need checked answers and complete answer for h! thanks!

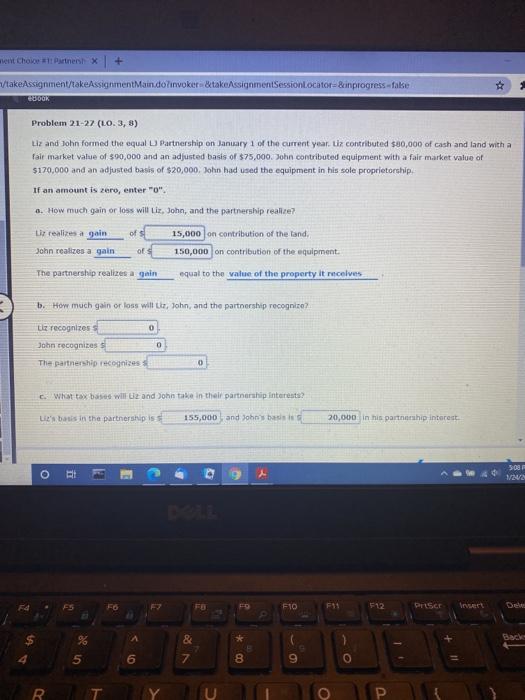

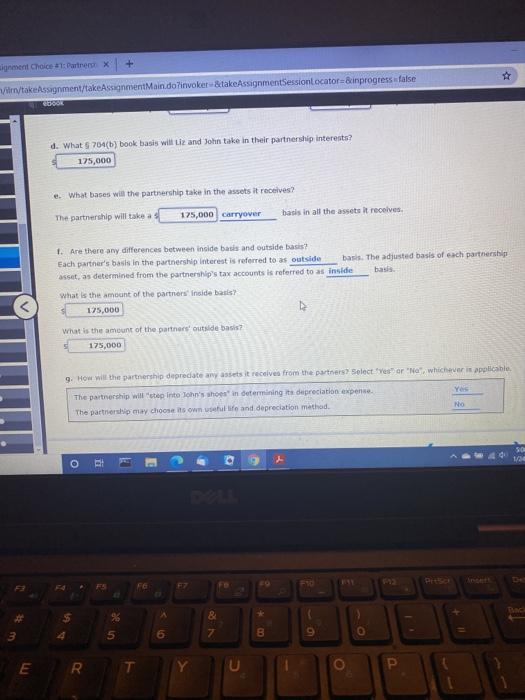

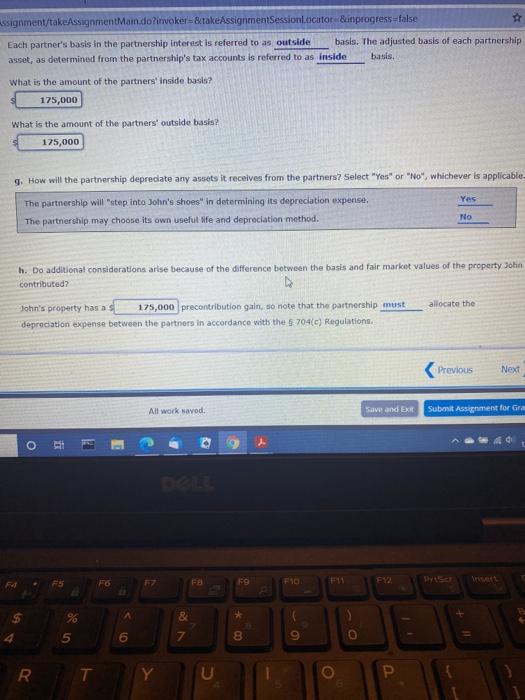

Vent Choice Partnersh x takeAssignment/takeAssignmentMain.dolinvokertakassignmentSession.ocator=&inprogress-fake BOOK Problem 21-27 (0.3, 8) Liz and John formed the equal D Partnership on January 1 of the current year. Liz contributed $80,000 of cash and land with a fair market value of $90,000 and an adjusted basis of $75,000. John contributed equipment with a fair market value of $170,000 and an adjusted basis of $20,000. John had used the equipment in his sole proprietorship If an amount is zero, enterTo". 0. How much gain or loss will Liz, John, and the partnership realize? of 15,000 on contribution of the land, Liz realizes again John realizes a gain of 150,000 on contribution of the equipment. The partnership realizes a gain equal to the value of the property it receives b. How much gain or loss will tiz, John, and the partnership recognize? 0 Uz recognizes John recognizes The partnership recognizes 0 c. What tax base will ut and John take in their partnership Interest L' as in the partnership is 155,000 and Johns 20,000 in his partnership interest 5.08 O 4 5 FIO F 512 PESCE levert & Bache 5 6 00 R U + signment Choice 1: Partner X ilm/takeAssignment/takeAssignmentMain.doinvokettakeAssignmentSessionlocator=&inprogress false d. What S 704(b) book basis will Liz and John take in their partnership interests? 175,000 e. What bases will the partnership take in the assets it receives? The partnership will take a 175,000 carryover basis in all the assets it receives 1. Are there any differences between inside basis and outside basist Each partner's basis in the partnership Interest is referred to as outside basis. The adjusted basis of each partnership asset, as determined from the partnership's tax accounts is referred to as inside ba what is the amount of the partners inside basis? 175,000 What is the amount of the partners outside basis? 175,000 9. How will the partnership depredate any assets it receives from the partners Select Yes" or "Ne", whichever is applicable The partnership will step into John's shoes in determining it depreciation expense The partnership may choose its own life and depreciation method No 50 1/3 RI 4 5 6 7 8 E R P Assignment/takeAssignment Main.do?invoket & takeAssignmentSessionLocutore&inprogress false Each partner's basis in the partnership interest is referred to as outside basis. The adjusted basis of each partnership asset, as determined from the partnership's tax accounts is referred to as inside basis. What is the amount of the partners' inside basis? 175,000 What is the amount of the partners' outside basis? 175,000 9. How will the partnership depredate any assets it receives from the partners Select "Yes" or "No", whichever is applicable Yes The partnership will step into John's shoes" in determining its depreciation expense. The partnership may choose its own useful life and depreciation method. No h. Do additional considerations arise because of the difference between the basis and fair market values of the property John contributed? allocate the John's property has as 175,000 precontribution gain, so note that the partnership must depreciation expense between the partners in accordance with the $ 704(c) Regulations Previous Next All work saved Save and EKK Submit Assignment for Gram 0 E Fo Fa F10 DYS & 5 6 00 R U Vent Choice Partnersh x takeAssignment/takeAssignmentMain.dolinvokertakassignmentSession.ocator=&inprogress-fake BOOK Problem 21-27 (0.3, 8) Liz and John formed the equal D Partnership on January 1 of the current year. Liz contributed $80,000 of cash and land with a fair market value of $90,000 and an adjusted basis of $75,000. John contributed equipment with a fair market value of $170,000 and an adjusted basis of $20,000. John had used the equipment in his sole proprietorship If an amount is zero, enterTo". 0. How much gain or loss will Liz, John, and the partnership realize? of 15,000 on contribution of the land, Liz realizes again John realizes a gain of 150,000 on contribution of the equipment. The partnership realizes a gain equal to the value of the property it receives b. How much gain or loss will tiz, John, and the partnership recognize? 0 Uz recognizes John recognizes The partnership recognizes 0 c. What tax base will ut and John take in their partnership Interest L' as in the partnership is 155,000 and Johns 20,000 in his partnership interest 5.08 O 4 5 FIO F 512 PESCE levert & Bache 5 6 00 R U + signment Choice 1: Partner X ilm/takeAssignment/takeAssignmentMain.doinvokettakeAssignmentSessionlocator=&inprogress false d. What S 704(b) book basis will Liz and John take in their partnership interests? 175,000 e. What bases will the partnership take in the assets it receives? The partnership will take a 175,000 carryover basis in all the assets it receives 1. Are there any differences between inside basis and outside basist Each partner's basis in the partnership Interest is referred to as outside basis. The adjusted basis of each partnership asset, as determined from the partnership's tax accounts is referred to as inside ba what is the amount of the partners inside basis? 175,000 What is the amount of the partners outside basis? 175,000 9. How will the partnership depredate any assets it receives from the partners Select Yes" or "Ne", whichever is applicable The partnership will step into John's shoes in determining it depreciation expense The partnership may choose its own life and depreciation method No 50 1/3 RI 4 5 6 7 8 E R P Assignment/takeAssignment Main.do?invoket & takeAssignmentSessionLocutore&inprogress false Each partner's basis in the partnership interest is referred to as outside basis. The adjusted basis of each partnership asset, as determined from the partnership's tax accounts is referred to as inside basis. What is the amount of the partners' inside basis? 175,000 What is the amount of the partners' outside basis? 175,000 9. How will the partnership depredate any assets it receives from the partners Select "Yes" or "No", whichever is applicable Yes The partnership will step into John's shoes" in determining its depreciation expense. The partnership may choose its own useful life and depreciation method. No h. Do additional considerations arise because of the difference between the basis and fair market values of the property John contributed? allocate the John's property has as 175,000 precontribution gain, so note that the partnership must depreciation expense between the partners in accordance with the $ 704(c) Regulations Previous Next All work saved Save and EKK Submit Assignment for Gram 0 E Fo Fa F10 DYS & 5 6 00 R U