Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need answers 32-36 Taxes deductible as an itemized deduction include all of the following except: Personal property taxes based on the value of the property.

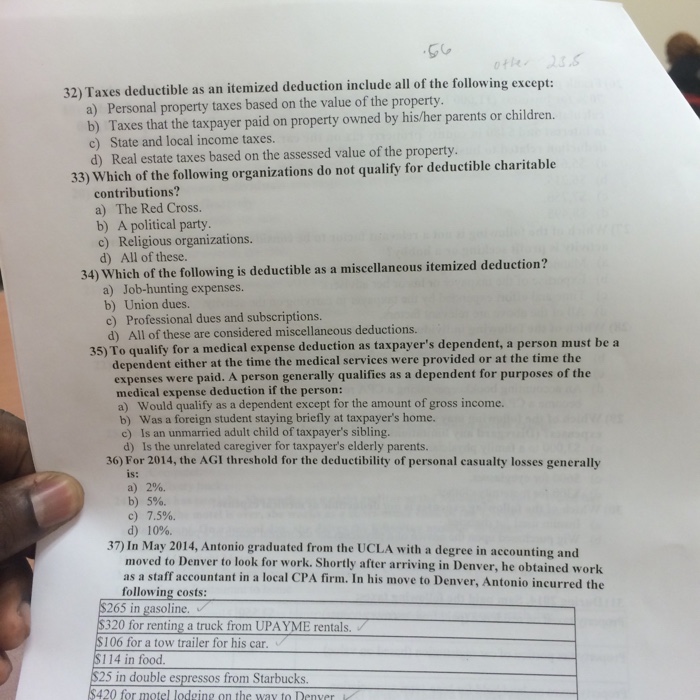

Need answers 32-36  Taxes deductible as an itemized deduction include all of the following except: Personal property taxes based on the value of the property. Taxes that the taxpayer paid on property owned by his/her parents or children. State and local income taxes. Real estate taxes based on the assessed value of the property. Which of the following organizations do not qualify for deductible charitable contributions? The Red Cross. A political party. Religious organizations. All of these. Which of the following is deductible as a miscellaneous itemized deduction? Job-hunting expenses. Union dues. Professional dues and subscriptions. All of these are considered miscellaneous deductions. To qualify for a medical expense deduction as taxpayer's dependent, a person must be a dependent cither at the time the medical services were provided or at the time the expenses were paid. A person generally qualifies as a dependent for purposes of the medical expense deduction if the person: Would qualify as a dependent except for the amount of gross income. Was a foreign student staying briefly at taxpayer's home. Is an unmarried adult child of taxpayer's sibling. Is the unrelated caregiver for taxpayer's elderly parents. For 2014, the AC I threshold for the deductibility of personal casualty losses generally 2%. 5%. 7.5%. 10%. In May 2014, Antonio graduated from the UCLA with a degree in accounting and moved to Denver to look for work. Shortly after arriving in Denver, he obtained work as a staff accountant in a local CPA firm. In his move to Denver, Antonio incurred the following costs: $265 in gasoline. $320 for renting a truck from UPAYME rentals. $106 for a tow trailer for his car. $114 in food. $25 in double espressos from Starbucks. 420 for mold lodging on the way to Denver

Taxes deductible as an itemized deduction include all of the following except: Personal property taxes based on the value of the property. Taxes that the taxpayer paid on property owned by his/her parents or children. State and local income taxes. Real estate taxes based on the assessed value of the property. Which of the following organizations do not qualify for deductible charitable contributions? The Red Cross. A political party. Religious organizations. All of these. Which of the following is deductible as a miscellaneous itemized deduction? Job-hunting expenses. Union dues. Professional dues and subscriptions. All of these are considered miscellaneous deductions. To qualify for a medical expense deduction as taxpayer's dependent, a person must be a dependent cither at the time the medical services were provided or at the time the expenses were paid. A person generally qualifies as a dependent for purposes of the medical expense deduction if the person: Would qualify as a dependent except for the amount of gross income. Was a foreign student staying briefly at taxpayer's home. Is an unmarried adult child of taxpayer's sibling. Is the unrelated caregiver for taxpayer's elderly parents. For 2014, the AC I threshold for the deductibility of personal casualty losses generally 2%. 5%. 7.5%. 10%. In May 2014, Antonio graduated from the UCLA with a degree in accounting and moved to Denver to look for work. Shortly after arriving in Denver, he obtained work as a staff accountant in a local CPA firm. In his move to Denver, Antonio incurred the following costs: $265 in gasoline. $320 for renting a truck from UPAYME rentals. $106 for a tow trailer for his car. $114 in food. $25 in double espressos from Starbucks. 420 for mold lodging on the way to Denver

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started