Answered step by step

Verified Expert Solution

Question

1 Approved Answer

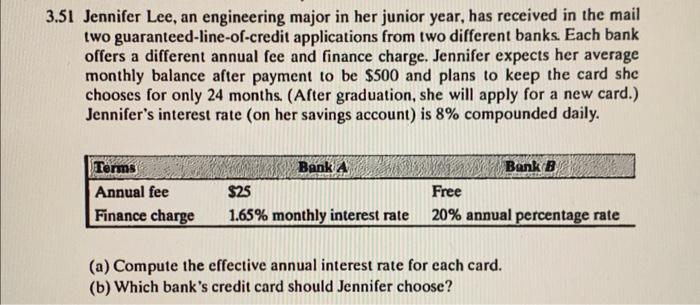

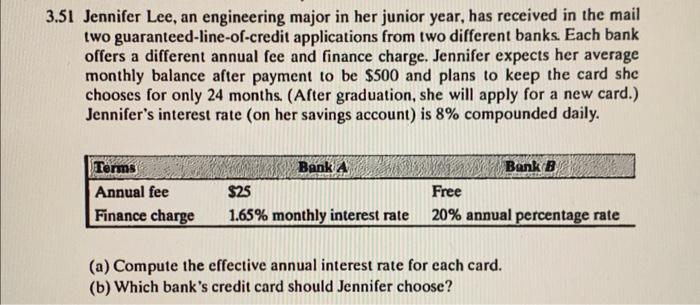

need both parts solved with explanation and without excel please 51 Jennifer Lee, an engineering major in her junior year, has received in the mail

need both parts solved with explanation and without excel please

51 Jennifer Lee, an engineering major in her junior year, has received in the mail two guaranteed-line-of-credit applications from two different banks. Each bank offers a different annual fee and finance charge. Jennifer expects her average monthly balance after payment to be $500 and plans to keep the card she chooses for only 24 months. (After graduation, she will apply for a new card.) Jennifer's interest rate (on her savings account) is 8% compounded daily. (a) Compute the effective annual interest rate for each card. (b) Which bank's credit card should Jennifer choose

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started