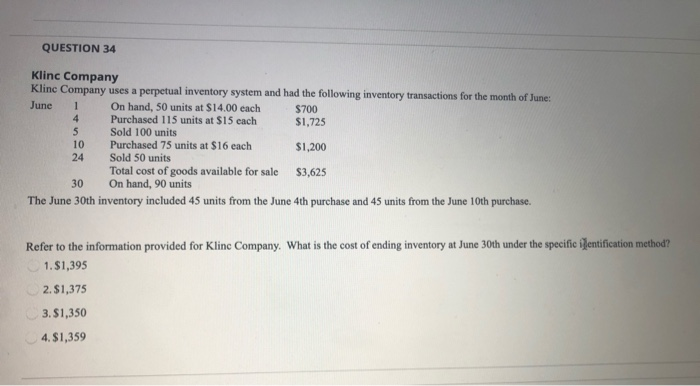

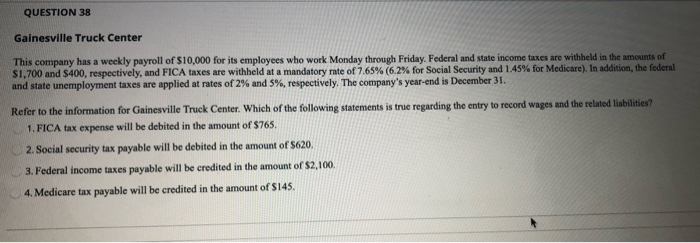

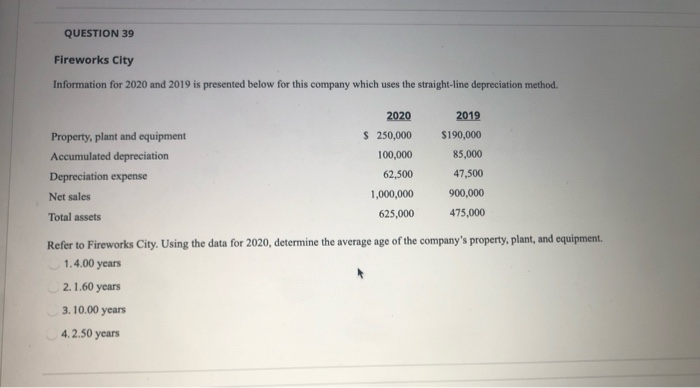

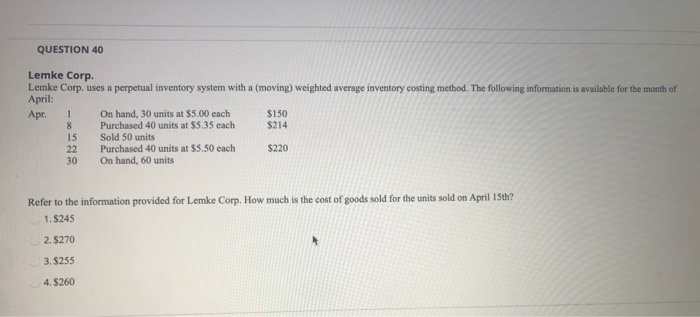

QUESTION 34 Klinc Company Klinc Company uses a perpetual inventory system and had the following inventory transactions for the month of June June 1 On hand, 50 units at $14.00 each $700 4 Purchased 115 units at $15 each $1,725 Sold 100 units 10 Purchased 75 units at $16 each $1,200 24 Sold 50 units Total cost of goods available for sale $3,625 On hand, 90 units The June 30th inventory included 45 units from the June 4th purchase and 45 units from the June 10th purchase. 30 Refer to the information provided for Klinc Company. What is the cost of ending inventory at June 30th under the specificientification method? 1. $1,395 2. $1,375 3. $1,350 4. $1,359 QUESTION 38 Gainesville Truck Center This company has a weekly payroll of $10,000 for its employees who work Monday through Friday, Federal and state income taxes are withheld in the amounts of $1,700 and $400, respectively, and FICA taxes are withheld at a mandatory rate of 7.65%(6.2% for Social Security and 145% for Medicare). In addition, the federal and state unemployment taxes are applied at rates of 2% and 5%, respectively. The company's year-end is December 31 Refer to the information for Gainesville Truck Center. Which of the following statements is true regarding the entry to record wages and the related liabilities 1. FICA tax expense will be debited in the amount of $765. 2. Social security tax payable will be debited in the amount of 5620. 3. Federal income taxes payable will be credited in the amount of $2,100 4. Medicare tax payable will be credited in the amount of $145. QUESTION 39 Fireworks City Information for 2020 and 2019 is presented below for this company which uses the straight-line depreciation method. Property, plant and equipment Accumulated depreciation Depreciation expense Net sales Total assets 2020 $ 250,000 100,000 62,500 1,000,000 625,000 2019 $190,000 85,000 47,500 900,000 475,000 Refer to Fireworks City. Using the data for 2020, determine the average age of the company's property, plant, and equipment. 1.4.00 years 2.1.60 years 3.10.00 years 4.2.50 years QUESTION 40 Lemke Corp. Lemke Corp. uses a perpetual inventory system with a moving) weighted average inventory costing method. The following information is available for the month of April: Apr. On hand, 30 units at $5.00 each $150 Purchased 40 units at $5.35 each 5214 Sold 50 units Purchased 40 units at $5.50 each $220 30 On hand, 60 units Refer to the information provided for Lemke Corp. How much is the cost of goods sold for the units sold on April 15th? 1.5245 2. $270 3.8255 4. S260