Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need Answer to Part C Question 2 Key Company acquired 30% of the outstanding voting common shares of Stone Inc. for S660,000 on January 1,

Need Answer to Part C

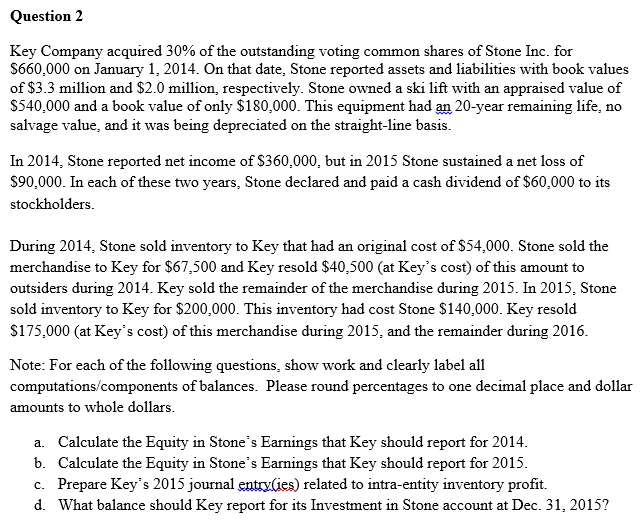

Question 2 Key Company acquired 30% of the outstanding voting common shares of Stone Inc. for S660,000 on January 1, 2014. On that date, Stone reported assets and liabilities with book values of $3.3 million and $2.0 million, respectively. Stone owned a ski lift with an appraised value of S540,000 and a book value of only $180,000. This equipment had an 20-year remaining life, no salvage value, and it was being depreciated on the straight-line basis In 2014, Stone reported net income of $360,000, but in 2015 Stone sustained a net loss of S90,000. In each of these two years, Stone declared and paid a cash dividend of $60,000 to its stockholders During 2014, Stone sold inventory to Key that had an original cost of $54,000. Stone sold the merchandise to Key for $67,500 and Key resold $40,500 (at Key's cost) of this amount to outsiders during 2014. Key sold the remainder of the merchandise during 2015. In 2015, Stone sold inventory to Key for $200,000. This inventory had cost Stone $140,000. Key resold S 175,000 at Key's cost of this merchandise during 2015. and the remainder during 2016 Note: For each of the following questions, show work and clearly label all computations components of balances. Please round percentages to one decimal place and dollar amounts to whole dollars a. Calculate the Equity in Stone's Earnings that Key should report for 2014 b. Calculate the Equity in Stone's Earnings that Key should report for 2015 c. Prepare Key's 2015 journal entryGes related to intra-entity inventory profit. d. at balance should Key report for its Investment in Stone account at Dec. 31, 2015Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started