Question

Need assistance Image transcription text Mastery Problem: Time Value of Money Time value of money Due to both interest earnings and the fact that money

Need assistance

Image transcription text

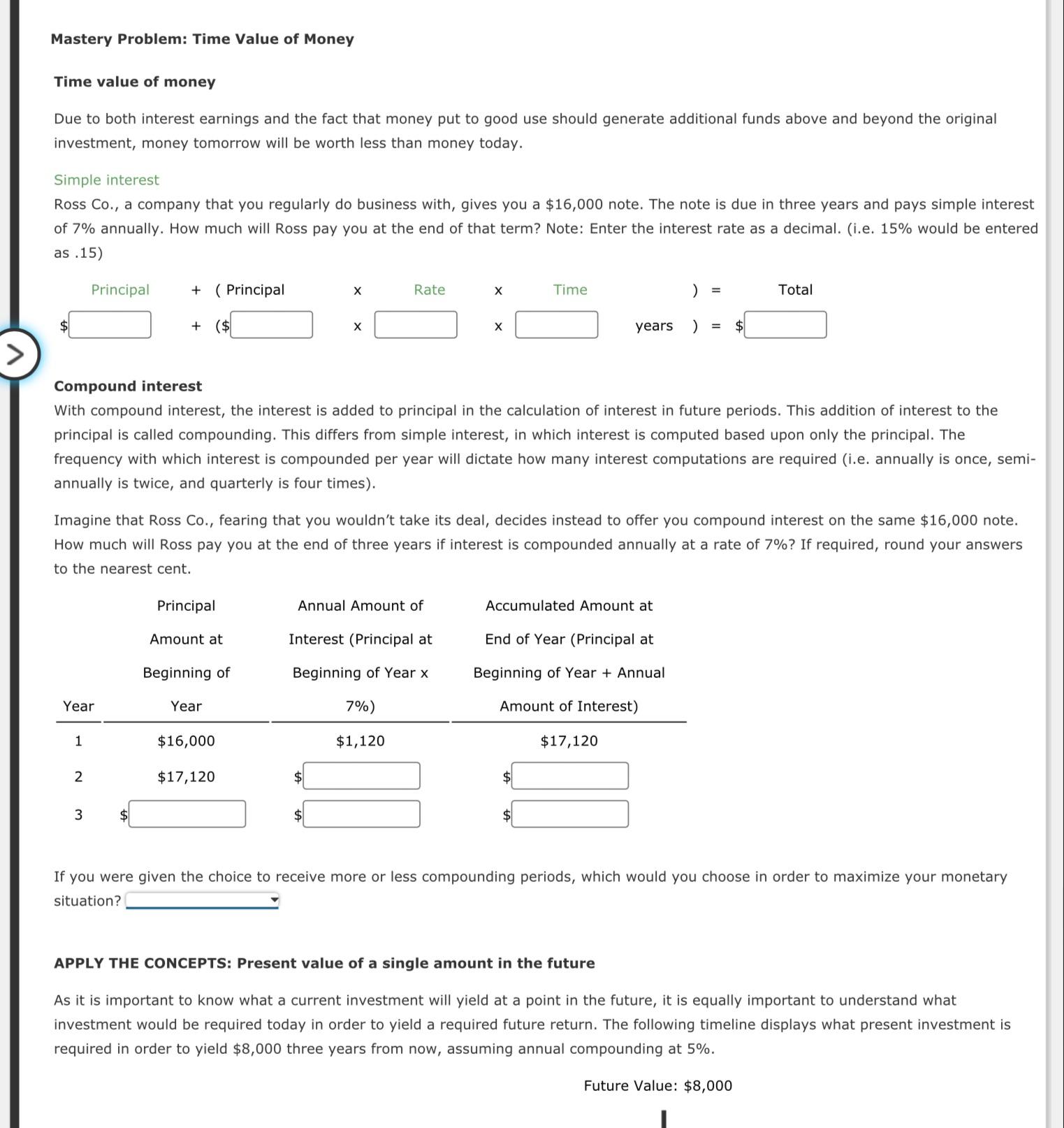

Mastery Problem: Time Value of Money Time value of money Due to both interest earnings and the fact that money put to good use should generate additional funds above and beyond the original investment, money tomorrow will be worth less than money today. Simple interest Ross Co., a company that you regularly do business with, gives you a $16,000 note. The note is due in three years and pays simple interest of 7% annually. How much will Ross pay you at the end of that term? Note: Enter the interest rate as a decimal. (i.e. 15% would be entered as .15) Principal + ( Principal X Rate X Time ) Compound interest With compound interest, the interest is added to principal in the calculation of interest in future periods. This addition of interest to the Total { ] I principal is called compounding. This differs from simple interest, in which interest is computed based upon only the principal. The frequency with which interest is compounded per year will dictate how many interest computations are required (i.e. annually is once, semi- annually is twice, and quarterly is four times). Imagine that Ross Co., fearing that you wouldn't take its deal, decides instead to offer you compound interest on the same $16,000 note. How much will Ross pay you at the end of three years if interest is compounded annually at a rate of 7%? If required, round your answers to the nearest cent. Principal Annual Amount of Accumulated Amount at Amount at Interest (Principal at End of Year (Principal at Beginning of Beginning of Year x Beginning of Year + Annual Year Year 7%) Amount of Interest) 1 $16,000 $1,120 $17,120 3 |9 ] o ] If you were given the choice to receive more or less compounding periods, which would you choose in order to maximize your monetary situation? v APPLY THE CONCEPTS: Present value of a single amount in the future As it is important to know what a current investment will yield at a point in the future, it is equally important to understand what investment would be required today in order to yield a required future return. The following timeline displays what present investment is required in order to yield $8,000 three years from now, assuming annual compounding at 5%. Future Value: $8,000

Mastery Problem: Time Value of Money Time value of money Due to both interest earnings and the fact that money put to good use should generate additional funds above and beyond the original investment, money tomorrow will be worth less than money today. Simple interest Ross Co., a company that you regularly do business with, gives you a $16,000 note. The note is due in three years and pays simple interest of 7% annually. How much will Ross pay you at the end of that term? Note: Enter the interest rate as a decimal. (i.e. 15% would be entered as .15) Principal + (Principal X Rate X Time = Total $ + ($ X years ) = $ Compound interest With compound interest, the interest is added to principal in the calculation of interest in future periods. This addition of interest to the principal is called compounding. This differs from simple interest, in which interest is computed based upon only the principal. The frequency with which interest is compounded per year will dictate how many interest computations are required (i.e. annually is once, semi- annually is twice, and quarterly is four times). Imagine that Ross Co., fearing that you wouldn't take its deal, decides instead to offer you compound interest on the same $16,000 note. How much will Ross pay you at the end of three years if interest is compounded annually at a rate of 7%? If required, round your answers to the nearest cent. Principal Annual Amount of Accumulated Amount at Amount at Beginning of Interest (Principal at Beginning of Year x Year Year 1 $16,000 7%) $1,120 End of Year (Principal at Beginning of Year + Annual Amount of Interest) $17,120 2 $17,120 $ 3 $ $ If you were given the choice to receive more or less compounding periods, which would you choose in order to maximize your monetary situation? APPLY THE CONCEPTS: Present value of a single amount in the future As it is important to know what a current investment will yield at a point in the future, it is equally important to understand what investment would be required today in order to yield a required future return. The following timeline displays what present investment is required in order to yield $8,000 three years from now, assuming annual compounding at 5%. Future Value: $8,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started