Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need done asap please and thank you! Instruction: Type your answers in the space provided. Be sure to provide supporting calculations, as needed, to obtain

need done asap please and thank you!

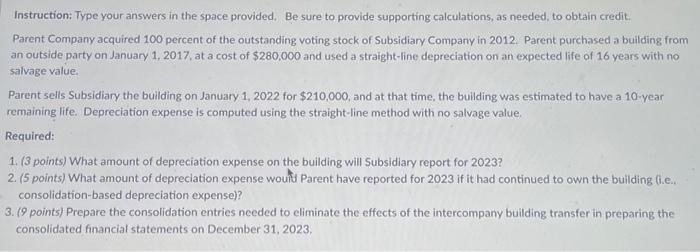

Instruction: Type your answers in the space provided. Be sure to provide supporting calculations, as needed, to obtain credit. Parent Company acquired 100 percent of the outstanding voting stock of Subsidiary Company in 2012. Parent purchased a building from an outside party on January 1, 2017, at a cost of $280,000 and used a straight-line depreciation on an expected life of 16 years with no salvage value. Parent sells Subsidiary the building on January 1,2022 for $210,000, and at that time, the building was estimated to have a 10 -year remaining life. Depreciation expense is computed using the straight-line method with no salvage value. Required: 1. (3 points) What amount of depreciation expense on the building will Subsidiary report for 2023 ? 2. ( 5 points) What amount of depreciation expense woutd Parent have reported for 2023 if it had continued to own the building (i.e., consolidation-based depreciation expense)? 3. (9 points) Prepare the consolidation entries needed to eliminate the effects of the intercompany building transfer in preparing the consolidated financial statements on December 31, 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started