Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need calculations On October 1, 2019, Unique Solutions Inc. accepted a $20,000, five-month, 12% note from a customer, in settlement of an overdue account receivable.

need calculations

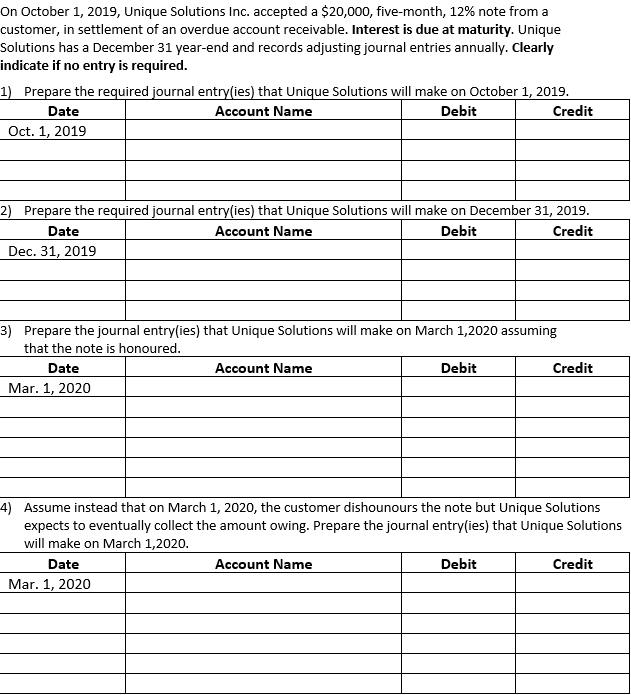

On October 1, 2019, Unique Solutions Inc. accepted a $20,000, five-month, 12% note from a customer, in settlement of an overdue account receivable. Interest is due at maturity. Unique Solutions has a December 31 year-end and records adjusting journal entries annually. Clearly indicate if no entry is required. 1) Prepare the required journal entry(ies) that Unique Solutions will make on October 1, 2019. Date Account Name Credit Oct. 1, 2019 Debit 2) Prepare the required journal entry(ies) that Unique Solutions will make on December 31, 2019. Date Account Name Debit Credit Dec. 31, 2019 3) Prepare the journal entry(ies) that Unique Solutions will make on March 1,2020 assuming that the note is honoured. Date Account Name Debit Credit Mar. 1, 2020 4) Assume instead that on March 1, 2020, the customer dishounours the note but Unique Solutions expects to eventually collect the amount owing. Prepare the journal entry(ies) that Unique Solutions will make on March 1,2020. Date Account Name Debit Credit Mar. 1, 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started