Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need complete as you can The basic point of this problem is to work out the binomial model version of Bailey's discussion connecting the Put-Call

need complete as you can

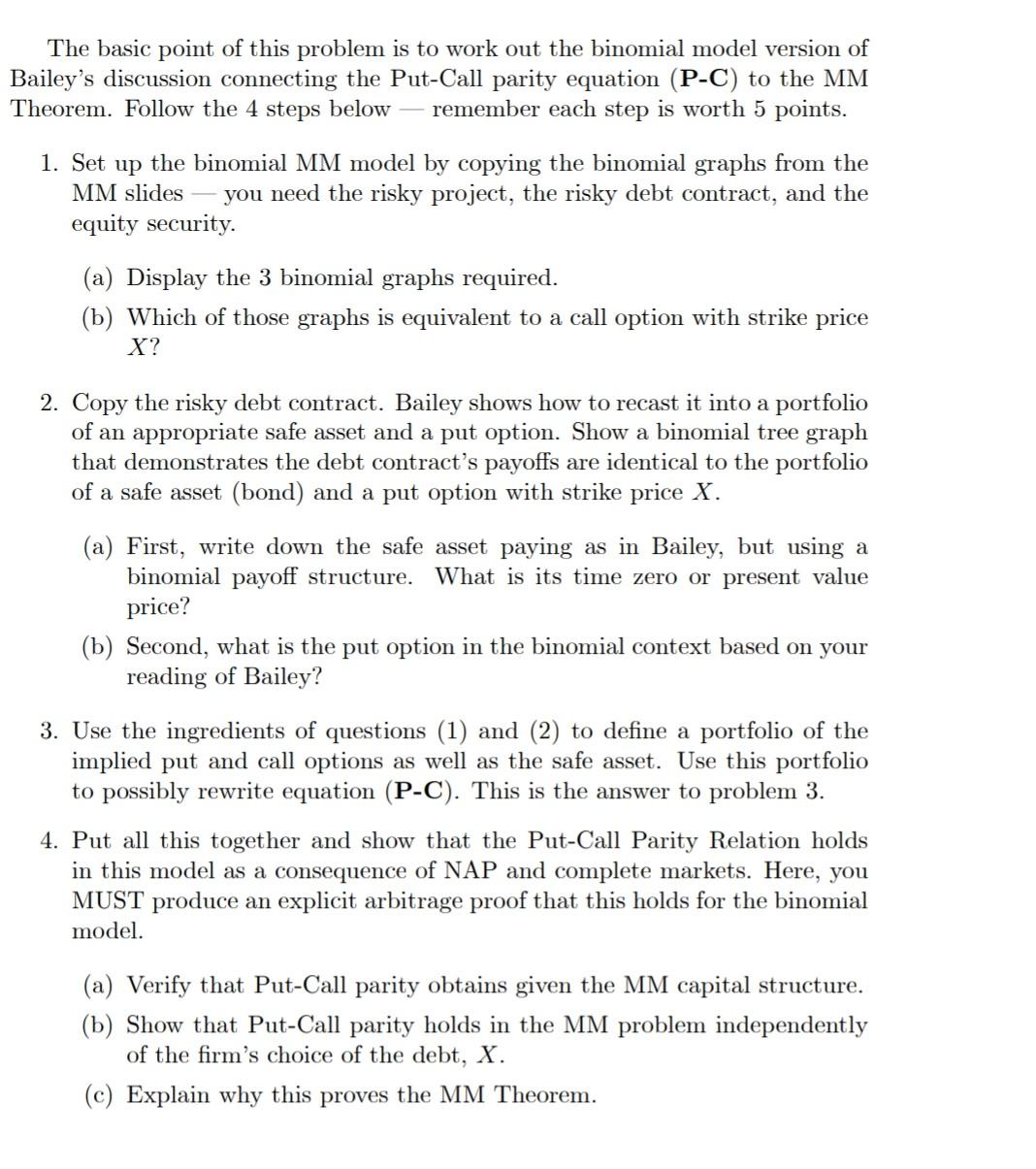

The basic point of this problem is to work out the binomial model version of Bailey's discussion connecting the Put-Call parity equation (P-C) to the MM Theorem. Follow the 4 steps below remember each step is worth 5 points. 1. Set up the binomial MM model by copying the binomial graphs from the MM slides you need the risky project, the risky debt contract, and the equity security. (a) Display the 3 binomial graphs required. (b) Which of those graphs is equivalent to a call option with strike price X? 2. Copy the risky debt contract. Bailey shows how to recast it into a portfolio of an appropriate safe asset and a put option. Show a binomial tree graph that demonstrates the debt contract's payoffs are identical to the portfolio of a safe asset (bond) and a put option with strike price X. (a) First, write down the safe asset paying as in Bailey, but using a binomial payoff structure. What is its time zero or present value price? (b) Second, what is the put option in the binomial context based on your reading of Bailey? 3. Use the ingredients of questions (1) and (2) to define a portfolio of the implied put and call options as well as the safe asset. Use this portfolio to possibly rewrite equation (P-C). This is the answer to problem 3. 4. Put all this together and show that the Put-Call Parity Relation holds in this model as a consequence of NAP and complete markets. Here, you MUST produce an explicit arbitrage proof that this holds for the binomial model. (a) Verify that Put-Call parity obtains given the MM capital structure. (b) Show that Put-Call parity holds in the MM problem independently of the firm's choice of the debt, X. (c) Explain why this proves the MM Theorem. The basic point of this problem is to work out the binomial model version of Bailey's discussion connecting the Put-Call parity equation (P-C) to the MM Theorem. Follow the 4 steps below remember each step is worth 5 points. 1. Set up the binomial MM model by copying the binomial graphs from the MM slides you need the risky project, the risky debt contract, and the equity security. (a) Display the 3 binomial graphs required. (b) Which of those graphs is equivalent to a call option with strike price X? 2. Copy the risky debt contract. Bailey shows how to recast it into a portfolio of an appropriate safe asset and a put option. Show a binomial tree graph that demonstrates the debt contract's payoffs are identical to the portfolio of a safe asset (bond) and a put option with strike price X. (a) First, write down the safe asset paying as in Bailey, but using a binomial payoff structure. What is its time zero or present value price? (b) Second, what is the put option in the binomial context based on your reading of Bailey? 3. Use the ingredients of questions (1) and (2) to define a portfolio of the implied put and call options as well as the safe asset. Use this portfolio to possibly rewrite equation (P-C). This is the answer to problem 3. 4. Put all this together and show that the Put-Call Parity Relation holds in this model as a consequence of NAP and complete markets. Here, you MUST produce an explicit arbitrage proof that this holds for the binomial model. (a) Verify that Put-Call parity obtains given the MM capital structure. (b) Show that Put-Call parity holds in the MM problem independently of the firm's choice of the debt, X. (c) Explain why this proves the MM TheoremStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started