need detailed answer in 45 mint

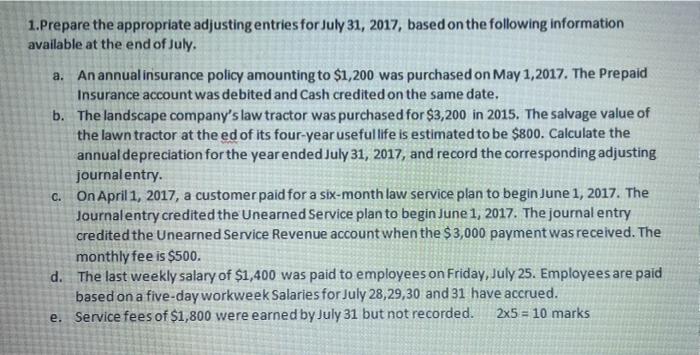

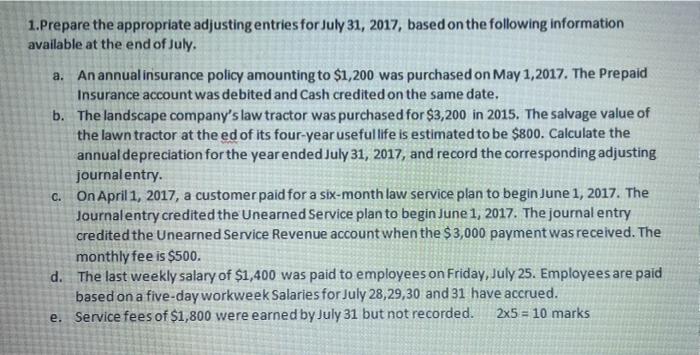

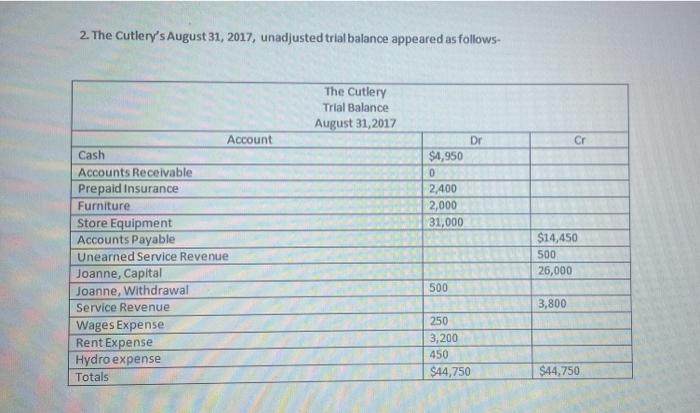

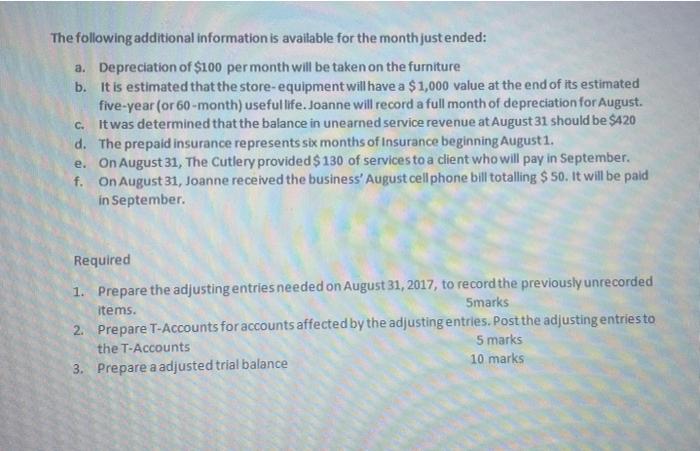

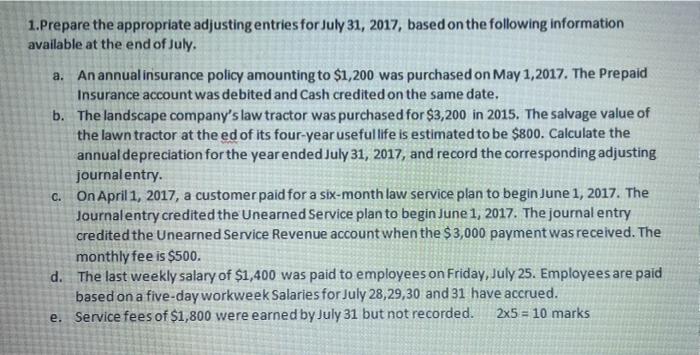

1.Prepare the appropriate adjusting entries for July 31, 2017, based on the following information available at the end of July. a. An annual insurance policy amounting to $1,200 was purchased on May 1, 2017. The Prepaid Insurance account was debited and Cash credited on the same date. b. The landscape company's law tractor was purchased for $3,200 in 2015. The salvage value of the lawn tractor at the ed of its four-year useful life is estimated to be $800. Calculate the annual depreciation for the year ended July 31, 2017, and record the corresponding adjusting journal entry. C. On April 1, 2017, a customer paid for a six-month law service plan to begin June 1, 2017. The Journal entry credited the Unearned Service plan to begin June 1, 2017. The journal entry credited the Unearned Service Revenue account when the $3,000 payment was received. The monthly fee is $500. d. The last weekly salary of $1,400 was paid to employees on Friday, July 25. Employees are paid based on a five-day workweek Salaries for July 28,29,30 and 31 have accrued. e. Service fees of $1,800 were earned by July 31 but not recorded. 2x5 = 10 marks 2. The cutlery's August 31, 2017, unadjusted trial balance appeared as follows- The Cutlery Trial Balance August 31, 2017 Cr Dr $4,950 0 2,400 2,000 31,000 Account Cash Accounts Receivable Prepaid Insurance Furniture Store Equipment Accounts Payable Unearned Service Revenue Joanne, Capital Joanne, Withdrawal Service Revenue Wages Expense Rent Expense Hydroexpense Totals $14,450 500 26,000 500 3,800 250 3,200 450 $44,750 $44,750 The following additional information is available for the month justended: a. Depreciation of $100 per month will be taken on the furniture b. It is estimated that the store equipment will have a $1,000 value at the end of its estimated five-year (or 60-month) usefullife. Joanne will record a full month of depreciation for August. C. It was determined that the balance in unearned service revenue at August 31 should be $420 d. The prepaid insurance represents six months of Insurance beginning Augusti e. On August 31, The Cutlery provided $ 130 of services to a client who will pay in September. f. On August 31, Joanne received the business' August cell phone bill totalling $ 50. It will be paid in September Required 1. Prepare the adjusting entries needed on August 31, 2017, to record the previously unrecorded items. Smarks 2. Prepare T-Accounts for accounts affected by the adjusting entries.Postthe adjusting entries to the T-Accounts 5 marks 3. Prepare a adjusted trial balance 10 marks