Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need answer to the Income Tax Software (Profile) Question. Q: Which of the following statements regarding the reporting of business income on the corporate tax

Need answer to the Income Tax Software (Profile) Question.

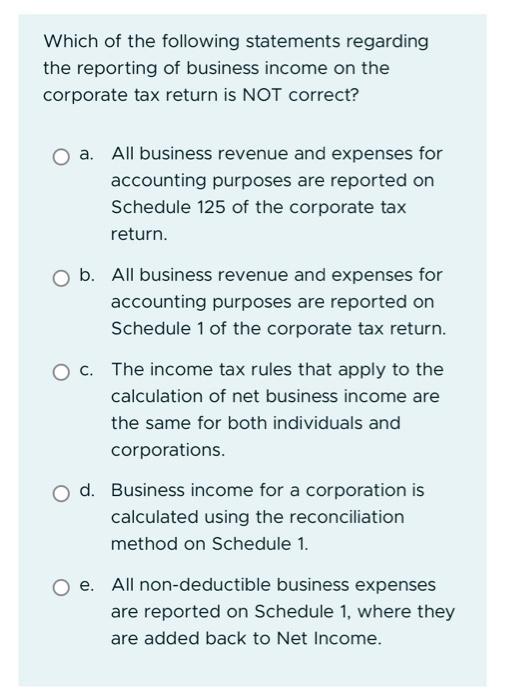

Which of the following statements regarding the reporting of business income on the corporate tax return is NOT correct? a. All business revenue and expenses for accounting purposes are reported on Schedule 125 of the corporate tax return. b. All business revenue and expenses for accounting purposes are reported on Schedule 1 of the corporate tax return. c. The income tax rules that apply to the calculation of net business income are the same for both individuals and corporations. d. Business income for a corporation is calculated using the reconciliation method on Schedule 1. e. All non-deductible business expenses are reported on Schedule 1, where they are added back to Net Income Q:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started