Need Answers Fast: very fast

20 mins

Thank You

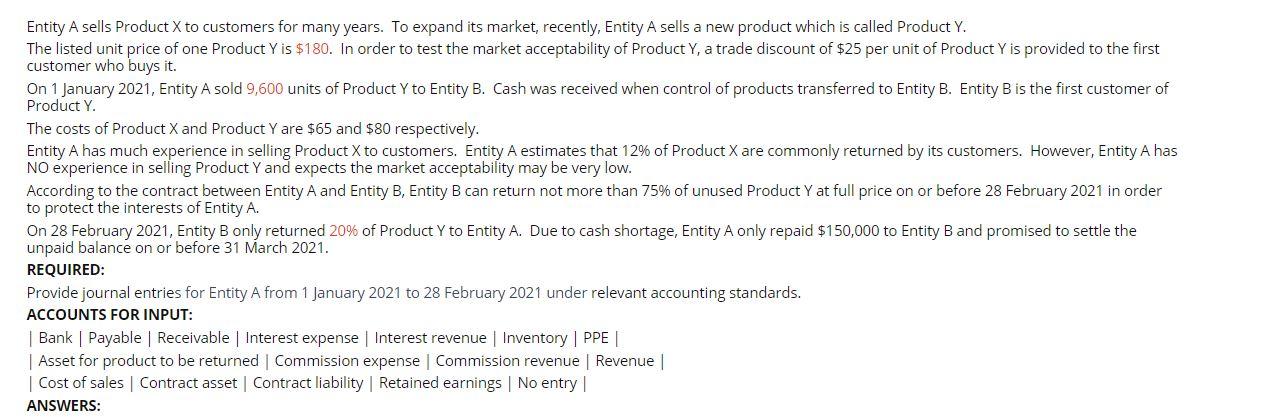

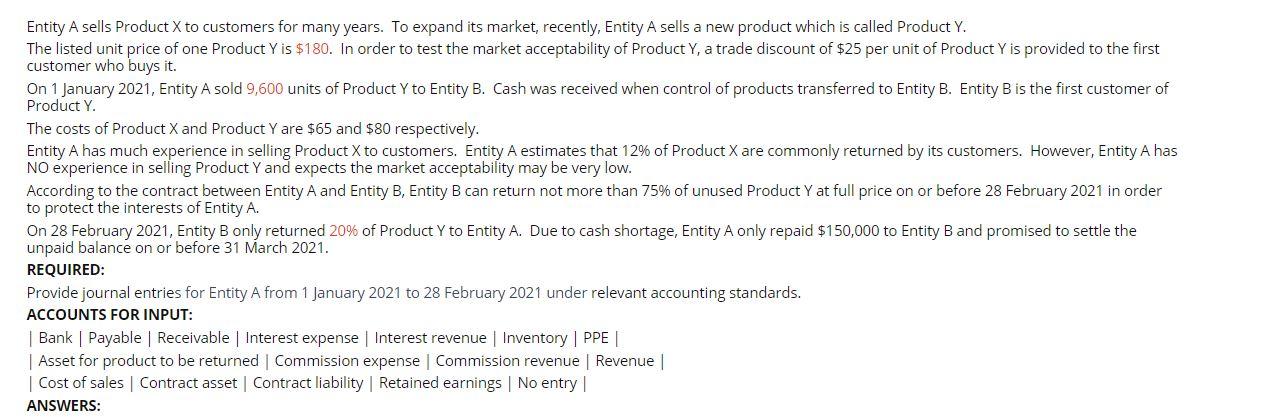

Entity A sells Product X to customers for many years. To expand its market, recently, Entity A sells a new product which is called Product Y. The listed unit price of one Product Y is $180. In order to test the market acceptability of Product Y, a trade discount of $25 per unit of Product Y is provided to the first customer who buys it. On 1 January 2021, Entity A sold 9,600 units of Product Y to Entity B. Cash was received when control of products transferred to Entity B. Entity B is the first customer of Product Y. The costs of Product X and Product Y are $65 and $80 respectively. Entity A has much experience in selling Product X to customers. Entity A estimates that 12% of Product X are commonly returned by its customers. However, Entity A has NO experience in selling Product Y and expects the market acceptability may be very low. According to the contract between Entity A and Entity B, Entity B can return not more than 75% of unused Product Y at full price on or before 28 February 2021 in order to protect the interests of Entity A. On 28 February 2021, Entity B only returned 20% of Product Y to Entity A. Due to cash shortage, Entity A only repaid $150,000 to Entity B and promised to settle the unpaid balance on or before 31 March 2021. REQUIRED: Provide journal entries for Entity A from 1 January 2021 to 28 February 2021 under relevant accounting standards. ACCOUNTS FOR INPUT: Bank [ Payable Receivable Interest expense Interest revenue Inventory | PPE | Asset for product to be returned Commission expense Commission revenue Revenue | Cost of sales Contract asset Contract liability Retained earnings | No entry | ANSWERS: ACCOUNTS FOR INPUT: Bank | Payable Receivable Interest expense Interest revenue Inventory | PPE Asset for product to be returned | Commission expense Commission revenue Revenue | Cost of sales Contract asset Contract liability Retained earnings | No entry ANSWERS: Journal Entries: Date Account Name Debit ($) Credit ($) 1-Jan-21 Hints For Sequence Not a Revenue Account. An Asset Account. 28-Feb-21 A Liability Account 28-Feb-21 A Liability Account. Entity A sells Product X to customers for many years. To expand its market, recently, Entity A sells a new product which is called Product Y. The listed unit price of one Product Y is $180. In order to test the market acceptability of Product Y, a trade discount of $25 per unit of Product Y is provided to the first customer who buys it. On 1 January 2021, Entity A sold 9,600 units of Product Y to Entity B. Cash was received when control of products transferred to Entity B. Entity B is the first customer of Product Y. The costs of Product X and Product Y are $65 and $80 respectively. Entity A has much experience in selling Product X to customers. Entity A estimates that 12% of Product X are commonly returned by its customers. However, Entity A has NO experience in selling Product Y and expects the market acceptability may be very low. According to the contract between Entity A and Entity B, Entity B can return not more than 75% of unused Product Y at full price on or before 28 February 2021 in order to protect the interests of Entity A. On 28 February 2021, Entity B only returned 20% of Product Y to Entity A. Due to cash shortage, Entity A only repaid $150,000 to Entity B and promised to settle the unpaid balance on or before 31 March 2021. REQUIRED: Provide journal entries for Entity A from 1 January 2021 to 28 February 2021 under relevant accounting standards. ACCOUNTS FOR INPUT: Bank [ Payable Receivable Interest expense Interest revenue Inventory | PPE | Asset for product to be returned Commission expense Commission revenue Revenue | Cost of sales Contract asset Contract liability Retained earnings | No entry | ANSWERS: ACCOUNTS FOR INPUT: Bank | Payable Receivable Interest expense Interest revenue Inventory | PPE Asset for product to be returned | Commission expense Commission revenue Revenue | Cost of sales Contract asset Contract liability Retained earnings | No entry ANSWERS: Journal Entries: Date Account Name Debit ($) Credit ($) 1-Jan-21 Hints For Sequence Not a Revenue Account. An Asset Account. 28-Feb-21 A Liability Account 28-Feb-21 A Liability Account