Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need detailed steps to solve 1. (a) Your boss wants to investigate the profitability of several projects the company is interested in. In particular, he

need detailed steps to solve

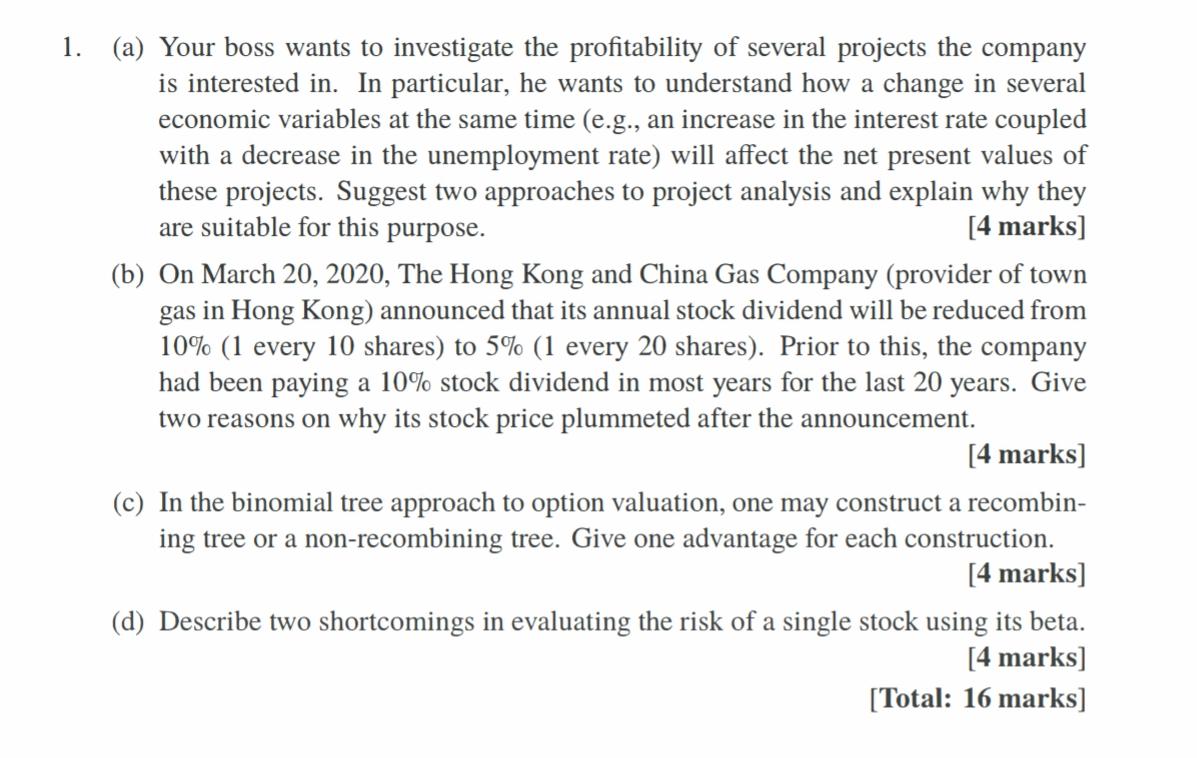

1. (a) Your boss wants to investigate the profitability of several projects the company is interested in. In particular, he wants to understand how a change in several economic variables at the same time (e.g., an increase in the interest rate coupled with a decrease in the unemployment rate) will affect the net present values of these projects. Suggest two approaches to project analysis and explain why they are suitable for this purpose. [4 marks] (b) On March 20, 2020, The Hong Kong and China Gas Company (provider of town gas in Hong Kong) announced that its annual stock dividend will be reduced from 10% (1 every 10 shares) to 5% (1 every 20 shares). Prior to this, the company had been paying a 10% stock dividend in most years for the last 20 years. Give two reasons on why its stock price plummeted after the announcement. [4 marks] (c) In the binomial tree approach to option valuation, one may construct a recombin- ing tree or a non-recombining tree. Give one advantage for each construction. [4 marks] (d) Describe two shortcomings in evaluating the risk of a single stock using its beta. [4 marks] [Total: 16 marks] 1. (a) Your boss wants to investigate the profitability of several projects the company is interested in. In particular, he wants to understand how a change in several economic variables at the same time (e.g., an increase in the interest rate coupled with a decrease in the unemployment rate) will affect the net present values of these projects. Suggest two approaches to project analysis and explain why they are suitable for this purpose. [4 marks] (b) On March 20, 2020, The Hong Kong and China Gas Company (provider of town gas in Hong Kong) announced that its annual stock dividend will be reduced from 10% (1 every 10 shares) to 5% (1 every 20 shares). Prior to this, the company had been paying a 10% stock dividend in most years for the last 20 years. Give two reasons on why its stock price plummeted after the announcement. [4 marks] (c) In the binomial tree approach to option valuation, one may construct a recombin- ing tree or a non-recombining tree. Give one advantage for each construction. [4 marks] (d) Describe two shortcomings in evaluating the risk of a single stock using its beta. [4 marks] [Total: 16 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started