Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need anwser for both of these thank you The SuperOrange Corporation (SOC) plans to invest in a new orange farm. The expected cash flows are

need anwser for both of these thank you

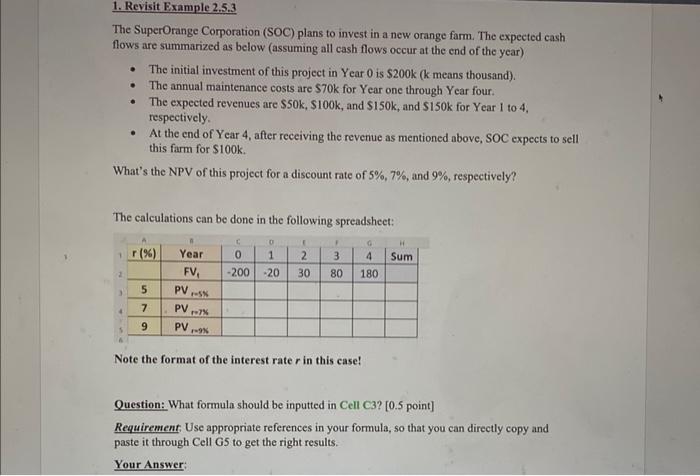

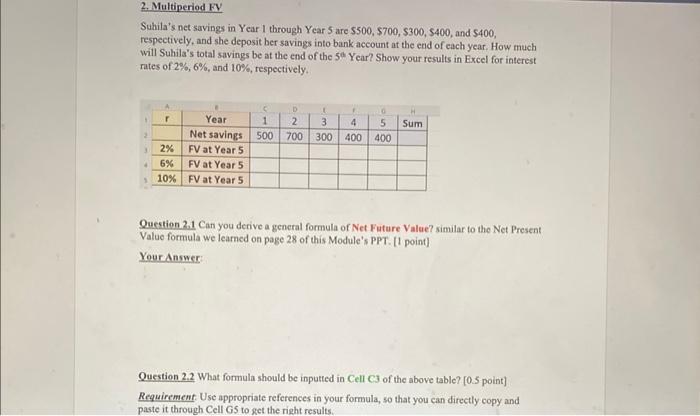

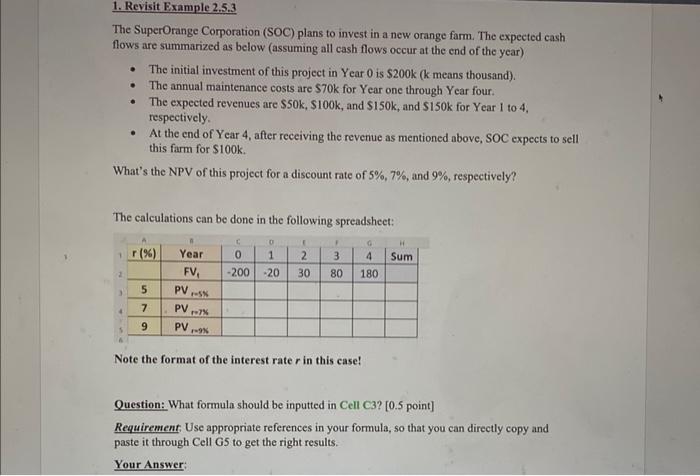

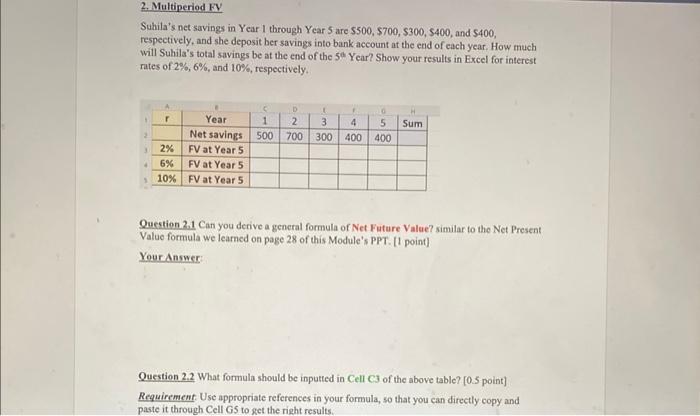

The SuperOrange Corporation (SOC) plans to invest in a new orange farm. The expected cash flows are summarized as below (assuming all cash flows occur at the end of the year) - The initial investment of this project in Year 0 is $200k ( k means thousand). - The annual maintenance costs are $70k for Year one through Year four. - The expected revenues are $50k,$100k, and $150k, and $150k for Y ear 1 to 4 , respectively. - At the end of Year 4, after receiving the revenue as mentioned above, SOC expects to sell this farm for $100k. What's the NPV of this project for a discount rate of 5%,7%, and 9%, respectively? The calculations can be done in the following spreadsheet: Note the format of the interest rate r in this case! Question: What formula should be inputted in Cell C3? [0.5 point] Requirement: Use appropriate references in your formula, so that you can directly copy and paste it through Cell G5 to get the right results. Your Answer: Suhila's net savings in Year I through Year 5 are $500,$700,$300,$400, and $400, respectively, and she deposit ber savings into bank account at the end of each year. How much will Suhila's total savings be at the end of the 5th Year? Show your results in Excel for interest rates of 2%,6%, and 10%, respectively. Question 2.1 Can you derive a general formula of Net Future Value? similar to the Net Present Value formula we learned on page 28 of this Module's PPT. (1 point) Youranswer: Question 2.2 What formula should be inputted in Cell C3 of the above table? [0.5 point] Requirement. Use appropriate references in your formula, so that you can directly copy and paste it through Cell GS to get the right results

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started