Answered step by step

Verified Expert Solution

Question

1 Approved Answer

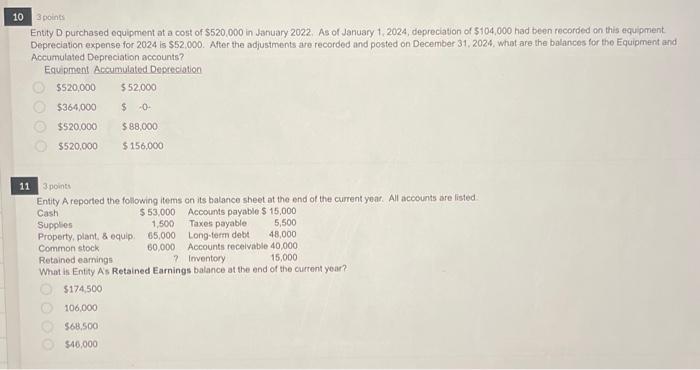

need asap please please :) Entity D purchased equipment at a cont of $520,000 in January 2022. As of January 1,2024 , depreciation of $104,000

need asap please please :)

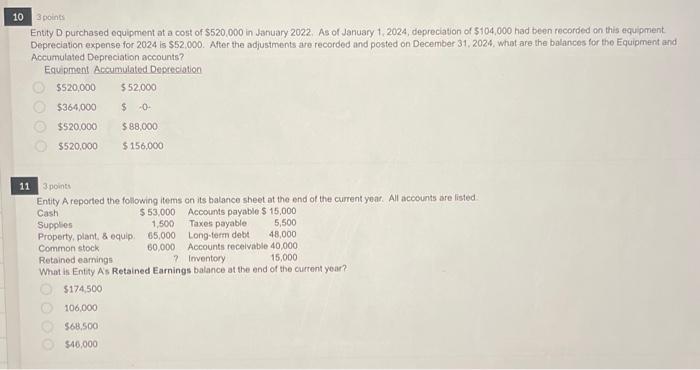

Entity D purchased equipment at a cont of $520,000 in January 2022. As of January 1,2024 , depreciation of $104,000 had been recorded on this equipment. Depreciation-expense for 2024 is $52,000. After the adjustments are recorded and posted on December 31 , 2024, what-are the balances for the Equipment and Accumulated Depreciation accounts? Equipment Aczumulated Depreciation $520,000$364,000$520,000$520,000$52,000$10$88,000$156,000 11 3points Entity A reported the following items on its balance sheet at the end of the current yoar. Alt accounts are listed What is Entity As Retained Earnings barance at wne eno on wo curtent year? $174,500106,000$68,500$46,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started