need answrs for enitre question thanks.

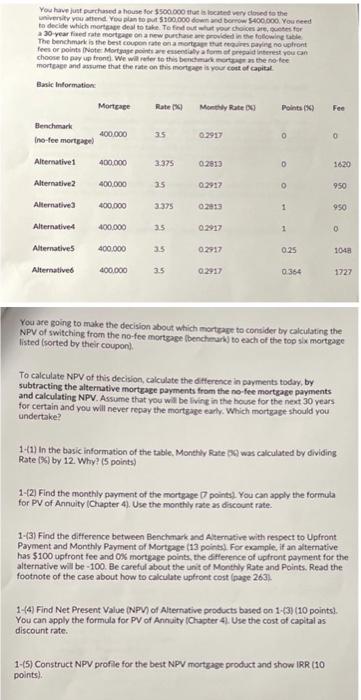

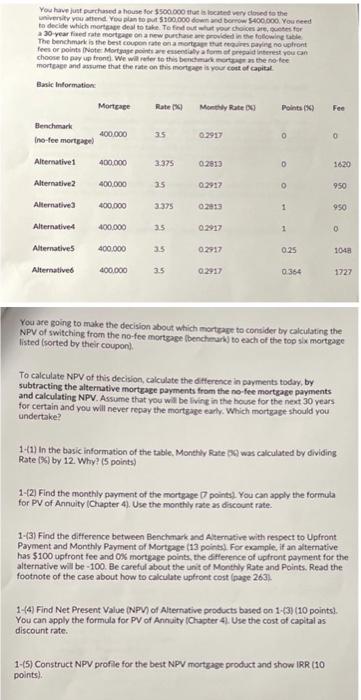

You have just purchased a house for $500.000 ut is located very corned to the und to 5300.000 and borrow $400.000. You need to decide which more deal to take. Te fed out what your choices are for on The benchmark is the best coupon rate enamorar tu equires rive no uolont feet or points Note Morte postessential form of repaid interest you can choose to pay front we will refer to this benchmark moes the role more and assume that the rate on this mortgage is your cost of capital Basic Information Mortgage Rate Montsly Rate 00 Points Benchmark 400.000 35 Ino-fee mort Fee O 0 Alternative 400.000 3375 0.2013 0 1620 Alternative 400.000 35 02912 0 950 Alternative 400.000 3375 02013 1 950 Alternative 400,000 35 1 0 Alternatives 400.000 35 02917 0.25 1048 Alternative 400.000 3.5 0.2917 0364 1727 You are going to make the decision about which mortege to consider by calculating the NPV of switching from the no-fee morter Ibenchmarks to each of the top six mortgage listed (sorted by their coupon) To calculate NPV of this decision, calculate the difference in payments today, by subtracting the alternative mortgage payments from the no-fee mortgage payments and calculating NPV. Assume that you will be living in the house for the next 30 years for certain and you will never repay the mortgage early. Which mortgage should you undertake? 1-(1) In the basic information of the table, Monthly Rate 19 was calculated by dividing Rate(%) by 12. Why? (5 points) 1-(2) Find the monthly payment of the mortgage points). You can apply the formula for PV of Annuity (Chapter 4). Use the monthly rate as discount rate. 1-(3) Find the difference between Benchmark and Alternative with respect to Upfront Payment and Monthly Payment of Mortgage (13 points for comple, if an alternative has $100 upfront fee and Ox mortgage points, the difference of upfront payment for the alternative will be -100. Be careful about the unit of Monthly Rate and points. Read the footnote of the case about how to calculate upfront cost (page 2631 1-(4) Find Net Present Value (NPV) of Alternative products based on 1-C3) (10 points). You can apply the formula for PV of Annuity Chapter 4. Use the cost of capital as discount rate. 1-(5) Construct NPV profile for the best NPV mortgage product and show IRR (10 points) You have just purchased a house for $500.000 ut is located very corned to the und to 5300.000 and borrow $400.000. You need to decide which more deal to take. Te fed out what your choices are for on The benchmark is the best coupon rate enamorar tu equires rive no uolont feet or points Note Morte postessential form of repaid interest you can choose to pay front we will refer to this benchmark moes the role more and assume that the rate on this mortgage is your cost of capital Basic Information Mortgage Rate Montsly Rate 00 Points Benchmark 400.000 35 Ino-fee mort Fee O 0 Alternative 400.000 3375 0.2013 0 1620 Alternative 400.000 35 02912 0 950 Alternative 400.000 3375 02013 1 950 Alternative 400,000 35 1 0 Alternatives 400.000 35 02917 0.25 1048 Alternative 400.000 3.5 0.2917 0364 1727 You are going to make the decision about which mortege to consider by calculating the NPV of switching from the no-fee morter Ibenchmarks to each of the top six mortgage listed (sorted by their coupon) To calculate NPV of this decision, calculate the difference in payments today, by subtracting the alternative mortgage payments from the no-fee mortgage payments and calculating NPV. Assume that you will be living in the house for the next 30 years for certain and you will never repay the mortgage early. Which mortgage should you undertake? 1-(1) In the basic information of the table, Monthly Rate 19 was calculated by dividing Rate(%) by 12. Why? (5 points) 1-(2) Find the monthly payment of the mortgage points). You can apply the formula for PV of Annuity (Chapter 4). Use the monthly rate as discount rate. 1-(3) Find the difference between Benchmark and Alternative with respect to Upfront Payment and Monthly Payment of Mortgage (13 points for comple, if an alternative has $100 upfront fee and Ox mortgage points, the difference of upfront payment for the alternative will be -100. Be careful about the unit of Monthly Rate and points. Read the footnote of the case about how to calculate upfront cost (page 2631 1-(4) Find Net Present Value (NPV) of Alternative products based on 1-C3) (10 points). You can apply the formula for PV of Annuity Chapter 4. Use the cost of capital as discount rate. 1-(5) Construct NPV profile for the best NPV mortgage product and show IRR (10 points)