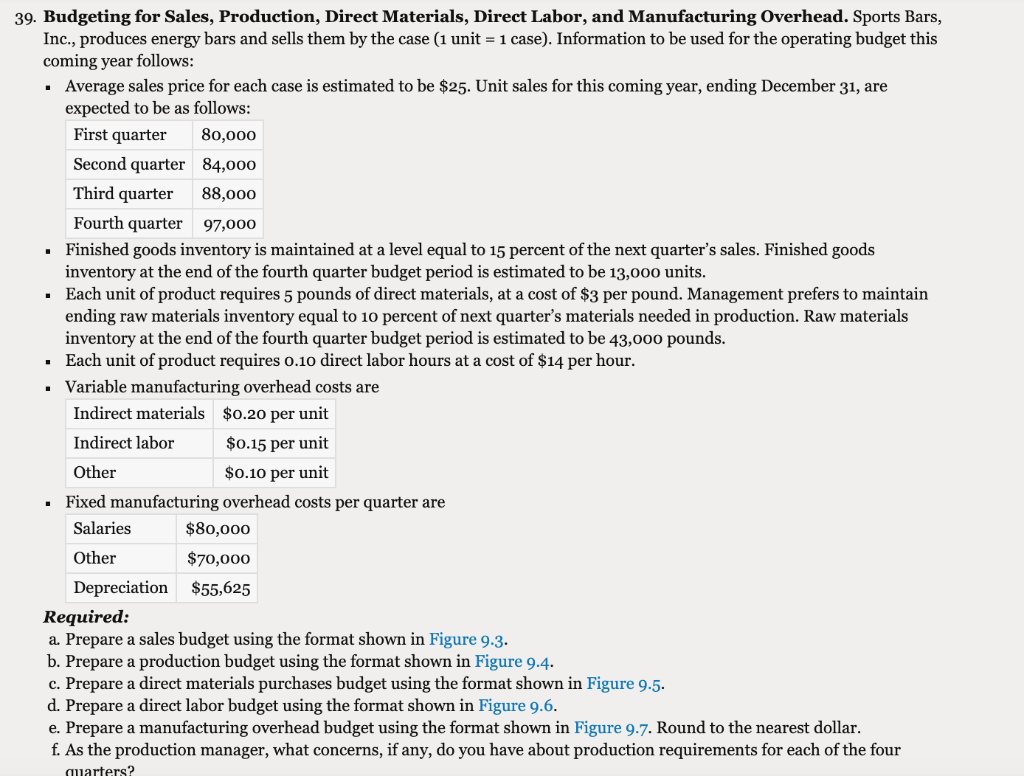

40. Selling and Administrative Budget and Budgeted Income Statement. (The previous problem must be completed before working this problem.) Sports Bars, Inc., produces energy bars. Management estimates all selling and administrative costs are fixed. Quarterly selling and administrative cost estimates for the coming year follow. Salaries $170,000 Rent Advertising $120,000 Depreciation $75,0oo Other $65,000 $36,000 Required: a. Use the information presented previously to prepare a selling and administrative budget. Refer to the format shown in Figure 9.8. b. Use the information from the previous problem and from requirement a of this problem to prepare a budgeted income statement. Refer to the format shown in Figure 9.9 c. How will management use the information presented in the budgeted income statement? Figure 9.8 Selling and Administrative Budget for Jerry's Ice Cream *Deduct depreciation to get the actual cash payment for selling and administrative costs **This information is needed for the cash budget presented in Figure 9.11. Jerry's Ice Cream Selling and Administrative Budget Year Ending December 31 Quarter Year $ 40,000 8,000 5,000 3,000 2,000 $58,000 3,000) Cash payments for selling and administrative$ 55,000 $ 40,000 8,000 5,000 3,000 2,000 $58,000 (3,000) 55,000 $ 40,000 8,000 5,000 3,000 2,000 $ 58,000 3,000) $ 55,000 $ 40,000 8,000 5,000 3,000 $160,000 32,000 20,000 12,000 8,000 $ 232,000 (12,000) $220,000 Salaries Rent Advertising Depreciation $ 58,000 (3,000) $ 55,000 Total selling administrative costs Deduct depreciation Figure 9.9 Budgeted Income Statement for Jerry's Ice Cream "cost of goods sold-Per unit cost of $4.50 (see above) Units sold (from Figure 9.3); for the first quarter, $180,000 cost of goods sold - $4.50 unit cost x 40,0oo units Jerry's Ice Cream Budgeted Income Statement Year Ending December 31 Quarter Year $1,200,000 $ 300,000 S 68,000 $ 240,000 $288,000 312,000 Sales Deduct costs of goods sold Gross margin Deduct selling and administrative costs Net income $ 360,000 180,000)(216,000) (270,000)(234,000) (900,000) $ 90,000 72,000 (58,000) 14,000 78,000 (58,000) $ 20,000 S 60,000 (58,000) $ 2,000 (58,000) (232,000) $ 32,000 Year Per unit cost of goods sold calculation: Direct materials Direct labor Manufacturing overhead s 2.00 1.30 1.20 $ 4.50 Total cost of goods sold per unit PROBLEMS (continued) 40. Selling and Administrative Budget and Budgeted Income Statement Selling and administrative budget a. Sports Bars, Inc. Selling and Administrative Budget Year Ending December 31 Quarter Year 4 Salaries Rent Advertising Depreciation Other Total selling and administrative costs Deduct depreciation Cash payments for selling and administrative S391,000 Selling and Administrative Budget and Budgeted Income Statement (continued) b. Budgeted income statement Sports Bars, Inc. Budgeted Income Statement Year Ending December 31 Quarter Year Sales (from sales budget) Deduct cost of goods sold Gross margin Deduct seling and administrative costs Net income (loss) S2,024,200 Per unit cost of goods sold calculation: Year Direct materials (from direct materials purchases budget) Direct labor (from direct labor budget) Manufacturing overhead (from manufacturing overhead budget) Total cost of goods sold per unit C. 39. Budgeting for Sales, Production, Direct Materials, Direct Labor, and Manufacturing Overhead. Sports Bars, Inc., produces energy bars and sells them by the case (1 unit-1 case). Information to be used for the operating budget this coming year follows Average sales price for each case is estimated to be $25. Unit sales for this coming year, ending December 31, are expected to be as follows: First quarter 80,ooo Second quarter 84,000 Third quarter 88,0o0 Fourth quarter 97,000 Finished goods inventory is maintained at a level equal to 15 percent of the next quarter's sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 13,00o units. Each unit of product requires 5 pounds of direct materials, at a cost of $3 per pound. Management prefers to maintain ending raw materials inventory equal to 10 percent of next quarter's materials needed in production. Raw materials inventory at the end of the fourth quarter budget period is estimated to be 43,000 pounds Each unit of product requires o.10 direct labor hours at a cost of $14 per hour Variable manufacturing overhead costs are . . Indirect materials Indirect labor Other $0.20 per unit $0.15 per unit $o.10 per unit Fixed manufacturing overhead costs per quarter are - Salaries $80,000 Other $70,000 Depreciation $55,625 Required: a. Prepare a sales budget using the format shown in Figure 9.3. b. Prepare a production budget using the format shown in Figure 9.4. c. Prepare a direct materials purchases budget using the format shown in Figure 9.5. d. Prepare a direct labor budget using the format shown in Figure 9.6 e. Prepare a manufacturing overhead budget using the format shown in Figure 9.7. Round to the nearest dollar f. As the production manager, what concerns, if any, do you have about production requirements for each of the four