Answered step by step

Verified Expert Solution

Question

1 Approved Answer

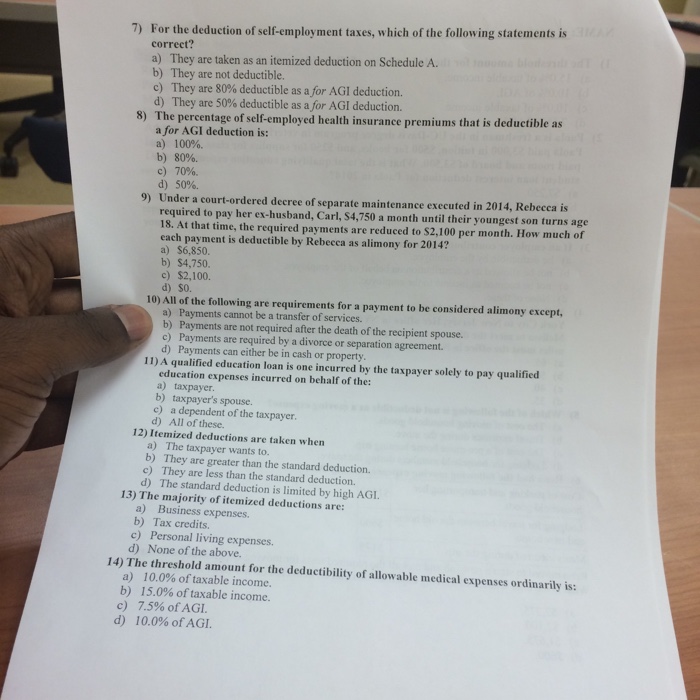

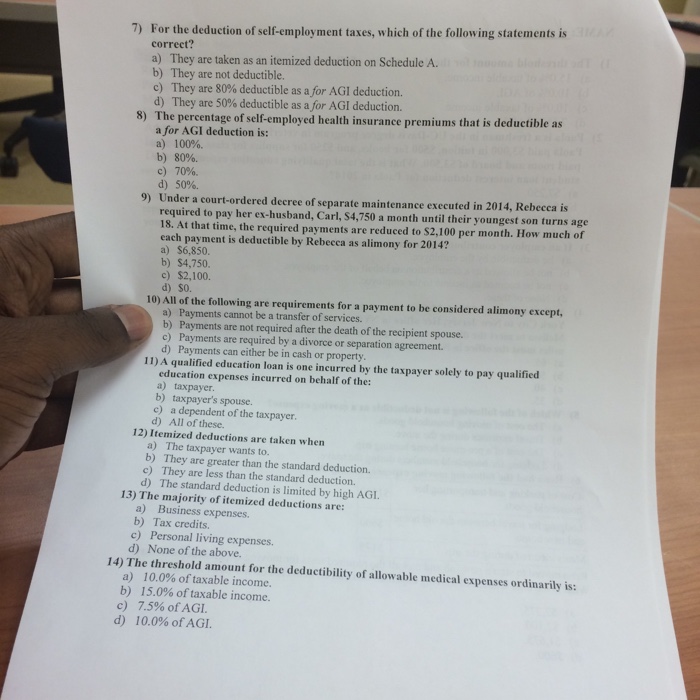

Need answers 7-14 For the deduction of self-employment taxes, which of the following statements is correct? They are taken as an itemized deduction on Schedule

Need answers 7-14

For the deduction of self-employment taxes, which of the following statements is correct? They are taken as an itemized deduction on Schedule A. They are not deductible. They are 80% deductible as a for AG I deduction. They arc 50% deductible as a for AGI deduction. The percentage of self-employed health insurance premiums that is deductible as a for AGI deduction is: 100%. 80%. 70%. 50%. Under a court-ordered decree of separate maintenance executed in 2014, Rebecca is required to pay her ex-husband, Carl, S4.750 a month until their youngest son turns age 18. At that time, the required payments are reduced to .$2, 100 per month. How much of each payment is deductible by Rebecca as alimony for 2014? $6, 850. $4, 750. $2, 100. $0. All of the following are requirements for a payment to be considered alimony except, Payments cannot be a transfer of services. Payments are not required after the death of the recipient spouse. Payments are required by a divorce or separation agreement. Payments can either be in cash or property. A qualified education loan is one incurred by the taxpayer solely to pay qualified education expenses incurred on behalf of the: taxpayer. taxpayer's spouse. a dependent of the taxpayer. All of these. Itemized deductions arc taken w hen The taxpayer wants to. They are greater than the standard deduction. They are less than the standard deduction. The standard deduction is limited by high AGI. The majority of itemized deductions are: Business expenses. Tax credits. Personal living expenses. None of the above. The threshold amount for the deductibility of allowable medical expenses ordinarily is: 10.0 % of taxable income 15.0% of taxable income. 7.5% of AGI. 10.0% of AGI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started