NEED ANSWERS FOR D ASAP PLEASE!

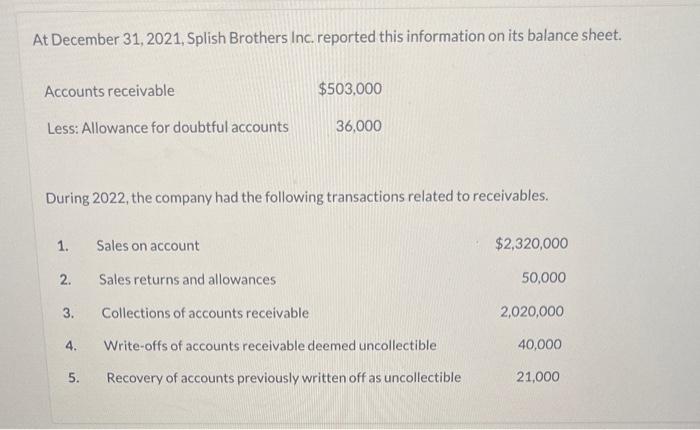

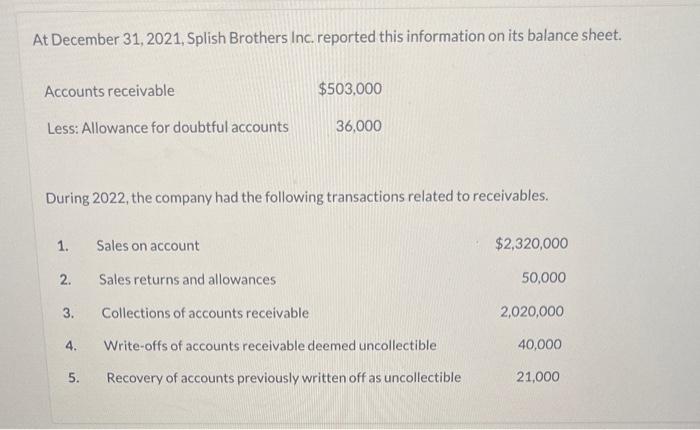

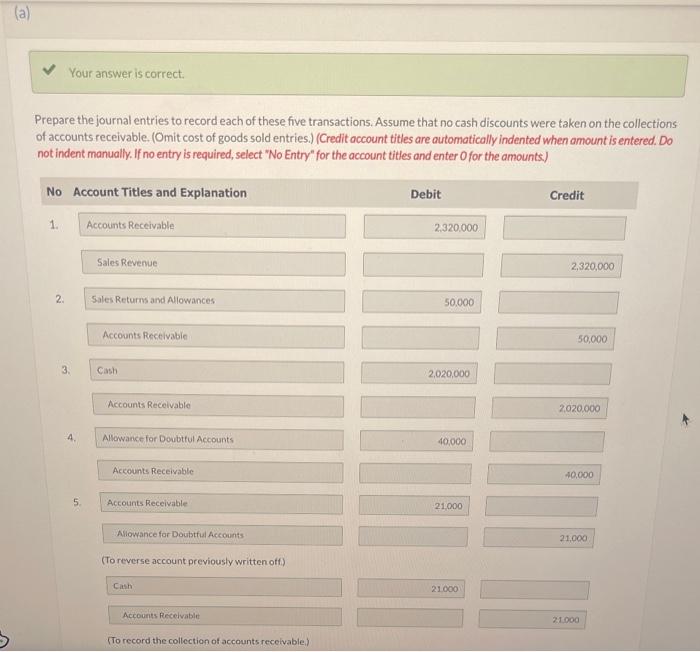

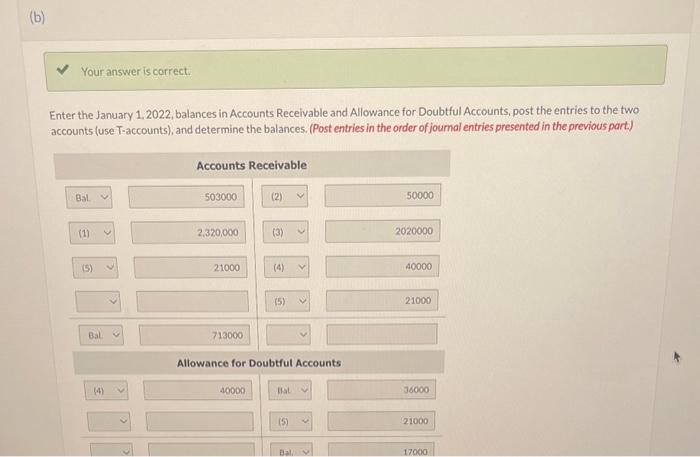

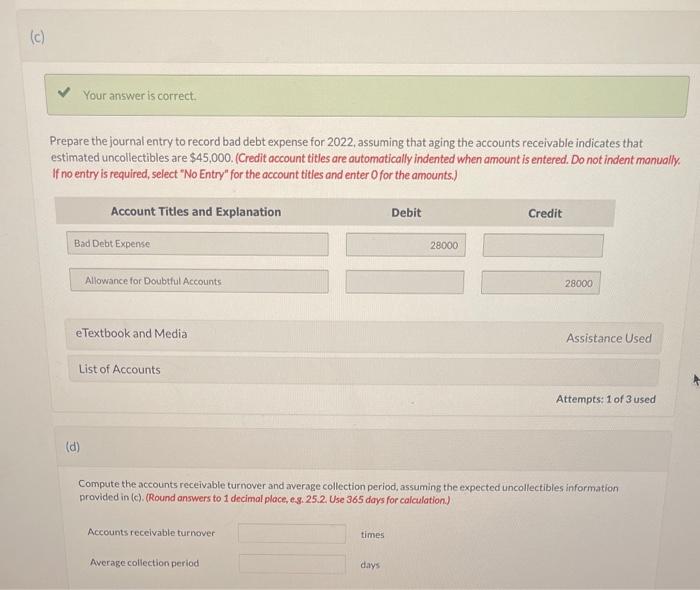

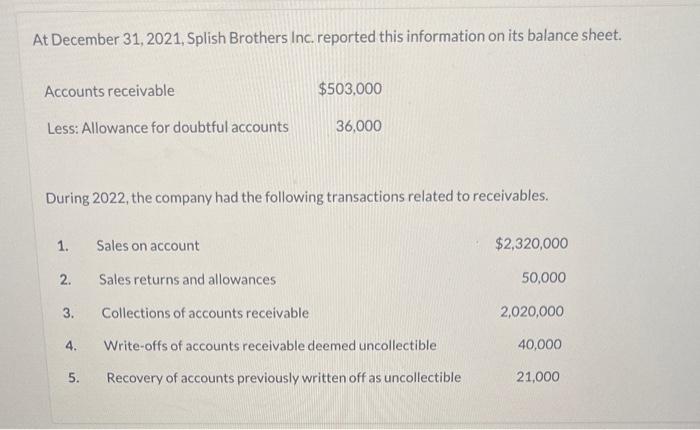

At December 31, 2021, Splish Brothers Inc. reported this information on its balance sheet. During 2022, the company had the following transactions related to receivables. Prepare the journal entries to record each of these five transactions. Assume that no cash discounts were taken on the collections of accounts receivable. (Omit cost of goods sold entries.) (Credit account titles are outomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts) Enter the January 1, 2022, balances in Accounts Receivable and Allowance for Doubtful Accounts, post the entries to the two accounts (use T-accounts), and determine the balances. (Post entries in the order of joumal entries presented in the previous part) Your answer is correct Prepare the journal entry to record bad debt expense for 2022 , assuming that aging the accounts receivable indicates that estimated uncollectibles are $45,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (d) Compute the accounts receivable turnover and average collection period, assuming the expected uncollectibles information provided in (c). (Round answers to 1 decimal place, es. 25.2. Use 365 days for calculation) Accounts receivable turnover times Average collection period days At December 31, 2021, Splish Brothers Inc. reported this information on its balance sheet. During 2022, the company had the following transactions related to receivables. Prepare the journal entries to record each of these five transactions. Assume that no cash discounts were taken on the collections of accounts receivable. (Omit cost of goods sold entries.) (Credit account titles are outomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts) Enter the January 1, 2022, balances in Accounts Receivable and Allowance for Doubtful Accounts, post the entries to the two accounts (use T-accounts), and determine the balances. (Post entries in the order of joumal entries presented in the previous part) Your answer is correct Prepare the journal entry to record bad debt expense for 2022 , assuming that aging the accounts receivable indicates that estimated uncollectibles are $45,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (d) Compute the accounts receivable turnover and average collection period, assuming the expected uncollectibles information provided in (c). (Round answers to 1 decimal place, es. 25.2. Use 365 days for calculation) Accounts receivable turnover times Average collection period days