need asap pleaseee

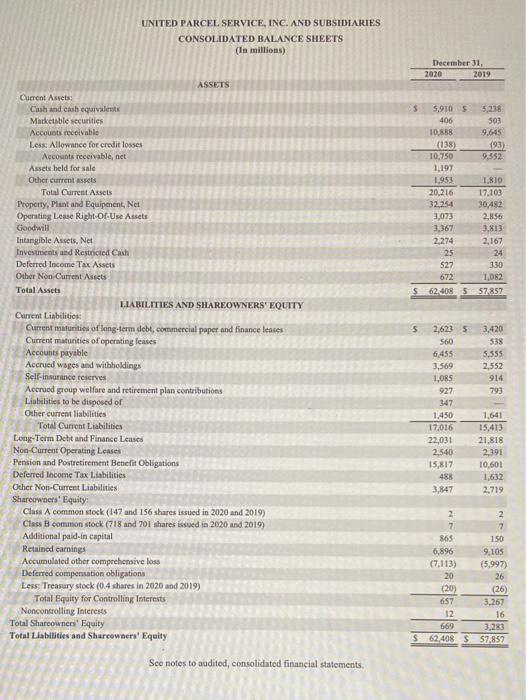

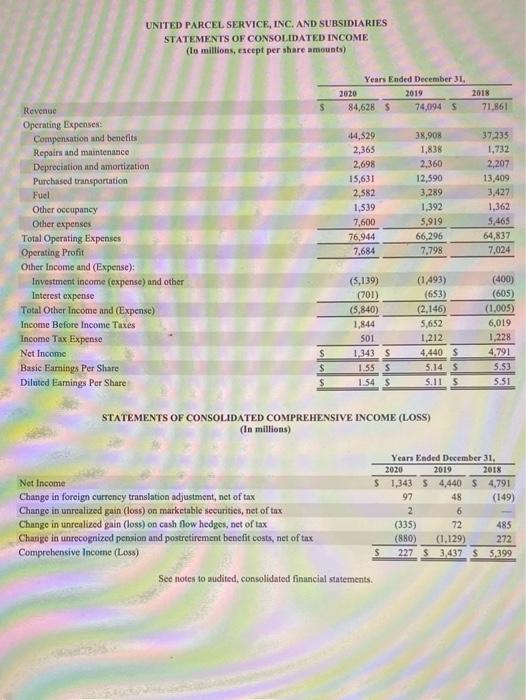

Using the following financial statements, calculate the Accounts Receivable Turnover for the 2020 fucal year ended December 31, 2020 Financial statements for United Parcel Services Inc 7.76 times O 7.87 times O 8.34 times 6.89 times UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions) December 31, 2020 2019 ASSETS Current Assets Cash and cash equivalent Marketsble securities $ 59105 5.238 503 406 Accounts receivable 9.645 Less Allowance for credit losses Accounts receivable, net 10,838 (138) 10,750 1,197 193) 9,552 Assets held for sale 1.953 1.810 20.216 32,254 17.103 30,452 2,856 3,813 3,073 3,367 2,274 2,167 25 24 527 330 672 1.082 62.408 5 57.857 5 2,623 5 3.420 560 538 5.555 2,552 6,455 3,569 1.ORS 927 914 793 347 Other current assets Total Current Assets Property, Plant and Equipment, Net Operating Lease Right-Of-Use Assets Goodwill Intangible Assets, Net Investments and Restricted Cash Deferred Income Tax Assets Other Non Current Assets Total Assets LIABILITIES AND SHAREOWNERS' EQUITY Current Liabilities: Current maturities of long-term debt, commercial paper and finance rates Current maturities of operating lesses Accounts payable Accrued wages and withholdings Self-insurance serves Accrued group welfare and retirement plan contributions Liabilities to be disposed of Other current liabilities Total Current Liabilities Long-Term Debt and Finance Leases Non-Current Operating Leases Pension and Postretirement Benefit Obligations Deferred Income Tax Liabilities Other Non-Current Liabilities Sharewers' Equity Class A common stock (147 and 156 shares issued in 2020 and 2019) Class B common stock (718 and 701 shares issued in 2020 and 2019) Additional pald.in capital Retained carnings Accumulated other comprehensive loss Deferred compensation obligations Less Treasury stock (0.4 shares in 2020 and 2019) Total Equity for Controlling Interests Noncontrolling Interests Total Sharcowners' Equity Total Liabilities and Sharcowners' Equity 1.450 1.641 15,413 21,818 17.016 22,031 2.540 15,817 488 2391 10,601 1,632 2,719 3,847 2 2. 7 7 865 150 6.896 (7.113) 20 9,105 (5.997) 26 (20) (26) 657 3.267 12 16 669 3,263 62.408 $ 57,857 $ See notes to audited, consolidated financial statements UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES STATEMENTS OF CONSOLIDATED INCOME (lo millions, except per share amounts) Years Ended December 31 2020 2019 2018 84,6285 74,094 5 71,861 38,908 Revenue Operating Expenses Compensation and benetits Repairs and maintenance Depreciation and amortization Purchased transportation Fuel 44,529 2,365 37.235 1,732 1,838 2,698 2,207 13.409 3,427 2.360 12,590 3,289 1.392 5,919 66,296 7.798 15,631 2,582 1,539 7,600 76,944 7,684 1,362 5,465 64,837 7,024 Other occupancy Other expenses Total Operating Expenses Operating Profit Other Income and (Expense): Investment income (expense) and other Interest expense Total Other Income and (Expense) (400) (605) (5,139) (701) (5,840) 1,844 501 Income Before Income Taxes (1,493) (653) (2,146) 5,652 1,212 4,440 $ 5.14 $ 5.11 5 Income Tax Expense Net Income (1.005) 6,019 1,228 4.791 5.53 $ 1,343 S $ 1.55S Basic Earnings Per Share Diluted Earnings Per Share 1.54 $ 5.51 STATEMENTS OF CONSOLIDATED COMPREHENSIVE INCOME (LOSS) (In millions) Net Income Change in foreign currency translation adjustment, net of tax Change in unrealized gain (loss) on marketuble securities, net of tax Change in unrealized gain (loss) on cash flow hedges, net of tax Change in unrecognized pension and postretirement benefit costs, net of tax Comprehensive Income (Loss) Year Ended December 31, 2020 2019 2018 $ 1,343 S 4.440 S4,791 97 48 (149) 2 6 (335) 72 485 (880) (1.129) 272 $ 227 S 3.437 $5,399 See notes to audited, consolidated financial statements