Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need ASAP. Thank you, I'll surely upvote. 4. A VAT registered business has the following transactions: Sale of goods to private entities, net 12% VAT

Need ASAP. Thank you, I'll surely upvote.

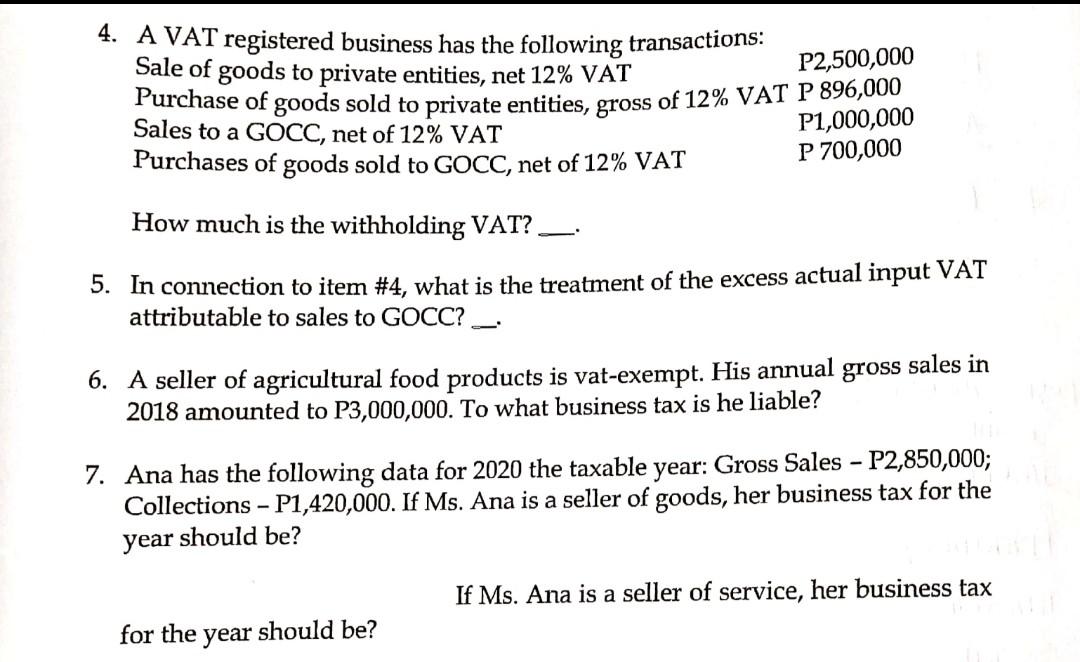

4. A VAT registered business has the following transactions: Sale of goods to private entities, net 12% VAT Purchase of goods sold to private entities, gross of 12% VAT P 896,000 Sales to a GOCC, net of 12% VAT P2,500,000 P1,000,000 Purchases of goods sold to GOCC, net of 12% VAT P 700,000 How much is the withholding VAT? 5. In connection to item #4, what is the treatment of the excess actual input VAT attributable to sales to GOCC? ____. 6. A seller of agricultural food products is vat-exempt. His annual gross sales in 2018 amounted to P3,000,000. To what business tax is he liable? 7. Ana has the following data for 2020 the taxable year: Gross Sales - P2,850,000; Collections - P1,420,000. If Ms. Ana is a seller of goods, her business tax for the year should be? If Ms. Ana is a seller of service, her business tax for the year should beStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started