Question: Need answers for this mini case for my finance class, included are pictures for the questions The Case: Please refer to the Alan & Angel

Need answers for this mini case for my finance class, included are pictures for the questions

The Case:

Please refer to the Alan & Angel Young MiniCase in your textbook for all client

information.

Additional Information:

They currently live in Lubbock, Texas

Alans DoB is

Angelas DoB is

Child # Name: Nathan, DoB:

Child # Name: Yu DoB:

Angelas Father Name: Ralph, DoB:

Angelas Mother Name: Yi DoB:

Alans Mother Name: Alaina, DoB:

Trust #Add as Other

Travel Goal is defined as $ a year every year starting at retirement and

ending at the end of plan age This will cover all their travel for that given

year. This is a Want

Alans Old K: Large Cap Growth, Large Cap Value, Small

Cap. Primary Beneficiary: Angela, Secondary: the Children each

Alans New k: Large Cap Growth, Mid Cap, LT Bonds,

Intermediate Bonds, Large Cap value. Primary Beneficiary: Angela,

Secondary: the Children each

Tax basis remaining in inherited portfolio: $

Very Willing to save extra if it means an early retirement.

month elimination period on his group disability, benefit is noninflation

adjusted.

HO and Auto Policy expires

Question #: Risk

Complete Exercise # at the end of Case include a complete table showing the

metrics used, your recommendations, and the costsavingsI encourage you to refer to

the minicase on Risk Management as a guide

ALAN AND ANGEL YOUNG

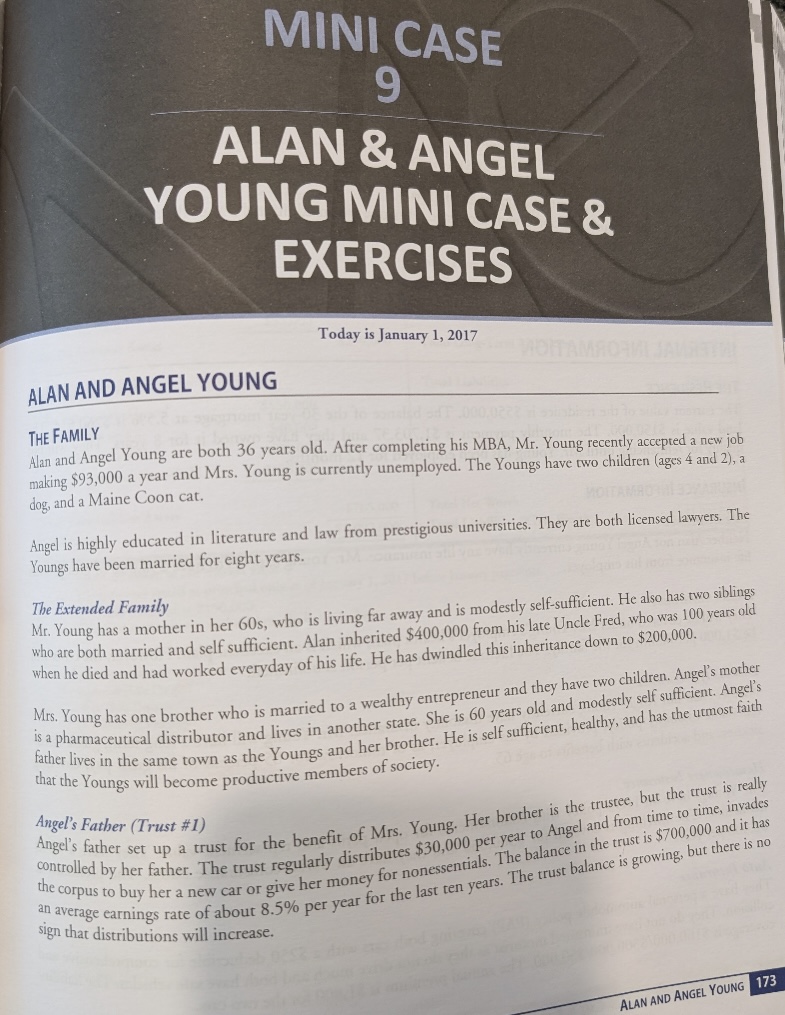

THE FAMILY

Alan and Angel Young are both years old. After completing his MBA, Mr Young recently accepped a new job

making $ a year and Mrs Young is currently unemployed. The Youngs have two children ages and a

dog, and a Maine Coon cat.

Angel is highly educated in literature and law from prestigious universities. They are both licensed lawyers. The

Youngs have been married for eight years.

The Extended Family

Mr Young has a mother in her s who is living far away and is modestly selfsufficient. He also has two siblings

who are both married and self sufficient. Alan inherited $ from his late Uncle Fred, who was

when he died and had worked everyday of his life. He has dwindled thing angel's mother

Mrs Young has one brother who is married to a wealthy entrepreneur and they have thodestly self sufficient. Angel's

is a pharmaceutical distributor and lives in another state. She is years old and, healthy, and has the utmost faith

father lives in the same town as the Youngs and her brother.

that the Youngs will become productive members of society.

Angel's Father Trust #

Angel's father set up a trust for the benefit of Mrs Young. Her brother Angel and from time to time, invades

controlled by her father. The trust regularly distributes $ per year to Ange in the trust is $ and it has

the corpus to buy her a new car or give her money for nonessentials. The balance trust balance is growing, but there is no

A A d

minicase

EXXERCISE RISK MANAGEMENT

prepart Metric Actual Recommendations Annual CostSavings Life Insurance His Life Insurance Hers Disability Insurance His Disability Insurance Hers Health Insurance LongTerm Care Property Insurance Homeowners Property Insurance Auto Property Insurance Other Liability Insurance

Life Insurance Hers

Disability Insurance His

Disability Insurance Hers

Health Insurance

LongTerm Care

Property Insurance Homeowners

Property Insurance Auto

Property Insurance Other

Liability Insurance

Comments:

qquad

qquad

qquad

qquad

qquad

qquad

qquad

qquad

qquad

Statement of Income and Expenses

Statement of Income and Expenses

Alan and Angel Young

Cash Outflows

Savings

k Plan

Taxes

Social Security Taxes

Federal Withholding

State Withholding

Property Tax Residence

Debt Payments Principal & Interest

Principal Residence P & I

Auto Loan

Credit Cards

Living Expenses

Tuition to Little Darling School for the two children

Utilities for Residence

EntertainmentVacation

Cable

Total Debt Payments

$

Total Savings

Clothing

Auto MaintenanceGa

Food

Insurance Payments

Total Taxes

Totals

Statement of Financial Position Beginning of Year

Assets are stated at fair market value.

Liabilities are stated at principal only as of January before January payments.

The land is valued at $

The trust assets are not included on the balance sheet.

Title Designations:

H Husband Sole Owner

W Wife Sole Owner

CP Community Property

EXTERNAL INFORMATION

ECONOMIC INFORMATION

General inflation has averaged annually for the last years and is expected to continue at

They live in a community property state.

Bank Lending Rates

year conformin

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock