Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need answers to all the blanks. Background Assume it is currently 1 June 2023. You are working for the temporary accounting employment agency known as

Need answers to all the blanks.

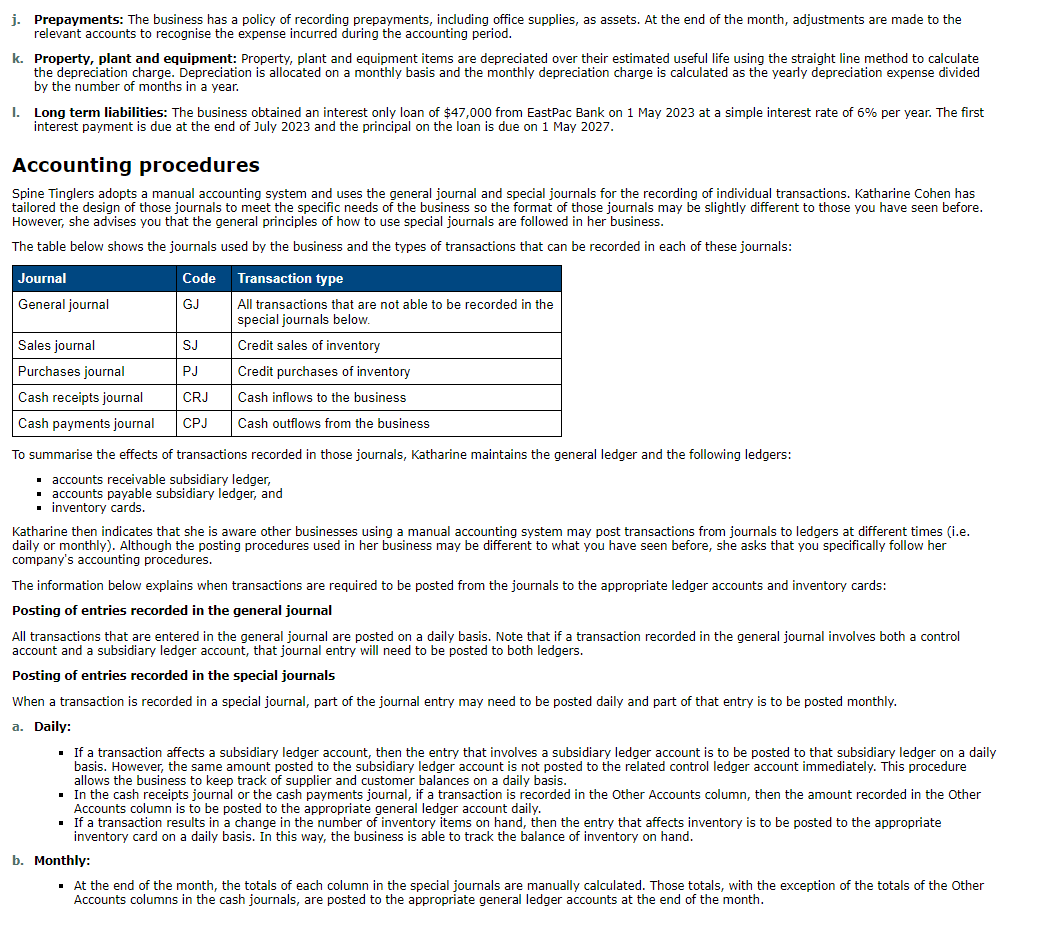

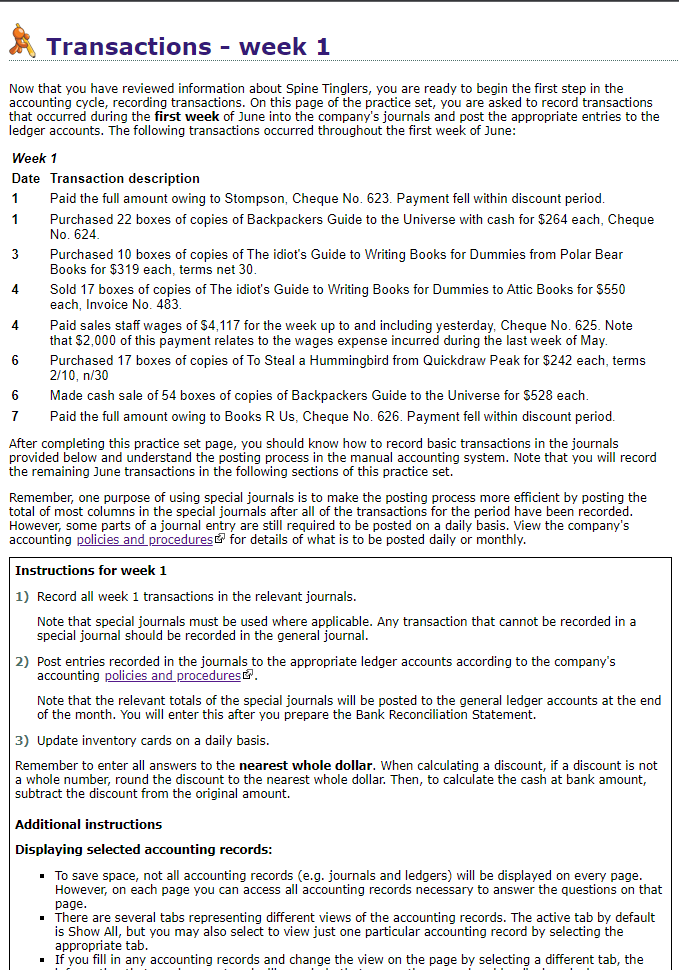

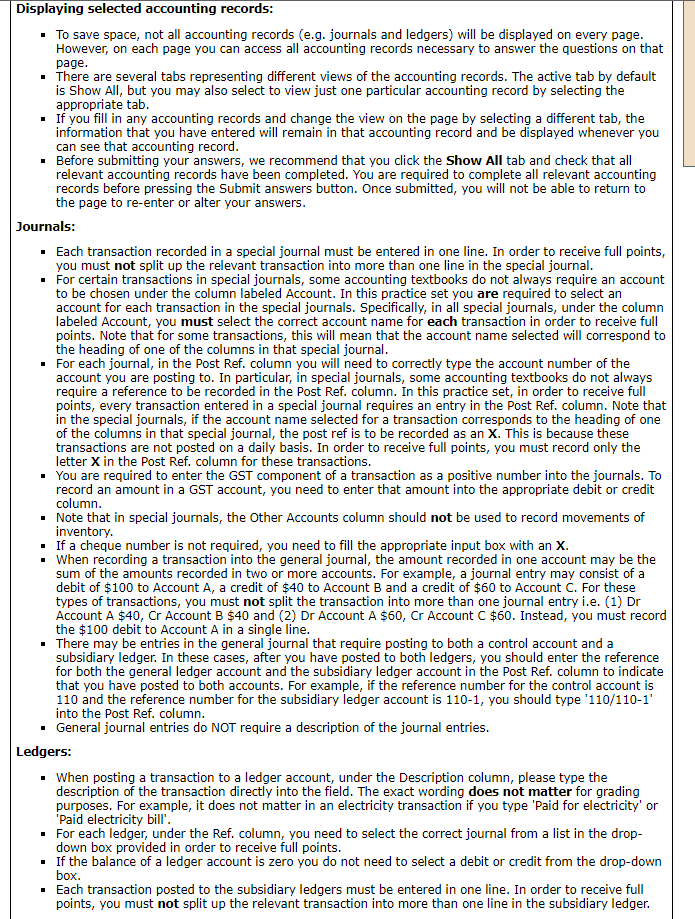

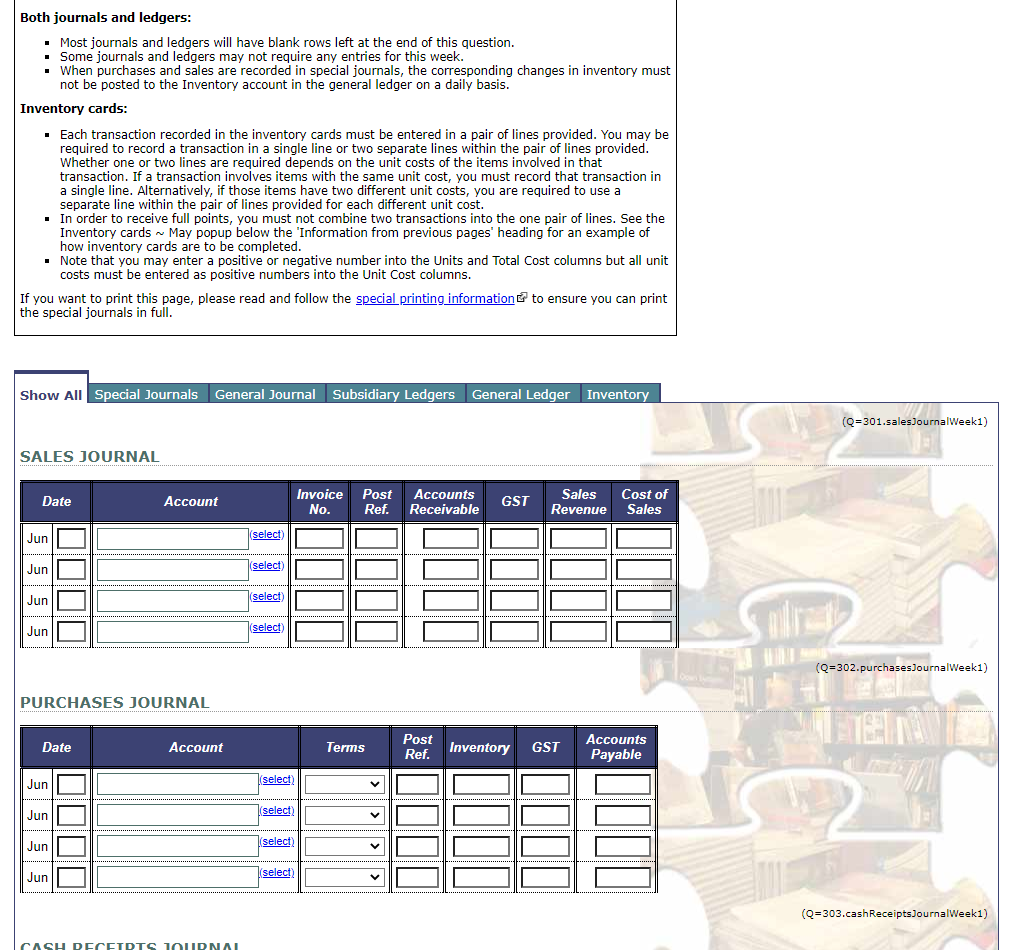

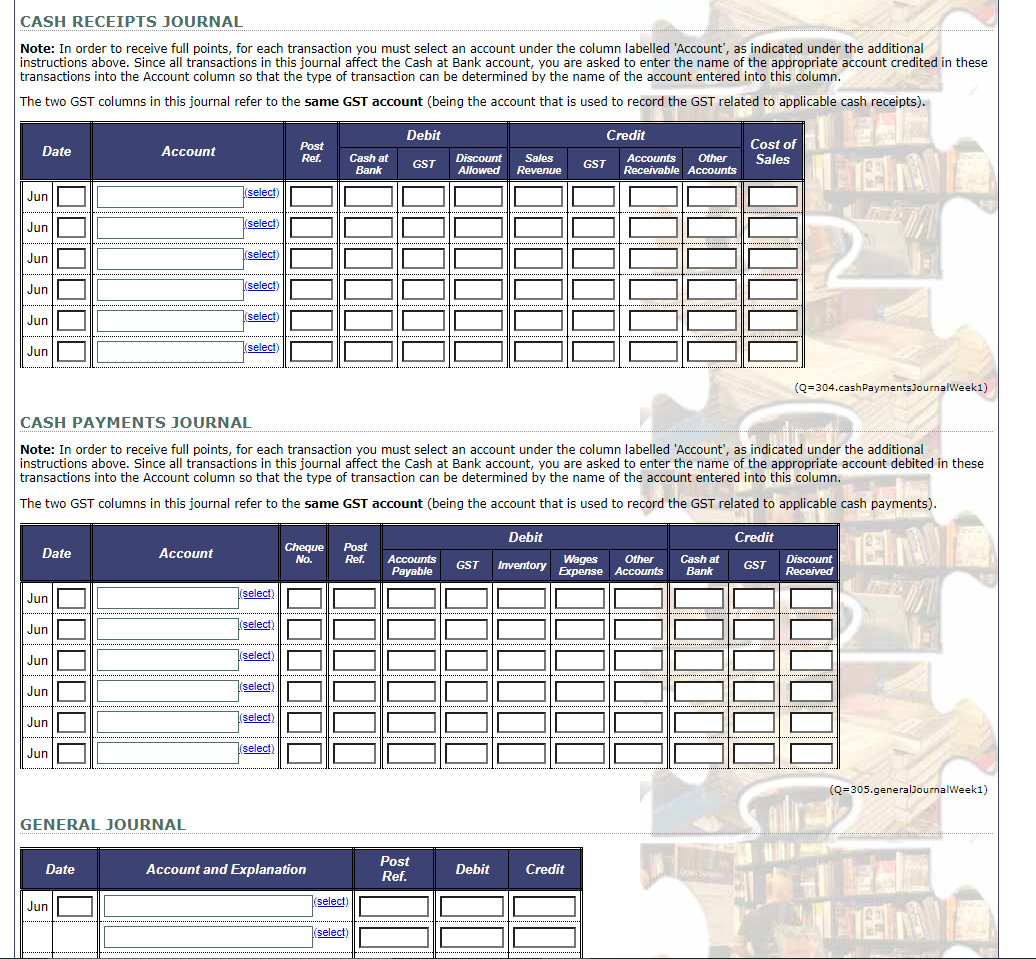

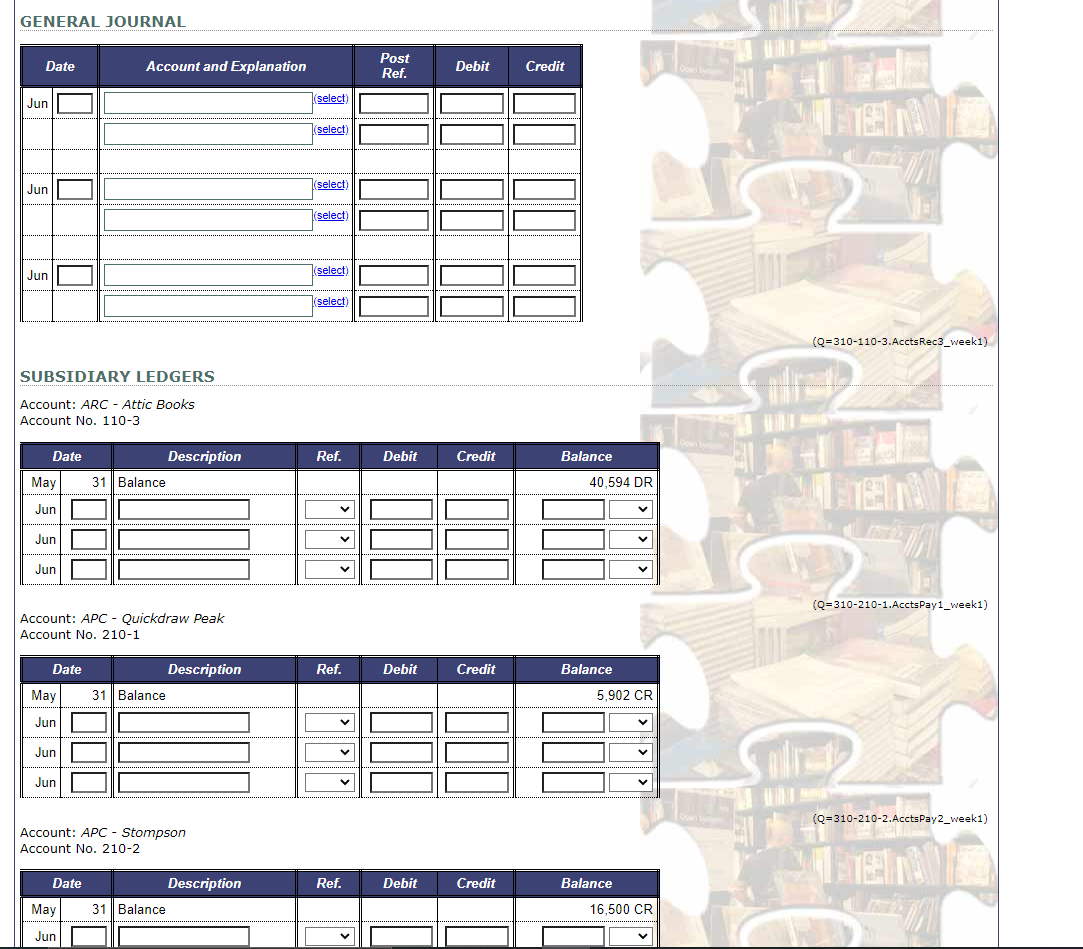

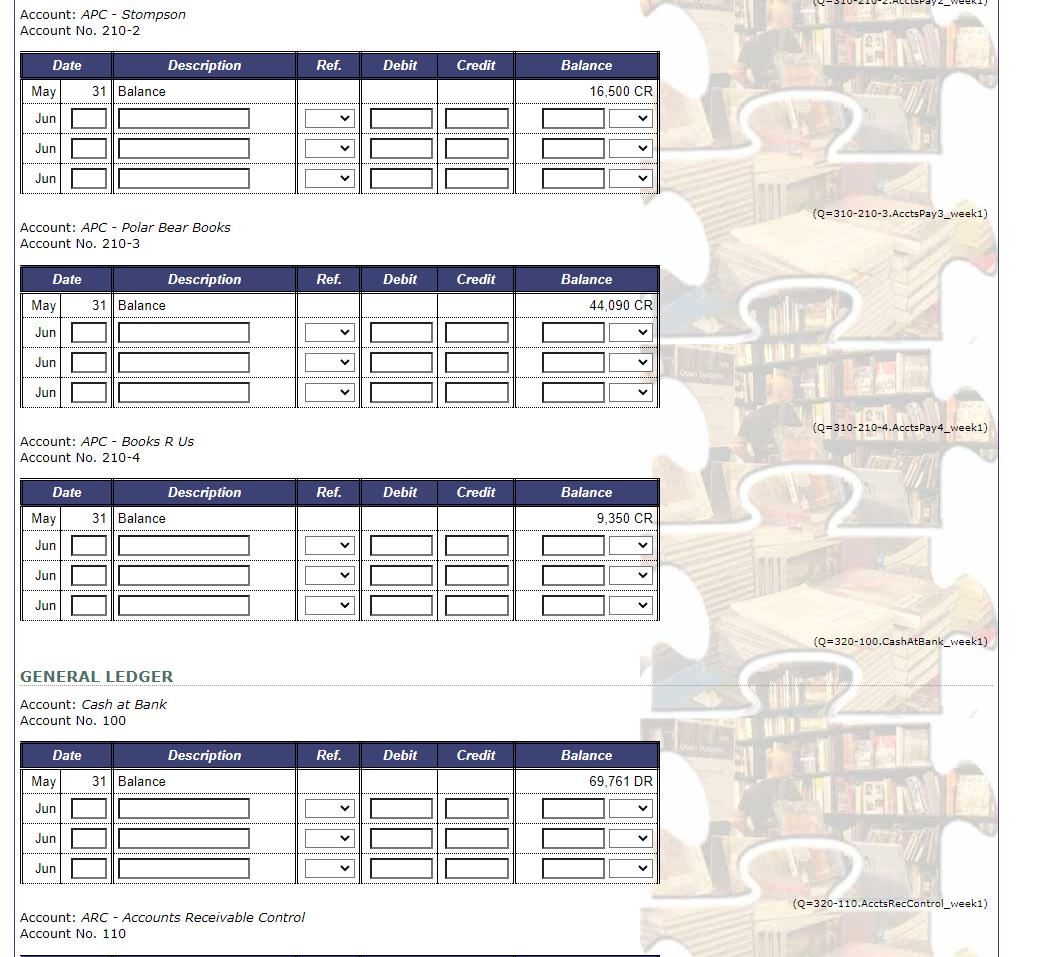

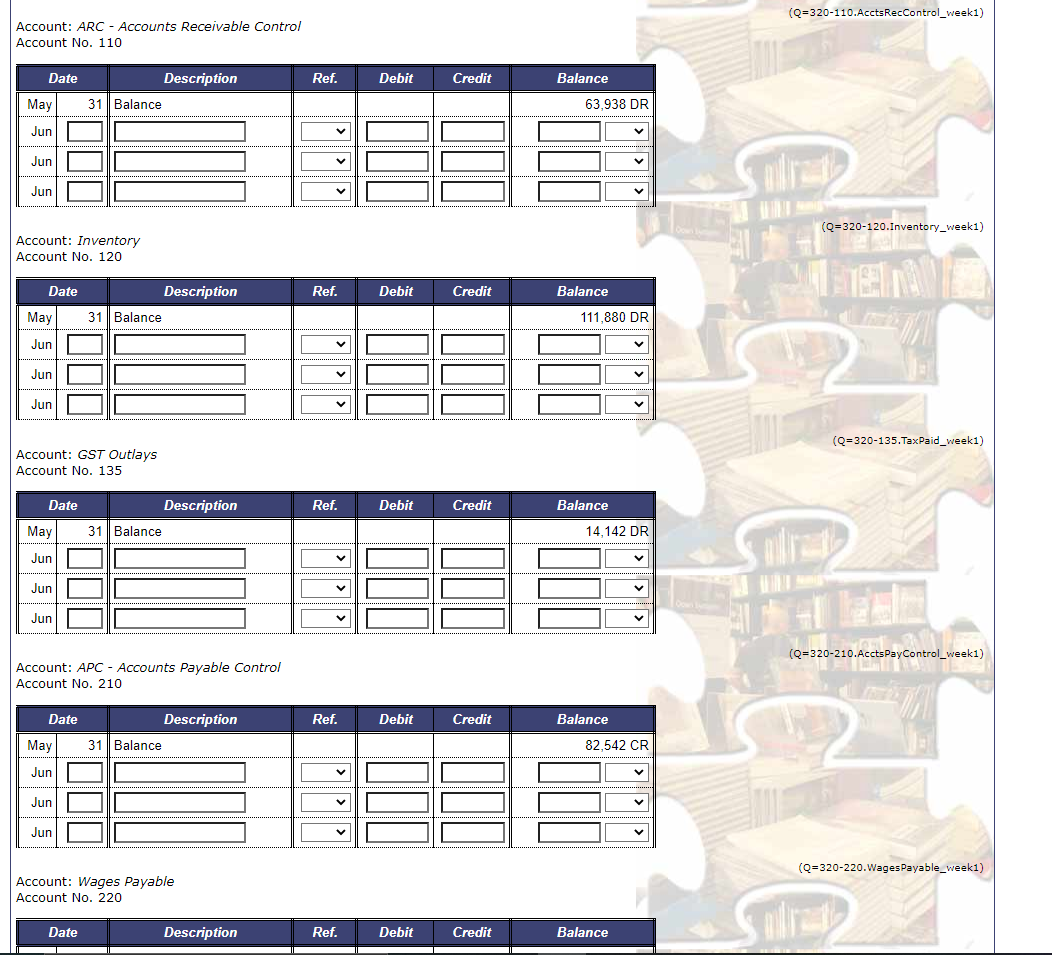

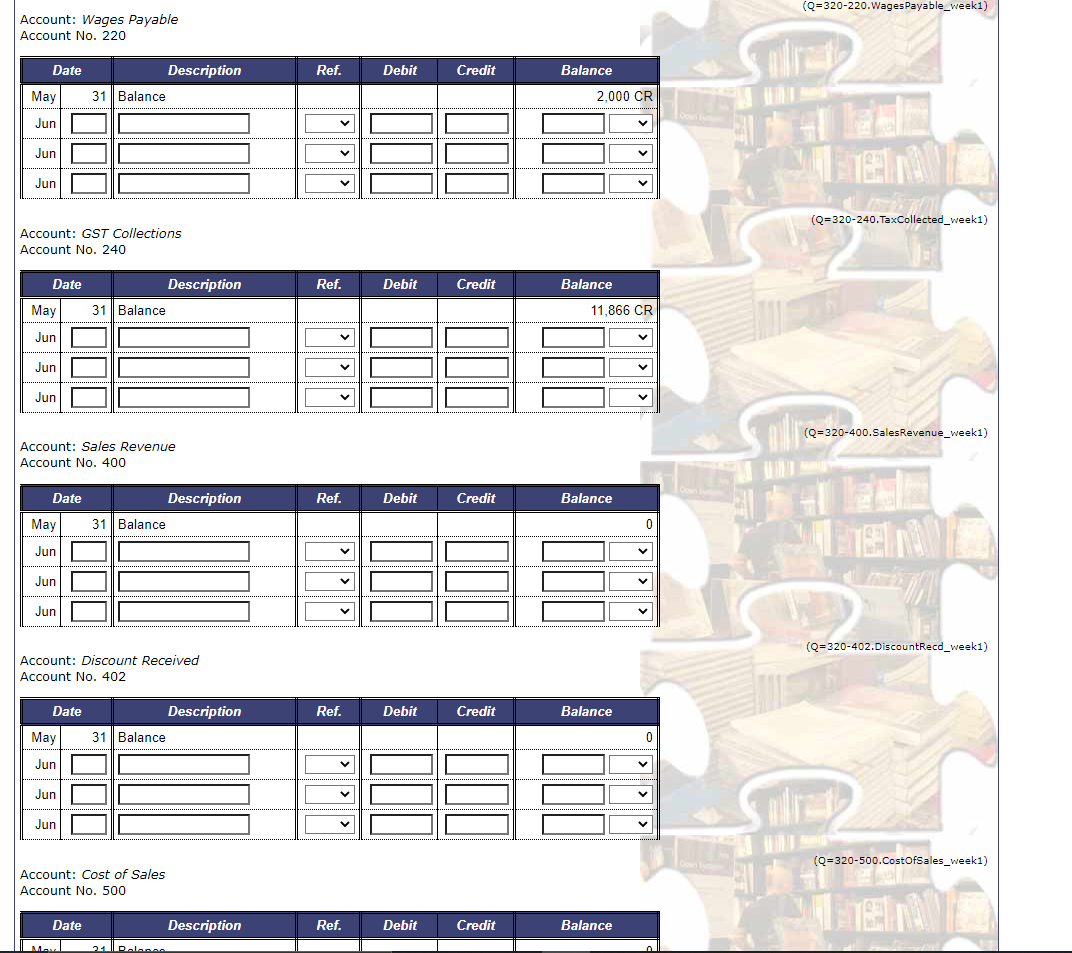

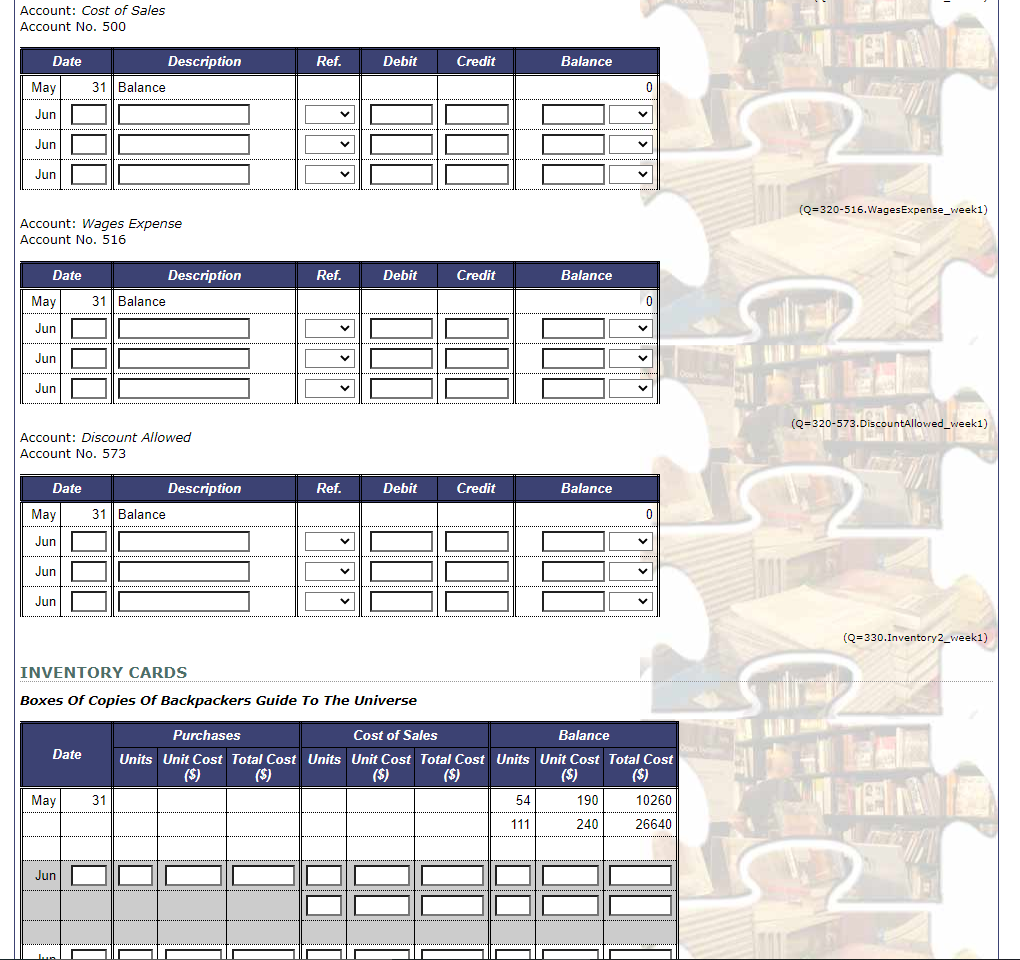

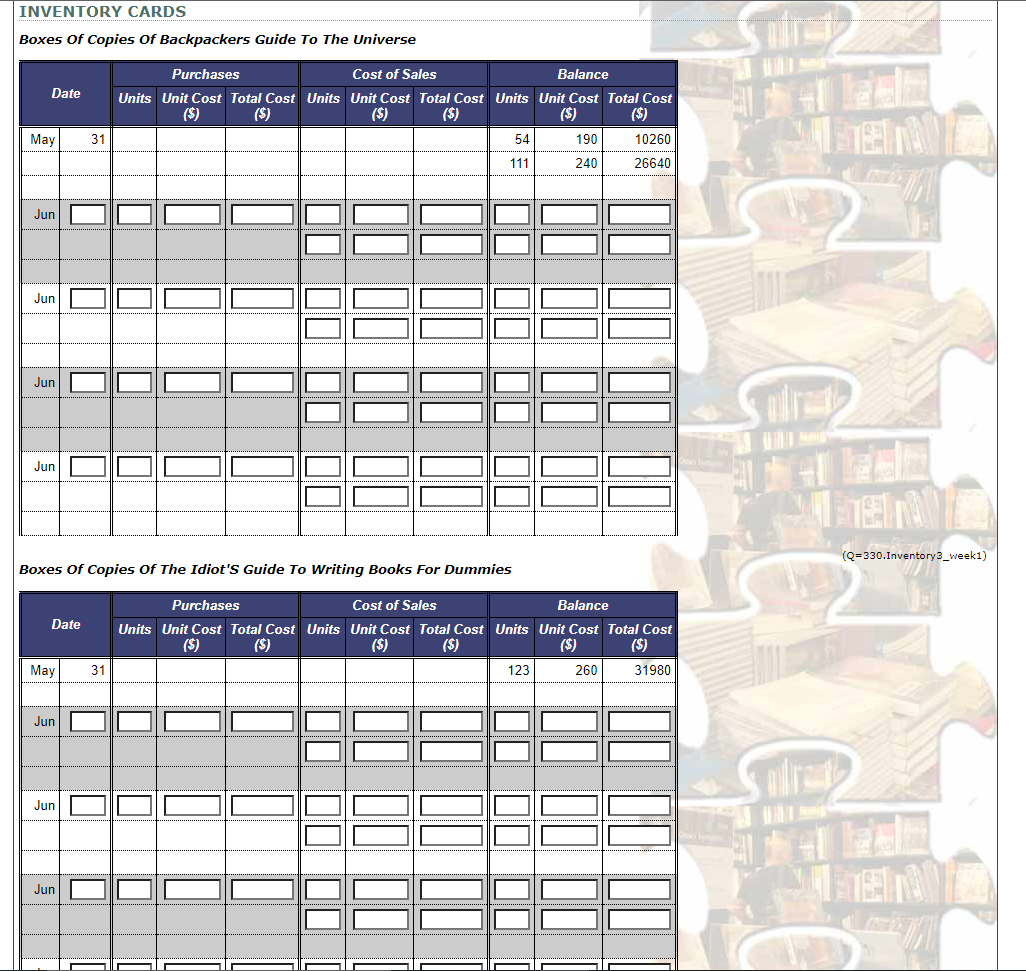

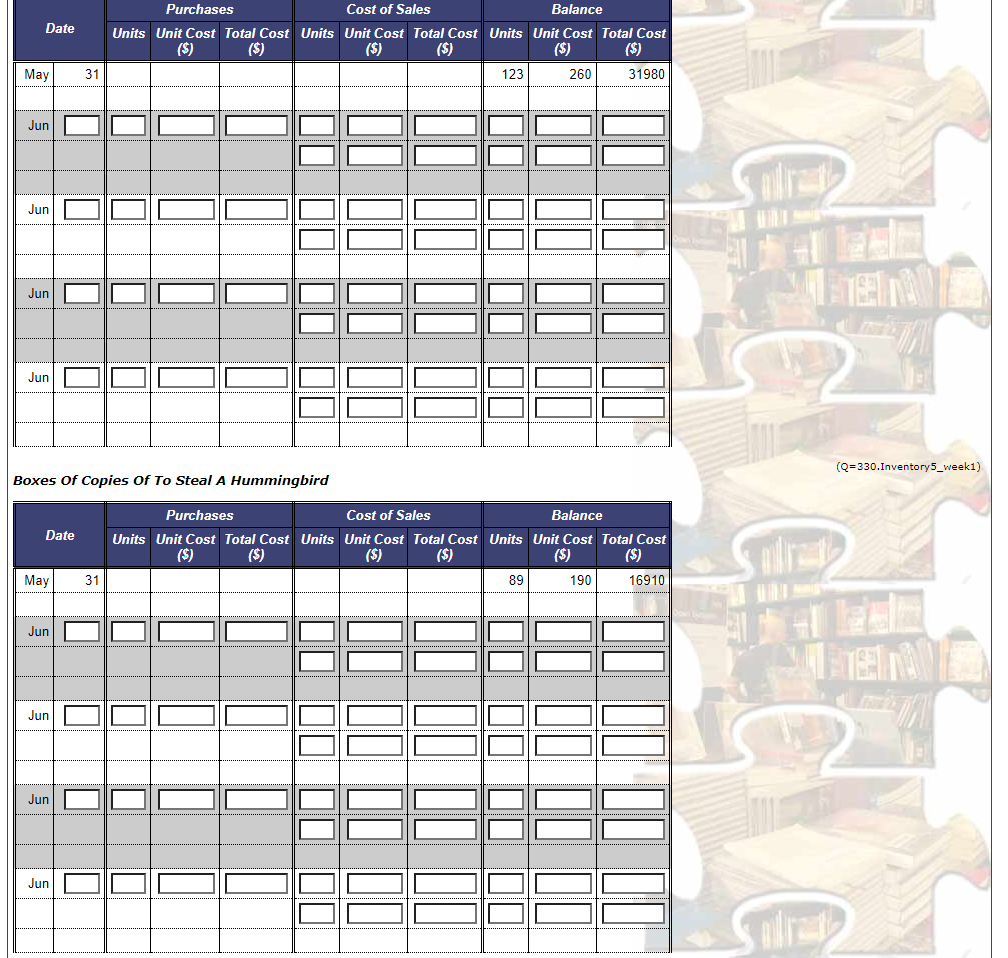

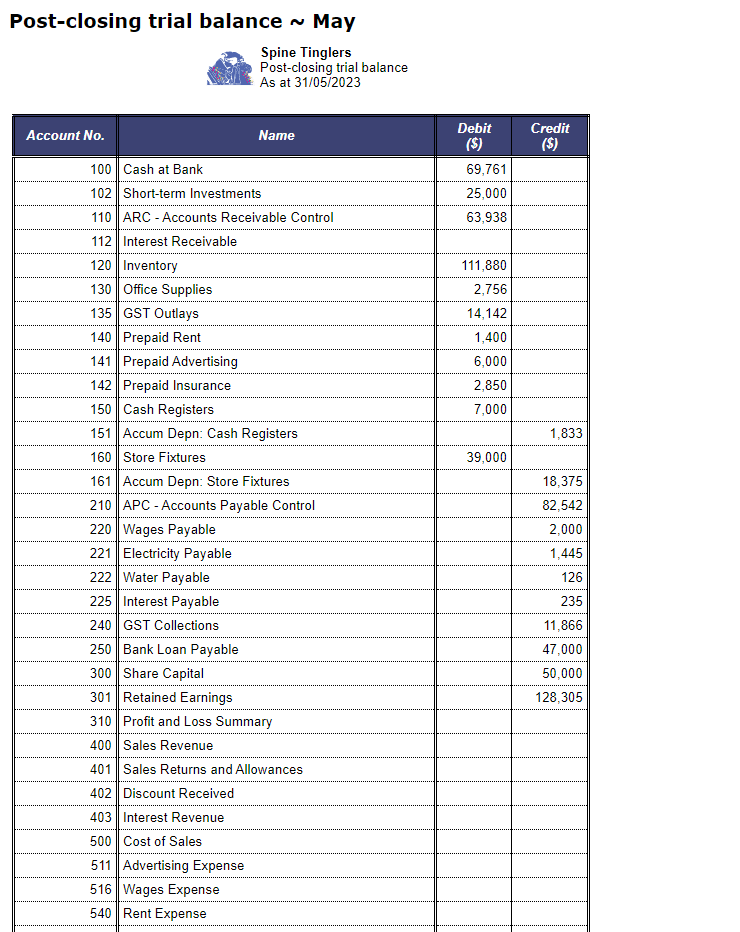

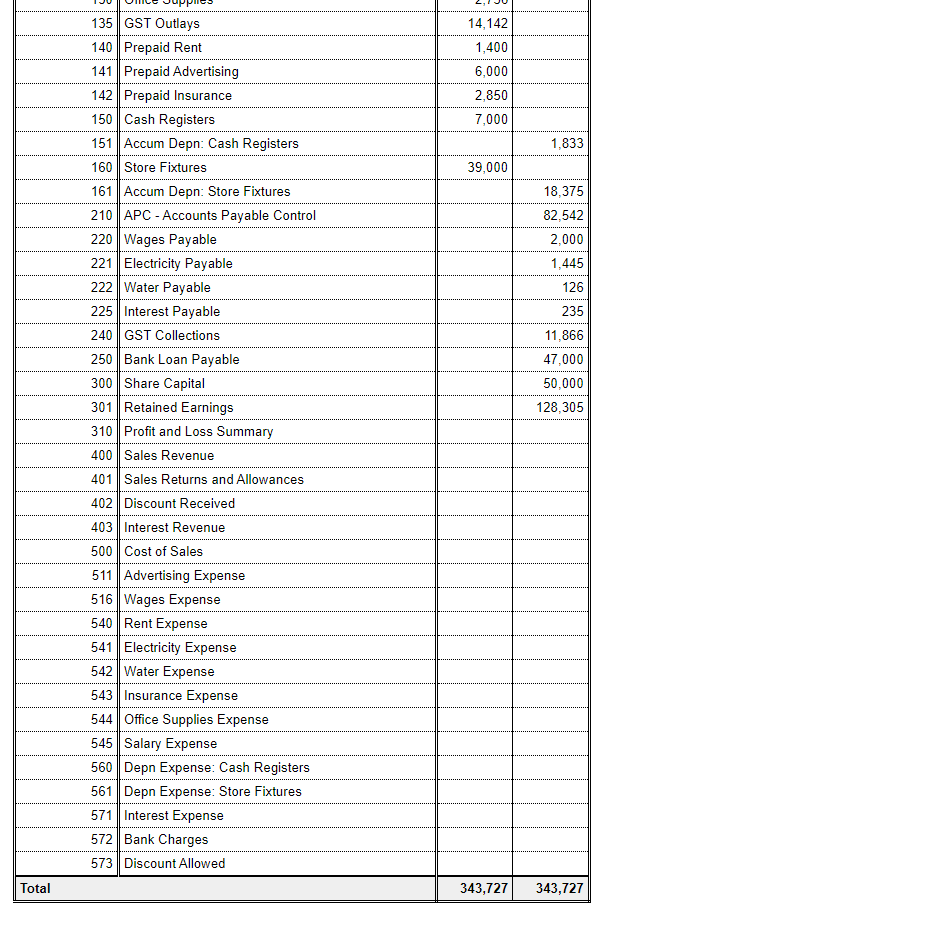

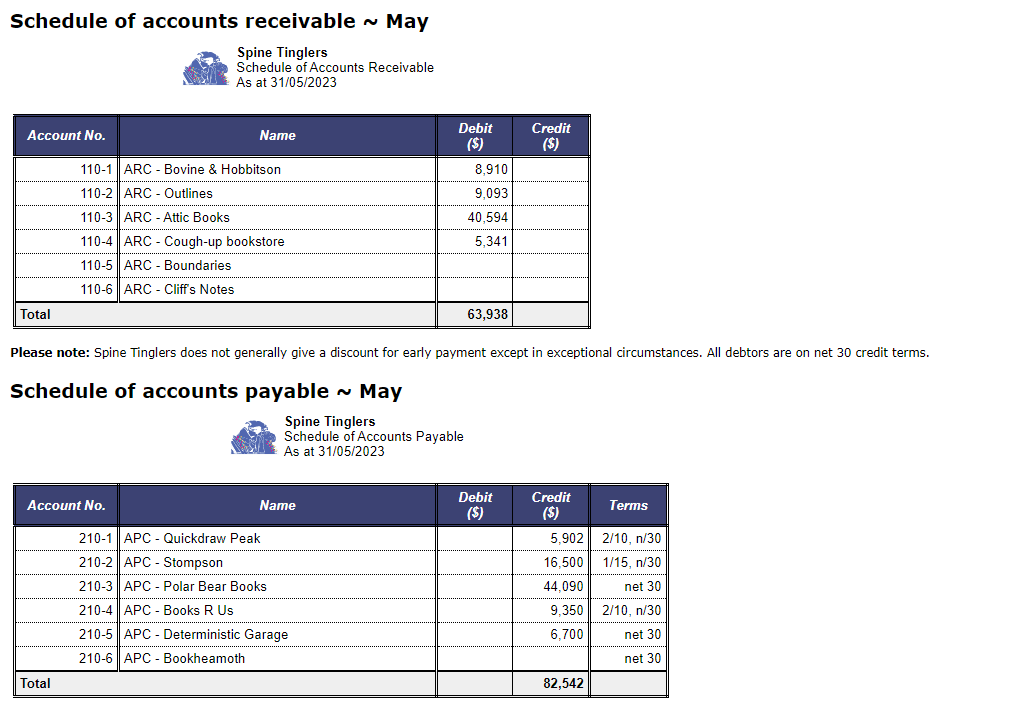

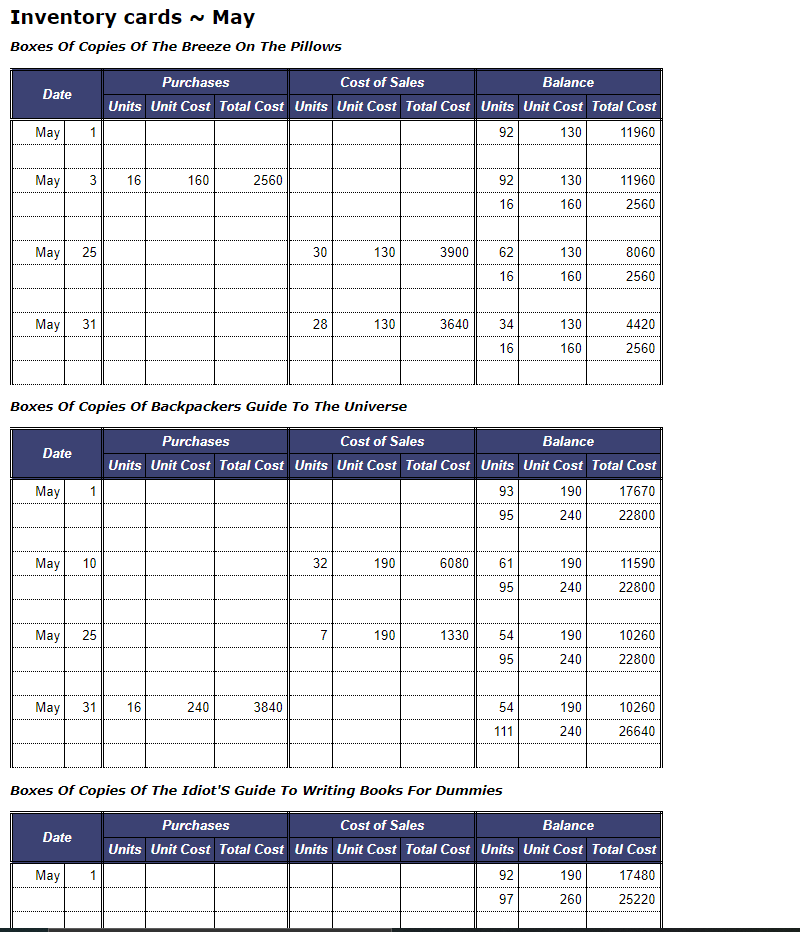

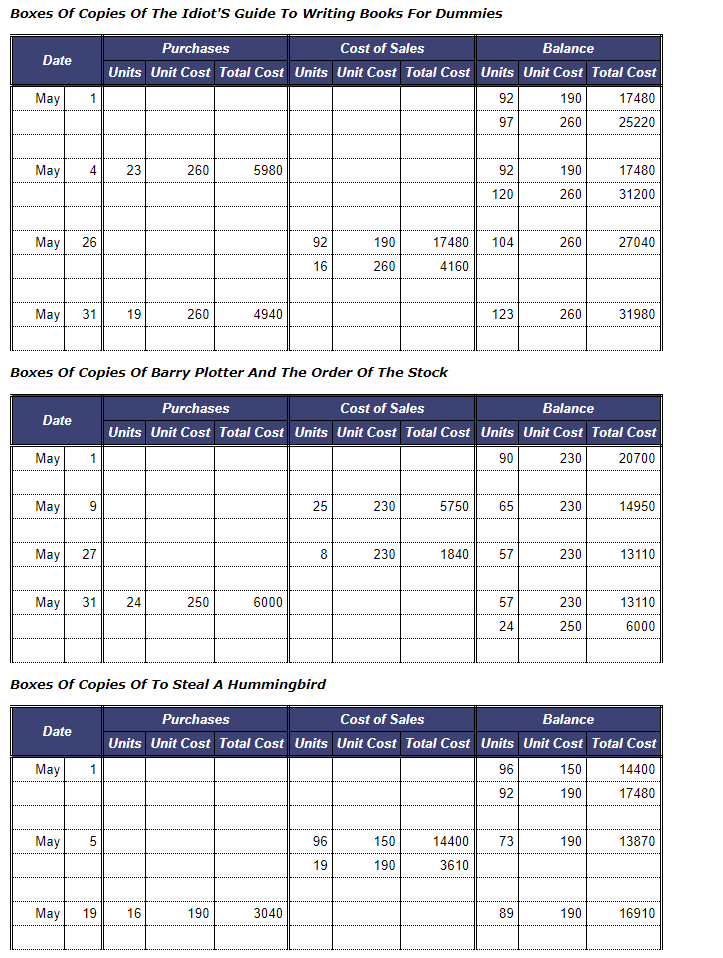

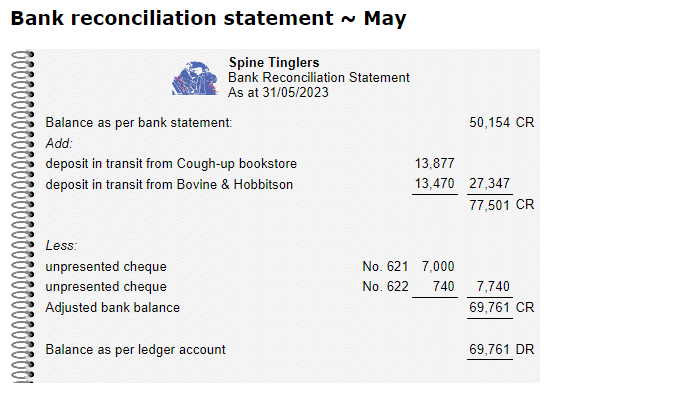

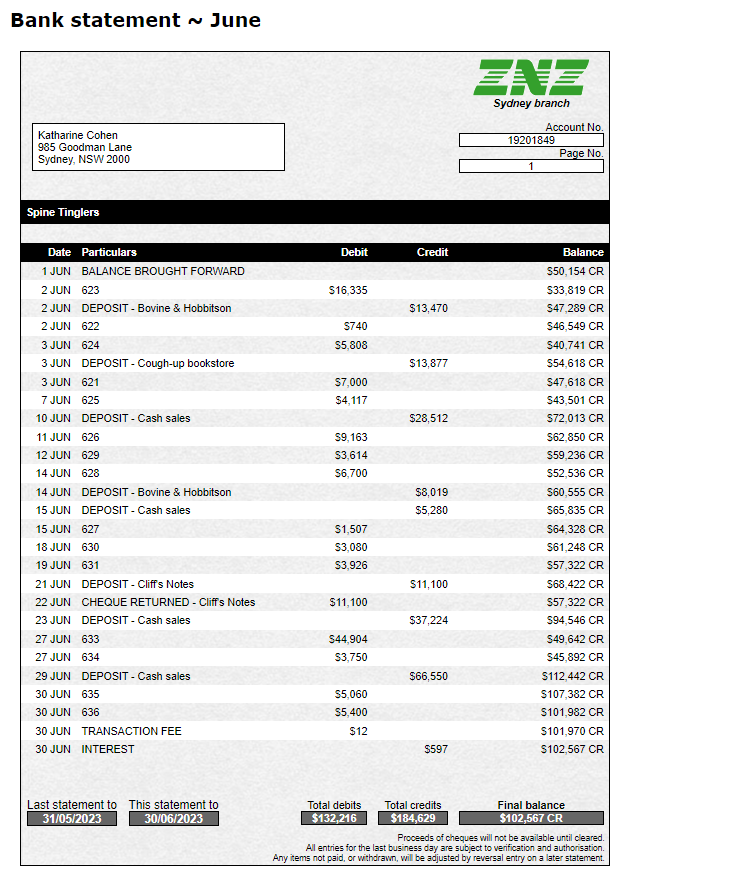

Background Assume it is currently 1 June 2023. You are working for the temporary accounting employment agency known as Accomp. Today you have been asked to work at Spine Tinglers, a small book store that operates in inner city Sydney and is owned by Katharine Cohen. Your task here is to complete the accounting cycle for Spine Tinglers for the month of June 2023 . To assist you in this task, Katharine tells you to read the company's accounting policies and procedures. Note that you will be required to follow these policies and procedures when completing the accounts for Spine Tinglers. Accounting policies a. Business operations: Spine Tinglers is set up as a private non-listed company based in Sydney with Katharine Cohen as the sole shareholder. The company derives its main source of revenue from retail sales of books. To assist in selling the products, Spine Tinglers rents a large showroom. Note that the business is required to pay for the rent for this premises in advance. The electricity and water expenses incurred during the month relate to the running of the showroom. Additional expenses include an insurance policy to protect the business against inventory items being damaged or lost during deliveries. All costs associated with the showroom are classified as selling and distribution expenses. All part-time employees in the business are sales staff who receive their wages on a weekly basis. Katharine is the only full-time employee and her role is to handle all administrative tasks. Katharine's salary is paid once at the end of each month. b. Accounting cycle: The business adopts a monthly accounting cycle. The time frames we provide are a guide only. It may c. Purchases: Purchases are recorded when the business receives the goods. All items purchased are received on the same day as recorded in the transaction list, except for purchase orders which are received at a later date. Note that the business uses the gross method of recording purchases and receives trade discounts and early payment discounts from some suppliers. d. Revenue recognition: The business recognises revenue when goods sold are delivered to customers. All Information from previous pages items sold are delivered on the same day as recorded in the transaction list except for sales orders, which are delivered at a later date as agreed with the customer. Note that the business uses the gross method of recording sales and sometimes grants trade discounts to customers. Past experience has shown that offering settlement discounts did not increase the likelihood of accounts receivable being paid promptly. Therefore, settlement discounts are not normally offered to credit customers except in exceptional circumstances. e. Sales returns: So that the business can easily track the level of sales returns in relation to overall sales, all sales returns are recorded using a contra revenue account (Sales Returns and Allowances) rather than being recorded directly in the Sales Revenue account. f. Goods and services tax (GST): The company is a registered entity for GST purposes and accounts for GST on an accrual basis. As a small business, Spine Tinglers pays GST in quarterly instalments and no GST is due to be remitted in the month of June. In the transaction list, all prices of goods and services that are subject to GST are quoted inclusive of 10\% GST unless specifically noted otherwise. In the list of adjusting entries, all prices are quoted exclusive of GST. Note that two separate accounts are maintained to record GST paid to suppliers and GST received from customers during the month. The net difference of these two accounts is reported as GST Payable in the financial statements when the business is required to pay the net amount to the Australian Taxation Office. If the business is entitled to receive the net difference from the Australian Taxation Office, this net amount is reported as GST Receivable. Further, GST does not apply to interest revenue, bank charges, salaries and wages but GST does apply to payments for rent and electricity. g. Cash: The business accepts cash and cheques and uses cheques to pay for the majority of its expenses. On the day cheques are received, Katharine deposits them at the bank. It may take a number of days for the cheques to be cleared by the bank. The business holds its cheque account with ZNZ Bank. h. Short-term investments: The business holds a six-month term deposit account with ZNZ Bank at a simple interest rate of 6%. Interest is calculated on a monthly basis and received at the end of the deposit term. The monthly interest earned is calculated as the yearly interest divided by the number of months in a year. Note that when the deposit matures, Katharine usually rolls over the principal and interest received at the end of the term. The term deposit account was rolled over on 1 June 2023. i. Inventories: The business uses the perpetual inventory system and applies the FIFO method to allocate costs to inventory and cost of sales. Note that the business maintains a set of inventory cards with multiple pairs of lines to keep track of changes in inventory. In each inventory card under the Balance column, items with j. Prepayments: The business has a policy of recording prepayments, including office supplies, as assets. At the end of the month, adjustments are made to the relevant accounts to recognise the expense incurred during the accounting period. k. Property, plant and equipment: Property, plant and equipment items are depreciated over their estimated useful life using the straight line method to calculate the depreciation charge. Depreciation is allocated on a monthly basis and the monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year. I. Long term liabilities: The business obtained an interest only loan of $47,000 from EastPac Bank on 1 May 2023 at a simple interest rate of 6% per year. The first interest payment is due at the end of July 2023 and the principal on the loan is due on 1 May 2027. Accounting procedures Spine Tinglers adopts a manual accounting system and uses the general journal and special journals for the recording of individual transactions. Katharine Cohen has tailored the design of those journals to meet the specific needs of the business so the format of those journals may be slightly different to those you have seen before. However, she advises you that the general principles of how to use special journals are followed in her business. The table below shows the journals used by the business and the types of transactions that can be recorded in each of these journals: To summarise the effects of transactions recorded in those journals, Katharine maintains the general ledger and the following ledgers: - accounts receivable subsidiary ledger, - accounts payable subsidiary ledger, and - inventory cards. Katharine then indicates that she is aware other businesses using a manual accounting system may post transactions from journals to ledgers at different times (i.e. daily or monthly). Although the posting procedures used in her business may be different to what you have seen before, she asks that you specifically follow her company's accounting procedures. The information below explains when transactions are required to be posted from the journals to the appropriate ledger accounts and inventory cards: Posting of entries recorded in the general journal All transactions that are entered in the general journal are posted on a daily basis. Note that if a transaction recorded in the general journal involves both a control account and a subsidiary ledger account, that journal entry will need to be posted to both ledgers. Posting of entries recorded in the special journals When a transaction is recorded in a special journal, part of the journal entry may need to be posted daily and part of that entry is to be posted monthly. a. Daily: - If a transaction affects a subsidiary ledger account, then the entry that involves a subsidiary ledger account is to be posted to that subsidiary ledger on a daily basis. However, the same amount posted to the subsidiary ledger account is not posted to the related control ledger account immediately. This procedure allows the business to keep track of supplier and customer balances on a daily basis. - In the cash receipts journal or the cash payments journal, if a transaction is recorded in the Other Accounts column, then the amount recorded in the Other Accounts column is to be posted to the appropriate general ledger account daily. - If a transaction results in a change in the number of inventory items on hand, then the entry that affects inventory is to be posted to the appropriate inventory card on a daily basis. In this way, the business is able to track the balance of inventory on hand. b. Monthly: - At the end of the month, the totals of each column in the special journals are manually calculated. Those totals, with the exception of the totals of the Other Accounts columns in the cash journals, are posted to the appropriate general ledger accounts at the end of the month. You will use the following five weeks of transactions as you complete the books for June. Note that the transactions are divided into five separate weeks. This is because you will not enter this whole list of transactions on any one page. You will be given five separate pages in which to enter the transactions for each of the five weeks. Date Description Week 1 1 Paid the full amount owing to Stompson, Cheque No. 623. Payment fell within discount period. Purchased 22 boxes of copies of Backpackers Guide to the Universe with cash for $264 each, Cheque No. 624. Purchased 10 boxes of copies of The idiot's Guide to Writing Books for Dummies from Polar Bear Books for $319 each, terms net 30 . Sold 17 boxes of copies of The idiot's Guide to Writing Books for Dummies to Attic Books for $550 each, Invoice No. 483. Paid sales staff wages of $4,117 for the week up to and including yesterday, Cheque No. 625 . Note that $2,000 of this payment relates to the wages expense incurred during the last week of May. 6 Purchased 17 boxes of copies of To Steal a Hummingbird from Quickdraw Peak for $242 each, terms 2/10, n/30 Made cash sale of 54 boxes of copies of Backpackers Guide to the Universe for $528 each. Paid the full amount owing to Books R Us, Cheque No. 626. Payment fell within discount period. Week 2 8 Sold 67 boxes of copies of Barry Plotter and the Order of the Stock to Cliff's Notes for $561 each, Invoice No. 484. 9 Bovine \& Hobbitson paid the full amount owing on their account. Since Bovine \& Hobbitson has been a loyal customer from the day the business commenced, a 10% discount was given for this early repayment. 9 Attic Books returned 10 boxes of copies of The idiot's Guide to Writing Books for Dummies that were originally sold for $550 each on 4 June. These items cost $260 each (excluding 10% GST) and were not faulty or damaged. Issued a Credit Note for $5,500. 10 Made payment of $1,507 to Enroff for 3 months of electricity up to and including 31 May, Cheque No. 627. 11 Paid the full amount owing to Deterministic Garage, Cheque No. 628. 11 Paid sales staff wages of $3,614 for the week up to and including yesterday, Cheque No. 629. 13 Made cash sale of 15 boxes of copies of The Breeze on the Pillows for $352 each. Week 3 15 Paid $3,080 for one month's rent of the show room (from 16 June to 15 July inclusive), Cheque No. 630. 16 Sold 91 boxes of copies of To Steal a Hummingbird to Boundaries for $407 each, Invoice No. 485. 17 Attic Books paid the full amount owing on their account. 18 Paid sales staff wages of $3,926 for the week up to and including yesterday, Cheque No. 631. 19 Cliff's Notes paid $11,100 in partial payment of their account. 20 Made cash sale of 94 boxes of copies of Backpackers Guide to the Universe for a list price of $528 each. A trade discount of 25% applies. 20 Received a purchase order from Cliff's Notes. Created a corresponding sales order to deliver 13 boxes of copies of Barry Plotter and the Order of the Stock to this customer for $561 each, Invoice No. 486 . 21 Returned 9 faulty boxes of copies of Backpackers Guide to the Universe, originally purchased for $264 each, to Polar Bear Books. Received a Credit Note for $2,376. Week 4 24 Paid the full amount owing to Quickdraw Peak, Cheque No. 632. 25 Paid the full amount owing to Polar Bear Books, Cheque No. 633. 25 Delivered 13 boxes of copies of Barry Plotter and the Order of the Stock to Cliff's Notes for $561 each, Invoice No. 486 , which was ordered on the 20th. 25 Paid sales staff wages of $3,750 for the week up to and including yesterday, Cheque No. 634. 26 Ordered 18 boxes of copies of To Steal a Hummingbird from Books R Us for $242 each, agreed terms with Books R Us are 2/10, n/30. 27 Made cash sale of 121 boxes of copies of The idiot's Guide to Writing Books for Dummies for $550 each. Week 5 29 Received 18 boxes of copies of To Steal a Hummingbird for $242 each, which were ordered on the 26th, agreed terms with Books R Us are 2/10, n/30. 29 Made cash sale of 22 boxes of copies of The Breeze on the Pillows for $352 each. Cough-up bookstore paid the full amount owing on their account. Purchased 23 boxes of copies of Barry Plotter and the Order of the Stock with cash for a list price of $275 each. A trade discount of 20% applies, Cheque No. 635. 30 Paid monthly salary of $5,400 to Katharine Cohen, Cheque No. 636. Adjusting entries information Using the following information, you will record end of month adjustments: - Cash Registers owned by the business: original purchase price was $7,000, estimated useful life was 6 years, and estimated residual value was $1,000 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year. - Store Fixtures owned by the business: original purchase price was $39,000, estimated useful life was 10 years, and estimated residual value was $4,000 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year. - The water usage for the month of June is estimated to be $115. - The estimated electricity payable as at the end of June is $487. - Sales staff work every single day during the week including weekends and are paid on a weekly basis. Wages were last paid up to and including 24 June. Wages incurred after that day (from 25 June to 30 June inclusive) are estimated to have been $590 per day. - Interest expense incurred during the month of June but not yet paid to EastPac Bank for the bank loan is $235. - Interest earned from short-term investments in ZNZ Bank for the month of June is $125. - Office supplies totalling $2,480 are still on hand at 30 June. - 15 days of rent remained pre-paid at the start of June. - 3 months of advertising remained pre-paid at the start of June. - 5 months of insurance remained pre-paid at the start of June. When calculating the portion of prepayments that expire during the month of June, you are asked to assume that an equal amount of expense is incurred per month. A stocktake revealed that the balance of inventory on hand as at 30 June is equal to the closing balance of the Inventory account. This means there is no adjusting entry required for inventory shrinkage. Now that you have reviewed information about Spine Tinglers, you are ready to begin the first step in the accounting cycle, recording transactions. On this page of the practice set, you are asked to record transactions that occurred during the first week of June into the company's journals and post the appropriate entries to the ledger accounts. The following transactions occurred throughout the first week of June: Week 1 Date Transaction description 1 Paid the full amount owing to Stompson, Cheque No. 623. Payment fell within discount period. Purchased 22 boxes of copies of Backpackers Guide to the Universe with cash for $264 each, Cheque No. 624. 3 Purchased 10 boxes of copies of The idiot's Guide to Writing Books for Dummies from Polar Bear Books for $319 each, terms net 30 . 4 Sold 17 boxes of copies of The idiot's Guide to Writing Books for Dummies to Attic Books for $550 each, Invoice No. 483. 4 Paid sales staff wages of $4,117 for the week up to and including yesterday, Cheque No. 625. Note that $2,000 of this payment relates to the wages expense incurred during the last week of May. 6 Purchased 17 boxes of copies of To Steal a Hummingbird from Quickdraw Peak for $242 each, terms 2/10,n/30 6 Made cash sale of 54 boxes of copies of Backpackers Guide to the Universe for $528 each. 7 Paid the full amount owing to Books R Us, Cheque No. 626. Payment fell within discount period. After completing this practice set page, you should know how to record basic transactions in the journals provided below and understand the posting process in the manual accounting system. Note that you will record the remaining June transactions in the following sections of this practice set. Remember, one purpose of using special journals is to make the posting process more efficient by posting the total of most columns in the special journals after all of the transactions for the period have been recorded. However, some parts of a journal entry are still required to be posted on a daily basis. View the company's accounting policies and procedures Instructions for week 1 1) Record all week 1 transactions in the relevant journals. Note that special journals must be used where applicable. Any transaction that cannot be recorded in a special journal should be recorded in the general journal. 2) Post entries recorded in the journals to the appropriate ledger accounts according to the company's accounting policies and procedures 5. Note that the relevant totals of the special journals will be posted to the general ledger accounts at the end of the month. You will enter this after you prepare the Bank Reconciliation Statement. 3) Update inventory cards on a daily basis. Remember to enter all answers to the nearest whole dollar. When calculating a discount, if a discount is not a whole number, round the discount to the nearest whole dollar. Then, to calculate the cash at bank amount, subtract the discount from the original amount. Additional instructions Displaying selected accounting records: - To save space, not all accounting records (e.g. journals and ledgers) will be displayed on every page. However, on each page you can access all accounting records necessary to answer the questions on that page. - There are several tabs representing different views of the accounting records. The active tab by default is Show All, but you may also select to view just one particular accounting record by selecting the appropriate tab. - If you fill in any accounting records and change the view on the page by selecting a different tab, the Displaying selected accounting records: - To save space, not all accounting records (e.g. journals and ledgers) will be displayed on every page. However, on each page you can access all accounting records necessary to answer the questions on that page. - There are several tabs representing different views of the accounting records. The active tab by default is Show All, but you may also select to view just one particular accounting record by selecting the appropriate tab. - If you fill in any accounting records and change the view on the page by selecting a different tab, the information that you have entered will remain in that accounting record and be displayed whenever you can see that accounting record. - Before submitting your answers, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. You are required to complete all relevant accounting records before pressing the Submit answers button. Once submitted, you will not be able to return to the page to re-enter or alter your answers. Journals: - Each transaction recorded in a special journal must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the special journal. - For certain transactions in special journals, some accounting textbooks do not always require an account to be chosen under the column labeled Account. In this practice set you are required to select an account for each transaction in the special journals. Specifically, in all special journals, under the column labeled Account, you must select the correct account name for each transaction in order to receive full points. Note that for some transactions, this will mean that the account name selected will correspond to the heading of one of the columns in that special journal. - For each journal, in the Post Ref. column you will need to correctly type the account number of the account you are posting to. In particular, in special journals, some accounting textbooks do not always require a reference to be recorded in the Post Ref. column. In this practice set, in order to receive full points, every transaction entered in a special journal requires an entry in the Post Ref. column. Note that in the special journals, if the account name selected for a transaction corresponds to the heading of one of the columns in that special journal, the post ref is to be recorded as an X. This is because these transactions are not posted on a daily basis. In order to receive full points, you must record only the letter X in the Post Ref. column for these transactions. - You are required to enter the GST component of a transaction as a positive number into the journals. To record an amount in a GST account, you need to enter that amount into the appropriate debit or credit column. - Note that in special journals, the Other Accounts column should not be used to record movements of inventory. - If a cheque number is not required, you need to fill the appropriate input box with an X. - When recording a transaction into the general journal, the amount recorded in one account may be the sum of the amounts recorded in two or more accounts. For example, a journal entry may consist of a debit of $100 to Account A, a credit of $40 to Account B and a credit of $60 to Account C. For these types of transactions, you must not split the transaction into more than one journal entry i.e. (1) Dr Account A $40,Cr Account B $40 and (2) Dr Account A $60,Cr Account C $60. Instead, you must record the $100 debit to Account A in a single line. - There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 1101, you should type ' 110/1101 into the Post Ref. column. - General journal entries do NOT require a description of the journal entries. Ledgers: - When posting a transaction to a ledger account, under the Description column, please type the description of the transaction directly into the field. The exact wording does not matter for grading purposes. For example, it does not matter in an electricity transaction if you type 'Paid for electricity' or 'Paid electricity bill'. - For each ledger, under the Ref. column, you need to select the correct journal from a list in the dropdown box provided in order to receive full points. - If the balance of a ledger account is zero you do not need to select a debit or credit from the drop-down box. - Each transaction posted to the subsidiary ledgers must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the subsidiary ledger. Both journals and ledgers: - Most journals and ledgers will have blank rows left at the end of this question. - Some journals and ledgers may not require any entries for this week. - When purchases and sales are recorded in special journals, the corresponding changes in inventory must not be posted to the Inventory account in the general ledger on a daily basis. Inventory cards: - Each transaction recorded in the inventory cards must be entered in a pair of lines provided. You may be required to record a transaction in a single line or two separate lines within the pair of lines provided. Whether one or two lines are required depends on the unit costs of the items involved in that transaction. If a transaction involves items with the same unit cost, you must record that transaction in a single line. Alternatively, if those items have two different unit costs, you are required to use a separate line within the pair of lines provided for each different unit cost. - In order to receive full points, you must not combine two transactions into the one pair of lines. See the Inventory cards May popup below the 'Information from previous pages' heading for an example of how inventory cards are to be completed. - Note that you may enter a positive or negative number into the Units and Total Cost columns but all unit costs must be entered as positive numbers into the Unit Cost columns. If you want to print this page, please read and follow the special printing information 3 to ensure you can print the special journals in full. \begin{tabular}{|l|l|l|l|l|l} \hline Show All & Special Journals & General Journal & Subsidiary Ledgers & General Ledger & Inventory \\ \cline { 2 - 7 } \end{tabular} SALES JOURNAL PURCHASES JOURNAL (Q=302,purchasesJournalWeek1) (Q=303.cashReceiptsJournalWeek1) Note: In order to receive full points, for each transaction you must select an account under the column labelled 'Account', as indicated under the additional instructions above. Since all transactions in this journal affect the Cash at Bank account, you are asked to enter the name of the appropriate account credited in these transactions into the Account column so that the type of transaction can be determined by the name of the account entered into this column. The two GST columns in this journal refer to the same GST account (being the account that is used to record the GST related to applicable cash receipts). CASH PAYMENTS JOURNAL (Q=304,cashPaymentsjournalWeek1) Note: In order to receive full points, for each transaction you must select an account under the column labelled 'Account', as indicated under the additional instructions above. Since all transactions in this journal affect the Cash at Bank account, you are asked to enter the name of the appropriate account debited in these transactions into the Account column so that the type of transaction can be determined by the name of the account entered into this column. The two GST columns in this journal refer to the same GST account (being the account that is used to record the GST related to applicable cash payments). GENERAL JOURNAL (Q=305.generalJournalWeek1) GENERAL JOURNAL \[ (\mathrm{Q}=310-110-3 . \text { AcctsRec3_week } 1) \] SUBSIDIARY LEDGERS Account: ARC - Attic Books Account No. 110-3 Account: APC - Quickdraw Peak \[ (Q=310-210-1 \text {.AcctsPay1_week1) } \] Account No. 210-1 Account: APC - Stompson \[ (\mathrm{Q}=310-210-2 . \text { AcctsPay2_week } 1) \] Account No. 210-2 Account: APC - Stompson Account No. 210-2 Account: APC - Polar Bear Books \[ (Q=310-210-3 . \text { AcctsPay3_week } 1) \] Account No. 210-3 Account: APC - Books R Us \[ (Q=310-210-4 \text {.AcctsPay4_week } 1 \text { ) } \] Account No. 210-4 GENERAL LEDGER Account: Cash at Bank Account No. 100 Account: ARC - Accounts Receivable Control \[ (Q=320-100 . \text { CashAtBank_week1) } \] Account No. 110 Account: ARC - Accounts Receivable Control \[ (Q=320-110 \text {.AcctsRecControl_week } 1) \] Account No. 110 Account: Inventory (Q=320-120.Inventory_week1) Account No. 120 Account: GST Outlays \[ (Q=320-135 . \text { TaxPaid_week1 }) \] Account No. 135 Account: APC - Accounts Payable Control \[ (Q=320-210 . \text { AcctsPayControl_week } 1) \] Account No. 210 Account: Wages Payable Account No. 220 Account: Wages Payable Account No. 220 Account: GST Collections \[ (Q=320-240 . \text { TaxCollected_week1) } \] Account No. 240 Account: Sales Revenue Account No. 400 Account: Discount Received \[ (Q=320-400 . \text { SalesRevenue_week } 1) \] Account No. 402 Account: Cost of Sales \[ (Q=320-402 \text {.DiscountRecd_week } 1) \] Account No. 500 Account: Cost of Sales Account No. 500 Account: Wages Expense \[ (Q=320-516 . \text { Wages Expense_week } 1) \] Account No. 516 Account: Discount Allowed (Q=320573.DiscountAllowed_week1 1) Account No. 573 INVENTORY CARDS Boxes Of Copies of Backpackers Guide To The Universe Boxes of Copies of Backpackers Guide To The Universe Boxes of Copies of The Idiot's Guide To Writing Books For Dummies Boxes Of Copies Of To Steal A Hummingbird \[ (Q=330 \text {.Inventory5_week } 1) \] Post-closing trial balance May Spine Tinglers Post-closing trial balance As at 31/05/2023 Schedule of accounts receivable May Spine Tinglers Schedule of Accounts Receivable As at 31/05/2023 Please note: Spine Tinglers does not generally give a discount for early payment except in exceptional circumstances. All debtors are on net 30 credit terms. Schedule of accounts payable May Spine Tinglers Schedule of Accounts Payable As at 31/05/2023 Inventory cards May Boxes of Copies of The Breeze On The Pillows Boxes Of Copies of Backpackers Guide To The Universe Boxes of Copies of The Idiot's Guide To Writing Books For Dummies Boxes of Copies of The Idiot's Guide To Writing Books For Dummies Boxes of Copies of Barry Plotter And The Order Of The Stock Boxes of Copies of To Steal A Hummingbird Bank reconciliation statement May Spine Tinglers Bank Reconciliation Statement As at 31/05/2023 Bank statement June Spine Tinglers Last statement to Thic atatement tn 31/05/2023 Final balance \$102,567 CR Proceeds of cheques will not be available until cleared. All entries for the last business day are subject to verification and authorisation. Any items not paid, or vithdrawn, will be adjusted by reversal entry on a later statement. Background Assume it is currently 1 June 2023. You are working for the temporary accounting employment agency known as Accomp. Today you have been asked to work at Spine Tinglers, a small book store that operates in inner city Sydney and is owned by Katharine Cohen. Your task here is to complete the accounting cycle for Spine Tinglers for the month of June 2023 . To assist you in this task, Katharine tells you to read the company's accounting policies and procedures. Note that you will be required to follow these policies and procedures when completing the accounts for Spine Tinglers. Accounting policies a. Business operations: Spine Tinglers is set up as a private non-listed company based in Sydney with Katharine Cohen as the sole shareholder. The company derives its main source of revenue from retail sales of books. To assist in selling the products, Spine Tinglers rents a large showroom. Note that the business is required to pay for the rent for this premises in advance. The electricity and water expenses incurred during the month relate to the running of the showroom. Additional expenses include an insurance policy to protect the business against inventory items being damaged or lost during deliveries. All costs associated with the showroom are classified as selling and distribution expenses. All part-time employees in the business are sales staff who receive their wages on a weekly basis. Katharine is the only full-time employee and her role is to handle all administrative tasks. Katharine's salary is paid once at the end of each month. b. Accounting cycle: The business adopts a monthly accounting cycle. The time frames we provide are a guide only. It may c. Purchases: Purchases are recorded when the business receives the goods. All items purchased are received on the same day as recorded in the transaction list, except for purchase orders which are received at a later date. Note that the business uses the gross method of recording purchases and receives trade discounts and early payment discounts from some suppliers. d. Revenue recognition: The business recognises revenue when goods sold are delivered to customers. All Information from previous pages items sold are delivered on the same day as recorded in the transaction list except for sales orders, which are delivered at a later date as agreed with the customer. Note that the business uses the gross method of recording sales and sometimes grants trade discounts to customers. Past experience has shown that offering settlement discounts did not increase the likelihood of accounts receivable being paid promptly. Therefore, settlement discounts are not normally offered to credit customers except in exceptional circumstances. e. Sales returns: So that the business can easily track the level of sales returns in relation to overall sales, all sales returns are recorded using a contra revenue account (Sales Returns and Allowances) rather than being recorded directly in the Sales Revenue account. f. Goods and services tax (GST): The company is a registered entity for GST purposes and accounts for GST on an accrual basis. As a small business, Spine Tinglers pays GST in quarterly instalments and no GST is due to be remitted in the month of June. In the transaction list, all prices of goods and services that are subject to GST are quoted inclusive of 10\% GST unless specifically noted otherwise. In the list of adjusting entries, all prices are quoted exclusive of GST. Note that two separate accounts are maintained to record GST paid to suppliers and GST received from customers during the month. The net difference of these two accounts is reported as GST Payable in the financial statements when the business is required to pay the net amount to the Australian Taxation Office. If the business is entitled to receive the net difference from the Australian Taxation Office, this net amount is reported as GST Receivable. Further, GST does not apply to interest revenue, bank charges, salaries and wages but GST does apply to payments for rent and electricity. g. Cash: The business accepts cash and cheques and uses cheques to pay for the majority of its expenses. On the day cheques are received, Katharine deposits them at the bank. It may take a number of days for the cheques to be cleared by the bank. The business holds its cheque account with ZNZ Bank. h. Short-term investments: The business holds a six-month term deposit account with ZNZ Bank at a simple interest rate of 6%. Interest is calculated on a monthly basis and received at the end of the deposit term. The monthly interest earned is calculated as the yearly interest divided by the number of months in a year. Note that when the deposit matures, Katharine usually rolls over the principal and interest received at the end of the term. The term deposit account was rolled over on 1 June 2023. i. Inventories: The business uses the perpetual inventory system and applies the FIFO method to allocate costs to inventory and cost of sales. Note that the business maintains a set of inventory cards with multiple pairs of lines to keep track of changes in inventory. In each inventory card under the Balance column, items with j. Prepayments: The business has a policy of recording prepayments, including office supplies, as assets. At the end of the month, adjustments are made to the relevant accounts to recognise the expense incurred during the accounting period. k. Property, plant and equipment: Property, plant and equipment items are depreciated over their estimated useful life using the straight line method to calculate the depreciation charge. Depreciation is allocated on a monthly basis and the monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year. I. Long term liabilities: The business obtained an interest only loan of $47,000 from EastPac Bank on 1 May 2023 at a simple interest rate of 6% per year. The first interest payment is due at the end of July 2023 and the principal on the loan is due on 1 May 2027. Accounting procedures Spine Tinglers adopts a manual accounting system and uses the general journal and special journals for the recording of individual transactions. Katharine Cohen has tailored the design of those journals to meet the specific needs of the business so the format of those journals may be slightly different to those you have seen before. However, she advises you that the general principles of how to use special journals are followed in her business. The table below shows the journals used by the business and the types of transactions that can be recorded in each of these journals: To summarise the effects of transactions recorded in those journals, Katharine maintains the general ledger and the following ledgers: - accounts receivable subsidiary ledger, - accounts payable subsidiary ledger, and - inventory cards. Katharine then indicates that she is aware other businesses using a manual accounting system may post transactions from journals to ledgers at different times (i.e. daily or monthly). Although the posting procedures used in her business may be different to what you have seen before, she asks that you specifically follow her company's accounting procedures. The information below explains when transactions are required to be posted from the journals to the appropriate ledger accounts and inventory cards: Posting of entries recorded in the general journal All transactions that are entered in the general journal are posted on a daily basis. Note that if a transaction recorded in the general journal involves both a control account and a subsidiary ledger account, that journal entry will need to be posted to both ledgers. Posting of entries recorded in the special journals When a transaction is recorded in a special journal, part of the journal entry may need to be posted daily and part of that entry is to be posted monthly. a. Daily: - If a transaction affects a subsidiary ledger account, then the entry that involves a subsidiary ledger account is to be posted to that subsidiary ledger on a daily basis. However, the same amount posted to the subsidiary ledger account is not posted to the related control ledger account immediately. This procedure allows the business to keep track of supplier and customer balances on a daily basis. - In the cash receipts journal or the cash payments journal, if a transaction is recorded in the Other Accounts column, then the amount recorded in the Other Accounts column is to be posted to the appropriate general ledger account daily. - If a transaction results in a change in the number of inventory items on hand, then the entry that affects inventory is to be posted to the appropriate inventory card on a daily basis. In this way, the business is able to track the balance of inventory on hand. b. Monthly: - At the end of the month, the totals of each column in the special journals are manually calculated. Those totals, with the exception of the totals of the Other Accounts columns in the cash journals, are posted to the appropriate general ledger accounts at the end of the month. You will use the following five weeks of transactions as you complete the books for June. Note that the transactions are divided into five separate weeks. This is because you will not enter this whole list of transactions on any one page. You will be given five separate pages in which to enter the transactions for each of the five weeks. Date Description Week 1 1 Paid the full amount owing to Stompson, Cheque No. 623. Payment fell within discount period. Purchased 22 boxes of copies of Backpackers Guide to the Universe with cash for $264 each, Cheque No. 624. Purchased 10 boxes of copies of The idiot's Guide to Writing Books for Dummies from Polar Bear Books for $319 each, terms net 30 . Sold 17 boxes of copies of The idiot's Guide to Writing Books for Dummies to Attic Books for $550 each, Invoice No. 483. Paid sales staff wages of $4,117 for the week up to and including yesterday, Cheque No. 625 . Note that $2,000 of this payment relates to the wages expense incurred during the last week of May. 6 Purchased 17 boxes of copies of To Steal a Hummingbird from Quickdraw Peak for $242 each, terms 2/10, n/30 Made cash sale of 54 boxes of copies of Backpackers Guide to the Universe for $528 each. Paid the full amount owing to Books R Us, Cheque No. 626. Payment fell within discount period. Week 2 8 Sold 67 boxes of copies of Barry Plotter and the Order of the Stock to Cliff's Notes for $561 each, Invoice No. 484. 9 Bovine \& Hobbitson paid the full amount owing on their account. Since Bovine \& Hobbitson has been a loyal customer from the day the business commenced, a 10% discount was given for this early repayment. 9 Attic Books returned 10 boxes of copies of The idiot's Guide to Writing Books for Dummies that were originally sold for $550 each on 4 June. These items cost $260 each (excluding 10% GST) and were not faulty or damaged. Issued a Credit Note for $5,500. 10 Made payment of $1,507 to Enroff for 3 months of electricity up to and including 31 May, Cheque No. 627. 11 Paid the full amount owing to Deterministic Garage, Cheque No. 628. 11 Paid sales staff wages of $3,614 for the week up to and including yesterday, Cheque No. 629. 13 Made cash sale of 15 boxes of copies of The Breeze on the Pillows for $352 each. Week 3 15 Paid $3,080 for one month's rent of the show room (from 16 June to 15 July inclusive), Cheque No. 630. 16 Sold 91 boxes of copies of To Steal a Hummingbird to Boundaries for $407 each, Invoice No. 485. 17 Attic Books paid the full amount owing on their account. 18 Paid sales staff wages of $3,926 for the week up to and including yesterday, Cheque No. 631. 19 Cliff's Notes paid $11,100 in partial payment of their account. 20 Made cash sale of 94 boxes of copies of Backpackers Guide to the Universe for a list price of $528 each. A trade discount of 25% applies. 20 Received a purchase order from Cliff's Notes. Created a corresponding sales order to deliver 13 boxes of copies of Barry Plotter and the Order of the Stock to this customer for $561 each, Invoice No. 486 . 21 Returned 9 faulty boxes of copies of Backpackers Guide to the Universe, originally purchased for $264 each, to Polar Bear Books. Received a Credit Note for $2,376. Week 4 24 Paid the full amount owing to Quickdraw Peak, Cheque No. 632. 25 Paid the full amount owing to Polar Bear Books, Cheque No. 633. 25 Delivered 13 boxes of copies of Barry Plotter and the Order of the Stock to Cliff's Notes for $561 each, Invoice No. 486 , which was ordered on the 20th. 25 Paid sales staff wages of $3,750 for the week up to and including yesterday, Cheque No. 634. 26 Ordered 18 boxes of copies of To Steal a Hummingbird from Books R Us for $242 each, agreed terms with Books R Us are 2/10, n/30. 27 Made cash sale of 121 boxes of copies of The idiot's Guide to Writing Books for Dummies for $550 each. Week 5 29 Received 18 boxes of copies of To Steal a Hummingbird for $242 each, which were ordered on the 26th, agreed terms with Books R Us are 2/10, n/30. 29 Made cash sale of 22 boxes of copies of The Breeze on the Pillows for $352 each. Cough-up bookstore paid the full amount owing on their account. Purchased 23 boxes of copies of Barry Plotter and the Order of the Stock with cash for a list price of $275 each. A trade discount of 20% applies, Cheque No. 635. 30 Paid monthly salary of $5,400 to Katharine Cohen, Cheque No. 636. Adjusting entries information Using the following information, you will record end of month adjustments: - Cash Registers owned by the business: original purchase price was $7,000, estimated useful life was 6 years, and estimated residual value was $1,000 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year. - Store Fixtures owned by the business: original purchase price was $39,000, estimated useful life was 10 years, and estimated residual value was $4,000 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year. - The water usage for the month of June is estimated to be $115. - The estimated electricity payable as at the end of June is $487. - Sales staff work every single day during the week including weekends and are paid on a weekly basis. Wages were last paid up to and including 24 June. Wages incurred after that day (from 25 June to 30 June inclusive) are estimated to have been $590 per day. - Interest expense incurred during the month of June but not yet paid to EastPac Bank for the bank loan is $235. - Interest earned from short-term investments in ZNZ Bank for the month of June is $125. - Office supplies totalling $2,480 are still on hand at 30 June. - 15 days of rent remained pre-paid at the start of June. - 3 months of advertising remained pre-paid at the start of June. - 5 months of insurance remained pre-paid at the start of June. When calculating the portion of prepayments that expire during the month of June, you are asked to assume that an equal amount of expense is incurred per month. A stocktake revealed that the balance of inventory on hand as at 30 June is equal to the closing balance of the Inventory account. This means there is no adjusting entry required for inventory shrinkage. Now that you have reviewed information about Spine Tinglers, you are ready to begin the first step in the accounting cycle, recording transactions. On this page of the practice set, you are asked to record transactions that occurred during the first week of June into the company's journals and post the appropriate entries to the ledger accounts. The following transactions occurred throughout the first week of June: Week 1 Date Transaction description 1 Paid the full amount owing to Stompson, Cheque No. 623. Payment fell within discount period. Purchased 22 boxes of copies of Backpackers Guide to the Universe with cash for $264 each, Cheque No. 624. 3 Purchased 10 boxes of copies of The idiot's Guide to Writing Books for Dummies from Polar Bear Books for $319 each, terms net 30 . 4 Sold 17 boxes of copies of The idiot's Guide to Writing Books for Dummies to Attic Books for $550 each, Invoice No. 483. 4 Paid sales staff wages of $4,117 for the week up to and including yesterday, Cheque No. 625. Note that $2,000 of this payment relates to the wages expense incurred during the last week of May. 6 Purchased 17 boxes of copies of To Steal a Hummingbird from Quickdraw Peak for $242 each, terms 2/10,n/30 6 Made cash sale of 54 boxes of copies of Backpackers Guide to the Universe for $528 each. 7 Paid the full amount owing to Books R Us, Cheque No. 626. Payment fell within discount period. After completing this practice set page, you should know how to record basic transactions in the journals provided below and understand the posting process in the manual accounting system. Note that you will record the remaining June transactions in the following sections of this practice set. Remember, one purpose of using special journals is to make the posting process more efficient by posting the total of most columns in the special journals after all of the transactions for the period have been recorded. However, some parts of a journal entry are still required to be posted on a daily basis. View the company's accounting policies and procedures Instructions for week 1 1) Record all week 1 transactions in the relevant journals. Note that special journals must be used where applicable. Any transaction that cannot be recorded in a special journal should be recorded in the general journal. 2) Post entries recorded in the journals to the appropriate ledger accounts according to the company's accounting policies and procedures 5. Note that the relevant totals of the special journals will be posted to the general ledger accounts at the end of the month. You will enter this after you prepare the Bank Reconciliation Statement. 3) Update inventory cards on a daily basis. Remember to enter all answers to the nearest whole dollar. When calculating a discount, if a discount is not a whole number, round the discount to the nearest whole dollar. Then, to calculate the cash at bank amount, subtract the discount from the original amount. Additional instructions Displaying selected accounting records: - To save space, not all accounting records (e.g. journals and ledgers) will be displayed on every page. However, on each page you can access all accounting records necessary to answer the questions on that page. - There are several tabs representing different views of the accounting records. The active tab by default is Show All, but you may also select to view just one particular accounting record by selecting the appropriate tab. - If you fill in any accounting records and change the view on the page by selecting a different tab, the Displaying selected accounting records: - To save space, not all accounting records (e.g. journals and ledgers) will be displayed on every page. However, on each page you can access all accounting records necessary to answer the questions on that page. - There are several tabs representing different views of the accounting records. The active tab by default is Show All, but you may also select to view just one particular accounting record by selecting the appropriate tab. - If you fill in any accounting records and change the view on the page by selecting a different tab, the information that you have entered will remain in that accounting record and be displayed whenever you can see that accounting record. - Before submitting your answers, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. You are required to complete all relevant accounting records before pressing the Submit answers button. Once submitted, you will not be able to return to the page to re-enter or alter your answers. Journals: - Each transaction recorded in a special journal must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the special journal. - For certain transactions in special journals, some accounting textbooks do not always require an account to be chosen under the column labeled Account. In this practice set you are required to select an account for each transaction in the special journals. Specifically, in all special journals, under the column labeled Account, you must select the correct account name for each transaction in order to receive full points. Note that for some transactions, this will mean that the account name selected will correspond to the heading of one of the columns in that special journal. - For each journal, in the Post Ref. column you will need to correctly type the account number of the account you are posting to. In particular, in special journals, some accounting textbooks do not always require a reference to be recorded in the Post Ref. column. In this practice set, in order to receive full points, every transaction entered in a special journal requires an entry in the Post Ref. column. Note that in the special journals, if the account name selected for a transaction corresponds to the heading of one of the columns in that special journal, the post ref is to be recorded as an X. This is because these transactions are not posted on a daily basis. In order to receive full points, you must record only the letter X in the Post Ref. column for these transactions. - You are required to enter the GST component of a transaction as a positive number into the journals. To record an amount in a GST account, you need to enter that amount into the appropriate debit or credit column. - Note that in special journals, the Other Accounts column should not be used to record movements of inventory. - If a cheque number is not required, you need to fill the appropriate input box with an X. - When recording a transaction into the general journal, the amount recorded in one account may be the sum of the amounts recorded in two or more accounts. For example, a journal entry may consist of a debit of $100 to Account A, a credit of $40 to Account B and a credit of $60 to Account C. For these types of transactions, you must not split the transaction into more than one journal entry i.e. (1) Dr Account A $40,Cr Account B $40 and (2) Dr Account A $60,Cr Account C $60. Instead, you must record the $100 debit to Account A in a single line. - There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 1101, you should type ' 110/1101 into the Post Ref. column. - General journal entries do NOT require a description of the journal entries. Ledgers: - When posting a transaction to a ledger account, under the Description column, please type the description of the transaction directly into the field. The exact wording does not matter for grading purposes. For example, it does not matter in an electricity transaction if you type 'Paid for electricity' or 'Paid electricity bill'. - For each ledger, under the Ref. column, you need to select the correct journal from a list in the dropdown box provided in order to receive full points. - If the balance of a ledger account is zero you do not need to select a debit or credit from the drop-down box. - Each transaction posted to the subsidiary ledgers must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the subsidiary ledger. Both journals and ledgers: - Most journals and ledgers will have blank rows left at the end of this question. - Some journals and ledgers may not require any entries for this week. - When purchases and sales are recorded in special journals, the corresponding changes in inventory must not be posted to the Inventory account in the general ledger on a daily basis. Inventory cards: - Each transaction recorded in the inventory cards must be entered in a pair of lines provided. You may be required to record a transaction in a single line or two separate lines within the pair of lines provided. Whether one or two lines are required depends on the unit costs of the items involved in that transaction. If a transaction involves items with the same unit cost, you must record that transaction in a single line. Alternatively, if those items have two different unit costs, you are required to use a separate line within the pair of lines provided for each different unit cost. - In order to receive full points, you must not combine two transactions into the one pair of lines. See the Inventory cards May popup below the 'Information from previous pages' heading for an example of how inventory cards are to be completed. - Note that you may enter a positive or negative number into the Units and Total Cost columns but all unit costs must be entered as positive numbers into the Unit Cost columns. If you want to print this page, please read and follow the special printing information 3 to ensure you can print the special journals in full. \begin{tabular}{|l|l|l|l|l|l} \hline Show All & Special Journals & General Journal & Subsidiary Ledgers & General Ledger & Inventory \\ \cline { 2 - 7 } \end{tabular} SALES JOURNAL PURCHASES JOURNAL (Q=302,purchasesJournalWeek1) (Q=303.cashReceiptsJournalWeek1) Note: In order to receive full points, for each transaction you must select an account under the column labelled 'Account', as indicated under the additional instructions above. Since all transactions in this journal affect the Cash at Bank account, you are asked to enter the name of the appropriate account credited in these transactions into the Account column so that the type of transaction can be determined by the name of the account entered into this column. The two GST columns in this journal refer to the same GST account (being the account that is used to record the GST related to applicable cash receipts). CASH PAYMENTS JOURNAL (Q=304,cashPaymentsjournalWeek1) Note: In order to receive full points, for each transaction you must select an account under the column labelled 'Account', as indicated under the additional instructions above. Since all transactions in this journal affect the Cash at Bank account, you are asked to enter the name of the appropriate account debited in these transactions into the Account column so that the type of transaction can be determined by the name of the account entered into this column. The two GST columns in this journal refer to the same GST account (being the account that is used to record the GST related to applicable cash payments). GENERAL JOURNAL (Q=305.generalJournalWeek1) GENERAL JOURNAL \[ (\mathrm{Q}=310-110-3 . \text { AcctsRec3_week } 1) \] SUBSIDIARY LEDGERS Account: ARC - Attic Books Account No. 110-3 Account: APC - Quickdraw Peak \[ (Q=310-210-1 \text {.AcctsPay1_week1) } \] Account No. 210-1 Account: APC - Stompson \[ (\mathrm{Q}=310-210-2 . \text { AcctsPay2_week } 1) \] Account No. 210-2 Account: APC - Stompson Account No. 210-2 Account: APC - Polar Bear Books \[ (Q=310-210-3 . \text { AcctsPay3_week } 1) \] Account No. 210-3 Account: APC - Books R Us \[ (Q=310-210-4 \text {.AcctsPay4_week } 1 \text { ) } \] Account No. 210-4 GENERAL LEDGER Account: Cash at Bank Account No. 100 Account: ARC - Accounts Receivable Control \[ (Q=320-100 . \text { CashAtBank_week1) } \] Account No. 110 Account: ARC - Accounts Receivable Control \[ (Q=320-110 \text {.AcctsRecControl_week } 1) \] Account No. 110 Account: Inventory (Q=320-120.Inventory_week1) Account No. 120 Account: GST Outlays \[ (Q=320-135 . \text { TaxPaid_week1 }) \] Account No. 135 Account: APC - Accounts Payable Control \[ (Q=320-210 . \text { AcctsPayControl_week } 1) \] Account No. 210 Account: Wages Payable Account No. 220 Account: Wages Payable Account No. 220 Account: GST Collections \[ (Q=320-240 . \text { TaxCollected_week1) } \] Account No. 240 Account: Sales Revenue Account No. 400 Account: Discount Received \[ (Q=320-400 . \text { SalesRevenue_week } 1) \] Account No. 402 Account: Cost of Sales \[ (Q=320-402 \text {.DiscountRecd_week } 1) \] Account No. 500 Account: Cost of Sales Account No. 500 Account: Wages Expense \[ (Q=320-516 . \text { Wages Expense_week } 1) \] Account No. 516 Account: Discount Allowed (Q=320573.DiscountAllowed_week1 1) Account No. 573 INVENTORY CARDS Boxes Of Copies of Backpackers Guide To The Universe Boxes of Copies of Backpackers Guide To The Universe Boxes of Copies of The Idiot's Guide To Writing Books For Dummies Boxes Of Copies Of To Steal A Hummingbird \[ (Q=330 \text {.Inventory5_week } 1) \] Post-closing trial balance May Spine Tinglers Post-closing trial balance As at 31/05/2023 Schedule of accounts receivable May Spine Tinglers Schedule of Accounts Receivable As at 31/05/2023 Please note: Spine Tinglers does not generally give a discount for early payment except in exceptional circumstances. All debtors are on net 30 credit terms. Schedule of accounts payable May Spine Tinglers Schedule of Accounts Payable As at 31/05/2023 Inventory cards May Boxes of Copies of The Breeze On The Pillows Boxes Of Copies of Backpackers Guide To The Universe Boxes of Copies of The Idiot's Guide To Writing Books For Dummies Boxes of Copies of The Idiot's Guide To Writing Books For Dummies Boxes of Copies of Barry Plotter And The Order Of The Stock Boxes of Copies of To Steal A Hummingbird Bank reconciliation statement May Spine Tinglers Bank Reconciliation Statement As at 31/05/2023 Bank statement June Spine Tinglers Last statement to Thic atatement tn 31/05/2023 Final balance \$102,567 CR Proceeds of cheques will not be available until cleared. All entries for the last business day are subject to verification and authorisation. Any items not paid, or vithdrawn, will be adjusted by reversal entry on a later statementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started