Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need asap! Thank you i have 1 hour Instruction: Type your answers in the space provided. Be sure to provide supporting calculations, as needed, to

need asap! Thank you

i have 1 hour

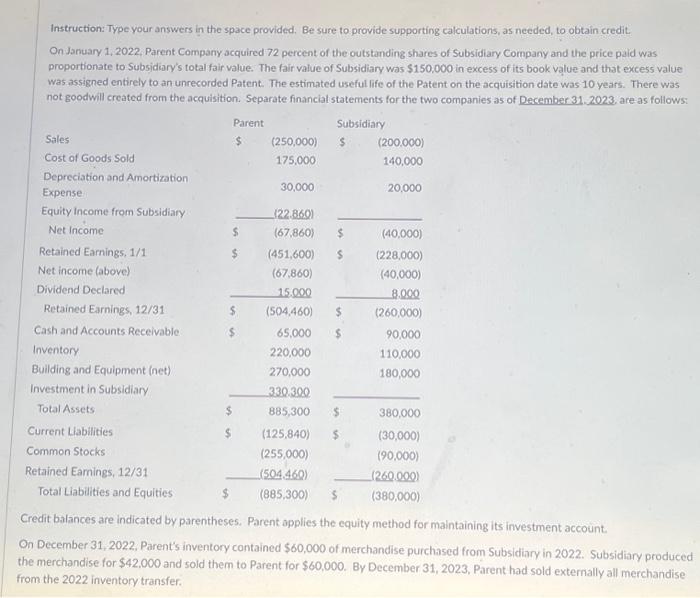

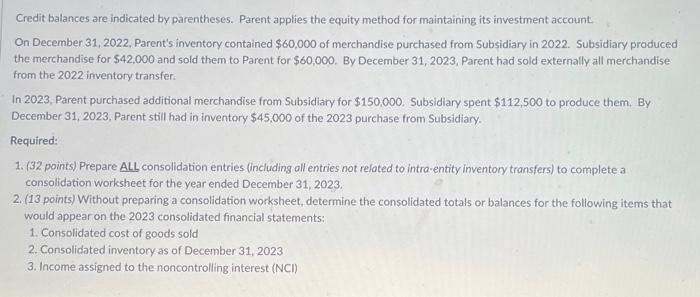

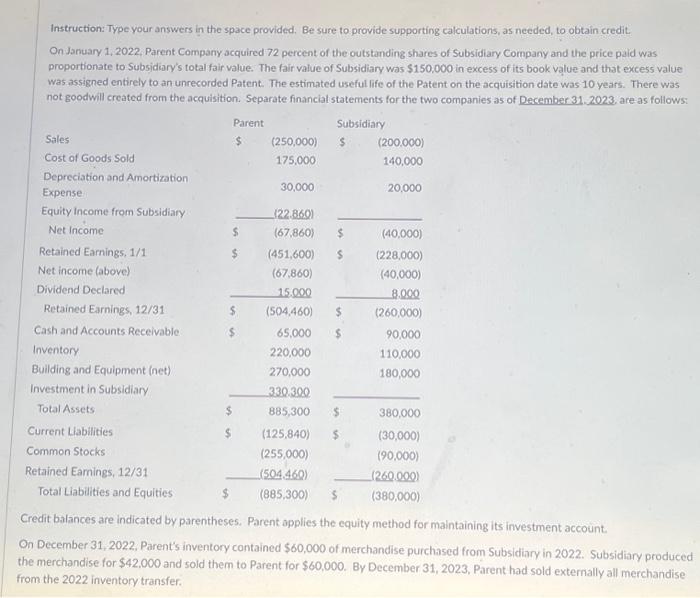

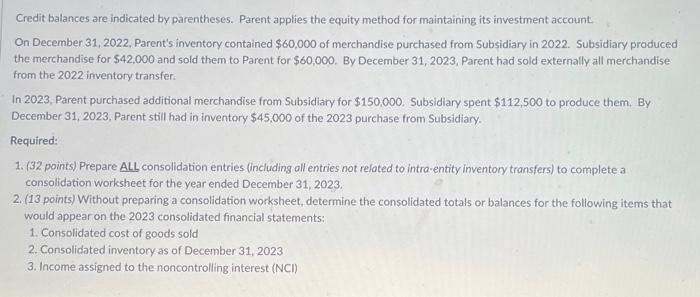

Instruction: Type your answers in the space provided. Be sure to provide supporting calculations, as needed, to obtain credit. OnJanuary 1,2022, Parent Company acquired 72 percent of the outstanding shares of Subsidiary Company and the price paid was proportionate to Subsidiary's total fair value. The fair value of Subsidiary was $150,000 in excess of its book value and that excess value was assigned entirely to an unrecorded Patent. The estimated useful life of the Patent on the acquisition date was 10 years. There was Credit balances are indicated by parentheses. Parent opplies the equity method for maintaining its investment account On December 31, 2022. Parent's inventory contained $60,000 of merchandise purchased from Subsidiary in 2022. Subsidiary produced the merchandise for $42,000 and soid them to Parent for $60,000. By December 31,2023 , Parent had sold extemally all merchandise from the 2022 inventory transfer. Credit balances are indicated by parentheses. Parent applies the equity method for maintaining its investment account. On December 31, 2022, Parent's inventory contained $60,000 of merchandise purchased from Subsidiary in 2022. Subsidiary produced the merchandise for $42,000 and sold them to Parent for $60,000. By December 31,2023 , Parent had sold externally all merchandise from the 2022 inventory transfer. In 2023, Parent purchased additional merchandise from Subsidiary for $150,000. Subsidiary spent $112,500 to produce them. By December 31, 2023, Parent still had in inventory $45,000 of the 2023 purchase from Subsidiary. Required: 1. (32 points) Prepare ALL consolidation entries (including all entries not related to intra-entity inventory transfers) to complete a consolidation worksheet for the year ended December 31, 2023. 2. (13 points) Without preparing a consolidation worksheet, determine the consolidated totals or balances for the following items that would appear on the 2023 consolidated financial statements: 1. Consolidated cost of goods sold 2. Consolidated inventory as of December 31, 2023 3. Income assigned to the noncontrolling interest (NCI) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started