Answered step by step

Verified Expert Solution

Question

1 Approved Answer

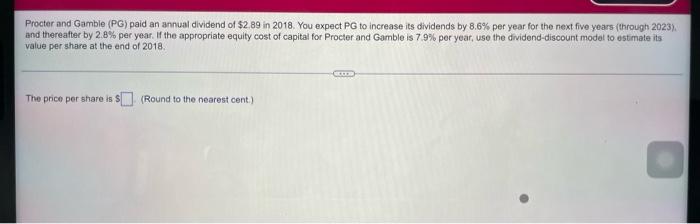

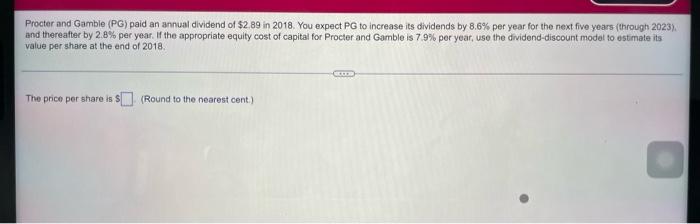

need clear steps thanks Procter and Gamble (PG) paid an annual dividend of $2.89 in 2018. You expect PG to increase its dividends by 8.6%

need clear steps thanks

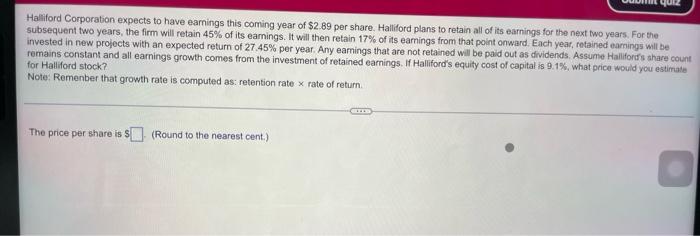

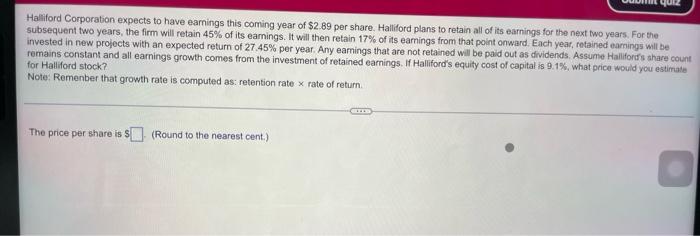

Procter and Gamble (PG) paid an annual dividend of $2.89 in 2018. You expect PG to increase its dividends by 8.6% per year for the next five years through 2023) and thereafter by 2.8% per year. If the appropriate equity cost of capital for Procter and Gamble is 7.9% per year, use the dividend-discount model to estimate its value per share at the end of 2018 The price per share in (Round to the nearest cent) Haliford Corporation expects to have eamings this coming year of $2.89 per share. Haliford plans to retain all of its earnings for the next two years. For the subsequent two years, the firm will retain 45% of its earnings. It will then retain 17% of its earnings from that point onward. Each year, retained earnings will be invested in new projects with an expected return of 27.45% per year. Any earings that are not retained will be paid out as dividends. Assume Hallford's share count remains constant and all earnings growth comes from the investment of retained earnings. If Halliford's equity cost of capital is 9.1%, what price would you estimate for Halliford stock? Note: Remenber that growth rate is computed as: retention rate x rate of return The price per share is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started