NEED DONE ASAP

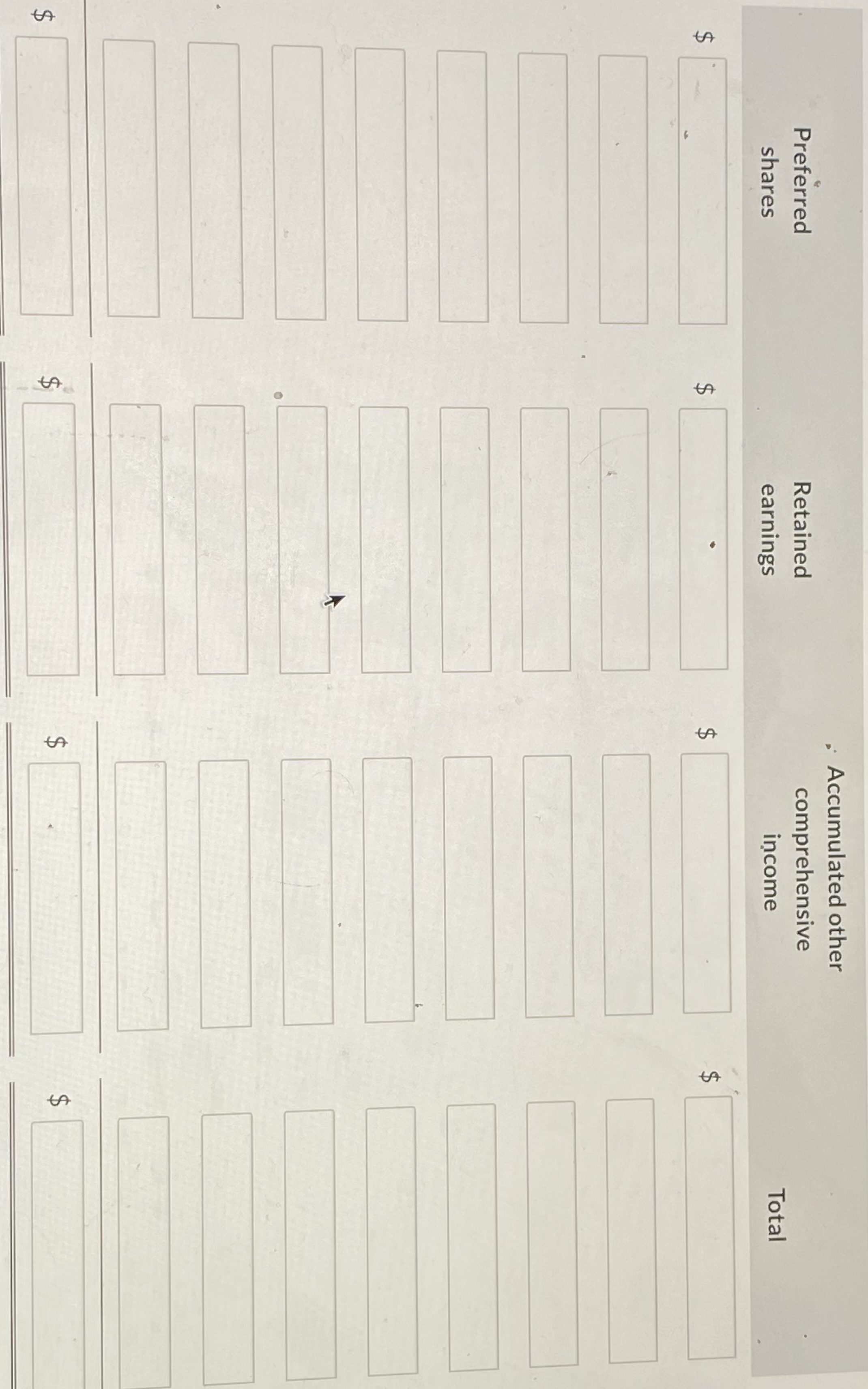

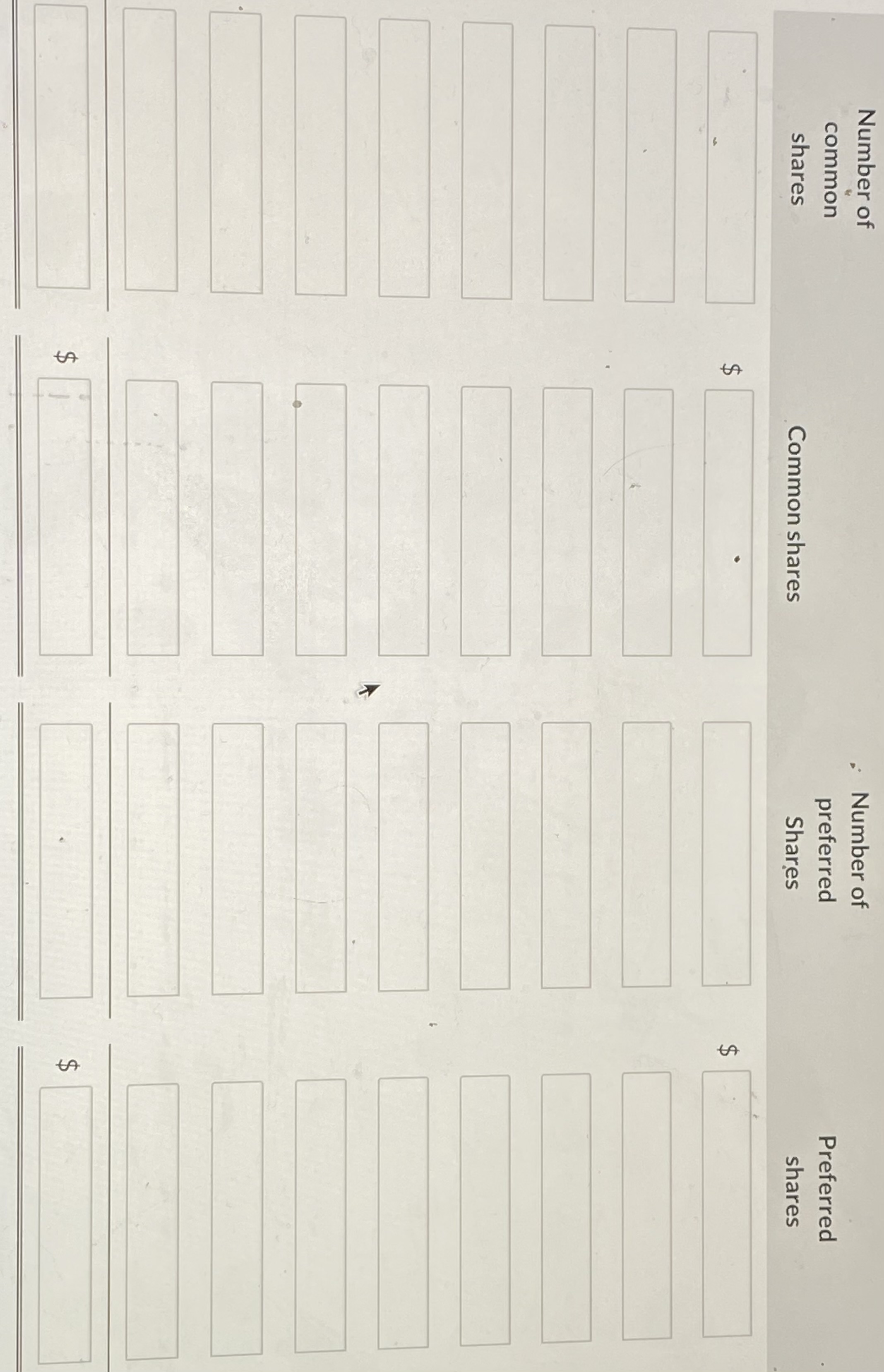

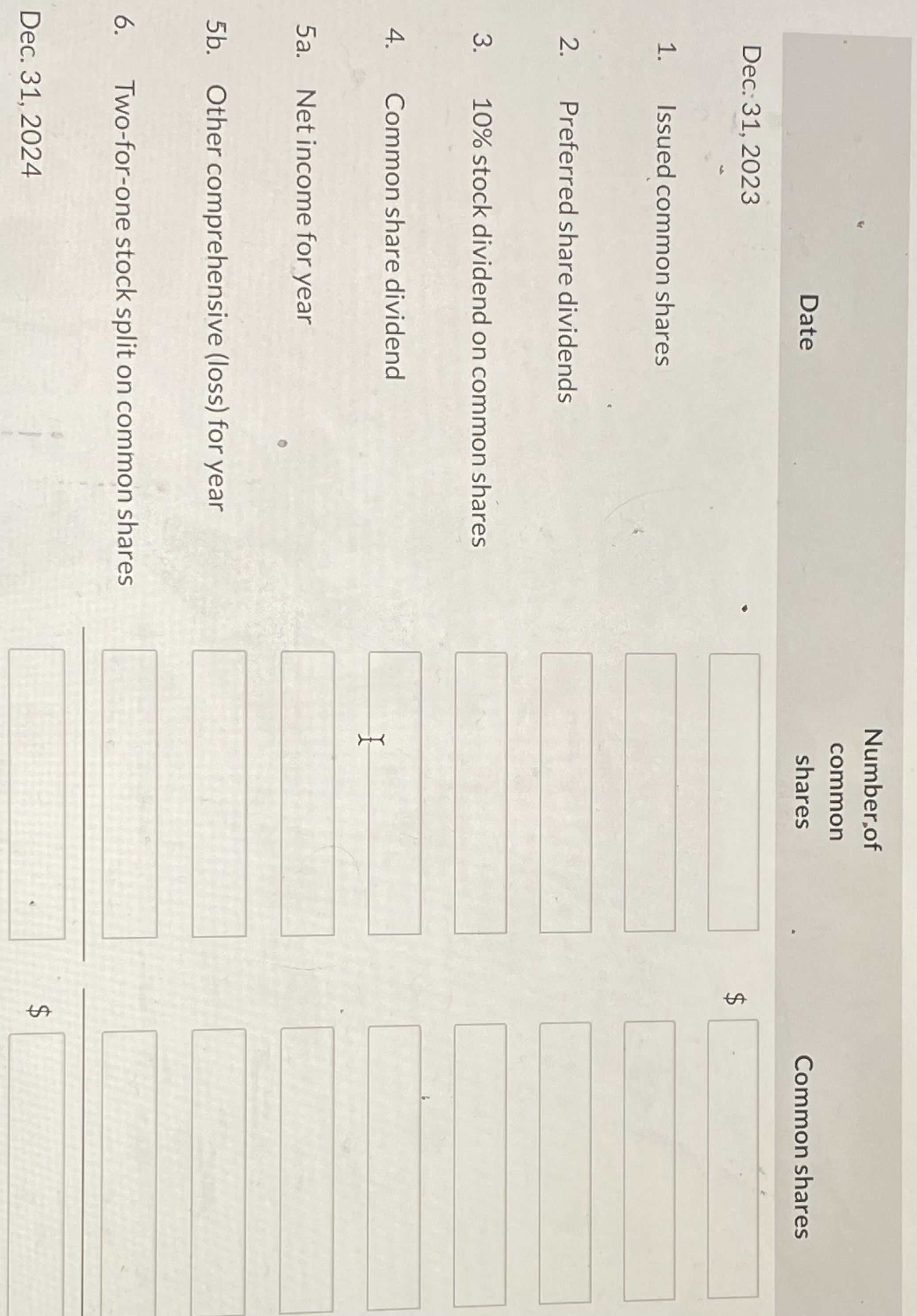

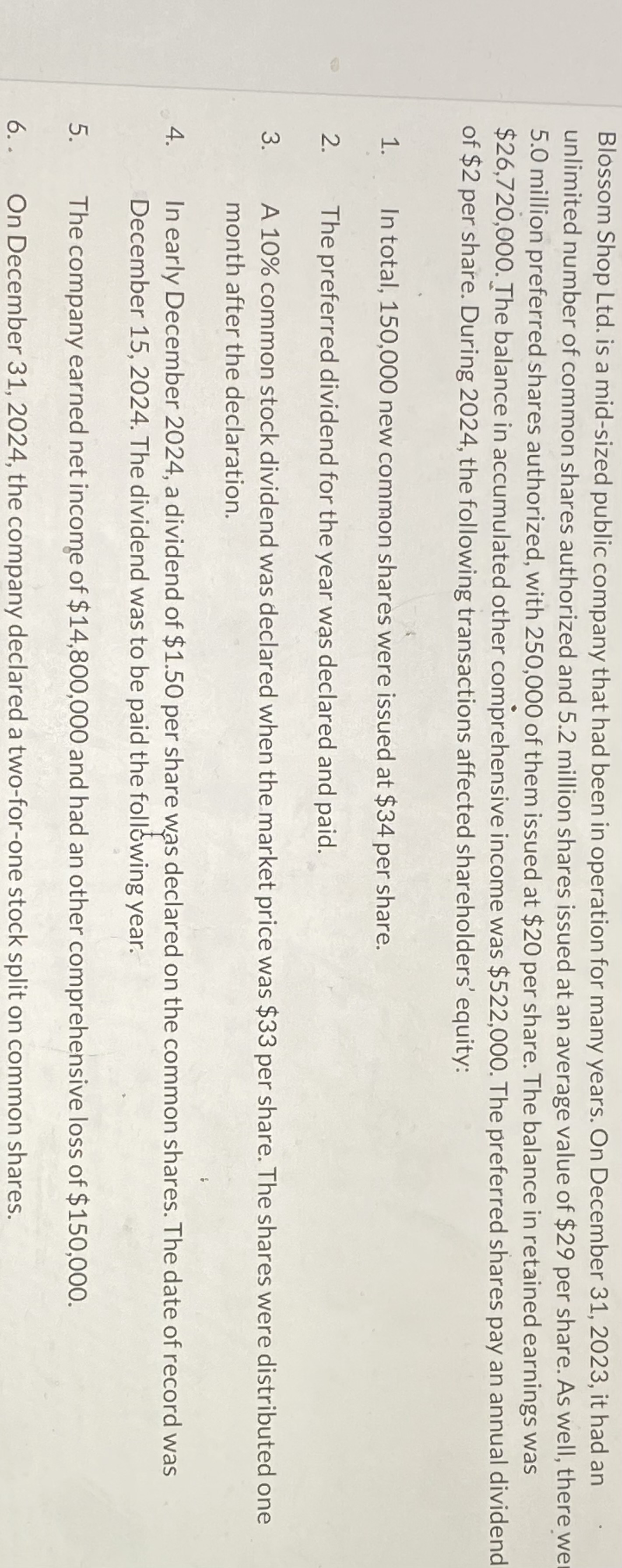

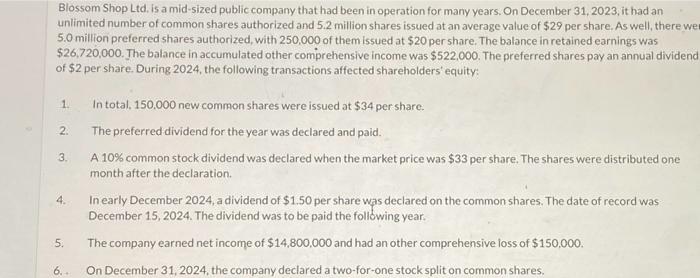

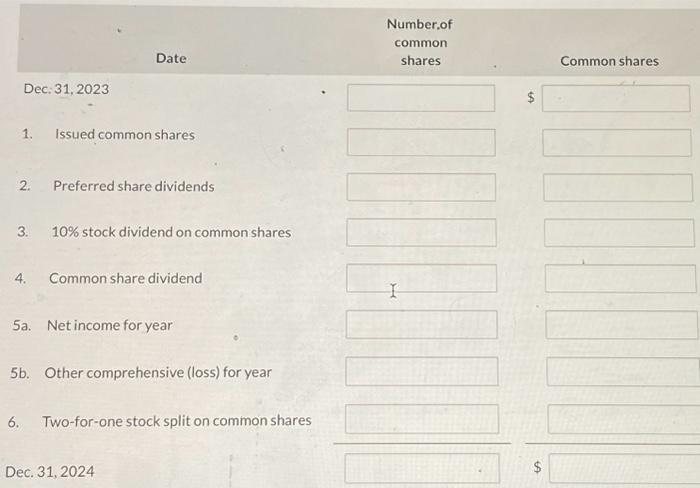

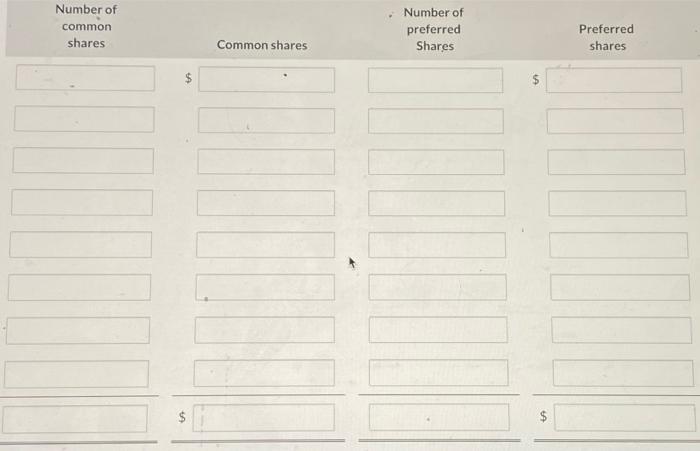

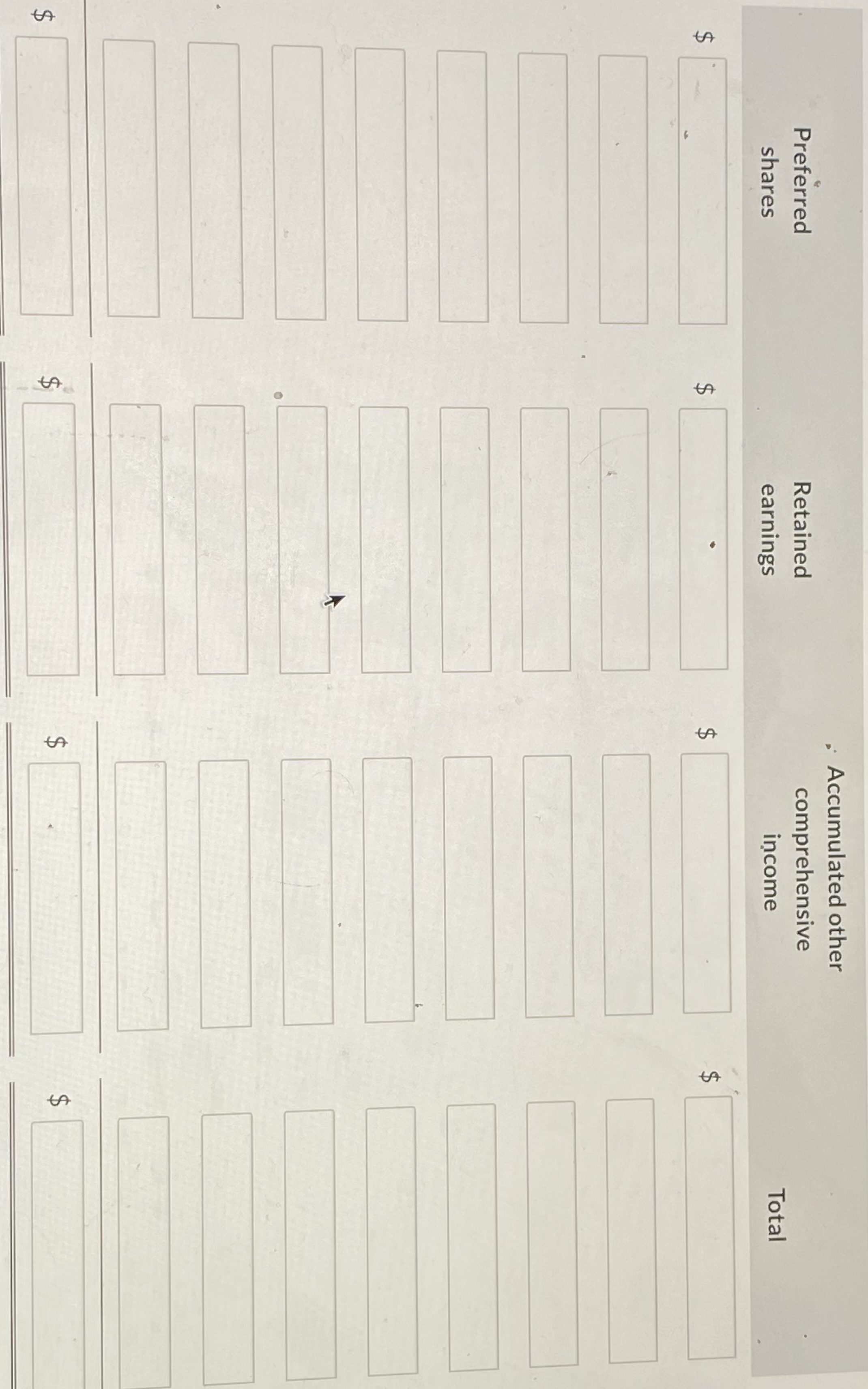

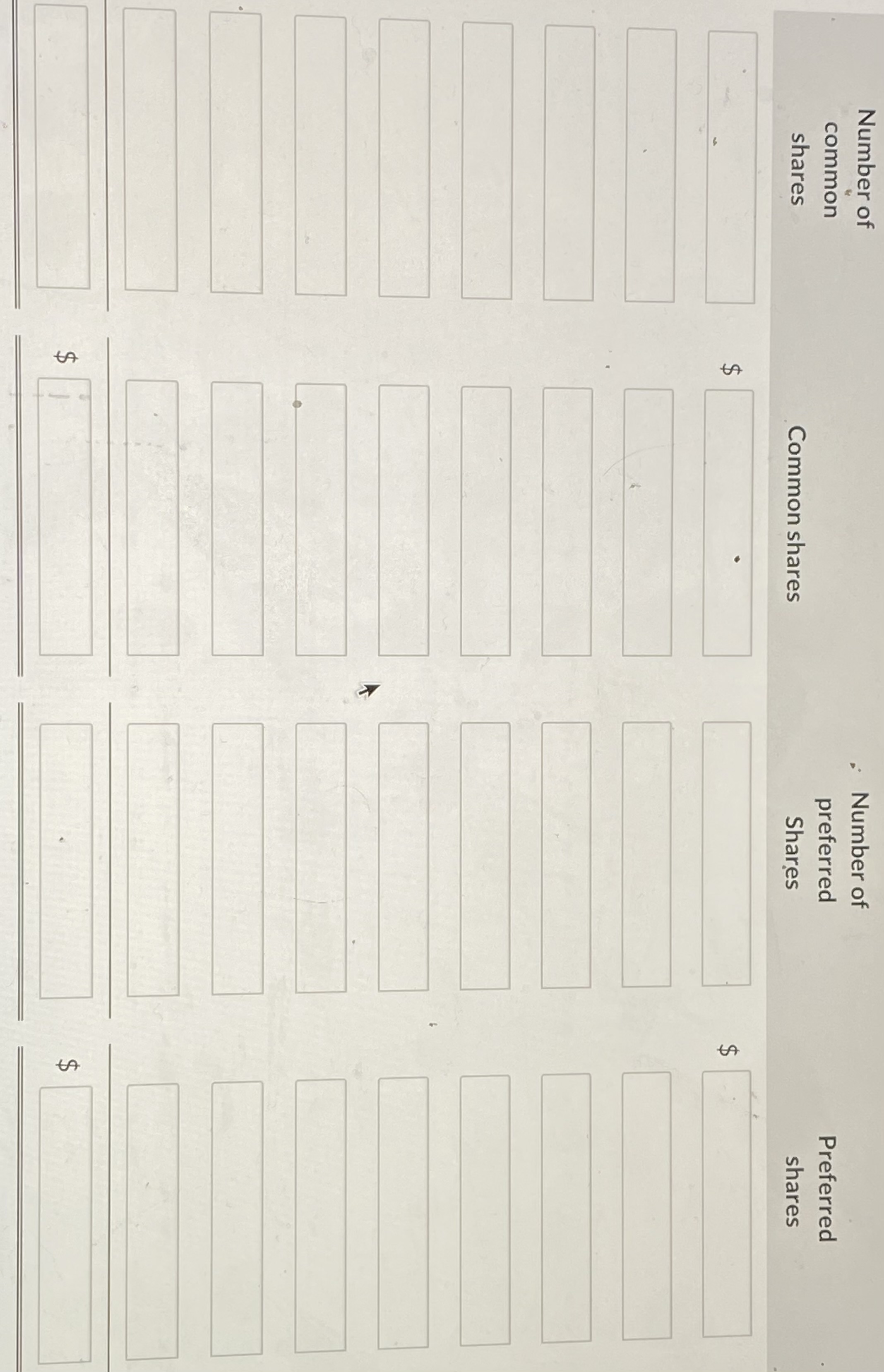

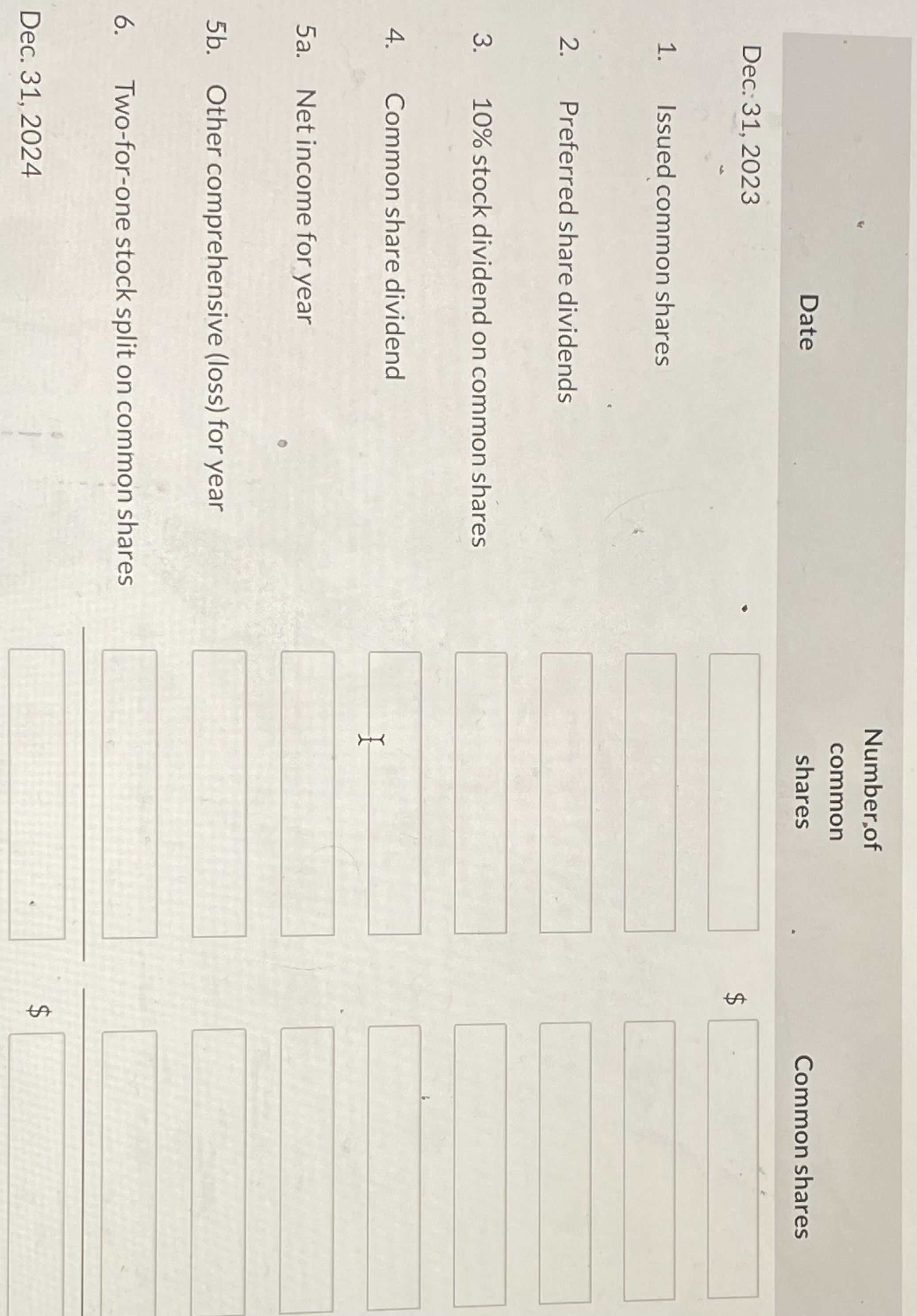

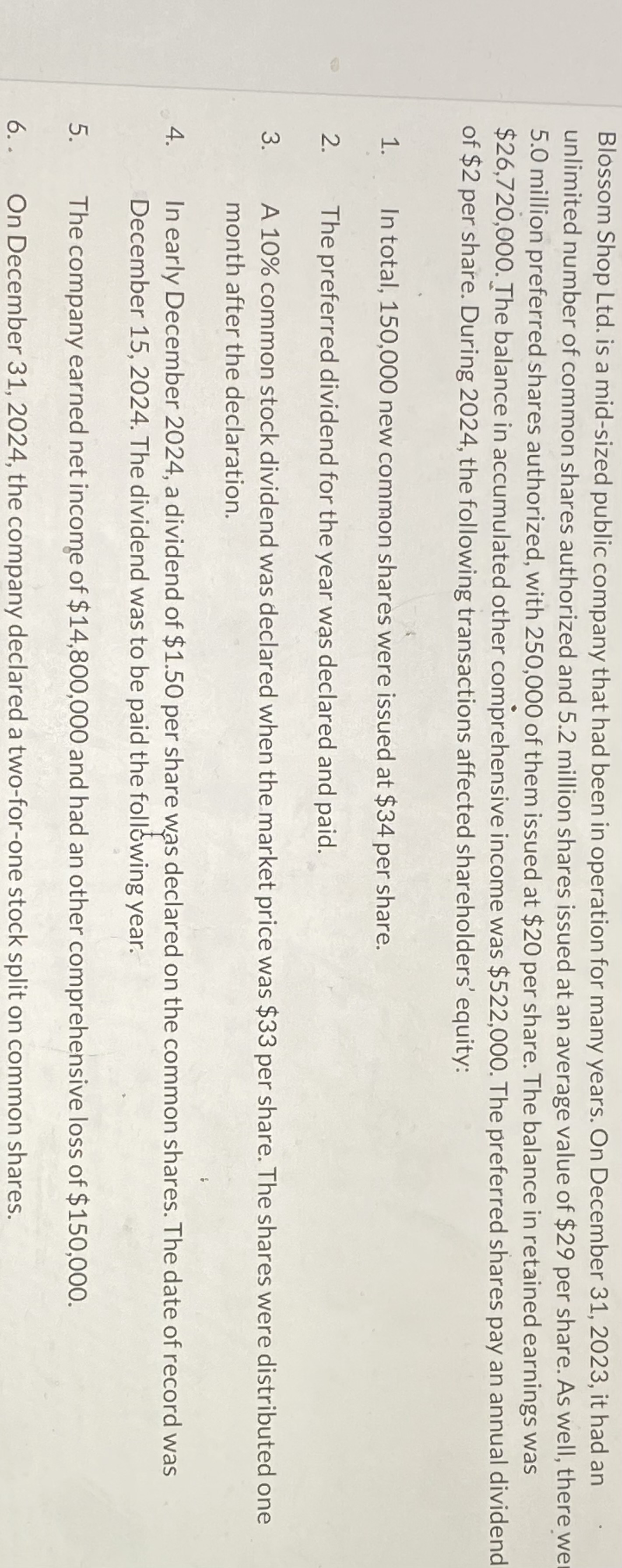

Number of common shares Number of preferred Common shares $ Preferred shares $ Blossom Shop Ltd. is a mid-sized public company that had been in operation for many years. On December 31,2023 , it had an unlimited number of common shares authorized and 5.2 million shares issued at an average value of $29 per share. As well, there we 5.0 million preferred shares authorized, with 250,000 of them issued at $20 per share. The balance in retained earnings was $26,720,000. The balance in accumulated other comprehensive income was $522,000. The preferred shares pay an annual dividenc of $2 per share. During 2024 , the following transactions affected shareholders' equity: 1. In total, 150,000 new common shares were issued at $34 per share. 2. The preferred dividend for the year was declared and paid. 3. A 10% common stock dividend was declared when the market price was $33 per share. The shares were distributed one month after the declaration. 4. In early December 2024 , a dividend of $1.50 per share was declared on the common shares. The date of record was December 15, 2024. The dividend was to be paid the folluwing year. 5. The company earned net income of $14,800,000 and had an other comprehensive loss of $150,000. 6. . On December 31,2024 , the company declared a two-for-one stock split on common shares. \begin{tabular}{lll|} \hline Dec: 31,2023 & Date & Number,ofcommonshares \\ \hline \end{tabular} 1. Issued common shares 2. Preferred share dividends 3. 10% stock dividend on common shares 4. Common share dividend 5a. Net income for year 5b. Other comprehensive (loss) for year 6. Two-for-one stock split on common shares Dec. 31,2024 1. Issued common shares 2. Preferred share dividends 3. 10% stock dividend on common shares 4. Common share dividend 5a. Net income for year 5b. Other comprehensive (loss) for year 6. Two-for-one stock split on common shares Dec. 31,2024 Blossom Shop Ltd. is a mid-sized public company that had been in operation for many years. On December 31,2023 , it had an unlimited number of common shares authorized and 5.2 million shares issued at an average value of $29 per share. As well, there we 5.0 million preferred shares authorized, with 250,000 of them issued at $20 per share. The balance in retained earnings was $26,720,000. The balance in accumulated other comprehensive income was $522,000. The preferred shares pay an annual dividenc of $2 per share. During 2024 , the following transactions affected shareholders' equity: 1. In total, 150.000 new common shares were issued at $34 per share. 2. The preferred dividend for the year was declared and paid. 3. A 10% common stock dividend was declared when the market price was $33 per share. The shares were distributed one month after the declaration. 4. In early December 2024 , a dividend of $1.50 per share was declared on the common shares. The date of record was December 15,2024 . The dividend was to be paid the following year. 5. The company earned net income of $14,800,000 and had an other comprehensive loss of $150,000. 6. On December 31,2024, the company declared a two-for-one stock split on common shares. Number of common shares - Number of preferred Shares Preferred shares $ $