Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plz , I would like to check my answers if they are correct. please anyone help me answers these questions. thx a lot!! Question 24

Plz , I would like to check my answers if they are correct. please anyone help me answers these questions. thx a lot!!

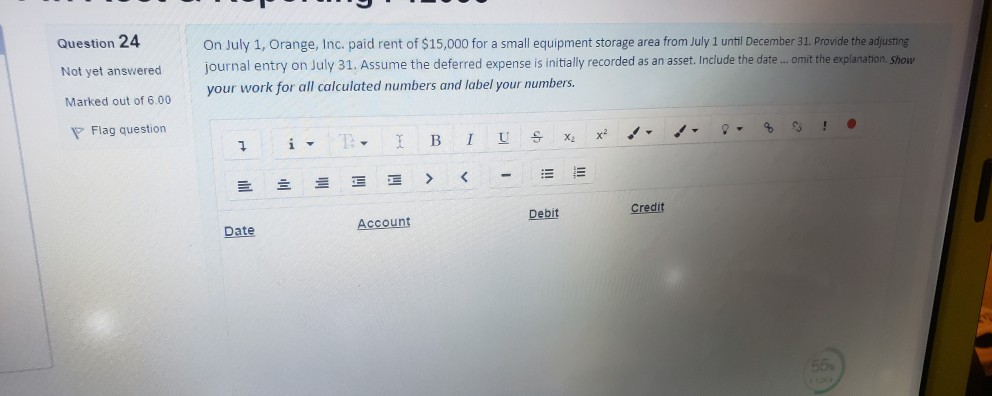

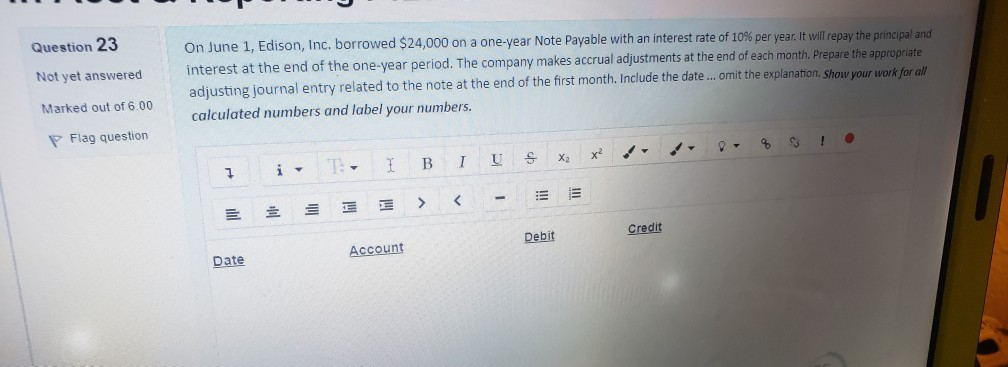

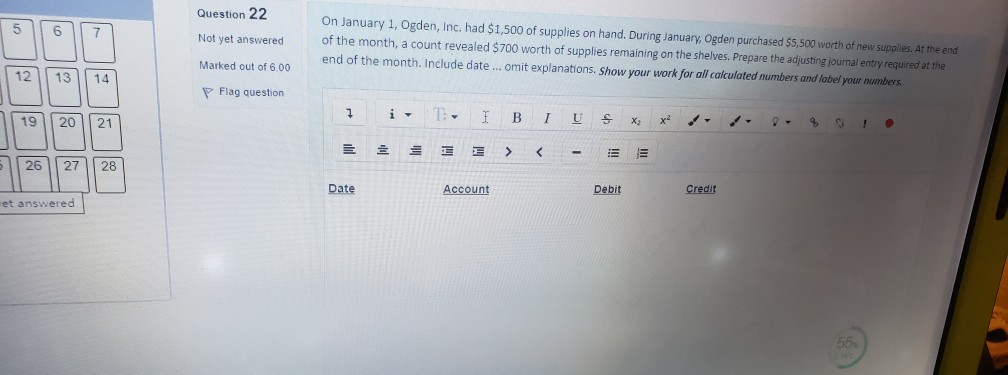

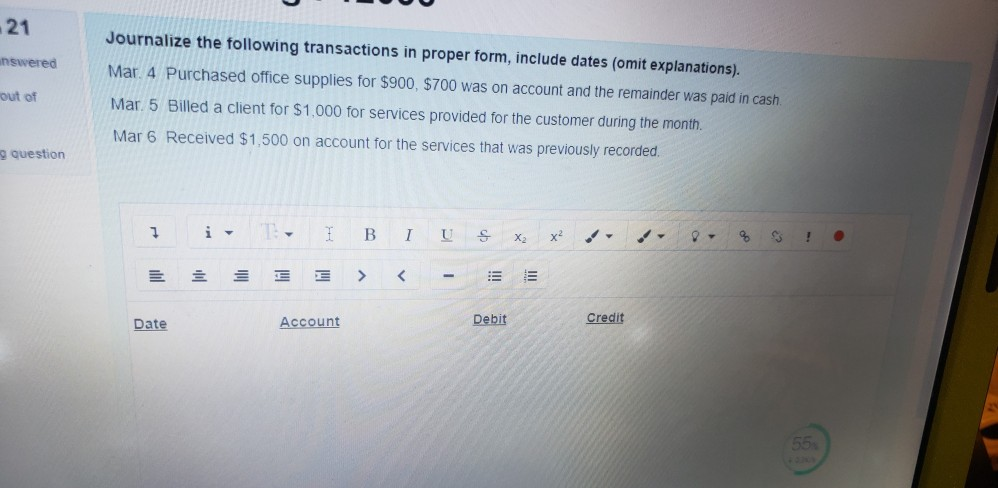

Question 24 Not yet answered On July 1, Orange, Inc. paid rent of $15,000 for a small equipment storage area from July 1 until December 31. Provide the adjusting journal entry on July 31. Assume the deferred expense is initially recorded as an asset. Include the date...omit the explanation. Show your work for all calculated numbers and label your numbers. Marked out of 6.00 P Flag question 1 1 B U x S - 7 X2 E > 5 26 27 28 Date Account Debit Credit et answered 21 answered Journalize the following transactions in proper form, include dates (omit explanations). Mar. 4 Purchased office supplies for $900, $700 was on account and the remainder was paid in cash Mar. 5 Billed a client for $1,000 for services provided for the customer during the month. Mar 6 Received $1,500 on account for the services that was previously recorded. out of question 1 1 B 1 U s X2 x2 0- % EStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started