Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NEED CALCULATIONS AND DETAILED EXPLANATIONS CLT Group's stock has a beta of 1.4. The company's earnings this year is $5 per share and the dividend

NEED CALCULATIONS AND DETAILED EXPLANATIONS

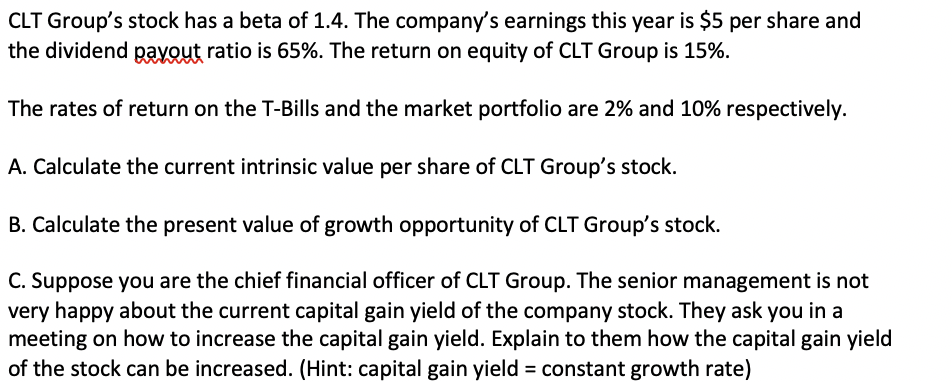

CLT Group's stock has a beta of 1.4. The company's earnings this year is $5 per share and the dividend payout ratio is 65%. The return on equity of CLT Group is 15%. The rates of return on the T-Bills and the market portfolio are 2% and 10% respectively. A. Calculate the current intrinsic value per share of CLT Group's stock. B. Calculate the present value of growth opportunity of CLT Group's stock. C. Suppose you are the chief financial officer of CLT Group. The senior management is not very happy about the current capital gain yield of the company stock. They ask you in a meeting on how to increase the capital gain yield. Explain to them how the capital gain yield of the stock can be increased. (Hint: capital gain yield = constant growth rate)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started