Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need answer to questions 2&3 need answer for question 4 too. 2nd 2. The creation of a portfolio by combining two assets having pe alph

need answer to questions 2&3

need answer for question 4 too.

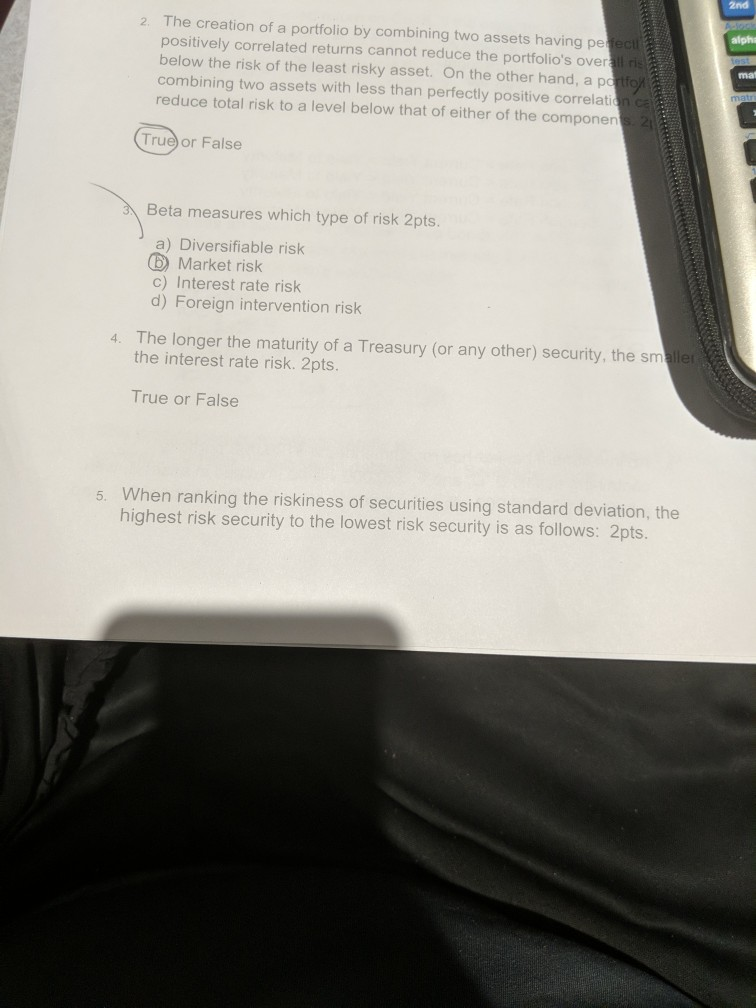

2nd 2. The creation of a portfolio by combining two assets having pe alph positively correlated returns cannot reduce the portfolio's overall below the risk of the least risky asset. On the other hand, a pot combining two assets with less than perfectly positive correlation ca reduce total risk to a level below that of either of the componer mat True or False Beta measures which type of risk 2pts. a) Diversifiable risk Market risk c) Interest rate rislk d) Foreign intervention risk 4. The longer the maturity of a Treasury (or any other) security, the smalle the interest rate risk. 2pts True or False 5. When ranking the riskiness of securities using standard deviation, the highest risk security to the lowest risk security is as follows: 2ptsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started