Answered step by step

Verified Expert Solution

Question

1 Approved Answer

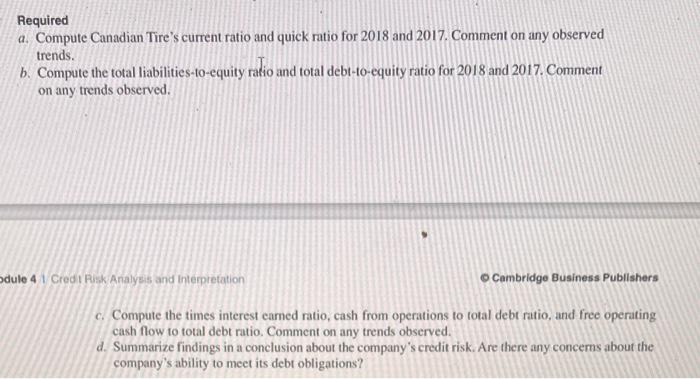

need answers for A B C and D Compute and Interpret Liquidity, Solvency and Coverage Ratios Canadian Tire is a retail company that sells a

need answers for A B C and D

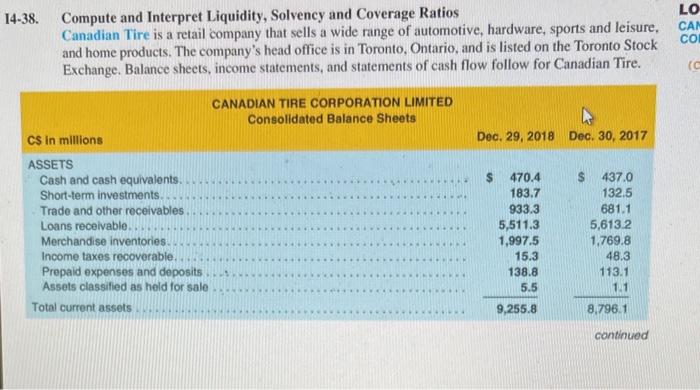

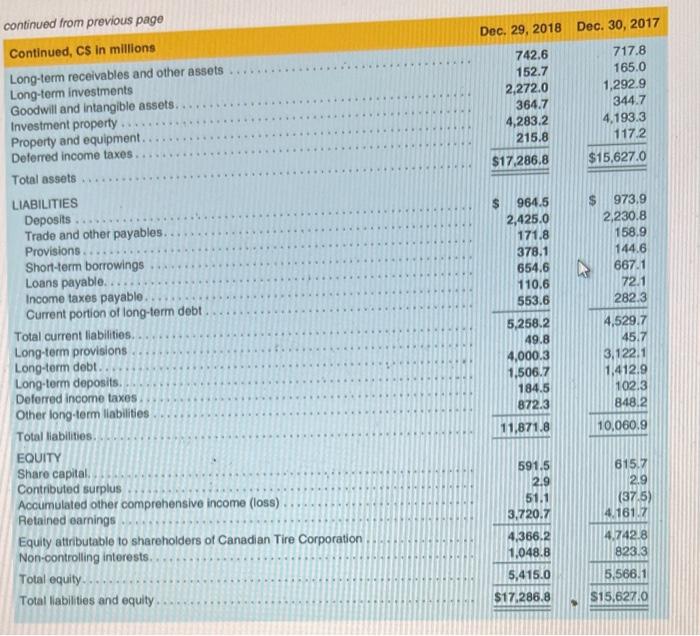

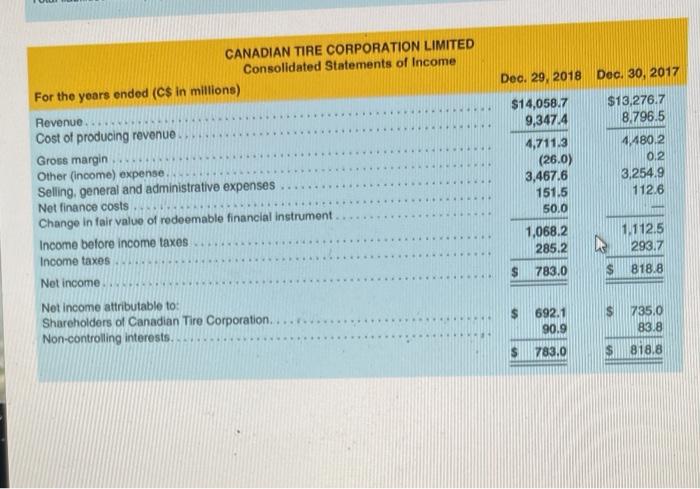

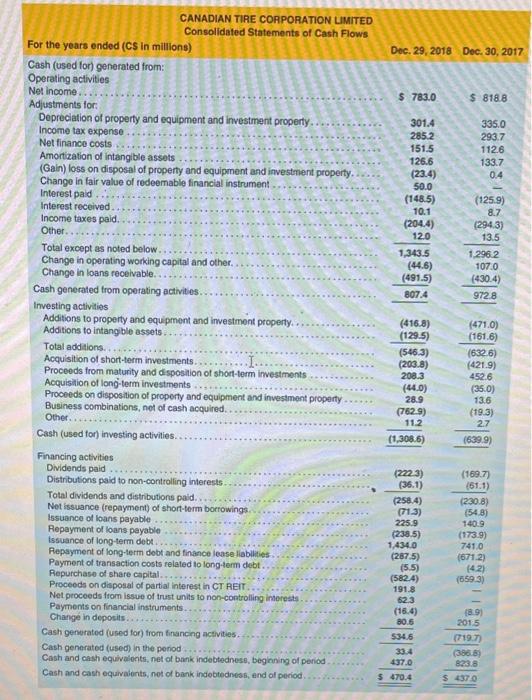

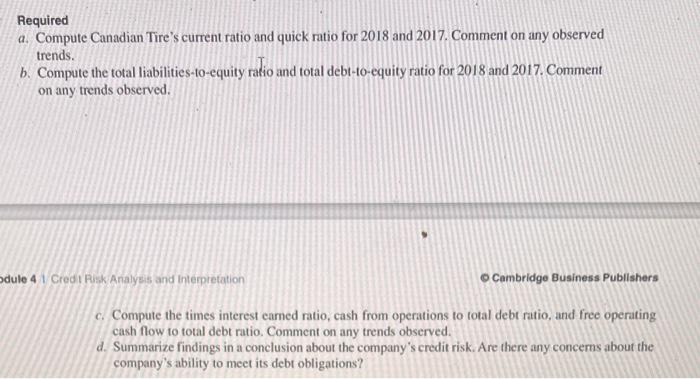

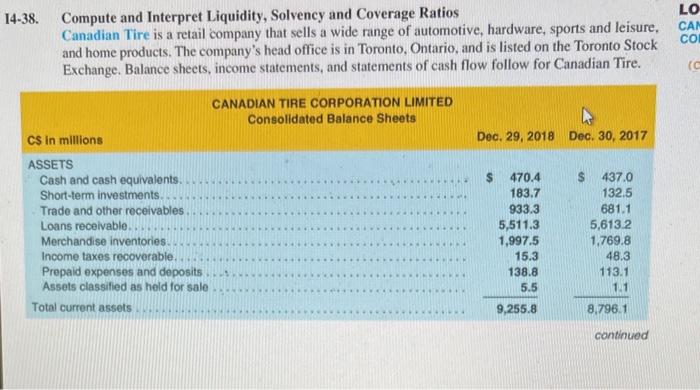

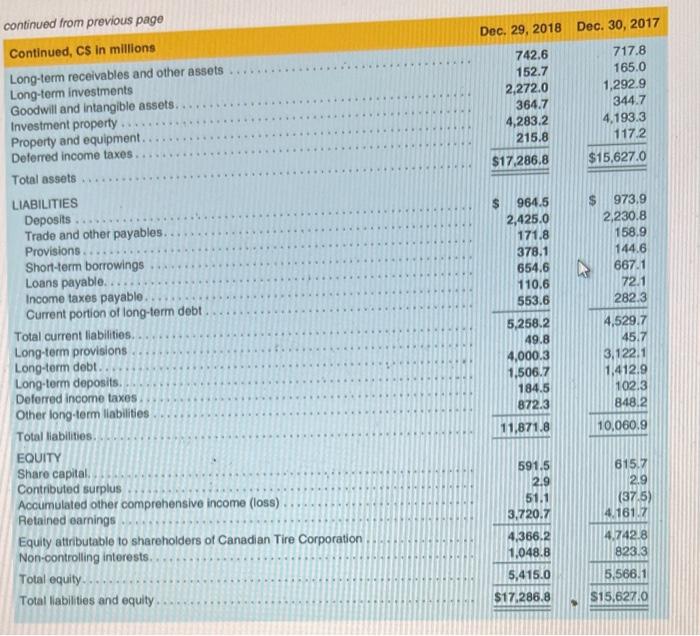

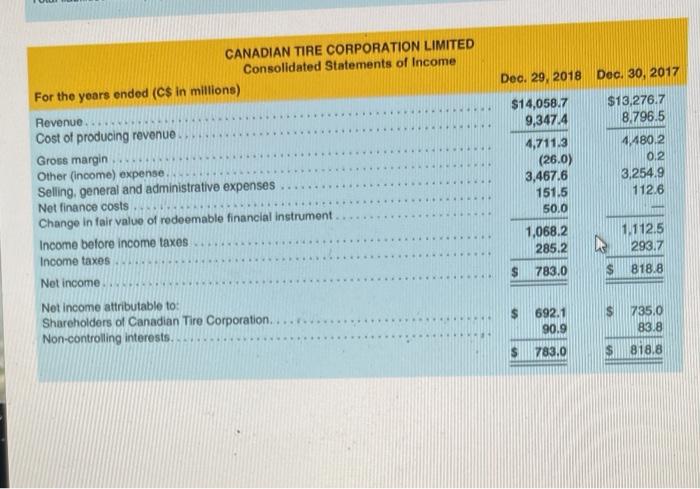

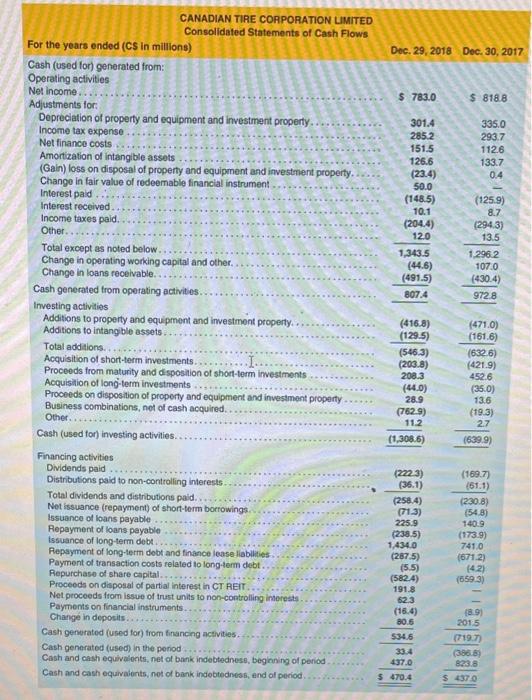

Compute and Interpret Liquidity, Solvency and Coverage Ratios Canadian Tire is a retail company that sells a wide range of automotive, hardware, sports and leisure, and home products. The company's head office is in Toronto, Ontario, and is listed on the Toronto Stock Exchange. Balance sheets, income statements, and statements of cash flow follow for Canadian Tire. continued continued from previous page Continued, CS In millions Long-term receivables a Long-term investments Goodwill and intangible Investment property ... Property and equipment Deterred income taxes. Total assets CANADIAN TIRE CORPORATION LIMITED CANADIAN TIRE CORPORATION LIMITED Consolidated Statements of Cash Flows For the years ended (CS in millions) Cash (used for) generated from: Operating activities Net income..... Adjustments for: Depreciation of property and equipment and investment property.... Dec. 29,2018 Dec. 30,2017 Income tax expense... Net finance costs Amorization of intanglble assots (Gain) loss on disposal of property and equipment and investment property. Investing activitios Additions to property and equipment and investment property. ... Additions to intangble assets... Total additions.... Acquisition of short-ted Proceeds from matunt Acquisilion of long -. Proceeds on disposito Business combination: Other......... Cash (used for) investing Financing activities Required a. Compute Canadian Tire's current ratio and quick ratio for 2018 and 2017. Comment on any observed trends. b. Compute the total liabilities-to-equity ratio and total debt-to-equity ratio for 2018 and 2017. Comment on any trends observed. lule 4 i Credi Pusk Aralyss and interpretation Cambridge Business Publishers c. Compute the times interest earned ratio, cash from operations to total debt ratio, and free operating cash flow to total debt ratio. Comment on any trends observed. d. Summarize findings in a conclusion about the company's credit risk. Are there any concerns about the company's ability to meet its debt obligations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started