Answered step by step

Verified Expert Solution

Question

1 Approved Answer

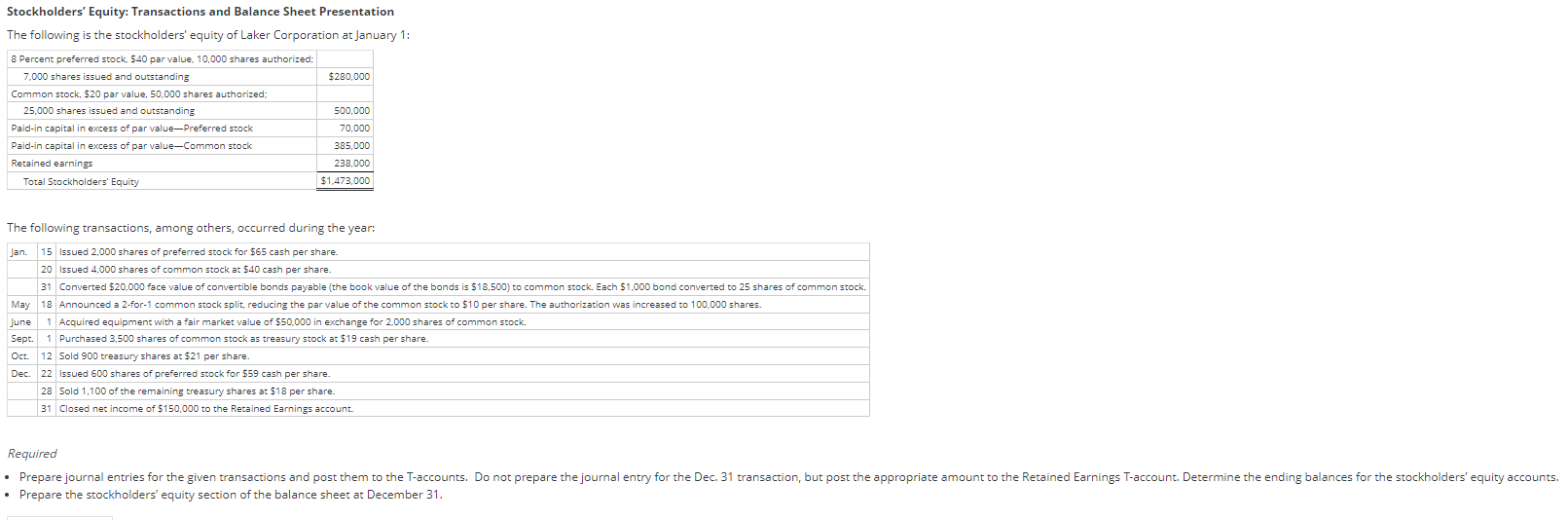

Need assistance completing the above sections using the stockholders' equity of Laker Corporation at January 1. All of the information that was provided is in

Need assistance completing the above sections using the stockholders' equity of Laker Corporation at January 1.

All of the information that was provided is in the first image. The question is asking for the journal entries, T-accounts, and Stockholder's Equity table to be filled out using the above information.

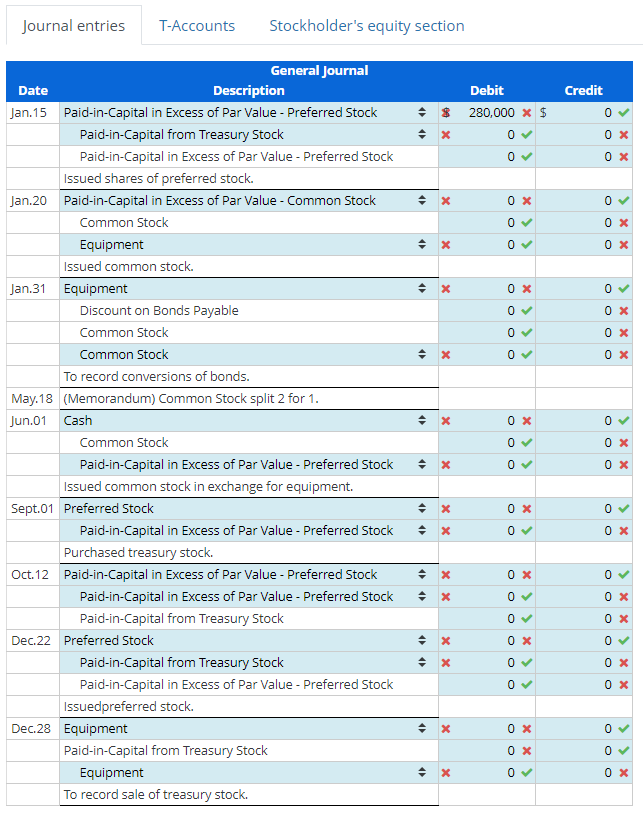

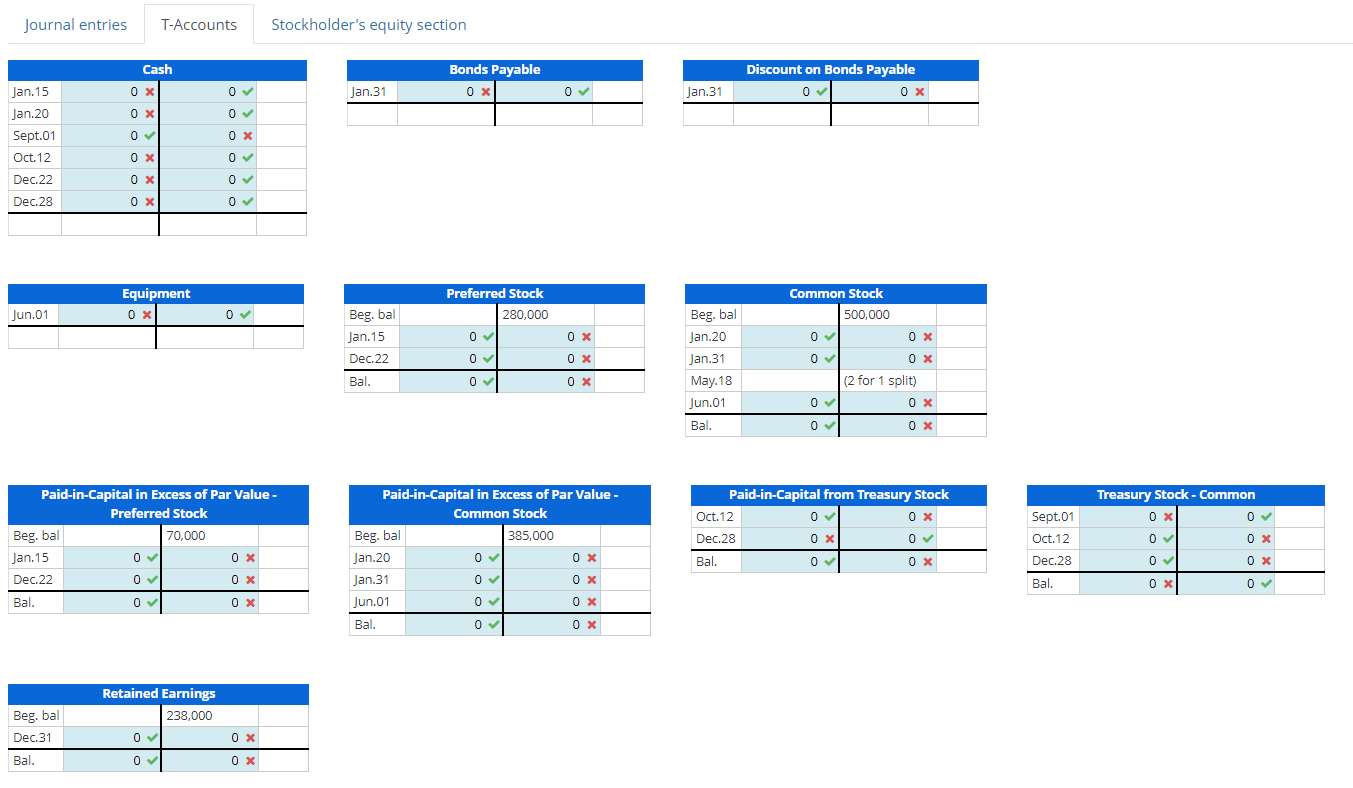

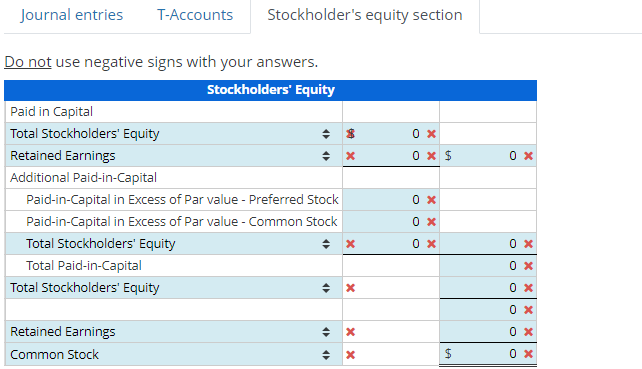

Stockholders' Equity: Transactions and Balance Sheet Presentation The following is the stockholders' equity of Laker Corporation at January 1: The following transactions, among others, occurred during the year: \begin{tabular}{|l|r|l|} \hline Jan. & 15 & Issued 2,000 shares of preferred stock for $65 cash per share. \\ \hline & 20 & lssued 4,000 shares of common stock at $40 cash per share. \\ \hline & 31 & Converted $20,000 face value of convertible bonds payable (the book value of the bonds is $18,500 ) to common stock. Each $1,000 bond converted to 25 shares of common stock. \\ \hline May & 18 & Announced a 2 -for-1 common stock split, reducing the par value of the common stock to $10 per share. The authorization was increased to 100,000 shares. \\ \hline June & 1 & Acquired equipment with a fair market value of $50,000 in exchange for 2,000 shares of common stock. \\ \hline Sept. & 1 & Purchased 3,500 shares of common stock as treasury stock at $19 cash per share. \\ \hline Oct. & 12 & Sold 900 treasury shares at $21 per share. \\ \hline Dec. & 22 & Issued 600 shares of preferred stock for $59 cash per share. \\ \hline & 28 & Sold 1,100 of the remaining treasury shares at $18 per share. \\ \hline & 31 & Closed net income of $150,000 to the Retained Earnings account. \\ \hline \end{tabular} Journal entries T-Accounts Stockholder's equity section Stockholder's equity section Do not use negative signs with your answers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started