Need assistance with question 1,2 and 4,5 and 6

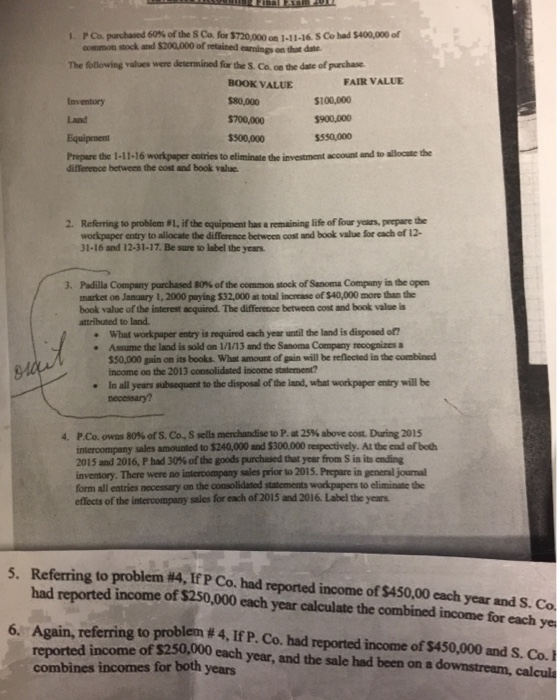

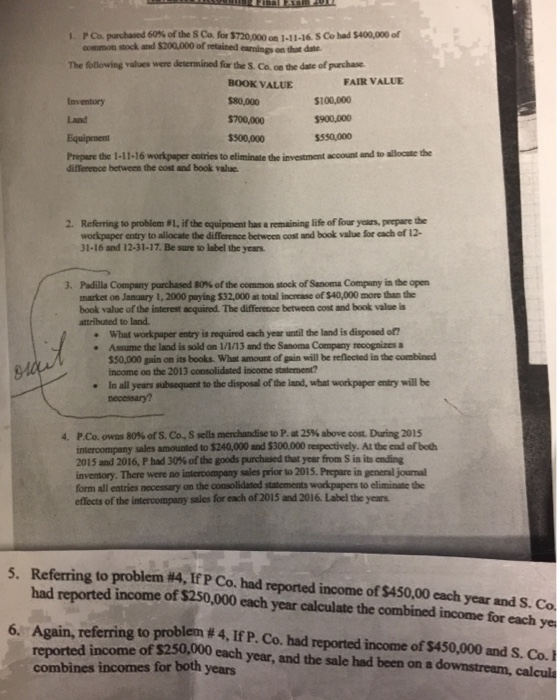

PCo.purchased 60% of the sca fr S720,000) on 1-11-16 SCohad S400,000 of onnon sack mi00000 of retained eanip onth dm 1. The following values were determined for the S. Co. on the date of purchase. BOOK VALUE FAIR VALUE $100,000 5900,000 5550,000 ,000 Inventory Land Equipment Prepare the 1-11-16 workpaper entries to eliminate the investment account and to allocate the $700,000 difference between the cost and book valuc. Referring to problem #L. ifthe ogupoent bas a remaining life offour yan, prepare the workpaper entry to alliocate the difference between oost and book value for each of 12- 31-16 and 12-31-17. Be sure to label the years. 2. Padilla Coapany purchased 80% ofthe com mon stock ofSanonia Compay iatheopen market on January 1,2000 Prying S32.000 at ttal increase of$40,000 more the book value of the interest acquired. The difference between cost and book value is 3. attributed to land What wmkpaper is required each year until the land isdiposed on . Assume the land is sold on l/1/13 and the Sanoma Company rocognizes a 50,000 gain on its books. What amount of gain will be reflected in the combined income on the 2013 consolidated income statement? all years subsequent to the disposal of the land, what workpaper entry will be necessary? . In P.Co. owns 80% ors, Co. S sells merchandise to P. at 25% above cost During 2015 intercompany sales amounted to $240,000 and $300,000 respectively. At the end of both 2015and 2016, P had 30% ofthe pods purchased that year from S in ita ig inventory. There were no intercompany sales prior to 2015. Prepare in general journal form all eatries necessary on the consolidated statements workpapers to eliminate the effects of the intercompany sales for each of 2015 and 2016. Label the years 4, 5. Referring to lem #4, If P Co. had reported income of$450,00 each year and S. Co. had reported income of $250,000 each year calculate the combined income for each ye 6. Again, referring to problen #4,If P.Co had reported income of$450,000 and SCo.1 reported income of $250,000 each year, and the sale had been on a downstream, calcula combines incomes for both years PCo.purchased 60% of the sca fr S720,000) on 1-11-16 SCohad S400,000 of onnon sack mi00000 of retained eanip onth dm 1. The following values were determined for the S. Co. on the date of purchase. BOOK VALUE FAIR VALUE $100,000 5900,000 5550,000 ,000 Inventory Land Equipment Prepare the 1-11-16 workpaper entries to eliminate the investment account and to allocate the $700,000 difference between the cost and book valuc. Referring to problem #L. ifthe ogupoent bas a remaining life offour yan, prepare the workpaper entry to alliocate the difference between oost and book value for each of 12- 31-16 and 12-31-17. Be sure to label the years. 2. Padilla Coapany purchased 80% ofthe com mon stock ofSanonia Compay iatheopen market on January 1,2000 Prying S32.000 at ttal increase of$40,000 more the book value of the interest acquired. The difference between cost and book value is 3. attributed to land What wmkpaper is required each year until the land isdiposed on . Assume the land is sold on l/1/13 and the Sanoma Company rocognizes a 50,000 gain on its books. What amount of gain will be reflected in the combined income on the 2013 consolidated income statement? all years subsequent to the disposal of the land, what workpaper entry will be necessary? . In P.Co. owns 80% ors, Co. S sells merchandise to P. at 25% above cost During 2015 intercompany sales amounted to $240,000 and $300,000 respectively. At the end of both 2015and 2016, P had 30% ofthe pods purchased that year from S in ita ig inventory. There were no intercompany sales prior to 2015. Prepare in general journal form all eatries necessary on the consolidated statements workpapers to eliminate the effects of the intercompany sales for each of 2015 and 2016. Label the years 4, 5. Referring to lem #4, If P Co. had reported income of$450,00 each year and S. Co. had reported income of $250,000 each year calculate the combined income for each ye 6. Again, referring to problen #4,If P.Co had reported income of$450,000 and SCo.1 reported income of $250,000 each year, and the sale had been on a downstream, calcula combines incomes for both years