Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need asap thank you! The Umbrella company is planning to purchase one of two substances. Management wants a 20% return on all investments. Use the

need asap thank you!

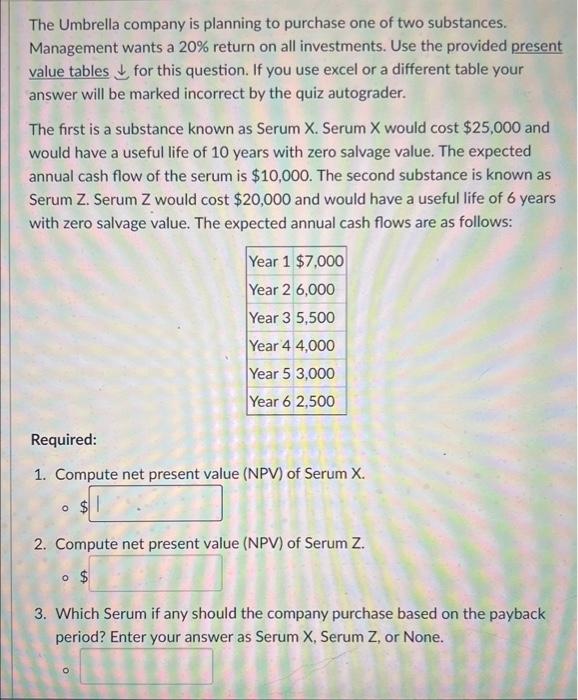

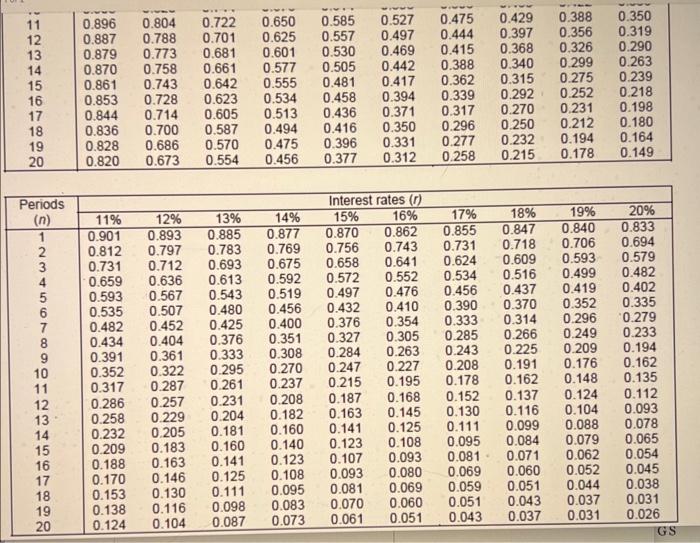

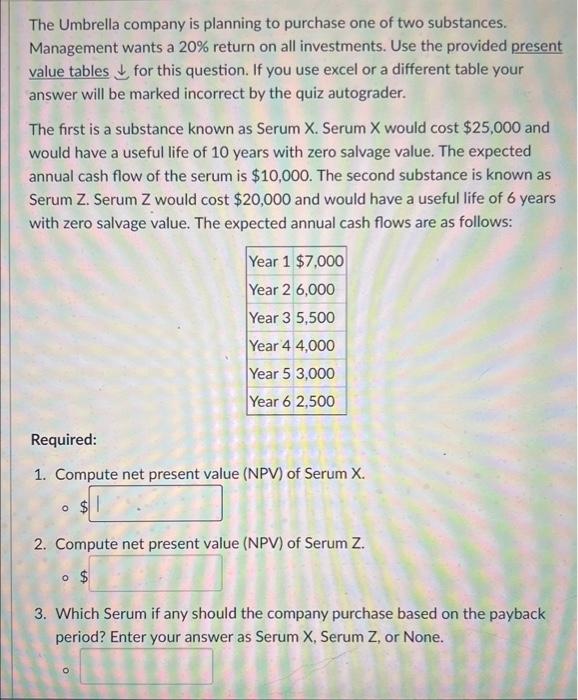

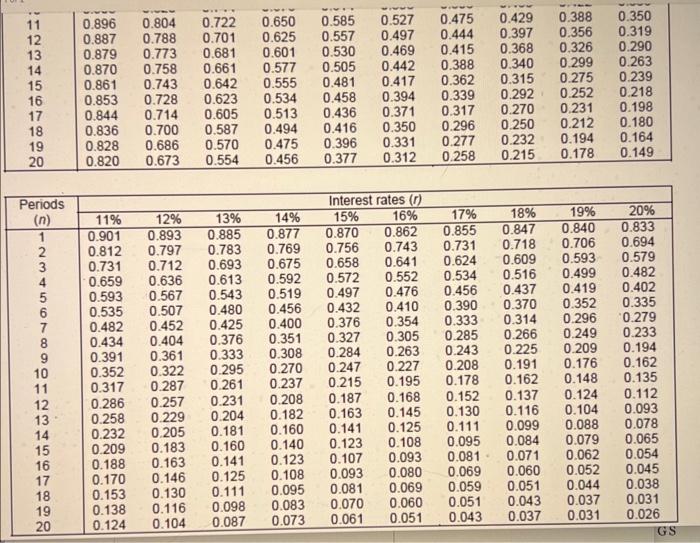

The Umbrella company is planning to purchase one of two substances. Management wants a 20% return on all investments. Use the provided present value tables for this question. If you use excel or a different table your answer will be marked incorrect by the quiz autograder. The first is a substance known as Serum X. Serum X would cost $25,000 and would have a useful life of 10 years with zero salvage value. The expected annual cash flow of the serum is $10,000. The second substance is known as Serum Z. Serum Z would cost $20,000 and would have a useful life of 6 years with zero salvage value. The expected annual cash flows are as follows: Required: 1. Compute net present value (NPV) of Serum X. 0$ 2. Compute net present value (NPV) of Serum Z. 3. Which Serum if any should the company purchase based on the payback period? Enter your answer as Serum X, Serum Z, or None. \begin{tabular}{|l|llllllllll} 11 & 0.896 & 0.804 & 0.722 & 0.650 & 0.585 & 0.527 & 0.475 & 0.429 & 0.388 & 0.350 \\ 12 & 0.887 & 0.788 & 0.701 & 0.625 & 0.557 & 0.497 & 0.444 & 0.397 & 0.356 & 0.319 \\ 13 & 0.879 & 0.773 & 0.681 & 0.601 & 0.530 & 0.469 & 0.415 & 0.368 & 0.326 & 0.290 \\ 14 & 0.870 & 0.758 & 0.661 & 0.577 & 0.505 & 0.442 & 0.388 & 0.340 & 0.299 & 0.263 \\ 15 & 0.861 & 0.743 & 0.642 & 0.555 & 0.481 & 0.417 & 0.362 & 0.315 & 0.275 & 0.239 \\ 16 & 0.853 & 0.728 & 0.623 & 0.534 & 0.458 & 0.394 & 0.339 & 0.292 & 0.252 & 0.218 \\ 17 & 0.844 & 0.714 & 0.605 & 0.513 & 0.436 & 0.371 & 0.317 & 0.270 & 0.231 & 0.198 \\ 18 & 0.836 & 0.700 & 0.587 & 0.494 & 0.416 & 0.350 & 0.296 & 0.250 & 0.212 & 0.180 \\ 19 & 0.828 & 0.686 & 0.570 & 0.475 & 0.396 & 0.331 & 0.277 & 0.232 & 0.194 & 0.164 \\ 20 & 0.820 & 0.673 & 0.554 & 0.456 & 0.377 & 0.312 & 0.258 & 0.215 & 0.178 & 0.149 \\ \hline \end{tabular} \begin{tabular}{|c|rrrrrrrrrr|} \hline Periods & \multicolumn{10}{|c|}{ Interest rates (r)} \\ \cline { 2 - 11 }(n) & 11% & 12% & 13% & 14% & 15% & 16% & 17% & 18% & 19% & 20% \\ \hline 1 & 0.901 & 0.893 & 0.885 & 0.877 & 0.870 & 0.862 & 0.855 & 0.847 & 0.840 & 0.833 \\ 2 & 0.812 & 0.797 & 0.783 & 0.769 & 0.756 & 0.743 & 0.731 & 0.718 & 0.706 & 0.694 \\ 3 & 0.731 & 0.712 & 0.693 & 0.675 & 0.658 & 0.641 & 0.624 & 0.609 & 0.593 & 0.579 \\ 4 & 0.659 & 0.636 & 0.613 & 0.592 & 0.572 & 0.552 & 0.534 & 0.516 & 0.499 & 0.482 \\ 5 & 0.593 & 0.567 & 0.543 & 0.519 & 0.497 & 0.476 & 0.456 & 0.437 & 0.419 & 0.402 \\ 6 & 0.535 & 0.507 & 0.480 & 0.456 & 0.432 & 0.410 & 0.390 & 0.370 & 0.352 & 0.335 \\ 7 & 0.482 & 0.452 & 0.425 & 0.400 & 0.376 & 0.354 & 0.333 & 0.314 & 0.296 & 0.279 \\ 8 & 0.434 & 0.404 & 0.376 & 0.351 & 0.327 & 0.305 & 0.285 & 0.266 & 0.249 & 0.233 \\ 9 & 0.391 & 0.361 & 0.333 & 0.308 & 0.284 & 0.263 & 0.243 & 0.225 & 0.209 & 0.194 \\ 10 & 0.352 & 0.322 & 0.295 & 0.270 & 0.247 & 0.227 & 0.208 & 0.191 & 0.176 & 0.162 \\ 11 & 0.317 & 0.287 & 0.261 & 0.237 & 0.215 & 0.195 & 0.178 & 0.162 & 0.148 & 0.135 \\ 12 & 0.286 & 0.257 & 0.231 & 0.208 & 0.187 & 0.168 & 0.152 & 0.137 & 0.124 & 0.112 \\ 13 & 0.258 & 0.229 & 0.204 & 0.182 & 0.163 & 0.145 & 0.130 & 0.116 & 0.104 & 0.093 \\ 14 & 0.232 & 0.205 & 0.181 & 0.160 & 0.141 & 0.125 & 0.111 & 0.099 & 0.088 & 0.078 \\ 15 & 0.209 & 0.183 & 0.160 & 0.140 & 0.123 & 0.108 & 0.095 & 0.084 & 0.079 & 0.065 \\ 16 & 0.188 & 0.163 & 0.141 & 0.123 & 0.107 & 0.093 & 0.081 & 0.071 & 0.062 & 0.054 \\ 17 & 0.170 & 0.146 & 0.125 & 0.108 & 0.093 & 0.080 & 0.069 & 0.060 & 0.052 & 0.045 \\ 18 & 0.153 & 0.130 & 0.111 & 0.095 & 0.081 & 0.069 & 0.059 & 0.051 & 0.044 & 0.038 \\ 19 & 0.138 & 0.116 & 0.098 & 0.083 & 0.070 & 0.060 & 0.051 & 0.043 & 0.037 & 0.031 \\ 20 & 0.124 & 0.104 & 0.087 & 0.073 & 0.061 & 0.051 & 0.043 & 0.037 & 0.031 & 0.026 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started