NEED ASAP THANK YOU. PLEASE SHOW ALL WORK

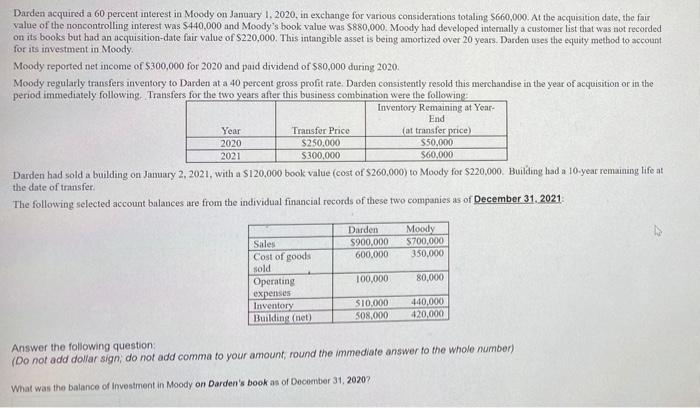

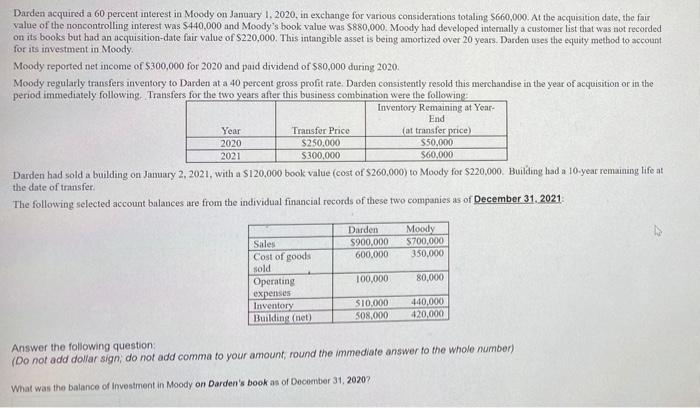

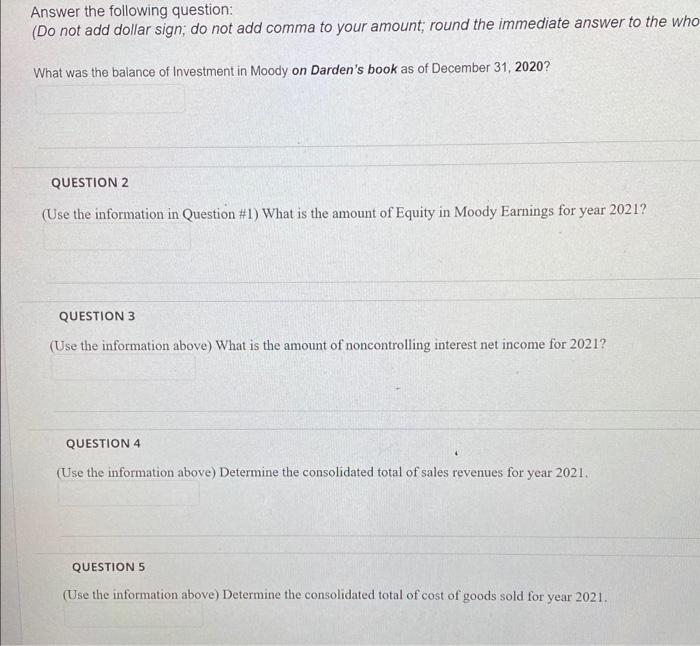

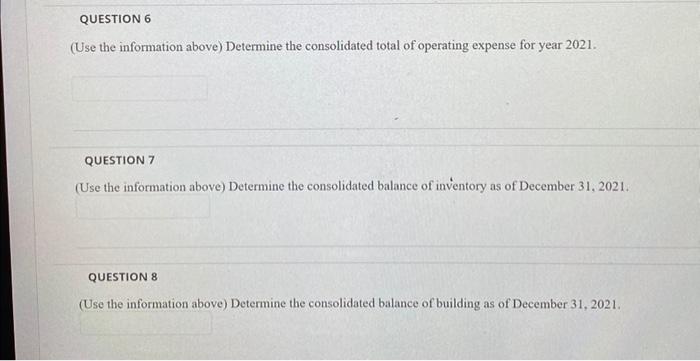

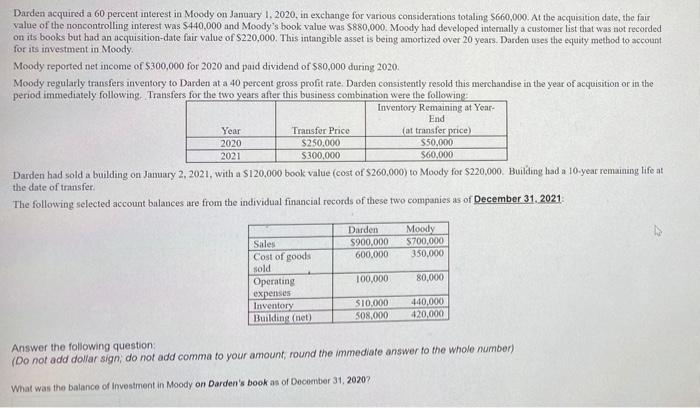

Darden acquired a 60 percent interest in Moody on January 1, 2020, in exchange for various considerations totaling 5660,000. At the acquisition date, the fair value of the noncontrolling interest was S440,000 and Moody's book value was $880,000. Moody had developed intemally a customer list that was not recorded on its books but had an acquisition date fair value of S220,000. This intangible asset is being amortized over 20 years. Darden uses the equity method to account for its investment in Moody Moody reported net income of $300,000 for 2020 and paid dividend of $80,000 during 2020 Moody regularly transfers inventory to Darden at a 40 percent gross profit rate. Darden consistently resold this merchandise in the year of acquisition or in the period immediately following. Transfers for the two years after this business combination were the following: Inventory Remaining at Year- End Year Transfer Price (at transfer price) 2020 $250.000 550.000 2021 $300,000 $60,000 Darden had sold a building on January 2, 2021, with a $120,000 book value (cost of $260,000) to Moody for $220,000. Building had a 10-year remaining life at the date of transfer The following selected account balances are from the individual financial records of these two companies as of December 31, 2021 Darden $900,000 600,000 Moody $700,000 350,000 Sales Cost of goods sold Operating expenses Inventory Building (net) 100,000 80,000 $10,000 508.000 440,000 420,000 Answer the following question (Do not add dollar sign, do not add comma to your amount, round the immediate answer to the whole number) What was the balance of Investment in Moody on Darden's book as of December 31, 2020? Answer the following question: (Do not add dollar sign; do not add comma to your amount; round the immediate answer to the who What was the balance of Investment in Moody on Darden's book as of December 31, 2020? QUESTION 2 (Use the information in Question #1) What is the amount of Equity in Moody Earnings for year 2021? QUESTION 3 (Use the information above) What is the amount of noncontrolling interest net income for 2021? QUESTION 4 (Use the information above) Determine the consolidated total of sales revenues for year 2021. QUESTION 5 (Use the information above) Determine the consolidated total of cost of goods sold for year 2021. QUESTION 6 (Use the information above) Determine the consolidated total of operating expense for year 2021. QUESTION 7 (Use the information above) Determine the consolidated balance of inventory as of December 31, 2021. QUESTIONS (Use the information above) Determine the consolidated balance of building as of December 31, 2021