Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need answers now pls. will give thumbs up. An oil-drilling company must choose between two mutually exclusive extraction projects, and each requires an initial outlay

need answers now pls. will give thumbs up.

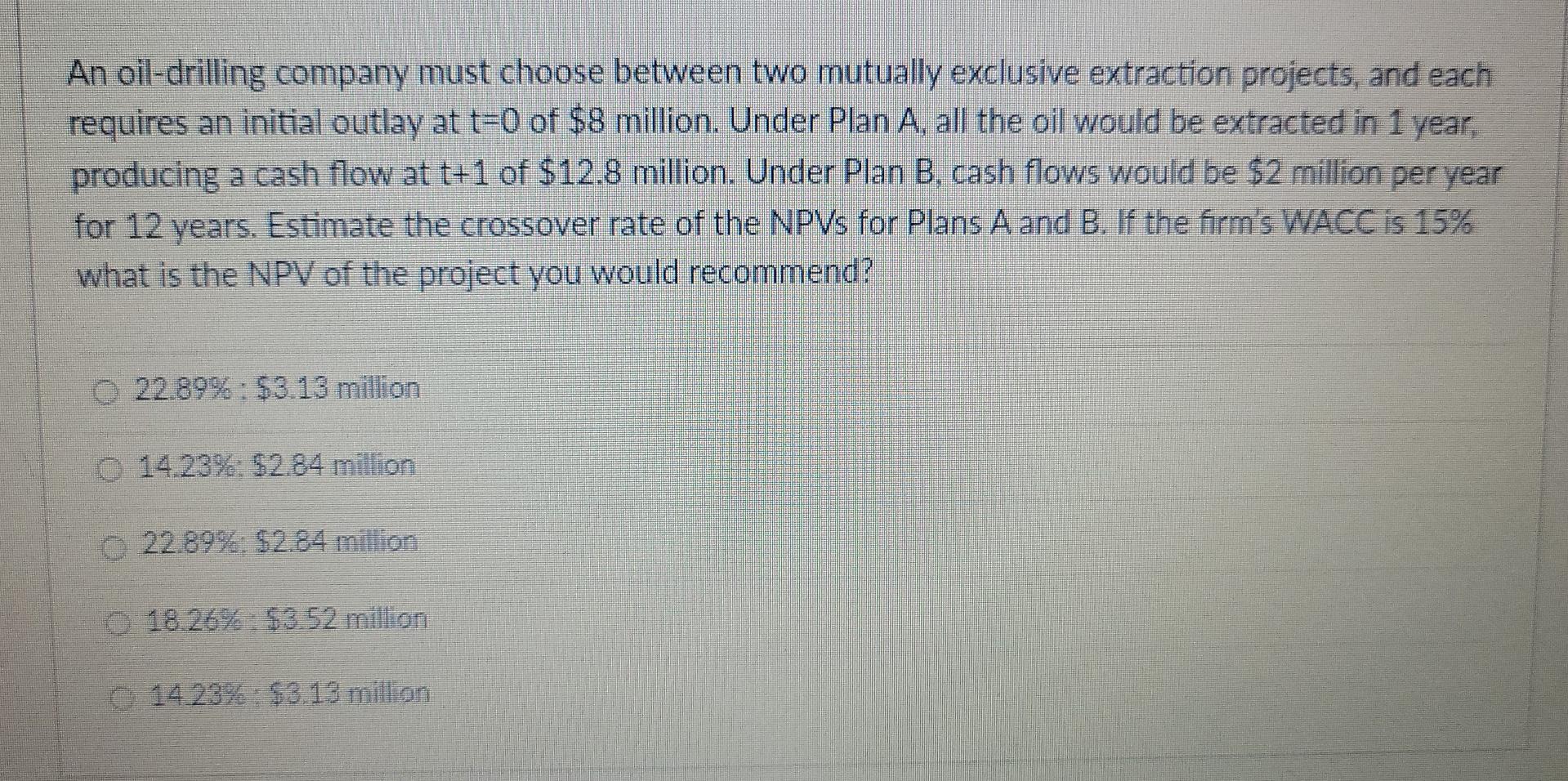

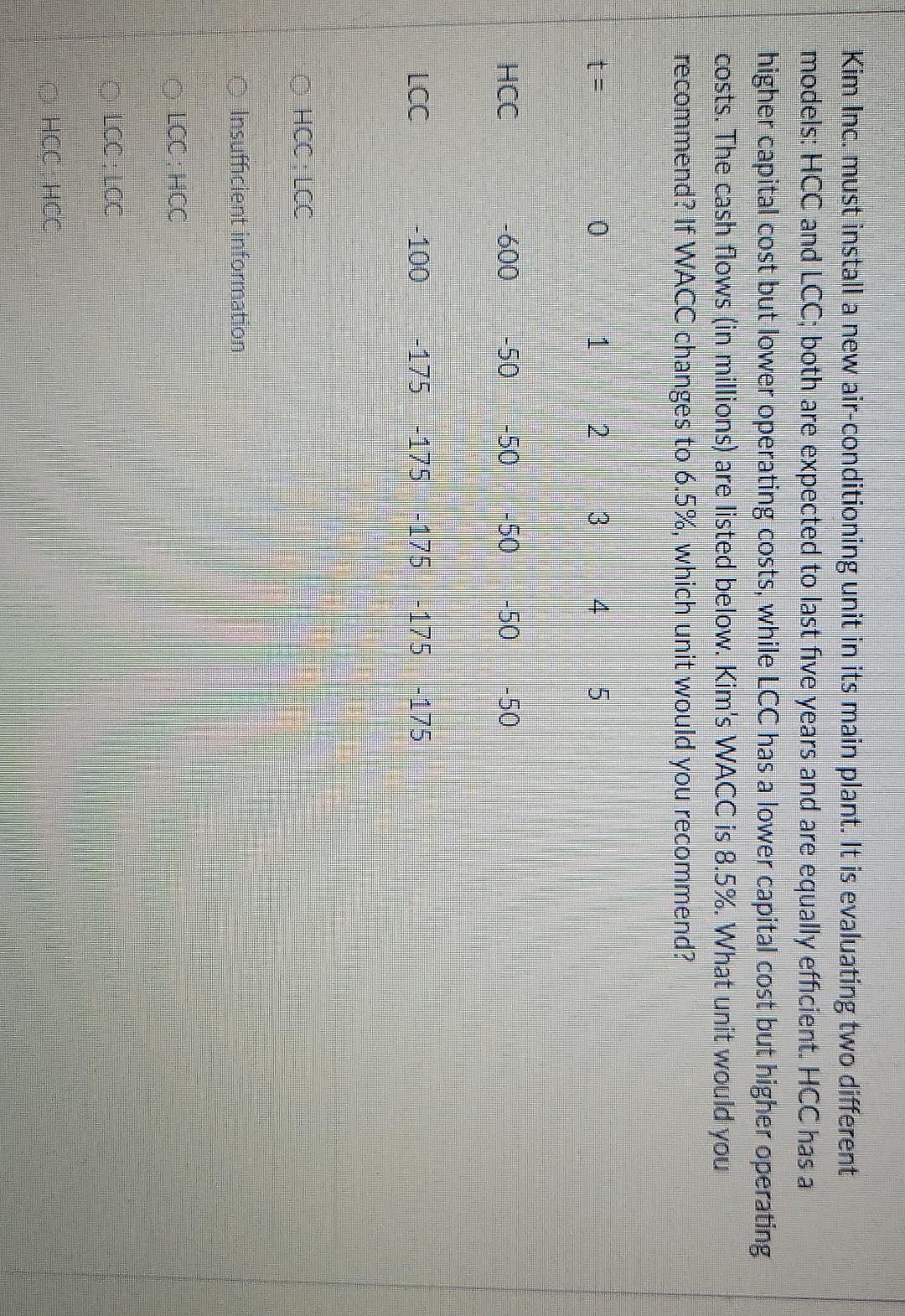

An oil-drilling company must choose between two mutually exclusive extraction projects, and each requires an initial outlay at t=0 of $8 million. Under Plan A. all the oil would be extracted in 1 year. producing a cash flow at t+1 of $12.8 million. Under Plan B, cash flows would be $2 million per year for 12 years. Estimate the crossover rate of the NPVs for Plans A and B. If the firm's WACC is 15% what is the NPV of the project you would recommend? 22.89% : $3.13 million 14.239: $2.84 million 22.8996. $2.84 million 18.26% $3.52 million 14.23% : $3.13 million Kim Inc. must install a new air-conditioning unit in its main plant. It is evaluating two different models: HCC and LCC; both are expected to last five years and are equally efficient. HCC has a higher capital cost but lower operating costs, while LCC has a lower capital cost but higher operating costs. The cash flows (in millions) are listed below. Kim's WACC is 8.5%. What unit would you recommend? If WACC changes to 6.5%, which unit would you recommend? t = 0 1 2 3 5 -600 --50 -50 -50 --50 LCC -100 -175 -175 -175 -175-175 HCC: LCC Insufficient information LCC: HCC OLCC: LCCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started