Need both parts answered please

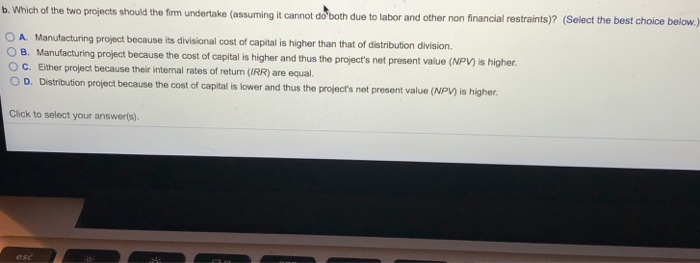

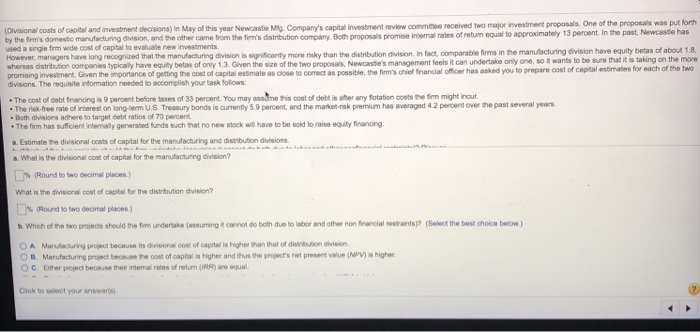

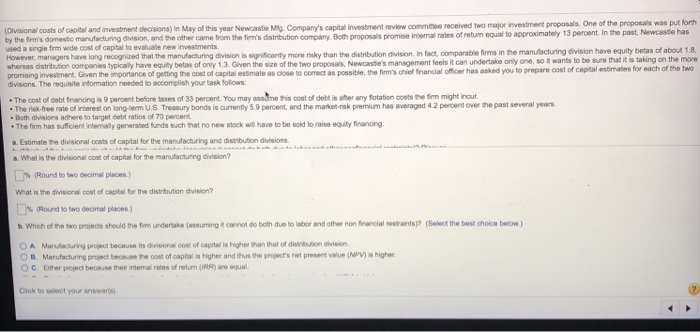

(Divisional costs of capital and investment deaisions) in May of this year Newcastie Mlg Company's capital by the Sem's domestie manufacturing used a single firm wide cost of capital to evaluale new investments ever man ge have ang econded that the manufacturing divis on s s tear y men sky than the distribution dviuon n fact, o para e ma n tema u tung disen ne eq whereas distribution companies typically have equity betas of only 1.3. Given the size of the two proposals, Newcaste's management feels it can promising investment. Given the importance of getting the cost of capital estimate as close to comect as possible, the fim's chief financial officer has divisions. The requisite information needed to accomplish your task follows investment review commmee received two major investment proposals. One of the proposals was put forth al rates of retum equal to approximately 13 percent. In the past, Newcastle has be as of bot a undertake only one, so it wants to be sure that it is taking on the more asked you to prepare cost of capital estimates for each of the two ass me is cost of dett is er any fotation costs the firm might inour The cost of debt fnaning is 9 peroent befione taxes of 33 percent. You may The risk-free rate of interest on long-1erm U.S. Treasury bonds is currently 5.9 percent, and the market-risk premium has averaged 4.2 percent over the past several years Beth divisions adhere to target debt ratios of 70 percent The firm has sufficient intemally generated funds such that no new stock will have to be sold to raise equilty financing. a. Estimate the dhisional costs of captal for the manufachuring and distribution divisions a. What is the divisional cost of capital for the manufacturing division? (Round to two decimal places.) What is the divisional cost of capital for the distribution division? []% . which ofte two points shold he frm urder ake (assuming t Round to two decimal places rot dobotn duo to ator and other non frniai restrants)? (Select the best choice too.) O A. Manufacuring project because its divisional cost of capital is higher than that of distribuion division O B Manufacturing project because the oost of captal is higher and hus the project's net present value (NPV) is highe O C. Either project because ther intemal rates of returm (RR)are equal Cick to select your answer undertake (assuming it cannot do'both due to labor and other non financial restraints)? (Select the best choice below.) nufacturing project because its divisional cost of capital is higher than that of distribution division. O A. Ma OB. Manufacturing project because the cost of capital is higher and thus the project's net present value (NPV)s O c. Either project because their internal rates of return (IRR) are equal. O D. Distribution project because the cost of capital is lower and thus the project's net present value (NPV) is higher Click to select your answer(s). esc (Divisional costs of capital and investment deaisions) in May of this year Newcastie Mlg Company's capital by the Sem's domestie manufacturing used a single firm wide cost of capital to evaluale new investments ever man ge have ang econded that the manufacturing divis on s s tear y men sky than the distribution dviuon n fact, o para e ma n tema u tung disen ne eq whereas distribution companies typically have equity betas of only 1.3. Given the size of the two proposals, Newcaste's management feels it can promising investment. Given the importance of getting the cost of capital estimate as close to comect as possible, the fim's chief financial officer has divisions. The requisite information needed to accomplish your task follows investment review commmee received two major investment proposals. One of the proposals was put forth al rates of retum equal to approximately 13 percent. In the past, Newcastle has be as of bot a undertake only one, so it wants to be sure that it is taking on the more asked you to prepare cost of capital estimates for each of the two ass me is cost of dett is er any fotation costs the firm might inour The cost of debt fnaning is 9 peroent befione taxes of 33 percent. You may The risk-free rate of interest on long-1erm U.S. Treasury bonds is currently 5.9 percent, and the market-risk premium has averaged 4.2 percent over the past several years Beth divisions adhere to target debt ratios of 70 percent The firm has sufficient intemally generated funds such that no new stock will have to be sold to raise equilty financing. a. Estimate the dhisional costs of captal for the manufachuring and distribution divisions a. What is the divisional cost of capital for the manufacturing division? (Round to two decimal places.) What is the divisional cost of capital for the distribution division? []% . which ofte two points shold he frm urder ake (assuming t Round to two decimal places rot dobotn duo to ator and other non frniai restrants)? (Select the best choice too.) O A. Manufacuring project because its divisional cost of capital is higher than that of distribuion division O B Manufacturing project because the oost of captal is higher and hus the project's net present value (NPV) is highe O C. Either project because ther intemal rates of returm (RR)are equal Cick to select your answer undertake (assuming it cannot do'both due to labor and other non financial restraints)? (Select the best choice below.) nufacturing project because its divisional cost of capital is higher than that of distribution division. O A. Ma OB. Manufacturing project because the cost of capital is higher and thus the project's net present value (NPV)s O c. Either project because their internal rates of return (IRR) are equal. O D. Distribution project because the cost of capital is lower and thus the project's net present value (NPV) is higher Click to select your answer(s). esc

Need both parts answered please

Need both parts answered please