Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need Answers To All Of Them An oil company is drilling a series of new wells on the perimeter of a producing oll field. About

Need Answers To All Of Them

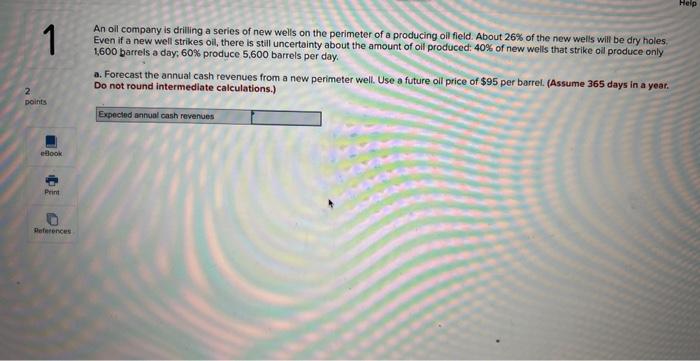

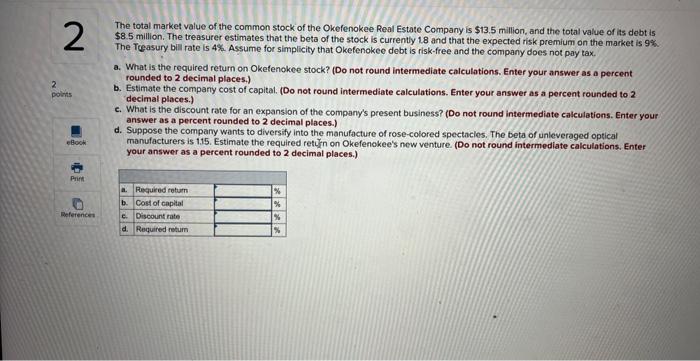

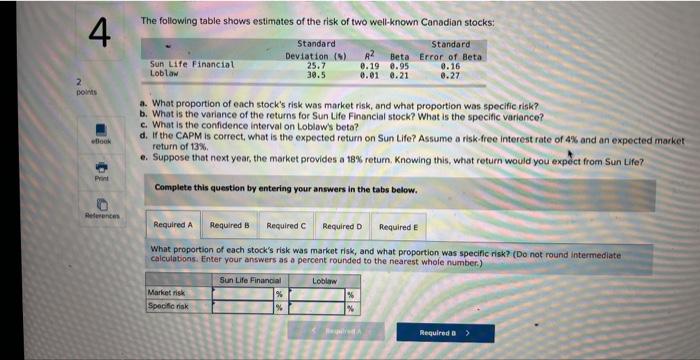

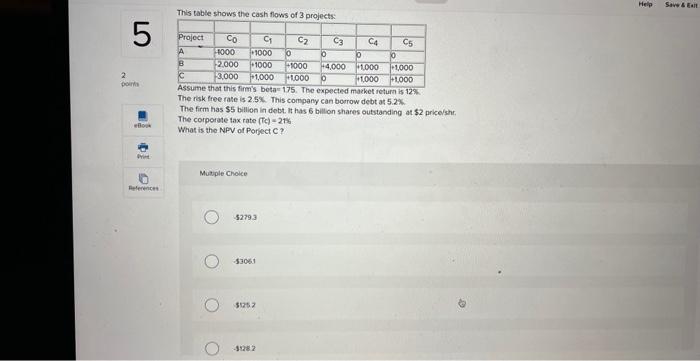

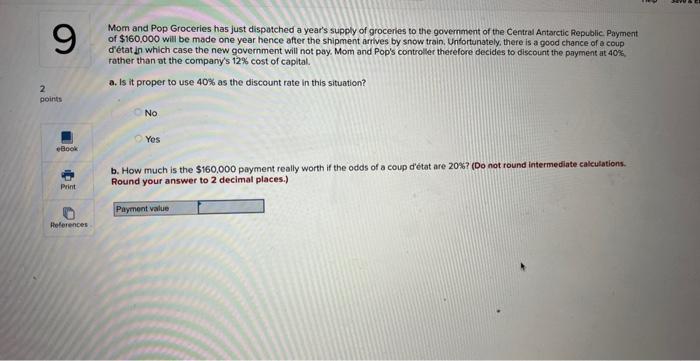

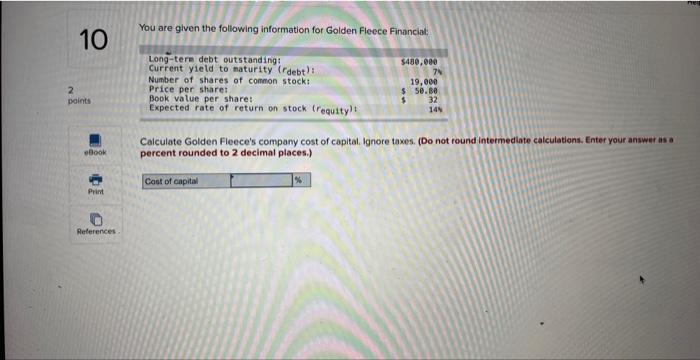

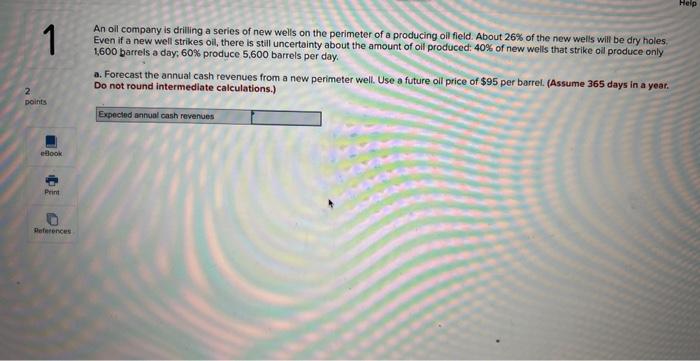

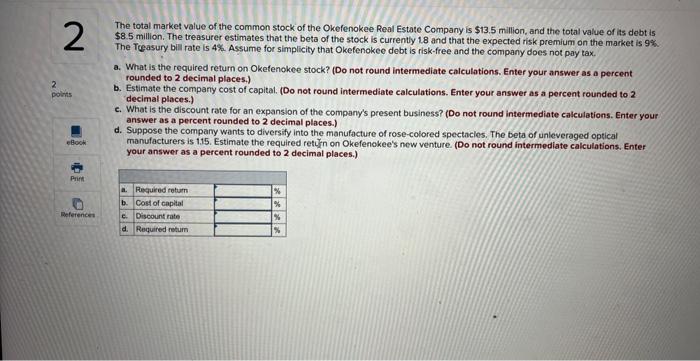

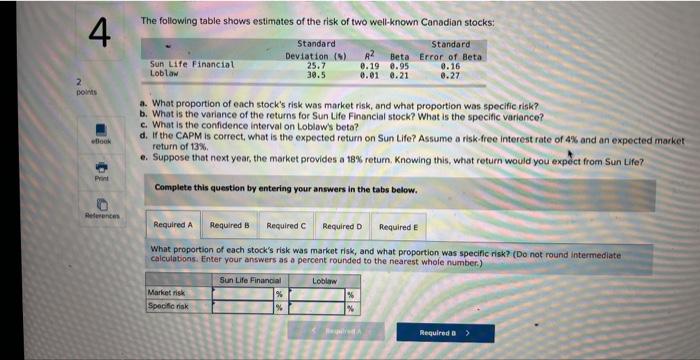

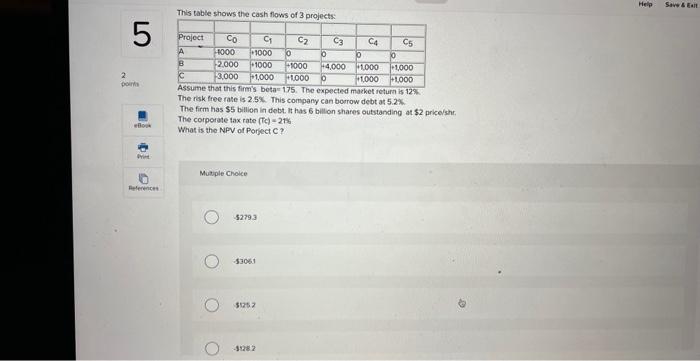

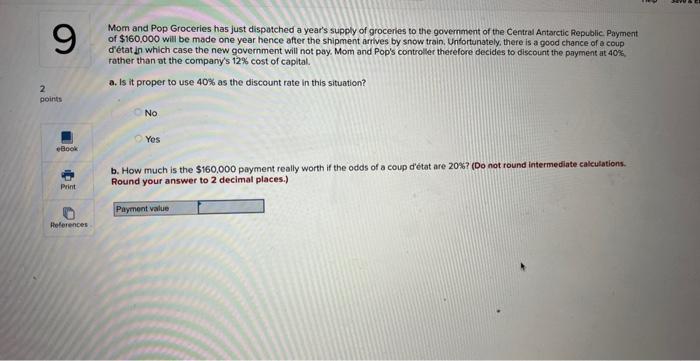

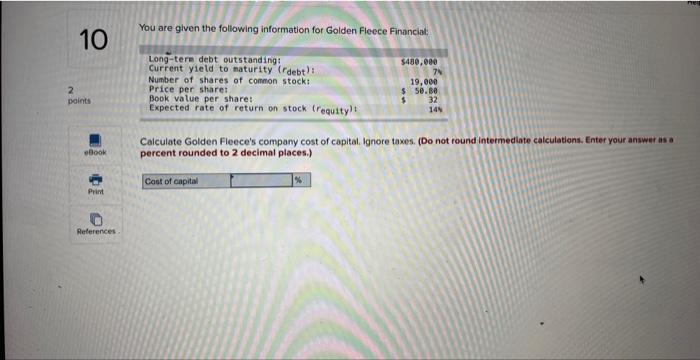

An oil company is drilling a series of new wells on the perimeter of a producing oll field. About 26% of the new wells will be dry holes, Even if a new well strikes oll, there is still uncertainty about the amount of oll produced: 40% of new wells that strike oil produce only 1,600 barrels a day; 60% produce 5,600 barrels per day. a. Forecast the annual cash revenues from a new perimeter well. Use a future oil price of $95 per barrel. (Assume 365 days in a year. Do not round intermediate calculations.) The total market value of the common stock of the Okefenokee Real Estate Company is $13.5 million, and the total value of its debt is $8.5 million. The treasurer estimates that the beta of the stock is currently 1.8 and that the expected risk premium on the market is 9% The Teeasury bill rate is 4%. Assume for simplicity that Okefenokee debt is risk-free and the company does not pay tax. a. What is the required retum on Okefenokee stock? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) b. Estimate the company cost of capital. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What is the discount rate for an expansion of the company's present business? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) d. Suppose the company wants to diversify into the manufacture of rose-colored spectacies. The beta of unleveraged optical manufacturers is 115. Estimate the required retn on Okefenokee's new venture. (Do not round intermediate calculations, Enter your answer as a percent rounded to 2 decimal places.) The following table shows estimates of the risk of two well-known Canadian stocks: a. What proportion of each stock's risk was market risk, and what proportion was specific risk? b. What is the variance of the returns for Sun Life Financial stock? What is the specific variance? c. What is the confidence interval on Loblaw's beta? d. If the CAPM is correct, what is the expected return on Sun Life? Assume a risk-free interest rate of 4% and an expected market return of 13% e. Suppose that next year, the market provides a 18% return. Knowing this, what return would you expct from Sun Life? Complete this question by entering your answers in the tabs below. What proportion of each stock's risk was market risk, and what proportion was specific risk? (Do not round intermediate calculations. Enter your answers as a percent rounded to the nearest whole number.) This table shows the cash flows of 3 projects: Mssume tnat tirs aims beta= 175 . The expected macket refurn is 12%. The risk free rate is 2.5%. This company can bourow debt at 5.2%. The firm has $5 billion in debt, it has 6 billion shares outstanding at $2 pricelsht. The corporate tax rate (Tc)=21s1 What is the NPV of Porject C ? Mutiple Choice 52793 53051 5sin2 1328 Mom and Pop Groceries has just dispatched a year's supply of groceries to the government of the Centrai Antarctic Repuolic Payment of $160,000 will be made one year hence after the shipment arrives by snow train, Unfortunately, there is a good chance of a coup detat in which case the new government will not pay. Mom and Pop's controlier therefore decides to discount the payment at 40 za rather than ot the company's 12% cost of capital. a. Is it proper to use 40% as the discount rate in this situation? No Yos b. How much is the $160,000 payment really worth if the odds of a coup dectat are 20\%? (Do not round intermediate caleutations. Round your answer to 2 decimal places.) You are given the following information for Golden Fleece Financial: Calculate Golden Fleece's company cost of copital. Ignore taxes. (Do not round intermediate calculations, Enter your answer as a percent rounded to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started